LiteFinance / Profil

The online ECN broker LiteFinance (ex. LiteForex) has been providing its clients access to Tier 1 liquidity in the currency, commodity, and stock market since 2005. All major currency pairs and cross rates, oil, precious metals, stock indexes, blue chips, and the largest set of cryptocurrency pairs can be traded at LiteFinance (ex. LiteForex).

Freunde

381

Anfragen

Ausgehend

LiteFinance

Dollar is conducting an investigation

Traders, like detectives, must ask a question about who benefits

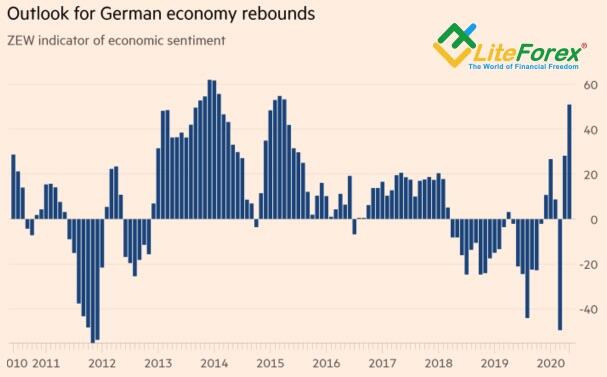

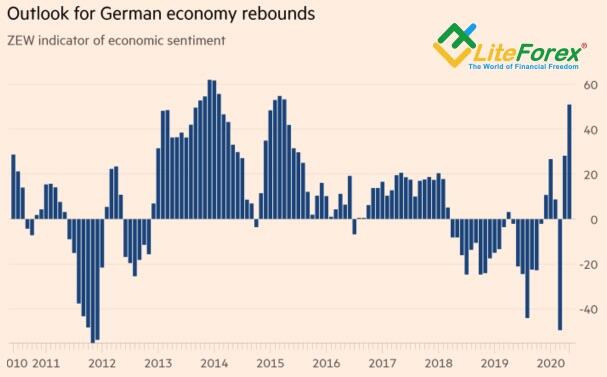

In 2018-2019, when the US dollar was growing steadily, and Donald Trump was talking about the drawbacks of a strong local currency, investors were discussing the possibility of joint intervention by the Fed and the US Treasury to hold the USD bulls back. They estimated the resources that Steven Mnuchin and his colleagues can afford, they projected the levels where they should start selling the greenback. The pandemic has proved that things are much simpler. Low Treasury rates and steadily rising US stock indexes are the major growth drivers for the EUR/USD. The euro-area positive PMI data are just another reason to sell the US dollar.

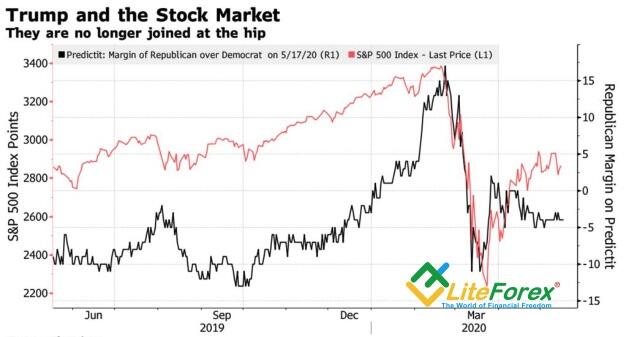

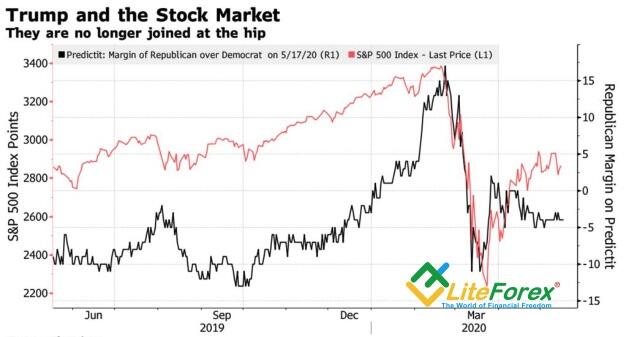

Traders, like detectives, must ask a question about who benefits. The rise of the Misery index, including both unemployment and inflation, to its all-time highs is posing a significant threat to President Donald Trump’s re-election in November. Historically, such increases have correlated with a loss for the incumbent party in the White House, and right now, the signals have never been more positive for the challenger. Donald Trump urgently needs strong stock indices, to prove that the US economy is strong. That is why he insists that the US-China trade deal is intact and COVID-19 should go away after a while, although it would be good to have a vaccine.

The Fed is not going to oppose the US president. The US central bank, like the White House, needs a strong economy. Jerome Powell and his fellow central-bankers are concerned about the rise of the personal savings rate in the U.S. They need low interest rates to encourage Americans to take their money away from banks and spend, thereby supporting the rebound of the US GDP.

So, investors, who buy the greenback now, have to go against both the Fed and the White House, which is extremely risky. The decision on whether to hold the USD in portfolios in the same volume or not has been taken. There is another question now, what to buy? Does it make sense to buy the euro? Yes, there are disputes in the euro area: between the “Frugal Four” and other EU members on the emergency recovery fund, and between the ECB and Germany’s constitutional court on the QE, between the UK and the EU on Brexit. However, everybody is confident that everything will end up well. Furthermore, the euro-area strong PMI data in June bring back the idea of the V-shaped recovery of the euro-area economy.

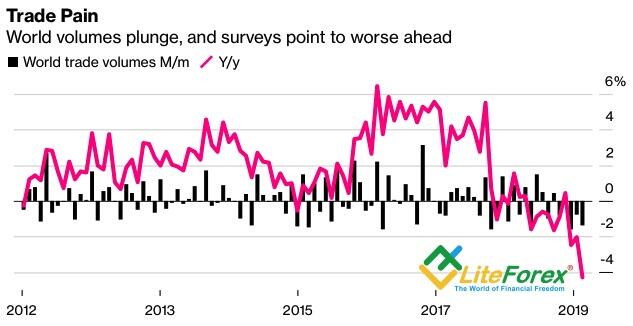

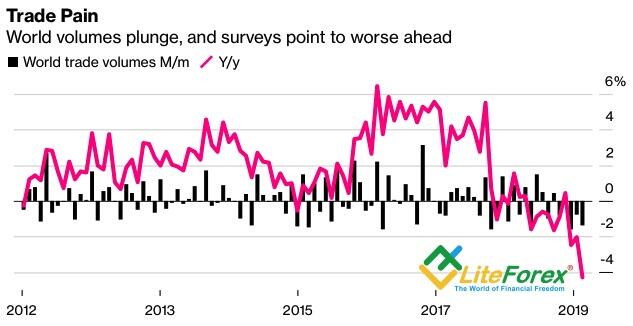

Investors do not worry that the PMI is still below the critical level of 50, and the economy will hardly return to the pre-crisis levels before 2022. Markets bet on the improvement of the epidemiological situation in Europe, which, like China, should restore economic growth faster than the USA. The only threat to this scenario could be posed by trade wars. If there are no shocks, the EUR/USD can well meet my forecast made in December and rise to 1.14 in late June and 1.16 in late December.

Dynamics of Misery Index

Traders, like detectives, must ask a question about who benefits

In 2018-2019, when the US dollar was growing steadily, and Donald Trump was talking about the drawbacks of a strong local currency, investors were discussing the possibility of joint intervention by the Fed and the US Treasury to hold the USD bulls back. They estimated the resources that Steven Mnuchin and his colleagues can afford, they projected the levels where they should start selling the greenback. The pandemic has proved that things are much simpler. Low Treasury rates and steadily rising US stock indexes are the major growth drivers for the EUR/USD. The euro-area positive PMI data are just another reason to sell the US dollar.

Traders, like detectives, must ask a question about who benefits. The rise of the Misery index, including both unemployment and inflation, to its all-time highs is posing a significant threat to President Donald Trump’s re-election in November. Historically, such increases have correlated with a loss for the incumbent party in the White House, and right now, the signals have never been more positive for the challenger. Donald Trump urgently needs strong stock indices, to prove that the US economy is strong. That is why he insists that the US-China trade deal is intact and COVID-19 should go away after a while, although it would be good to have a vaccine.

The Fed is not going to oppose the US president. The US central bank, like the White House, needs a strong economy. Jerome Powell and his fellow central-bankers are concerned about the rise of the personal savings rate in the U.S. They need low interest rates to encourage Americans to take their money away from banks and spend, thereby supporting the rebound of the US GDP.

So, investors, who buy the greenback now, have to go against both the Fed and the White House, which is extremely risky. The decision on whether to hold the USD in portfolios in the same volume or not has been taken. There is another question now, what to buy? Does it make sense to buy the euro? Yes, there are disputes in the euro area: between the “Frugal Four” and other EU members on the emergency recovery fund, and between the ECB and Germany’s constitutional court on the QE, between the UK and the EU on Brexit. However, everybody is confident that everything will end up well. Furthermore, the euro-area strong PMI data in June bring back the idea of the V-shaped recovery of the euro-area economy.

Investors do not worry that the PMI is still below the critical level of 50, and the economy will hardly return to the pre-crisis levels before 2022. Markets bet on the improvement of the epidemiological situation in Europe, which, like China, should restore economic growth faster than the USA. The only threat to this scenario could be posed by trade wars. If there are no shocks, the EUR/USD can well meet my forecast made in December and rise to 1.14 in late June and 1.16 in late December.

Dynamics of Misery Index

LiteFinance

Silver is outperforming gold

XAG/USD bulls are going ahead

If you asked me which Forex&Commodities asset is the most promising investment, I would choose silver without hesitating. First, silver traditionally follows the sector leader, gold, so, it has the same growth drivers. Second, the main consumer of physical silver is the industry. It suggests the XAG/USD falls faster during global recessions, but the uptrend also recovers faster than the XAU/USD during the rebound of global growth.

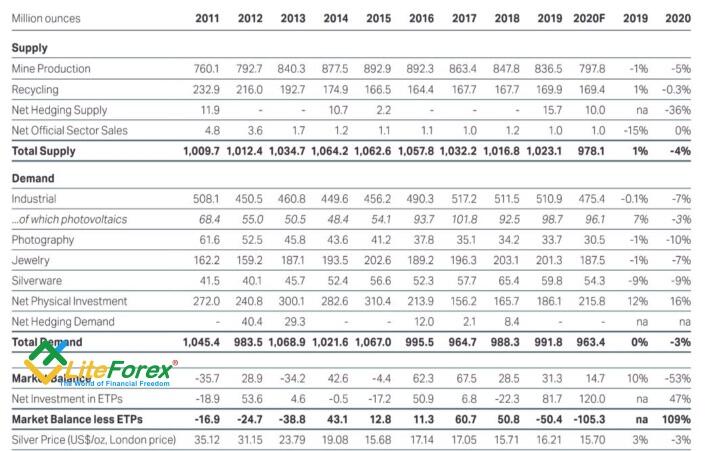

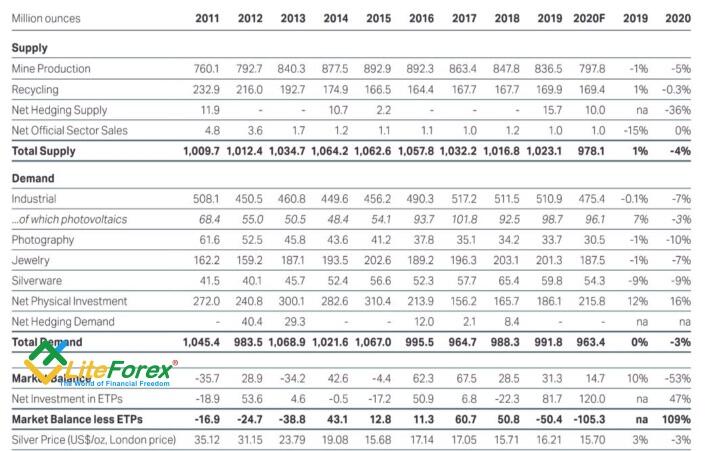

According to the Silver Institute, silver should save investors from the economic fallout of the pandemic. The organization says, in 2020, the global physical silver demand in the industrial consumption will decline from 510.9 million ounces to 475.4 million ounces, the consumption of silver jewelry and silverware will be down from 201.3 million ounces to 187.5 million ounces. However, the demand for ETF products will increase from 81.7 million ounces to 120 million ounces.

In fact, the ETF silver holdings are increasing much faster. Since the XAG/USD price started growing up from the March low, according to Commerzbank, the ETF silver holdings increased by 4900 tons, which is equivalent to two months of global mining. Differently put, 2/3 of global silver production is consumed by ETFs.

In my opinion, the silver industrial demand will be increasing faster than the Silver Institute expects. Under the current conditions, it is easier to return people to production than make them use restaurants and hotels. The results of social distancing are still present. That is why the manufacturing PMI is going up to the trend faster than the services PMI. One of the best performers is China, which has been one of the first to defeat the COVID-19 epidemic. The growth of China’s PMI gives a clue on the XAG/USD future price trend.

A significant proportion of the industrial consumption in sliver demand influences the trend of silver futures during the recession, followed by the global economic recovery. The silver price was sliding down faster than gold to the low of March 2020 and to the low of October 2008 during the previous economic crisis. From the lows of 2008 to the record highs of 2011, the XAU/USD increased by 165%, while the XAG/USD was 490%(!) up. Since mid-March, gold has been 21% up, while the silver price has increased by 53%.

In addition to the economic recovery after the recession, silver is supported by the growth drivers of gold. These are huge volumes of cheap liquidity provided by the Fed and other central banks, ultra-low rates of the global bond market, and the weakness of the world major currencies, including the US dollar. Therefore, I could recommend buying silver on the breakout of the resistance levels at $18.2 and $18.45. The middle-term upside targets for silver purchases are $20 and $23 per ounce. The major risks for this scenario are the second wave of the coronavirus pandemic and the escalation of trade wars.

Dynamics and structure of supply and demand for silver

XAG/USD bulls are going ahead

If you asked me which Forex&Commodities asset is the most promising investment, I would choose silver without hesitating. First, silver traditionally follows the sector leader, gold, so, it has the same growth drivers. Second, the main consumer of physical silver is the industry. It suggests the XAG/USD falls faster during global recessions, but the uptrend also recovers faster than the XAU/USD during the rebound of global growth.

According to the Silver Institute, silver should save investors from the economic fallout of the pandemic. The organization says, in 2020, the global physical silver demand in the industrial consumption will decline from 510.9 million ounces to 475.4 million ounces, the consumption of silver jewelry and silverware will be down from 201.3 million ounces to 187.5 million ounces. However, the demand for ETF products will increase from 81.7 million ounces to 120 million ounces.

In fact, the ETF silver holdings are increasing much faster. Since the XAG/USD price started growing up from the March low, according to Commerzbank, the ETF silver holdings increased by 4900 tons, which is equivalent to two months of global mining. Differently put, 2/3 of global silver production is consumed by ETFs.

In my opinion, the silver industrial demand will be increasing faster than the Silver Institute expects. Under the current conditions, it is easier to return people to production than make them use restaurants and hotels. The results of social distancing are still present. That is why the manufacturing PMI is going up to the trend faster than the services PMI. One of the best performers is China, which has been one of the first to defeat the COVID-19 epidemic. The growth of China’s PMI gives a clue on the XAG/USD future price trend.

A significant proportion of the industrial consumption in sliver demand influences the trend of silver futures during the recession, followed by the global economic recovery. The silver price was sliding down faster than gold to the low of March 2020 and to the low of October 2008 during the previous economic crisis. From the lows of 2008 to the record highs of 2011, the XAU/USD increased by 165%, while the XAG/USD was 490%(!) up. Since mid-March, gold has been 21% up, while the silver price has increased by 53%.

In addition to the economic recovery after the recession, silver is supported by the growth drivers of gold. These are huge volumes of cheap liquidity provided by the Fed and other central banks, ultra-low rates of the global bond market, and the weakness of the world major currencies, including the US dollar. Therefore, I could recommend buying silver on the breakout of the resistance levels at $18.2 and $18.45. The middle-term upside targets for silver purchases are $20 and $23 per ounce. The major risks for this scenario are the second wave of the coronavirus pandemic and the escalation of trade wars.

Dynamics and structure of supply and demand for silver

LiteFinance

Does dollar need a revolution?

The dollar smile theory is again discussed in Forex

The rules are unable and the ruled ones are unwilling. The EUR/USD pair seems to be reaching a revolutionary stage which may lead to unexpected results. The buyers of the S&P 500 and the euro are losing the faith in the V-shaped recovery of the US economy, or a soon victory over COVID-19. Besides, such factors as the huge fiscal and monetary stimulus provided by the EU and the ECB have been already priced in the major currency pair. The bulls need good news or fresh drivers to be encouraged to buy, but such drivers are not always provided. Bears are not willing to ahead without being confident in the second wave of the pandemic or the escalation of trade wars. Is there coming a revolution?

Donald Trump is again talking about cutting off relations with China. Steven Mnuchin says the U.S. doesn’t want to continue negotiations on digital taxation at the OECD. France calls this a provocation. Despite the investigation launched by the US trade representative Robert Lighthizer on whether Washington can unilaterally impose import tariffs as retaliation to the taxation of the US large companies abroad, France states it will continue taxation of digital giants. Facebook, Apple, and other giants receive a substantial revenue share from European users, which can’t but raise concerns in the EU. There is now a real chance that the dispute will end with a trade war.

The number of new COVID-19 cases is growing in some US states and in the world, the euphoria in the US stock market is gradually giving way to fear. The S&P 500 drop below 3000 will be a real disaster for the EUR/USD. Investors discuss the idea that the dollar smile theory will work out once again. It suggests the greenback strengthen following the crash of the stock indexes signaling a recession, and it weakens amid the Fed’s huge monetary stimulus and the improvement of the risk appetite. However, the dollar should start rising again afterward amid the expectations that the US economy will be recovering faster than the global. In fact, strong US employment data and retail sales increase the chance that the US GDP will quickly rebound, and the USD index is moving according to the smile theory. Its 10% rise was followed by a 6% crash. Is there going to be the third stage?

Investors are closely watching the events going on in the USA, and I can understand this. The growing dominance of the dollar in international finance means that U.S. problems pose a threat to the entire world. According to BIS, the share of the greenback as a currency for international financing has been the biggest since 2000. Its share in global FX reserves is 61%, in exchange operations – 85%, in the international settlements – about 50%.

What can the euro present? The official approval of the French-German fiscal stimulus project at the EU summit in June? I do not think this will provoke a strong reaction of traders. Another matter if there are problems with the plan’s approval. In this case, the EUR/USD could drop to 1.115 and 1.1125.

V-shaped recovery of the US economic surprise index

The dollar smile theory is again discussed in Forex

The rules are unable and the ruled ones are unwilling. The EUR/USD pair seems to be reaching a revolutionary stage which may lead to unexpected results. The buyers of the S&P 500 and the euro are losing the faith in the V-shaped recovery of the US economy, or a soon victory over COVID-19. Besides, such factors as the huge fiscal and monetary stimulus provided by the EU and the ECB have been already priced in the major currency pair. The bulls need good news or fresh drivers to be encouraged to buy, but such drivers are not always provided. Bears are not willing to ahead without being confident in the second wave of the pandemic or the escalation of trade wars. Is there coming a revolution?

Donald Trump is again talking about cutting off relations with China. Steven Mnuchin says the U.S. doesn’t want to continue negotiations on digital taxation at the OECD. France calls this a provocation. Despite the investigation launched by the US trade representative Robert Lighthizer on whether Washington can unilaterally impose import tariffs as retaliation to the taxation of the US large companies abroad, France states it will continue taxation of digital giants. Facebook, Apple, and other giants receive a substantial revenue share from European users, which can’t but raise concerns in the EU. There is now a real chance that the dispute will end with a trade war.

The number of new COVID-19 cases is growing in some US states and in the world, the euphoria in the US stock market is gradually giving way to fear. The S&P 500 drop below 3000 will be a real disaster for the EUR/USD. Investors discuss the idea that the dollar smile theory will work out once again. It suggests the greenback strengthen following the crash of the stock indexes signaling a recession, and it weakens amid the Fed’s huge monetary stimulus and the improvement of the risk appetite. However, the dollar should start rising again afterward amid the expectations that the US economy will be recovering faster than the global. In fact, strong US employment data and retail sales increase the chance that the US GDP will quickly rebound, and the USD index is moving according to the smile theory. Its 10% rise was followed by a 6% crash. Is there going to be the third stage?

Investors are closely watching the events going on in the USA, and I can understand this. The growing dominance of the dollar in international finance means that U.S. problems pose a threat to the entire world. According to BIS, the share of the greenback as a currency for international financing has been the biggest since 2000. Its share in global FX reserves is 61%, in exchange operations – 85%, in the international settlements – about 50%.

What can the euro present? The official approval of the French-German fiscal stimulus project at the EU summit in June? I do not think this will provoke a strong reaction of traders. Another matter if there are problems with the plan’s approval. In this case, the EUR/USD could drop to 1.115 and 1.1125.

V-shaped recovery of the US economic surprise index

LiteFinance

Dollar: is the glass half-full or half-empty?

The U.S. dollar is responsive to the market sentiment, optimistic or pessimistic

If the glass is half full for Donald Trump, for Jerome Powell, it is half empty. The Fed Chairman, during his speech to Congress, said a full US economic recovery will not occur until the American people are sure that the coronavirus epidemic has been brought under control. Despite an improvement of some economic indicators, production and employment are still below the pre-crisis levels. Besides, there is still great uncertainty about the strength and the terms of the US GDP rebound. Once the central bank’s president suggested uncertainty, the US dollar has strengthened. As I have stressed many times, all kinds of uncertainty support safe-haven demand.

The Fed has managed to stabilize the US stock market using the huge monetary stimulus. At present, however, the Federal Reserve seems to be concerned about a too fast rally of the S&P 500. The epic rally of the US stocks obviously includes a speculative element, the bubble is being inflated, and, if there is a second wave of COVID-19, it will immediately burst. The White House accuses Jerome Powell of being too pessimistic, but the Fed’s president is a realist who realizes that it is better to show restraint than build castles in the sky.

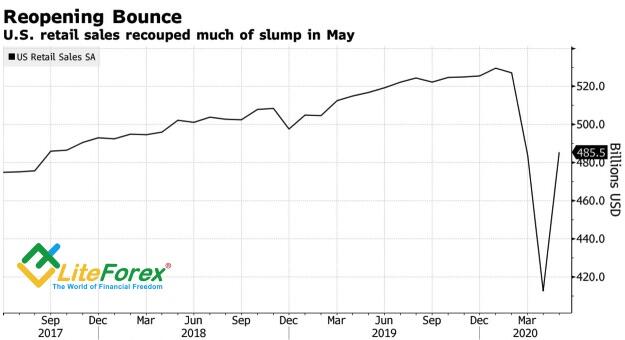

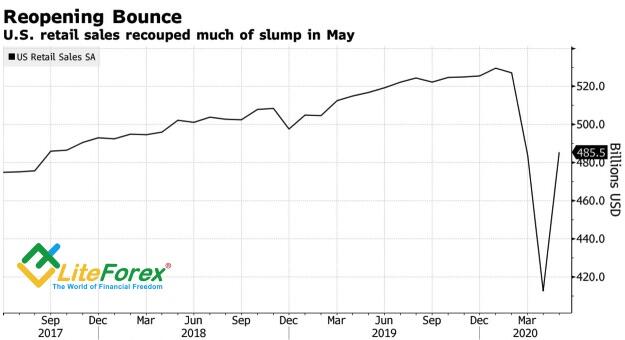

Financial markets are quite responsive to the speeches of the Fed’s Chairman. The growth of retail sales in May by 17.7% M-o-M, which is the best performance since the record began in 1992, has provided only temporary support to the S&P 500. Investors still realize that the indicator is below the pre-crisis level ($485 billion compared to $527 billion in February), and has contracted by 6.1% on an annual basis. That is what Jerome Powell was talking about, there are already some positive signs, but the general outlook is still grim.

Therefore, the dollar is supported by uncertainty, and the euro buyers are nervous ahead of the EU summit on June 18-19, where the fiscal stimulus issues will be discussed. The French-German plan is adopted de facto, but it is still to be legally approved. According to the German government, the ECB actions should be explained to the German Constitutional court by the Bundesbank. The Bundesbank, by the way, has already presented all the benefits of the European QE on its website.

The inflation slowdown increases the risk of the QE expansion, which won’t be the bullish factor for the EUR/USD as the euro-area economy is recovering. According to Citigroup, the extra €600 billion added by Christine Lagarde and her colleagues in early June do not meet the borrowing needs of the euro-area countries. The ECB will have to boost the QE by at least another €150 billion. Otherwise, Italy’s bond yield will start rising again. The euro still has its flaws, but all the problems can be solved.

The weak response of the S&P 500 to the US strong retail sales data is the bad news for the EUR/USD bulls. Another negative factor is the uncertainty around COVID-19 and the US economic rebound. However, if you believe that the glass is half-full, you could bet on the breakout of the top of the consolidation range 1.124-1.134.

Dynamics of US retail sales

The U.S. dollar is responsive to the market sentiment, optimistic or pessimistic

If the glass is half full for Donald Trump, for Jerome Powell, it is half empty. The Fed Chairman, during his speech to Congress, said a full US economic recovery will not occur until the American people are sure that the coronavirus epidemic has been brought under control. Despite an improvement of some economic indicators, production and employment are still below the pre-crisis levels. Besides, there is still great uncertainty about the strength and the terms of the US GDP rebound. Once the central bank’s president suggested uncertainty, the US dollar has strengthened. As I have stressed many times, all kinds of uncertainty support safe-haven demand.

The Fed has managed to stabilize the US stock market using the huge monetary stimulus. At present, however, the Federal Reserve seems to be concerned about a too fast rally of the S&P 500. The epic rally of the US stocks obviously includes a speculative element, the bubble is being inflated, and, if there is a second wave of COVID-19, it will immediately burst. The White House accuses Jerome Powell of being too pessimistic, but the Fed’s president is a realist who realizes that it is better to show restraint than build castles in the sky.

Financial markets are quite responsive to the speeches of the Fed’s Chairman. The growth of retail sales in May by 17.7% M-o-M, which is the best performance since the record began in 1992, has provided only temporary support to the S&P 500. Investors still realize that the indicator is below the pre-crisis level ($485 billion compared to $527 billion in February), and has contracted by 6.1% on an annual basis. That is what Jerome Powell was talking about, there are already some positive signs, but the general outlook is still grim.

Therefore, the dollar is supported by uncertainty, and the euro buyers are nervous ahead of the EU summit on June 18-19, where the fiscal stimulus issues will be discussed. The French-German plan is adopted de facto, but it is still to be legally approved. According to the German government, the ECB actions should be explained to the German Constitutional court by the Bundesbank. The Bundesbank, by the way, has already presented all the benefits of the European QE on its website.

The inflation slowdown increases the risk of the QE expansion, which won’t be the bullish factor for the EUR/USD as the euro-area economy is recovering. According to Citigroup, the extra €600 billion added by Christine Lagarde and her colleagues in early June do not meet the borrowing needs of the euro-area countries. The ECB will have to boost the QE by at least another €150 billion. Otherwise, Italy’s bond yield will start rising again. The euro still has its flaws, but all the problems can be solved.

The weak response of the S&P 500 to the US strong retail sales data is the bad news for the EUR/USD bulls. Another negative factor is the uncertainty around COVID-19 and the US economic rebound. However, if you believe that the glass is half-full, you could bet on the breakout of the top of the consolidation range 1.124-1.134.

Dynamics of US retail sales

LiteFinance

Fed puts the dollar in place

The EUR/USD may continue its rally up to 1.138 and break through the June’s highs

Donald Trump wants to control everything but the financial markets are ruled by the Fed. The president criticized the central bank for a too grim forecast, but this was necessary. Jerome Powell and his colleagues do not rule out a V-shaped recovery of the US economy, which was voiced by Dallas Fed President Robert Kaplan. However, the basic scenario is still the Nike-shaped recovery of the US GDP. If so, there will be needed huge volumes of monetary stimulus. Once the Fed added more liquidity, the S&P 500 has been up, which has sent the US dollar down.

The Fed has outlined its corporate bond-buying program and the detail of lending to commercial companies. The central bank will create a corporate bond portfolio that is based on a broad, diversified market index of U.S. corporate bonds. First, it will calculate an aggregate for the entire $9.6-trillion market, according to which it is planned to purchase the securities. According to Morgan Stanley, the Fed will buy corporate bonds for $385 billion, BofA Merrill Lynch believes that it will be about $419 billion. At the same time, the Federal Reserve is willing to give about $ 600 billion in loans to businesses with up to 15,000 employees and incomes up to $5 billion. Banks, which give them money, can sell up to 95% of loans to an investment agency organized by the Boston Federal Reserve

The US stock market has rebounded after the Fed’s announcement, and this is not surprising. The stock indexes usually rise amid ultra-easy monetary policy, economic expansion, low loan rates, and positive corporate reports. There could be problems with the US corporate reporting, however, if the GDP rebound is V-shaped, the middle- and long-term outlook for the stock market will be rather positive. The rise of the US stock indexes has weakened the US dollar, which is also natural. Since May, the negative correlation between these two assets has been increasing steadily.

A stronger negative correlation results not only from the greenback’s safe-haven status but also from the Fed’s effective measures to satisfy the foreign demand for the dollar. This required less money than during the previous recession. In the first week of June, the foreign central banks acquired $447 billion through swap lines, in 2008-2009, it was $583 billion.

The lower demand for the greenback reduced hedging costs for the purchases of the US assets. The European investors can afford to resume the favorite strategy of the S&P 500 longs and USD shorts. As a result of lower hedging costs, the EUR/USD looks much undervalued.

In my opinion, if level 3000 is the S&P 500 local low, and the stock index resumes the rally or starts consolidation, the EUR/USD pair should break through the June’s high. I suggest holding the longs entered in the zone of 1.122-1.124 up and adding new purchases.

Dynamics of the U.S. dollar and S&P 500

The EUR/USD may continue its rally up to 1.138 and break through the June’s highs

Donald Trump wants to control everything but the financial markets are ruled by the Fed. The president criticized the central bank for a too grim forecast, but this was necessary. Jerome Powell and his colleagues do not rule out a V-shaped recovery of the US economy, which was voiced by Dallas Fed President Robert Kaplan. However, the basic scenario is still the Nike-shaped recovery of the US GDP. If so, there will be needed huge volumes of monetary stimulus. Once the Fed added more liquidity, the S&P 500 has been up, which has sent the US dollar down.

