Changgui Leng / 个人资料

- 信息

|

6+ 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

Changgui Leng

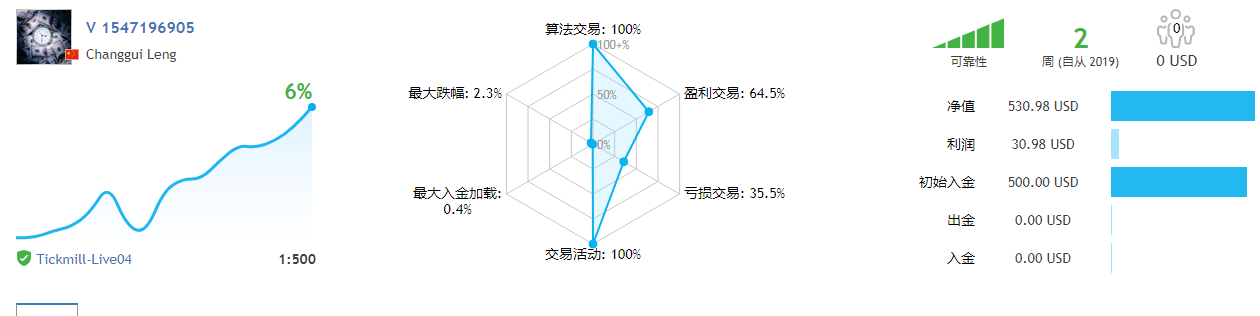

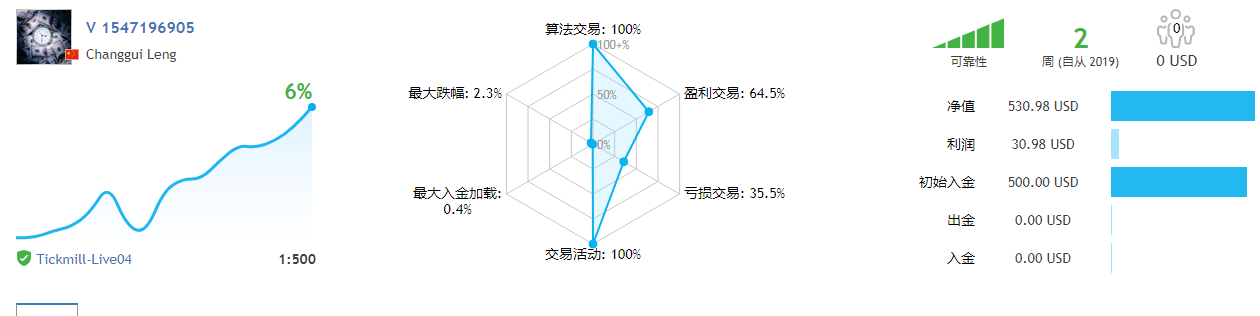

https://www.mql5.com/zh/signals/609483

1. Each currency has its own index entry and index channel exit criteria. Only in the face of special risks, single currency and other currencies will begin to make judgments according to the position risk, and multi-currency quantitative hedging of the whole position can effectively reduce the floating loss and position risk.

2. All warehouse receipts contain smaller independent stops (index channel stops, fixed stops and some other stops are easily frozen due to command problems, so internal cyclic processing must be hidden);

3. For each currency, it can be divided into 2-4 quantifications independently at most, and the stops and stops can be controlled by different strategies, so as to reduce the unexpected market position and hedge the risk. The default of each currency independent strategy is no more than 4 orders.

4. In addition to cross-breed hedging risk, each breed will control its total loss, effectively avoiding the Black Swan incident can directly lose its bill;

5. All transactions ensure that Martin's warehousing is excluded and trend call orders are excluded, and trading arbitrage is only detected for market momentum, which has little relevance to some market trends.

6. EA total position holder control, advance payment proportion control, maximum net value withdrawal rate of about 20%.

7. The trading account can be cleared every 2-3 days on average.

https://www.mql5.com/zh/signals/609483

1. Each currency has its own index entry and index channel exit criteria. Only in the face of special risks, single currency and other currencies will begin to make judgments according to the position risk, and multi-currency quantitative hedging of the whole position can effectively reduce the floating loss and position risk.

2. All warehouse receipts contain smaller independent stops (index channel stops, fixed stops and some other stops are easily frozen due to command problems, so internal cyclic processing must be hidden);

3. For each currency, it can be divided into 2-4 quantifications independently at most, and the stops and stops can be controlled by different strategies, so as to reduce the unexpected market position and hedge the risk. The default of each currency independent strategy is no more than 4 orders.

4. In addition to cross-breed hedging risk, each breed will control its total loss, effectively avoiding the Black Swan incident can directly lose its bill;

5. All transactions ensure that Martin's warehousing is excluded and trend call orders are excluded, and trading arbitrage is only detected for market momentum, which has little relevance to some market trends.

6. EA total position holder control, advance payment proportion control, maximum net value withdrawal rate of about 20%.

7. The trading account can be cleared every 2-3 days on average.

https://www.mql5.com/zh/signals/609483

分享社交网络 · 1

: