Mirza Baig / 个人资料

- 信息

|

10+ 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

::: You must expect to be stung by bees when in search of honey :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

Mirza Baig

::: Europe Week Ahead: ECB, BoE, Ger Factory Orders, EZ PMI, UK PMI (eFxnews) :::

The ECB bought itself an insurance against adverse economic developments by cutting the Refi rate pre-emptively in November, so that the immediate pressure to act has receded. The rebound in Eurozone HICP inflation, to 0.9% YoY in November, as well as the uneven, albeit ongoing improvement in leading indicators, will provide some extra breathing space. Therefore we do not expect any ECB action on policy rates at the 5 December meeting. The staff forecasts will be revised lower, and the 2015 HICP projection will likely remain below target, but this will provide an ex post justification for the November cut. Still, several risks remain, including ongoing disinflationary pressures, credit contraction and renewed EUR strength. Importantly, the ECB might soon be forced to act to keep liquidity conditions consistent with its broader policy stance as the pace of LTRO repayments. While another v-LTRO targeting SME loans could still be implemented next year, in our view, other intermediate options include a cut in reserve requirement (all or part of the remaining EUR104bn) or a suspension in SMP sterilisation auctions (all or part of the remaining Eur184bn).

We expect little changes to final PMI indices for November in core Eurozone countries put aside a possible upward revision to French PMI indices after the strong disappointment from their flash readings. Next week the calendar will also provide us PMI indices in peripheral countries (Italy, Spain, Ireland, Greece). We expect them to reflect modest declines in business sentiment in November as the momentum has turned slightly downside since August.

German factory orders will likely contract in October (-1.5% MoM). This is a small setback coming after a very strong rebound in the previous month (3.3% MoM) which was triggered by foreign demand (Eurozone in particular).

BoE monetary policy meeting on 5 December is likely to be a non-event with no detailed statement expected either. The BoE will likely leave its current policy settings unchanged with the Bank rate left at 0.5% and the size of the asset purchase program at GBP375bn, in line with its forward guidance. The British economy continued to show resilience with no sign of a slowdown of activity in the final quarter of the year as suggested by the upbeat CBI and PMI surveys. The unemployment rate has continued to decline but the BoE made it crystal clear that the 7% threshold was not a trigger of a rate hike. The moderation of CPI inflation closer to the 2% target alleviates some pressure on the BoE to revise lower this threshold.

UK PMI manufacturing will likely decline in November for the second consecutive month to a still relatively high level at 55.7. Forward-looking components of the survey such as output and new orders fell both in October and November suggesting that the recent peak in business confidence might be behind us. In the key services sector however, the PMI has continued to increase reaching its highest since May 1997. The sustained improvement in the labour market continues to bode well for household consumption going forward, likely providing an offsetting effect to the continued squeeze in consumer purchasing power and hikes to energy prices. We expect only a small contraction in the PMI services to around 62.0.

The ECB bought itself an insurance against adverse economic developments by cutting the Refi rate pre-emptively in November, so that the immediate pressure to act has receded. The rebound in Eurozone HICP inflation, to 0.9% YoY in November, as well as the uneven, albeit ongoing improvement in leading indicators, will provide some extra breathing space. Therefore we do not expect any ECB action on policy rates at the 5 December meeting. The staff forecasts will be revised lower, and the 2015 HICP projection will likely remain below target, but this will provide an ex post justification for the November cut. Still, several risks remain, including ongoing disinflationary pressures, credit contraction and renewed EUR strength. Importantly, the ECB might soon be forced to act to keep liquidity conditions consistent with its broader policy stance as the pace of LTRO repayments. While another v-LTRO targeting SME loans could still be implemented next year, in our view, other intermediate options include a cut in reserve requirement (all or part of the remaining EUR104bn) or a suspension in SMP sterilisation auctions (all or part of the remaining Eur184bn).

We expect little changes to final PMI indices for November in core Eurozone countries put aside a possible upward revision to French PMI indices after the strong disappointment from their flash readings. Next week the calendar will also provide us PMI indices in peripheral countries (Italy, Spain, Ireland, Greece). We expect them to reflect modest declines in business sentiment in November as the momentum has turned slightly downside since August.

German factory orders will likely contract in October (-1.5% MoM). This is a small setback coming after a very strong rebound in the previous month (3.3% MoM) which was triggered by foreign demand (Eurozone in particular).