The Fed has outlined its corporate bond-buying program and the detail of lending to commercial companies. The central bank will create a corporate bond portfolio that is based on a broad, diversified market index of U.S. corporate bonds. First, it will calculate an aggregate for the entire $9.6-trillion market, according to which it is planned to purchase the securities. According to Morgan Stanley, the Fed will buy corporate bonds for $385 billion, BofA Merrill Lynch believes that it will be about $419 billion. At the same time, the Federal Reserve is willing to give about $ 600 billion in loans to businesses with up to 15,000 employees and incomes up to $5 billion. Banks, which give them money, can sell up to 95% of loans to an investment agency organized by the Boston Federal Reserve

The US stock market has rebounded after the Fed’s announcement, and this is not surprising. The stock indexes usually rise amid ultra-easy monetary policy, economic expansion, low loan rates, and positive corporate reports. There could be problems with the US corporate reporting, however, if the GDP rebound is V-shaped, the middle- and long-term outlook for the stock market will be rather positive. The rise of the US stock indexes has weakened the US dollar, which is also natural. Since May, the negative correlation between these two assets has been increasing steadily.

A stronger negative correlation results not only from the greenback’s safe-haven status but also from the Fed’s effective measures to satisfy the foreign demand for the dollar. This required less money than during the previous recession. In the first week of June, the foreign central banks acquired $447 billion through swap lines, in 2008-2009, it was $583 billion.

The lower demand for the greenback reduced hedging costs for the purchases of the US assets. The European investors can afford to resume the favorite strategy of the S&P 500 longs and USD shorts. As a result of lower hedging costs, the EUR/USD looks much undervalued.

In my opinion, if level 3000 is the S&P 500 local low, and the stock index resumes the rally or starts consolidation, the EUR/USD pair should break through the June’s high. I suggest holding the longs entered in the zone of 1.122-1.124 up and adding new purchases.

Dynamics of the U.S. dollar and S&P 500

LiteFinance

Gold requires financial repression

Gold traders rely on the Fed

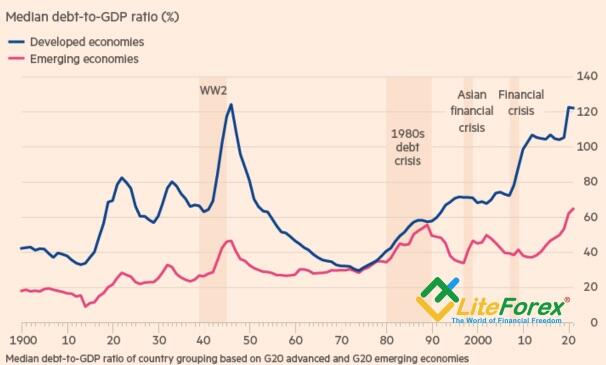

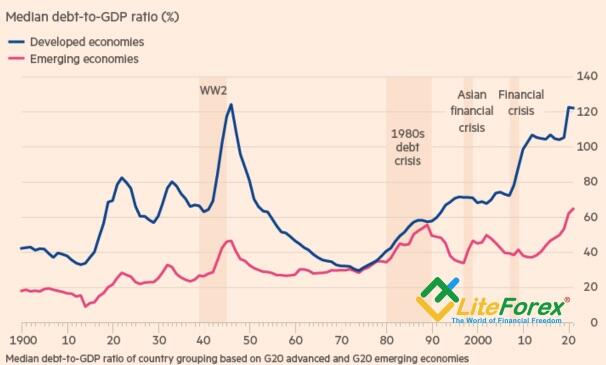

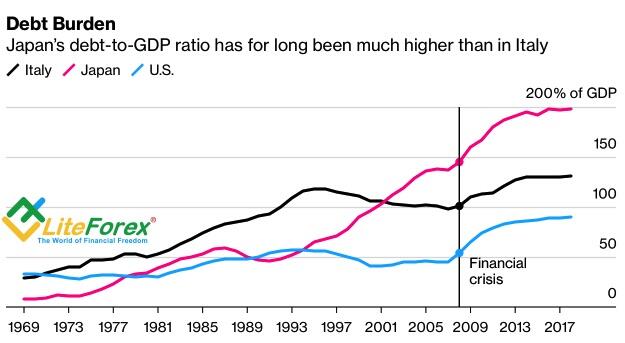

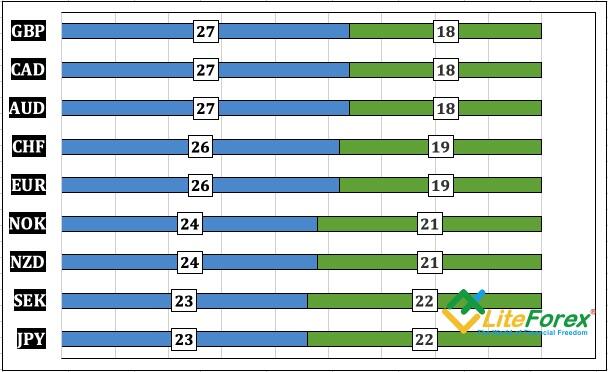

The world’s leaders compared their fight with the coronavirus with the world war. This war won’t end after COVID-19 is defeated, as the governments will have to repay huge debts. In the US alone the public debt will be up from 109% to 131% of the GDP in 2020. According to Goldman Sachs research, the debt-to-GDP ratio is developed economies will hit the levels recorded in the 1940s. At that time, to avert the growth of borrowing costs, the Fed introduced financial repression, including the Treasury yield control and setting the rules encouraging investors to hold such securities in the portfolios. If the US central bank uses the experience of the past, the gold price will surge.

Gold has featured a strong response to the outcomes of the FOMC June meeting. Jerome Powell made investors doubt in the V-shaped recovery of the US economy, and so, 10-year Treasury yield went back to 0.7%. The growth of the bond market rates in early summer was excessive and could hinder the GDP return to the trend. The gold market is quite responsive to the changes in Treasury yields. So, the Fed’s willingness to buy $80 billion in government bonds per month has encouraged the bulls. According to Gain Capital Group, this is a perfect scenario for XAU/USD. Concerns about slow recovery of economic growth and an unlimited monetary stimulus support the gold uptrend.

If the Fed manages to hold the bond market rates, the decline of the real yield amid a gradual acceleration of the inflation will support the price growth of the precious metal. Other growth drivers for the XAU/USD could be the weakness of the dollar and the stocks rally. The greenback is now seen as a main safe haven, so deterioration of the epidemiological situation in the USA has strengthened the US dollar, weighing on the S&P 500, which has somehow discouraged gold buyers. The gold price has been down to the important support at $1715-$1720 per ounce, the bulls need to hold the support up.

In my opinion, the success of the European countries in the fight with COVID-19 should suggest that the euro-area economy will recover quicker than the US. Do not forget that the EU is an export-led region, its close trade relations with China will play an important role in the future. The euro-area economy was hit by the US-China trade wars as much as China. However, in the present environment, the recovery of China’s economy is a very positive factor for the EU. Given the significant share of the euro in the structure of the USD index (57%), the downtrend of the US dollar will start sooner or later. This scenario could be canceled if the White House starts a new trade war, which is not advantageous under the current conditions. The escalation of the US-China trade battle will trigger the S&P 500 sell-off, which will press down Donald Trump’s approval ratings.

Therefore, gold buyers may count on such benefits as the decline of the Treasury real yield and the greenback’s weakening. Therefore, I would recommend buying gold if the gold price breaks out the resistance at $1745-$1750. The target could be set at $1830.

Dynamics of government debts

Gold traders rely on the Fed

The world’s leaders compared their fight with the coronavirus with the world war. This war won’t end after COVID-19 is defeated, as the governments will have to repay huge debts. In the US alone the public debt will be up from 109% to 131% of the GDP in 2020. According to Goldman Sachs research, the debt-to-GDP ratio is developed economies will hit the levels recorded in the 1940s. At that time, to avert the growth of borrowing costs, the Fed introduced financial repression, including the Treasury yield control and setting the rules encouraging investors to hold such securities in the portfolios. If the US central bank uses the experience of the past, the gold price will surge.

Gold has featured a strong response to the outcomes of the FOMC June meeting. Jerome Powell made investors doubt in the V-shaped recovery of the US economy, and so, 10-year Treasury yield went back to 0.7%. The growth of the bond market rates in early summer was excessive and could hinder the GDP return to the trend. The gold market is quite responsive to the changes in Treasury yields. So, the Fed’s willingness to buy $80 billion in government bonds per month has encouraged the bulls. According to Gain Capital Group, this is a perfect scenario for XAU/USD. Concerns about slow recovery of economic growth and an unlimited monetary stimulus support the gold uptrend.

If the Fed manages to hold the bond market rates, the decline of the real yield amid a gradual acceleration of the inflation will support the price growth of the precious metal. Other growth drivers for the XAU/USD could be the weakness of the dollar and the stocks rally. The greenback is now seen as a main safe haven, so deterioration of the epidemiological situation in the USA has strengthened the US dollar, weighing on the S&P 500, which has somehow discouraged gold buyers. The gold price has been down to the important support at $1715-$1720 per ounce, the bulls need to hold the support up.

In my opinion, the success of the European countries in the fight with COVID-19 should suggest that the euro-area economy will recover quicker than the US. Do not forget that the EU is an export-led region, its close trade relations with China will play an important role in the future. The euro-area economy was hit by the US-China trade wars as much as China. However, in the present environment, the recovery of China’s economy is a very positive factor for the EU. Given the significant share of the euro in the structure of the USD index (57%), the downtrend of the US dollar will start sooner or later. This scenario could be canceled if the White House starts a new trade war, which is not advantageous under the current conditions. The escalation of the US-China trade battle will trigger the S&P 500 sell-off, which will press down Donald Trump’s approval ratings.

Therefore, gold buyers may count on such benefits as the decline of the Treasury real yield and the greenback’s weakening. Therefore, I would recommend buying gold if the gold price breaks out the resistance at $1745-$1750. The target could be set at $1830.

Dynamics of government debts

LiteFinance

Fed doesn’t want a weaker dollar

Jerome Powell’s dovish tone hasn’t supported the EUR/USD rally

The US strong jobs report for May should have encouraged the Fed to demonstrate confidence in a soon rebound of the US economy after the shock resulting from the pandemic. However, Jerome Powell did what he should. The Fed’s chair didn’t make the mistake of the former central bank’s presidents. During the Great Depression, the Fed did not provide an extra stimulus, which resulted in the W-shaped economic recovery. During the previous recession, the central bank suggested normalizing the balance sheet too early, which send the S&P 500 28% down in March 2009, following its surge by 24% in January up from the low hit in November.