BoE monetary policy meeting on 5 December is likely to be a non-event with no detailed statement expected either. The BoE will likely leave its current policy settings unchanged with the Bank rate left at 0.5% and the size of the asset purchase program at GBP375bn, in line with its forward guidance. The British economy continued to show resilience with no sign of a slowdown of activity in the final quarter of the year as suggested by the upbeat CBI and PMI surveys. The unemployment rate has continued to decline but the BoE made it crystal clear that the 7% threshold was not a trigger of a rate hike. The moderation of CPI inflation closer to the 2% target alleviates some pressure on the BoE to revise lower this threshold.

UK PMI manufacturing will likely decline in November for the second consecutive month to a still relatively high level at 55.7. Forward-looking components of the survey such as output and new orders fell both in October and November suggesting that the recent peak in business confidence might be behind us. In the key services sector however, the PMI has continued to increase reaching its highest since May 1997. The sustained improvement in the labour market continues to bode well for household consumption going forward, likely providing an offsetting effect to the continued squeeze in consumer purchasing power and hikes to energy prices. We expect only a small contraction in the PMI services to around 62.0.

分享社交网络 · 1

Mirza Baig

::: USD/JPY: 2 Scenarios After The Triangle Breakout - Citi (eFxnews) :::

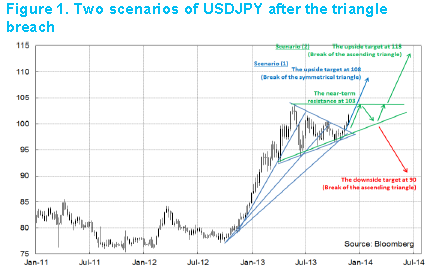

After the breach of the high in September at 100.61, it has been confirmed that USD/JPY rose up above the resistance line since this May, notes Citibank.

Thus, with the pair's ongoing rally, Citi points out to two scenarios from the formation analysis perspective.

"Namely, 1) the pair has already climbed up above the triangle and the upside target has been extended to around 108 (the apex of the triangle was around 98 and its width was about 10 big figures), and 2) the shape of the triangle is converting into an ascending one from a symmetrical one so far, with the new upper limit at around 103.7, this year high in May (Figure1)," Citi clarifies.

"But even in the latter case, the breach of the new upper limit would indicate a new extended target at 113, even while the high at 103.7 would act as a resistance in coming months. Thus, in the mid-term time horizon, the 108 level is recognized as a crucial target in either case," Citi projects.

After the breach of the high in September at 100.61, it has been confirmed that USD/JPY rose up above the resistance line since this May, notes Citibank.

Thus, with the pair's ongoing rally, Citi points out to two scenarios from the formation analysis perspective.

"Namely, 1) the pair has already climbed up above the triangle and the upside target has been extended to around 108 (the apex of the triangle was around 98 and its width was about 10 big figures), and 2) the shape of the triangle is converting into an ascending one from a symmetrical one so far, with the new upper limit at around 103.7, this year high in May (Figure1)," Citi clarifies.

"But even in the latter case, the breach of the new upper limit would indicate a new extended target at 113, even while the high at 103.7 would act as a resistance in coming months. Thus, in the mid-term time horizon, the 108 level is recognized as a crucial target in either case," Citi projects.

分享社交网络 · 1

Mirza Baig

::: UK As A Currency Area: 'In For A Penny, In For The Pound' - Deutsche Bank (eFxnews) :::

Focus of the day:

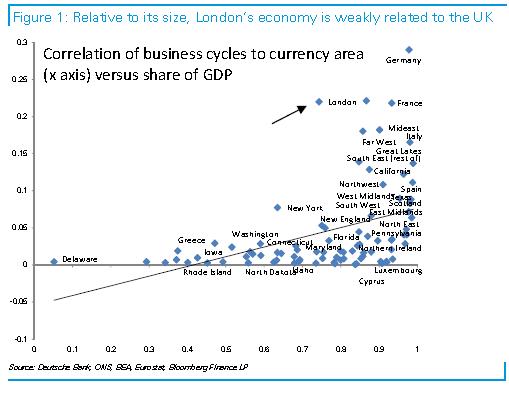

"We examine whether the UK fits the bill for an optimum currency area. We find that in terms of business cycle correlations and imbalances the UK’s monetary union has major flaws even compared to the Eurozone. This is the result of asymmetries between one region, London, and the rest of the country. However, differentials in regional employment rates are kept low because of high labour mobility and significant fiscal transfers from surplus to deficit regions. Also history suggests that currency unions are the product of political processes, rather than economic symmetry.

Asymmetries still carry significant macroeconomic costs, however. These can include bubbles in asset prices which pose a threat to financial stability, the impaired transmission of monetary policy which can hinder economic rebalancing and negative feedback loops that further weaken the currency area.