“We’re not thinking about raising rates, we’re not even thinking about thinking about raising rates”. All FOMC officials believe that the federal funds rate will remain at level 0%-0.25% through the end of 2021. 15 out of 17 members believe interest rates to remain at zero through 2022. The Fed’s projections emphasize that the US economy will take a long time to recover. The US GDP should contract by 6.5% in 2020, it will increase by 5% in 2021. The unemployment rate will be 5.5% in 2020, inflation – 1.7%, which is lower than the pre-crisis indicators. The Fed seems to believe that the US economic recovery will be slow, similar to the Nike logo when the downturn is first followed by a short bounce back, however, then comes a long period of the economy moving towards a trend.

Remarkably, the same is suggested by the OECD. It says most people see a V-shaped recovery but it is going to stop halfway. The OECD suggests the global economy will be 6% down in 2020, the US growth will contract by 7.3%, the euro-area economy will contract by 9.1%. Nonetheless, in 2021, the US GDP will expand by 4.1%, the euro-area growth will be 6.5% up.

I believe that, just as the S&P 500 is growing on expectations of improved corporate earnings in the future, the EUR/USD rally should continue due to the growth-gap between the euro area and the USA next year. Jerome Powell could have fueled the situation and weigh on the dollar if he had announced the Treasury yield control policy, but he didn’t. The Fed decided to fix the monthly volume of Treasury purchases and mortgage bonds at the levels of $80 billion and $40 billion. Its interference in the debt market is gradually fading away. In late March, the central bank was buying assets at a weekly pace of $375 billion, in late April, it bought $50 billion per week, and in early June, the central bank purchased $20 billion. The Fed probably believes that a fixed volume of purchases will be enough to stop the increase in the Treasury yields.

In general, The Fed has done what it should. Suggesting rather gloomy projections, it left the door open for the further expansion of the monetary stimulus. That is what financial markets need now. Unless there are no strong shocks, like the second wave of COVID-19 or a new round of trade wars, the S&P 500 may break through its all-time high already this year. If so, the EUR/USD can well meet my December forecast, suggesting the pair be at 1.14 and 1.16 in the middle and at the end of 2020. It is still relevant to buy the euro on the corrections down.

Dynamics of global GDP

Jerome Powell’s dovish tone hasn’t supported the EUR/USD rally

The US strong jobs report for May should have encouraged the Fed to demonstrate confidence in a soon rebound of the US economy after the shock resulting from the pandemic. However, Jerome Powell did what he should. The Fed’s chair didn’t make the mistake of the former central bank’s presidents. During the Great Depression, the Fed did not provide an extra stimulus, which resulted in the W-shaped economic recovery. During the previous recession, the central bank suggested normalizing the balance sheet too early, which send the S&P 500 28% down in March 2009, following its surge by 24% in January up from the low hit in November.

“We’re not thinking about raising rates, we’re not even thinking about thinking about raising rates”. All FOMC officials believe that the federal funds rate will remain at level 0%-0.25% through the end of 2021. 15 out of 17 members believe interest rates to remain at zero through 2022. The Fed’s projections emphasize that the US economy will take a long time to recover. The US GDP should contract by 6.5% in 2020, it will increase by 5% in 2021. The unemployment rate will be 5.5% in 2020, inflation – 1.7%, which is lower than the pre-crisis indicators. The Fed seems to believe that the US economic recovery will be slow, similar to the Nike logo when the downturn is first followed by a short bounce back, however, then comes a long period of the economy moving towards a trend.

Remarkably, the same is suggested by the OECD. It says most people see a V-shaped recovery but it is going to stop halfway. The OECD suggests the global economy will be 6% down in 2020, the US growth will contract by 7.3%, the euro-area economy will contract by 9.1%. Nonetheless, in 2021, the US GDP will expand by 4.1%, the euro-area growth will be 6.5% up.

I believe that, just as the S&P 500 is growing on expectations of improved corporate earnings in the future, the EUR/USD rally should continue due to the growth-gap between the euro area and the USA next year. Jerome Powell could have fueled the situation and weigh on the dollar if he had announced the Treasury yield control policy, but he didn’t. The Fed decided to fix the monthly volume of Treasury purchases and mortgage bonds at the levels of $80 billion and $40 billion. Its interference in the debt market is gradually fading away. In late March, the central bank was buying assets at a weekly pace of $375 billion, in late April, it bought $50 billion per week, and in early June, the central bank purchased $20 billion. The Fed probably believes that a fixed volume of purchases will be enough to stop the increase in the Treasury yields.

In general, The Fed has done what it should. Suggesting rather gloomy projections, it left the door open for the further expansion of the monetary stimulus. That is what financial markets need now. Unless there are no strong shocks, like the second wave of COVID-19 or a new round of trade wars, the S&P 500 may break through its all-time high already this year. If so, the EUR/USD can well meet my December forecast, suggesting the pair be at 1.14 and 1.16 in the middle and at the end of 2020. It is still relevant to buy the euro on the corrections down.

Dynamics of global GDP

LiteFinance

Dollar lets out doves

EUR/USD is up to three-month highs as Jerome Powell is expected to sound dovish

The best is the enemy of good. The Fed is in a difficult situation after the publication of the US jobs report for May. The drop in the unemployment rate and the biggest surge in employment since the end of World War Two suggest the V-shaped recovery of the US economy, which is expected by the White House. The Fed was opposing this idea until recently. According to Jerome Powell, it will take a long time until the US GDP is back to the pre-crisis growth pace. This should require an extra fiscal stimulus. Strong domestic data allow the US central bank to sound more optimistic than it did before. However, optimism could drop the US stock market.

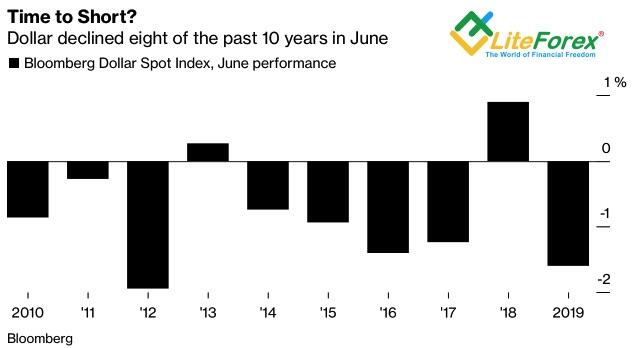

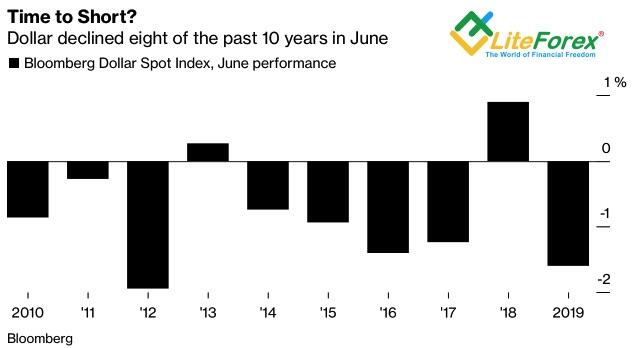

Powell has some negative experiences. In late 2018, his announcement that the current interest rates were far from being neutral started sell-offs of the S&P 500. The Fed’s chair must be extremely careful. Ahead of the publication of the FOMC June meeting’s outcomes, markets expect Powell to sound dovish. That is why the EUR/USD has rebounded up from the support at 1.124-1.1245 I suggested earlier and increased by an entire figure. Investors expect the Fed to express the willingness to hold the interest rates low for some years and signal the Treasury yields targeting policy. Both factors are bearish for the US dollar, which is also weighed on by the seasonal factor. In June, the USD index fell in eight cases out of the past ten by 0.7% on average.

The greenback has been ahead of the plan so far, as it has been more than 2% down since early June. However, investors are still willing to buy the EUR/USD. According to DoubleLine Capital, the US twin deficit (budget deficit and foreign trade deficit) should increase to 12% of GDP, and the dollar should be back to the levels of 2011. The euro is supported by the EU huge fiscal stimulus, which could mitigate the recession in the euro-area. Besides, amid aggressive rate cuts by global central banks, the ECB negative interest rates are not so harmful to the euro as they were before.

On the other hand, the rise in the Treasury yields and a lower chance that the Fed will cut the federal funds rate below zero are positive factors for the US dollar. These benefits of greenback can be neutralized if the Fed starts yield control policy, which should happen in September, according to Bloomberg. Investors can be lured back to the US dollar if there is COVID-19 second wave or a new round of trade wars. Unless this happens, the main scenario suggests the EUR/USD should rise to 1.147 and 1.155, and it will be relevant to buy the euro on the corrections down, as I wrote before. However, Jerome Powell’s carelessness and the fact that the euro-dollar rally ahead of the publication of the FOMC June meeting’s results implies the Fed’s dovish tone may become a reason for a drawdown.

Dynamics of Bloomberg USD index

EUR/USD is up to three-month highs as Jerome Powell is expected to sound dovish

The best is the enemy of good. The Fed is in a difficult situation after the publication of the US jobs report for May. The drop in the unemployment rate and the biggest surge in employment since the end of World War Two suggest the V-shaped recovery of the US economy, which is expected by the White House. The Fed was opposing this idea until recently. According to Jerome Powell, it will take a long time until the US GDP is back to the pre-crisis growth pace. This should require an extra fiscal stimulus. Strong domestic data allow the US central bank to sound more optimistic than it did before. However, optimism could drop the US stock market.

Powell has some negative experiences. In late 2018, his announcement that the current interest rates were far from being neutral started sell-offs of the S&P 500. The Fed’s chair must be extremely careful. Ahead of the publication of the FOMC June meeting’s outcomes, markets expect Powell to sound dovish. That is why the EUR/USD has rebounded up from the support at 1.124-1.1245 I suggested earlier and increased by an entire figure. Investors expect the Fed to express the willingness to hold the interest rates low for some years and signal the Treasury yields targeting policy. Both factors are bearish for the US dollar, which is also weighed on by the seasonal factor. In June, the USD index fell in eight cases out of the past ten by 0.7% on average.

The greenback has been ahead of the plan so far, as it has been more than 2% down since early June. However, investors are still willing to buy the EUR/USD. According to DoubleLine Capital, the US twin deficit (budget deficit and foreign trade deficit) should increase to 12% of GDP, and the dollar should be back to the levels of 2011. The euro is supported by the EU huge fiscal stimulus, which could mitigate the recession in the euro-area. Besides, amid aggressive rate cuts by global central banks, the ECB negative interest rates are not so harmful to the euro as they were before.