The implications are that monetary policy may need to display a regional bias in order to take account of asymmetries. We find that interest rates have historically been ‘biased’ towards London, but believe that this may change. We do not find that sterling has been more correlated to London than the rest of the country, and suggest this may be because of the capital’s status as a global financial centre, which drives capital outflows.

Finally, we find that Scotland would not benefit from leaving the sterling area if it declared independence. The country’s business cycle is highly correlated to the rest of the UK, it is highly competitive and an exit from the sterling area could spark a market crisis if UK liabilities were transferred. We suggest that if the country were unable to remain formally part of the sterling area, it could peg its currency to the pound."

Focus of the day:

"We examine whether the UK fits the bill for an optimum currency area. We find that in terms of business cycle correlations and imbalances the UK’s monetary union has major flaws even compared to the Eurozone. This is the result of asymmetries between one region, London, and the rest of the country. However, differentials in regional employment rates are kept low because of high labour mobility and significant fiscal transfers from surplus to deficit regions. Also history suggests that currency unions are the product of political processes, rather than economic symmetry.

Asymmetries still carry significant macroeconomic costs, however. These can include bubbles in asset prices which pose a threat to financial stability, the impaired transmission of monetary policy which can hinder economic rebalancing and negative feedback loops that further weaken the currency area.

The implications are that monetary policy may need to display a regional bias in order to take account of asymmetries. We find that interest rates have historically been ‘biased’ towards London, but believe that this may change. We do not find that sterling has been more correlated to London than the rest of the country, and suggest this may be because of the capital’s status as a global financial centre, which drives capital outflows.

Finally, we find that Scotland would not benefit from leaving the sterling area if it declared independence. The country’s business cycle is highly correlated to the rest of the UK, it is highly competitive and an exit from the sterling area could spark a market crisis if UK liabilities were transferred. We suggest that if the country were unable to remain formally part of the sterling area, it could peg its currency to the pound."

分享社交网络 · 1

Mirza Baig

::: Potential Currency Impact From Iranian Nuclear Accord - Credit Agricole (eFxnews) :::

In what is likely to be a quiet week ahead of the US holiday, news that the US and Iran reached a nuclear deal helped currencies diverge from recent trends. The dollar, in particular, rallied against nearly all the G10 currencies but declined against some EM currencies. The price action displayed an interesting shift away from the monetary policy outlook towards broader macro trends related to the sensitivity to oil prices. The outlook for oil importers and exporters terms of trade is likely the driver behind the knee-jerk market reaction to the nuclear deal.

However, the reaction may offer a script for long-term trends in FX rates if commodity prices continue to trend lower. Indeed, crude oil gapped lower and is now trading about 3% above its multi-month low, with the biggest crude oil exporters among the weakest performing against the dollar on the news. The prospects of more supply hitting the market in the near-term is clearly a negative for a commodity that remains in competition with the shale gas revolution in the US.

The sensitivity of currencies to oil prices is fairly intuitive and straightforward. Above all, an increase in oil prices boosts the terms of trade of commodity exporters and thus increases the demand for currency. This tends to boost the current account balance of commodity exporters. At the same time, lower oil prices are beneficial more commodity importers – whose current account is likely to improve as the cost of imports decline.

In short, among the best performers on the day were INR, TRY and INR while Asian equities outperformed, which suggests that the lower oil prices provided a brief respite for oil importers. Alternatively, the weakest performers were NOK, MXN, CAD and RUB – all currencies that commodity exporters.

Moving forward, while the deal with Iran may only provide a knee-jerk market reaction, the broader themes related to the US shale revolution and the end of the commodity super-cycle are likely to impact commodity producers (and their currencies) in much the same way.

In what is likely to be a quiet week ahead of the US holiday, news that the US and Iran reached a nuclear deal helped currencies diverge from recent trends. The dollar, in particular, rallied against nearly all the G10 currencies but declined against some EM currencies. The price action displayed an interesting shift away from the monetary policy outlook towards broader macro trends related to the sensitivity to oil prices. The outlook for oil importers and exporters terms of trade is likely the driver behind the knee-jerk market reaction to the nuclear deal.

However, the reaction may offer a script for long-term trends in FX rates if commodity prices continue to trend lower. Indeed, crude oil gapped lower and is now trading about 3% above its multi-month low, with the biggest crude oil exporters among the weakest performing against the dollar on the news. The prospects of more supply hitting the market in the near-term is clearly a negative for a commodity that remains in competition with the shale gas revolution in the US.