On the other hand, the rise in the Treasury yields and a lower chance that the Fed will cut the federal funds rate below zero are positive factors for the US dollar. These benefits of greenback can be neutralized if the Fed starts yield control policy, which should happen in September, according to Bloomberg. Investors can be lured back to the US dollar if there is COVID-19 second wave or a new round of trade wars. Unless this happens, the main scenario suggests the EUR/USD should rise to 1.147 and 1.155, and it will be relevant to buy the euro on the corrections down, as I wrote before. However, Jerome Powell’s carelessness and the fact that the euro-dollar rally ahead of the publication of the FOMC June meeting’s results implies the Fed’s dovish tone may become a reason for a drawdown.

Dynamics of Bloomberg USD index

LiteFinance

The dollar gave a pleasant surprise

The US employment rebounds quickly, which signals the recession has been the shortest in the US history

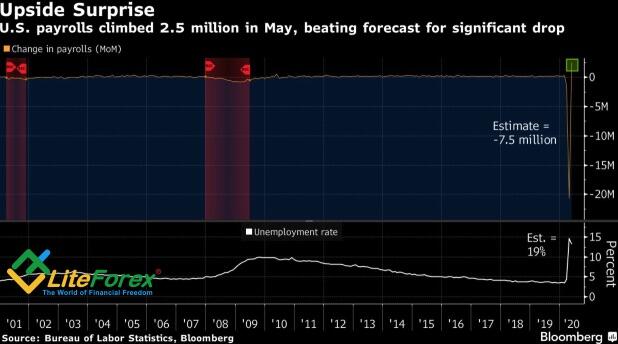

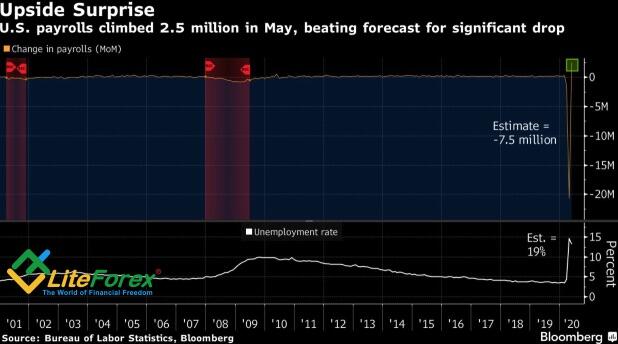

A downturn ends when the economy starts expanding. The US employment was up in May at the highest monthly pace since World War Two (+2.5 million), the US current US recession is going to be the deepest but the shortest since the 1930s. Despite the gloomy forecasts suggesting the rise in the unemployment rate to 20%, the indicator has been down from 14.7% to 13.3%, which sent the US stock indexes 3% up and encouraged the EUR/USD bulls to take the profits. When everyone is buying, it is a good chance to sell. The US dollar has strengthened due to this principle, the optimism about a quicker rebound of the US GDP than the global indicator, and the growth in the Treasury yields.

The euro’s three-week rally must have resulted from the signs of the unity in the euro area amid a considerable boost of the fiscal and monetary stimulus. According to the Bundesbank, which suggested the growth of Germany’s GDP by 3.2% and 3.8% in 2021-2022 following a drop by 7.1% in 2020, tax cuts in Germany and other support measures will add a percentage point to the GDP growth pace next year. Besides, I think it makes sense to exit the euro longs, as almost a 6% rally of the EUR/USD since late May suggests that most of the positive has been priced in the pair’s quotes. It is now relevant to sell, as many investors, encouraged by the pleasant surprise made by the US jobs report, are buying.

Will the euro sell-off continue? The clue should be given by Donald Trump and the Fed. The US president again threatens the EU to increase the import tariffs on European cars. The White House, as in the case of China in 2018-2019, starts with small steps. Trump claims that the Canadian lobsters are imported duty-free by the EU, while there is an 8% duty in the block for American live lobsters. If the EU doesn’t drop its tariff, the US will impose a new tariff on the EU cars. The same is also acute for China, which imposed a levy on the US live lobsters. The global economy, as well as China, is already weak amid the pandemic fallout, and a new round of trade wars will further weaken it. China’s economy is gradually recovering. In May, China's foreign trade surplus was up to the record level of $62.9. This should support GDP growth.

Will the Fed weigh on the US dollar? The huge volumes of the Treasury issuance (it is about $3 trillion in the second quarter, which is equal to 15% of GDP), an increase in the US employment and inflation rate encourages investors to buy risky assets and sell the government bonds. The growth of the Treasury yields will hinder the economic recovery and boost the debt servicing costs. Under such conditions, the Fed could follow the experience of BoJ and the RBA, which means the bond yield targeting. This will deprive the greenback of its important advantage. If so, it will be relevant to enter the EUR/USD longs when the price rebounds from the supports at 1.124 and 1.12.

Dynamics of employment and unemployment in the USA

The US employment rebounds quickly, which signals the recession has been the shortest in the US history

A downturn ends when the economy starts expanding. The US employment was up in May at the highest monthly pace since World War Two (+2.5 million), the US current US recession is going to be the deepest but the shortest since the 1930s. Despite the gloomy forecasts suggesting the rise in the unemployment rate to 20%, the indicator has been down from 14.7% to 13.3%, which sent the US stock indexes 3% up and encouraged the EUR/USD bulls to take the profits. When everyone is buying, it is a good chance to sell. The US dollar has strengthened due to this principle, the optimism about a quicker rebound of the US GDP than the global indicator, and the growth in the Treasury yields.

The euro’s three-week rally must have resulted from the signs of the unity in the euro area amid a considerable boost of the fiscal and monetary stimulus. According to the Bundesbank, which suggested the growth of Germany’s GDP by 3.2% and 3.8% in 2021-2022 following a drop by 7.1% in 2020, tax cuts in Germany and other support measures will add a percentage point to the GDP growth pace next year. Besides, I think it makes sense to exit the euro longs, as almost a 6% rally of the EUR/USD since late May suggests that most of the positive has been priced in the pair’s quotes. It is now relevant to sell, as many investors, encouraged by the pleasant surprise made by the US jobs report, are buying.

Will the euro sell-off continue? The clue should be given by Donald Trump and the Fed. The US president again threatens the EU to increase the import tariffs on European cars. The White House, as in the case of China in 2018-2019, starts with small steps. Trump claims that the Canadian lobsters are imported duty-free by the EU, while there is an 8% duty in the block for American live lobsters. If the EU doesn’t drop its tariff, the US will impose a new tariff on the EU cars. The same is also acute for China, which imposed a levy on the US live lobsters. The global economy, as well as China, is already weak amid the pandemic fallout, and a new round of trade wars will further weaken it. China’s economy is gradually recovering. In May, China's foreign trade surplus was up to the record level of $62.9. This should support GDP growth.

Will the Fed weigh on the US dollar? The huge volumes of the Treasury issuance (it is about $3 trillion in the second quarter, which is equal to 15% of GDP), an increase in the US employment and inflation rate encourages investors to buy risky assets and sell the government bonds. The growth of the Treasury yields will hinder the economic recovery and boost the debt servicing costs. Under such conditions, the Fed could follow the experience of BoJ and the RBA, which means the bond yield targeting. This will deprive the greenback of its important advantage. If so, it will be relevant to enter the EUR/USD longs when the price rebounds from the supports at 1.124 and 1.12.

Dynamics of employment and unemployment in the USA

LiteFinance

The dollar did it!

Is Greenback the reason for US stock market madness?

When the US stock market recovered after the 2009 crisis, they called it “the most hated rally in history”. Back then, most investors became hostages to their own scepticism as they had believed that a recession that large would make S&P 500 collapse much deeper than it actually did.

The current recovery of US stock indexes has lasted for about 10 months, but it has already become a new “most hated rally”. The markets are far from reality, shares go off like hot cakes and S&P 500 behaves like a true woman. Women usually prefer being beautiful to being smart because men usually prefer watching to thinking.

FOMC officials, Wall Street Journal experts, Ways and Means Committee and other competent organisations say that a V-shaped economic recovery is no longer a matter of fact, but the market doesn’t want to search for any other letters. The unemployment rate soared to 20%. The States plunged into the deepest recession since the Great Depression. Donald Trump continues putting pressure on China and Beijing halts imports of US agriculture products. But S&P 500 pays no attention to geopolitics, recessions or mass protests:

- Listen! Don’t even try using fake money in shops.

- They won’t strangle me for that and start a revolution, will they?

If the number of new coronavirus cases isn’t rapidly growing amidst US riots in the next few days, it will be really suspicious. The Fed representatives hint at new stimulus packages and a W-shape recovery that the second epidemic wave will lead to. However, when stocks grow so fast, the sense of fear vanishes. Many are afraid of missing out on the opportunity to buy and they just buy, and buy, and buy.

Mom would tell me you’re an idiot. Your own mom!

Some things make no sense: in the market there are rumours that the main reason for S&P 500’s rally was the weakness of the USD. They say the fall of the USD index boosts US companies’ competitiveness and their corporate profit. But for that to be true, there must be a time lag between the two events. I’d rather believe that stocks buying increased the share of dollars in investment portfolios as the USD is a tool hedging against a poorer global appetite for risk. The appetite didn’t and will hardly get worse as the global economy is recovering. So, they are just getting rid of the greenback. But isn’t it too early?

The higher euphoria, the stronger disappointment. Beware! S&P 500 still has many reasons for falling and bulls may be duped at any moment.

Is Greenback the reason for US stock market madness?

When the US stock market recovered after the 2009 crisis, they called it “the most hated rally in history”. Back then, most investors became hostages to their own scepticism as they had believed that a recession that large would make S&P 500 collapse much deeper than it actually did.

The current recovery of US stock indexes has lasted for about 10 months, but it has already become a new “most hated rally”. The markets are far from reality, shares go off like hot cakes and S&P 500 behaves like a true woman. Women usually prefer being beautiful to being smart because men usually prefer watching to thinking.

FOMC officials, Wall Street Journal experts, Ways and Means Committee and other competent organisations say that a V-shaped economic recovery is no longer a matter of fact, but the market doesn’t want to search for any other letters. The unemployment rate soared to 20%. The States plunged into the deepest recession since the Great Depression. Donald Trump continues putting pressure on China and Beijing halts imports of US agriculture products. But S&P 500 pays no attention to geopolitics, recessions or mass protests:

- Listen! Don’t even try using fake money in shops.

- They won’t strangle me for that and start a revolution, will they?