The sensitivity of currencies to oil prices is fairly intuitive and straightforward. Above all, an increase in oil prices boosts the terms of trade of commodity exporters and thus increases the demand for currency. This tends to boost the current account balance of commodity exporters. At the same time, lower oil prices are beneficial more commodity importers – whose current account is likely to improve as the cost of imports decline.

In short, among the best performers on the day were INR, TRY and INR while Asian equities outperformed, which suggests that the lower oil prices provided a brief respite for oil importers. Alternatively, the weakest performers were NOK, MXN, CAD and RUB – all currencies that commodity exporters.

Moving forward, while the deal with Iran may only provide a knee-jerk market reaction, the broader themes related to the US shale revolution and the end of the commodity super-cycle are likely to impact commodity producers (and their currencies) in much the same way.

分享社交网络 · 1

Mirza Baig

::: EUR: 'The ECB Is Importing Deflation From Around The World' - UBS :::

"The window for the ECB Governing Council to act on deflation pressures appears to be closing as even the Bank of Spain Governor noted on Monday that there was no risk of deflation in his country. He also backed up comments by fellow ECB officials noting that both lower rates and outright asset purchases are ‘difficult’. Markets will likely hold fire on euro longs ahead of the Eurozone inflation prints on Friday, but we believe there is merit in taking a step back to assess why the ECB itself seems less concerned about the current headwinds...

Even with the recent downside surprises in the Eurozone, it cannot mask the fact that structural inflationary impulse is falling in the US due to structural reasons. As such, whatever the ECB response is, the Fed has actually done more than expected, thereby containing EURUSD weakness.

Even if in the short-term the ECB chooses not to act, the lack of inflation upside surprises amongst its major trading partners needs close monitoring as well. With many other central banks still on blast the ECB is importing deflation from around the world. The REER appreciation pressure over the medium- to longer-term will become an issue, even if absolute price prints do not register strongly. As the ECB would probably be last to be dragged into such competitive easing as stimulus, markets may be more willing to own the currency if there is no clear policy signal to the contrary. Only then, when it looks a little late, might the ECB change tack."

"The window for the ECB Governing Council to act on deflation pressures appears to be closing as even the Bank of Spain Governor noted on Monday that there was no risk of deflation in his country. He also backed up comments by fellow ECB officials noting that both lower rates and outright asset purchases are ‘difficult’. Markets will likely hold fire on euro longs ahead of the Eurozone inflation prints on Friday, but we believe there is merit in taking a step back to assess why the ECB itself seems less concerned about the current headwinds...

Even with the recent downside surprises in the Eurozone, it cannot mask the fact that structural inflationary impulse is falling in the US due to structural reasons. As such, whatever the ECB response is, the Fed has actually done more than expected, thereby containing EURUSD weakness.

Even if in the short-term the ECB chooses not to act, the lack of inflation upside surprises amongst its major trading partners needs close monitoring as well. With many other central banks still on blast the ECB is importing deflation from around the world. The REER appreciation pressure over the medium- to longer-term will become an issue, even if absolute price prints do not register strongly. As the ECB would probably be last to be dragged into such competitive easing as stimulus, markets may be more willing to own the currency if there is no clear policy signal to the contrary. Only then, when it looks a little late, might the ECB change tack."

分享社交网络 · 1

Mirza Baig

::: Outlooks & Strategies For EUR/USD, GBP/USD, USD/JPY, & AUD/USD - Barclays (eFxnews) :::

The following are the latest technical outlooks and strategies for EUR/USD, GBP/USD, USD/JPY and AUD/USD as provided by the technical strategy team at Barclays Capital.

EUR/USD: We are clinging to our bearish view for EUR/USD against resistance in the 1.3630/50 area. While this caps we look for a move back in range toward targets near 1.3400. A move above 1.3650 would force us to assume a stronger-than-expected rally toward the 1.3700 area.

USD/JPY: Broad JPY weakness helps keep our bullish USD/JPY view on track toward the 2013 peak near 103.75. Beyond this, medium-term retracement objectives are at 105.75.

GBP/USD: Our adoption of a more positive view for GBP/USD was vindicated by the rally toward our initial target near 1.6380. A move above there would signal further upside toward the range highs near 1.6620.

AUD/USD: A move below our initial downside target in the 0.9040 area would signal further weakness toward 0.8900/0.8850, the range lows. We would place stops on short positions in the 0.9200 area, Tuesday’s reaction high.

The following are the latest technical outlooks and strategies for EUR/USD, GBP/USD, USD/JPY and AUD/USD as provided by the technical strategy team at Barclays Capital.

EUR/USD: We are clinging to our bearish view for EUR/USD against resistance in the 1.3630/50 area. While this caps we look for a move back in range toward targets near 1.3400. A move above 1.3650 would force us to assume a stronger-than-expected rally toward the 1.3700 area.