If the number of new coronavirus cases isn’t rapidly growing amidst US riots in the next few days, it will be really suspicious. The Fed representatives hint at new stimulus packages and a W-shape recovery that the second epidemic wave will lead to. However, when stocks grow so fast, the sense of fear vanishes. Many are afraid of missing out on the opportunity to buy and they just buy, and buy, and buy.

Mom would tell me you’re an idiot. Your own mom!

Some things make no sense: in the market there are rumours that the main reason for S&P 500’s rally was the weakness of the USD. They say the fall of the USD index boosts US companies’ competitiveness and their corporate profit. But for that to be true, there must be a time lag between the two events. I’d rather believe that stocks buying increased the share of dollars in investment portfolios as the USD is a tool hedging against a poorer global appetite for risk. The appetite didn’t and will hardly get worse as the global economy is recovering. So, they are just getting rid of the greenback. But isn’t it too early?

The higher euphoria, the stronger disappointment. Beware! S&P 500 still has many reasons for falling and bulls may be duped at any moment.

LiteFinance

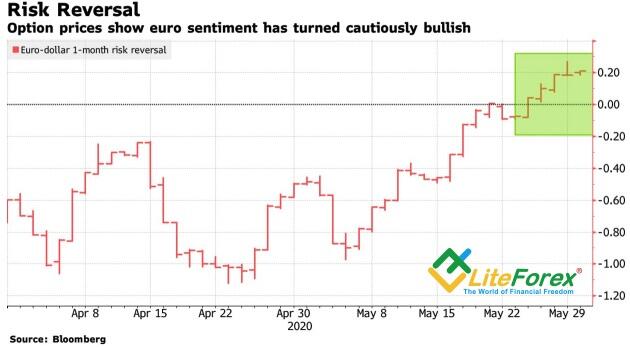

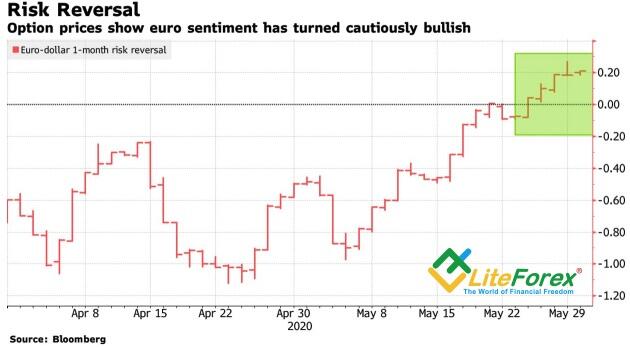

Euro is looking at the markets Forex and stock market trends signal a soon recovery of global and European economies What came first, the chicken or the egg? Do markets reflect what is going to be in the economy, or the economy is driving the markets in a particular direction? When I look at the S&P 500, I see a soon V-shaped rebound. This is what the markets signal, although the Fed’s officials, the members of the Congressional Budget Office, and numerous experts say that the US GDP recovery will take a long time. When I look at the GBP, I see at least the extension of the Brexit deadline or even a soon signing of the trade deal between the UK and the EU. Although Boris Johnson’s government is unwilling to follow either of the scenarios. Yes, euro gains back its old benefit, the hope that the Brexit matters will be settled down easily. The divorce, in any sense, is not an easy matter. Divorce is associated with significant financial costs in exchange for independence and peace of mind. The divorce of the UK and the EU is no exception. Both sides will suffer, and most of the negative was priced in the sterling’s quotes until recently. Once investors gained back the hope for the Brexit deal, they have started exiting the GBP/USD shorts. According to Bloomberg's source familiar with the matter, the European Union will try to convince Boris Johnson to forge a compromise later this month in an attempt to stop the U.K. from breaking away from the bloc without a trade deal. The stronger pound supports the euro. The euro-dollar risk reversals have entered the positive area for the first time since March, which signals the EUR/USD market is bullish. The euro’s rise is natural as the US stock indexes are rallying up although many controversial facts. There is a risk of the second wave of COVID-19, there are mass protests in the USA, the US-China trade relations are still tense. Moreover, the White House resumed the case of digital taxes in the EU in relation to US companies, which may result in new tariffs against the European Union. The growth of the global risk appetite has sent the USD down to its three-month low, and the sharks of Wall Street suggest that the greenback’s uptrend is about to turn down. According to Citigroup, as the Federal Reserve slashed interest rates to near zero and the potential growth of US GDP is lower than in the rest of the world, the dollar enters a bear market that should last from 5 to 10 years. A similar opinion is shared by Goldman Sachs, JP Morgan, and Deutsche Bank, which recommend their clients to reduce the share of the US dollar in the portfolios. The euro is also supported by the talks that Germany is to boost the fiscal stimulus by €50 billion - €100 billion and the hopes that the ECB will expand the QE size by another €500 billion. I think these factors have been already priced in the EUR/USD. If the ECB is not fast enough to take more stimulating measures or gives less than the market expects, the market can experience the same turmoil that was in March, when Christine Lagarde recklessly stated that the European Central Bank is not responsible for controlling the spreads of the debt market. The first targets for the euro longs at $1.115 and $1.12 have been already reached, the next upside targets at $1.122 and $1.124 are close. The ECB meeting should allow taking some of the profits. Dynamics of EUR/USD risk reversals

LiteFinance

Euro: save Rome or die ECB tries to prove that Italy’s central bank is strong enough to support the economy during the pandemic When the market is too optimistic, the good news is eagerly discussed and the bad news is ignored, I start thinking that it is the right time to exit. While Donald Trump is considering retaliatory measures to China because of Hong Kong, the S&P 500 is growing despite the deepest recession of the US economy since the Great Depression, the increase in the unemployment towards 20%, and the gloomy forecasts of the Congressional Budget Office. The CBO has lowered its GDP projection for 2030 made up in January by $15.7 trillion, suggesting the US economy should shrink by 5.6% in 2020, and the US economic recovery should take several years. The S&P 500 is just one growth driver among several ones encouraging the EUR/USD bulls. During the stress in the financial markets, investors turned to safe havens, first of all, the greenback and Treasuries. However, once the global economies are being reopened, investors are lured back to risky assets. The USD index has been falling over the past few days, the 30-year Treasury yield reached its highest level since March 20. Nonetheless, the US-China trade relations are still uncertain. According to Bloomberg's source familiar with the matter, China has told state-owned firms to halt purchases of farm products from the United States after Washington said it would eliminate special treatment for Hong Kong to punish Beijing. China may not meet the obligations under the phase 1 trade deal signed in January. The euro is also growing amid the French-German fiscal stimulus offer, the announcement of the European Commission about issuing bonds worth €750 billion, and the hopes for the expansion of the ECB’s €750 billion Pandemic Emergency Purchase Programme. Investors expect that Italy’s bond yields continue falling, and the Italy-German yield gap will be narrowing, which should finally defeat the Eurosceptics. Christine Lagarde is going to save Rome, and Italy is often compared with Japan. The same aging of the population, the same endless struggle for inflation growth...Nevertheless, Japan has its central bank, and the ECB has to prove that Italy's central bank is also strong. In addition to the QE boosting, the ECB may also start purchasing fallen angels and reinvesting incomes from the long-term asset-purchase program. The fiscal and monetary stimulus push the EUR/USD up and make banks revise their projections. HSBC sees the pair at 1.1 in late 2020, up from the previous forecast of 1.05, amid the drop in the risk of the euro-area breakup. Furthermore, the forecast of Bloomberg experts also suggests the EUR/USD be at 1.1. Nonetheless, the French-German plan hasn’t been approved yet, and the EUR/USD bulls could be set back as the ECB is not taking active measures right now. These facts, as well as the escalation of the US-China trade war, may force investors to start exiting longs. After all, the euro can still rise above $1.115. Dynamics of debt-to-GDP ratio in Italy, Japan, and the USA

LiteFinance

Gold: the pandemic starts and ends, but the liquidity remains The way the Fed follows the experience of other central banks will determine the gold future trend I am entertained with the headlines of the articles devoted to the gold market. Something like “Gold is down amid the reopening of the US economy and the rally of stock indexes”, “Gold price is rising as investors are concerned that Trump will take serious measures against China as the retaliation for Hong Kong”. The US didn’t impose tough sanctions against China, but the XAU/USD is still rising. Why? They say this is because of the riots in the US after the killing of an African American by the police. But the US stocks are still growing! Yes, because investors ignore those protests. I remember an old joke about two analysts speaking: Do you understand what is happening in the market? - Yes, let me explain… - No, thanks! I can explain this myself, but I still can’t understand... In my opinion, such controversial headlines of the tabloids, like there were two or three days ago, occur because their authors do not understand what is really going on. I will try to express my own opinion, which, however, may not be the universal truth. The price of any asset forms also because of the actions of big traders that are based on an investment idea. In most cases, this is an idea suggested by fundamental factors. Besides, the patterns in economic studies are as often as the technical patterns. The global economy is in the recession, so we can base on the gold trends that were typical during the former downturns. At those times, the market favored the idea that the inflation rise, spurred by the huge monetary stimulus, would push the gold future up above $2000 per once. The time was going, the gold price was growing and reached its all-time high at $1920 in 2011. However, the CPI and the PCE didn’t accelerate. Big traders realized that they had been wrong and started exiting longs, which broke the XAU/USD bull trend. History is not only repeated but also rhymed. The current monetary stimulus is greater than the previous one, however, banks and hedge funds are unwilling to repeat the old mistake, so they started exiting longs in late May. This is because inflation is not rising. Moreover, the demand can be weak for a long time due to the pandemic, which is clear from the dynamics of 10-year inflation expectations. Expected annual inflation in the USA and Europe As a result, the gold price rebounded from the top of the middle-term consolidation range of $1635-$1775 outlined in the previous gold analytics. If the price hadn’t remained above $1700, the correction could have continued. However, the Fed’s officials started talking about the yield curve control. According to the president of the Federal Reserve Bank of New York John Williams, this idea is being considered, and the experience of other countries is being analyzed. If the central bank keeps the bond market rates at a fixed level, the inflation rate should start rising (the pandemic starts and ends, but the liquidity remains). This will send down the real Treasury yield, and the gold price should be rising to at least $1830 per ounce. The US Treasuries are the main rival for gold, and a drop in Treasury yields encourages investors to increase the share of gold in the portfolios. Expected annual inflation in the USA and Europe

LiteFinance

Forex in June: the impossible is possible

The growth of global risk appetite, which looked incredible in April and unnatural in May, can continue in June

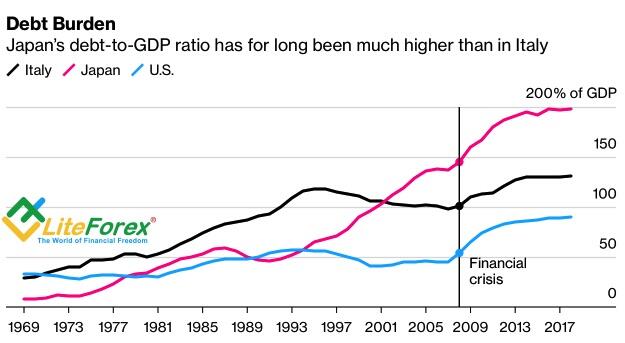

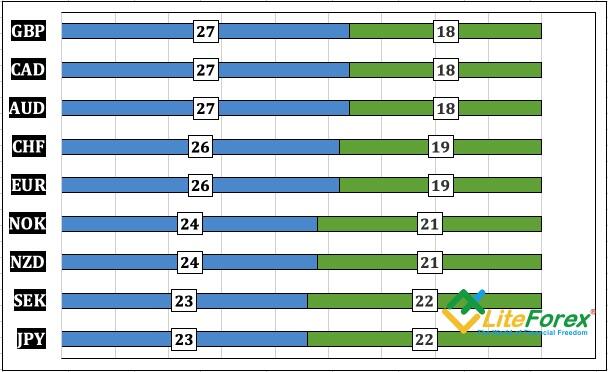

In Forex, like in a casino, the most important is to stop at the right time. Based on the statistical analysis with fundamental components, I recommended exiting the EUR/USD and GBP/USD shorts at the end of May. Just these two operations could have increased the deposit by 6%. Alas, but the strong euro rally at the end of May has a little spoiled the whole situation. The shorts on the EUR/USD and EUR/JPY yielded losses of about 3.3%, and shorts on the GBP/USD and GBP/CHF resulted in a loss of about 3.9%. Greed may lead to losses. However, I have many times stressed that seasonal regularities should be used in addition to the fundamental and technical analysis.

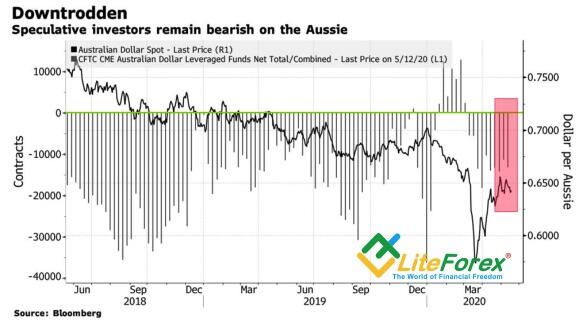

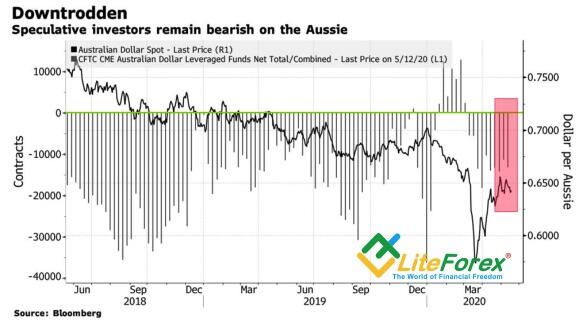

June is a good time for commodity currencies. Since 1975, the AUD and CAD strengthened versus the US dollar in 27 cases against 18. The NZD performed a little worse, however, it also rose against the greenback. The idea to buy the AUD/USD and sell the USD/CAD is not new, I have recently written about this based on the lockdown stringency.

The pound is usually weak in May amid the dividend payments to foreigners, which has been again proven in May. However, history proves that the situation radically changes in June. The sterling, as a rule, is among the best-performing currencies in June. The GBP median performance is behind only the AUD and the NZD. The median value was lower due to the GBP/USD sale-offs in 1975 (-6.1%), 1981 (-6.8%), 1988 (-7.9%), and 2016 (-8.4%). In the latter case, the sales resulted from the referendum on the UK membership in the EU, whose fallout is still present. For example, Boris Johnson should participate in the EU summit in June. If the UK Prime Minister makes a step towards the agreement with Brussels or extends the Brexit deadline, this will be a positive factor for the pound.

I should note that the greenback was usually rather weak in June, which under the current conditions means the S&P 500 rally should continue. According to James Bullard, the president Federal Reserve Bank of St. Louis, if the US GDP features the worst drop in the second quarter, it should feature the best performance in the third quarter. There is still some hope for the V-shaped recovery of the US economy. Besides, the growth of the US stocks, usually followed by an increase in the global risk appetite, is a good reason to use the excellent trading conditions offered by LiteForex and buy income-earning assets. However, do remember the rule that, in Forex, like in a casino, the most important is to stop on time. Even in the best times, the AUD and the CAD rose by just 1.55% and 1.12%.

Supported by the unity and generosity of the EU, the euro is rising. However, taking into account the seasonal strength of the Swiss franc, I would hedge the EUR/USD longs by the EUR/CHF shorts, betting on the high volatility of the world’s major currencies, which suggest moderate targets.

Periods of rise and fall

The growth of global risk appetite, which looked incredible in April and unnatural in May, can continue in June

In Forex, like in a casino, the most important is to stop at the right time. Based on the statistical analysis with fundamental components, I recommended exiting the EUR/USD and GBP/USD shorts at the end of May. Just these two operations could have increased the deposit by 6%. Alas, but the strong euro rally at the end of May has a little spoiled the whole situation. The shorts on the EUR/USD and EUR/JPY yielded losses of about 3.3%, and shorts on the GBP/USD and GBP/CHF resulted in a loss of about 3.9%. Greed may lead to losses. However, I have many times stressed that seasonal regularities should be used in addition to the fundamental and technical analysis.

June is a good time for commodity currencies. Since 1975, the AUD and CAD strengthened versus the US dollar in 27 cases against 18. The NZD performed a little worse, however, it also rose against the greenback. The idea to buy the AUD/USD and sell the USD/CAD is not new, I have recently written about this based on the lockdown stringency.

The pound is usually weak in May amid the dividend payments to foreigners, which has been again proven in May. However, history proves that the situation radically changes in June. The sterling, as a rule, is among the best-performing currencies in June. The GBP median performance is behind only the AUD and the NZD. The median value was lower due to the GBP/USD sale-offs in 1975 (-6.1%), 1981 (-6.8%), 1988 (-7.9%), and 2016 (-8.4%). In the latter case, the sales resulted from the referendum on the UK membership in the EU, whose fallout is still present. For example, Boris Johnson should participate in the EU summit in June. If the UK Prime Minister makes a step towards the agreement with Brussels or extends the Brexit deadline, this will be a positive factor for the pound.

I should note that the greenback was usually rather weak in June, which under the current conditions means the S&P 500 rally should continue. According to James Bullard, the president Federal Reserve Bank of St. Louis, if the US GDP features the worst drop in the second quarter, it should feature the best performance in the third quarter. There is still some hope for the V-shaped recovery of the US economy. Besides, the growth of the US stocks, usually followed by an increase in the global risk appetite, is a good reason to use the excellent trading conditions offered by LiteForex and buy income-earning assets. However, do remember the rule that, in Forex, like in a casino, the most important is to stop on time. Even in the best times, the AUD and the CAD rose by just 1.55% and 1.12%.

Supported by the unity and generosity of the EU, the euro is rising. However, taking into account the seasonal strength of the Swiss franc, I would hedge the EUR/USD longs by the EUR/CHF shorts, betting on the high volatility of the world’s major currencies, which suggest moderate targets.

Periods of rise and fall

LiteFinance

Gold market

Gold market: peculiarities of pricing and structure

When trading commodities, it’s important to be aware of their demand&supply’s structure and dynamics. A typical example is oil, which is recovering lost positions by leaps and bounds amid expectations of growing demand and surplus reduction, as main global economies have started to reopen. Unlike Brent and WTI, gold is less sensitive to the physical asset market’s state. However, it can punish any time a trader who ignores fundamental analysis.

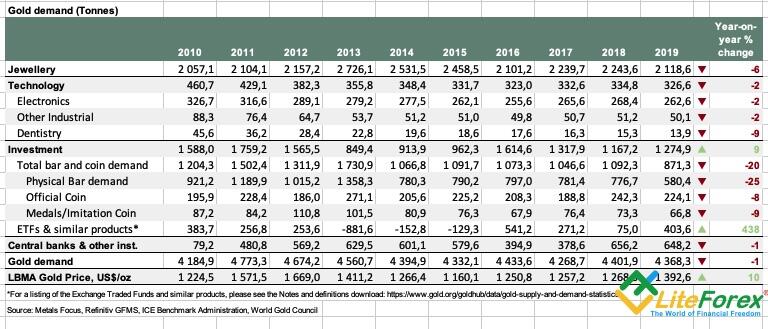

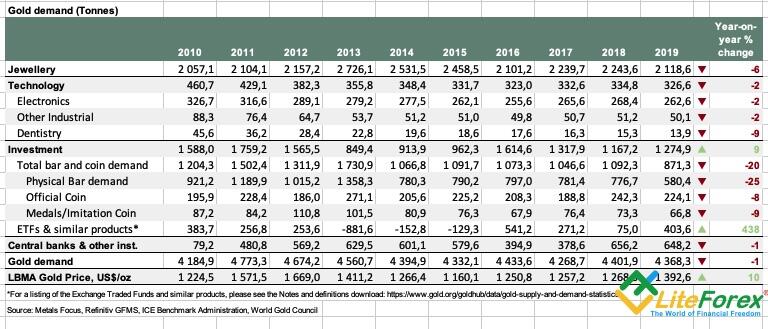

Jewellery production and investment prevail in the gold global demand structure. In 2019, they accounted for 48.5% and 29.2% of demand, respectively. Central banks’ share in gold purchases was 14.8% while industrial use accounted for 7.5% of gold consumption. The latter indicator is important. The thing is it is much higher for silver. The shutdown of industrial enterprises led therefore to a faster slump of XAG/USD if compared with XAU/USD. As a result, the gold-silver ratio soared to historical peaks. Against the backdrop of the recovering global economy, the ratio may be expected to drop. It means, we’d better bet on silver’s faster growth against gold.

The relative share of investment in the structure of the gold global demand grew up to 49.8% while the share of jewellery production dropped to 30.1%. Consumption of gold reduced almost in all sectors, except for ETFs and coins, as compared with October-December and January-March 2019.