USD/JPY: Broad JPY weakness helps keep our bullish USD/JPY view on track toward the 2013 peak near 103.75. Beyond this, medium-term retracement objectives are at 105.75.

GBP/USD: Our adoption of a more positive view for GBP/USD was vindicated by the rally toward our initial target near 1.6380. A move above there would signal further upside toward the range highs near 1.6620.

AUD/USD: A move below our initial downside target in the 0.9040 area would signal further weakness toward 0.8900/0.8850, the range lows. We would place stops on short positions in the 0.9200 area, Tuesday’s reaction high.

分享社交网络 · 1

Mirza Baig

::: 3 Reasons Why AUD/USD Still A Sell On Rallies - Credit Agricole (eFxnews) :::

The AUD has been rebounding of late, mainly on the back of improving risk sentiment and better than expected Q3 capital expenditure data.

However, we stick to the view that intraday rallies should be sold.

First of all the currency has been less correlated to risk appetite of late.

Secondly, the RBA is unlikely to become less dovish on the back of the most recent data. On the contrary, they will likely continue to keep a cautious stance when it comes to tighter monetary conditions on the back of the still strong currency.

Last but not least, pairs such as AUD/USD keep a close correlation to US yields. As we stick to the notion that there is room for investors’ Fed monetary policy expectations to adjust higher, this would come to the detriment of the AUD.

The AUD has been rebounding of late, mainly on the back of improving risk sentiment and better than expected Q3 capital expenditure data.

However, we stick to the view that intraday rallies should be sold.

First of all the currency has been less correlated to risk appetite of late.

Secondly, the RBA is unlikely to become less dovish on the back of the most recent data. On the contrary, they will likely continue to keep a cautious stance when it comes to tighter monetary conditions on the back of the still strong currency.

Last but not least, pairs such as AUD/USD keep a close correlation to US yields. As we stick to the notion that there is room for investors’ Fed monetary policy expectations to adjust higher, this would come to the detriment of the AUD.

分享社交网络 · 1

Mirza Baig

::: Morgan Stanley Booked 570 Pips On EUR/JPY Long, Hold 2 USD/JPY Longs (eFxnews) :::

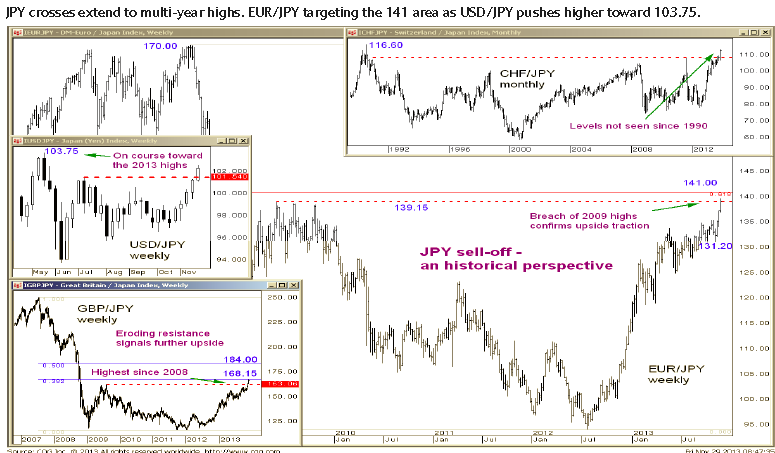

With EUR/JPY hitting the 139 mark today, Morgan Stanley booked a 570 pips profit on its long EUR/JPY position. The trade was running in MS medium-term macro portfolio for almost a month-long (from 133.30).

MS is still betting on more JPY losses with 2 running trades: a long USD/JPY in its short-term macro portfolio targeting 103 with a revised stop at 100.40 and another long in its medium-term macro portfolio targeting 105, with a revised stop at 99.40.

"We hold our long USD/JPY position as the three main drivers of the pair remain supportive. These are, (1) a widening rate differential between the US and Japan, (2) constructive global risk appetite, and (3) optimism on Japan’s structural reforms. Meanwhile, we expect more action from the BoJ next spring as fiscal consolidation begins to take its toll. As real rate expectations fall, Japanese investors are likely to allocate more to risk assets, including those outside of Japan," MS says as rationale behind this call.

With EUR/JPY hitting the 139 mark today, Morgan Stanley booked a 570 pips profit on its long EUR/JPY position. The trade was running in MS medium-term macro portfolio for almost a month-long (from 133.30).

MS is still betting on more JPY losses with 2 running trades: a long USD/JPY in its short-term macro portfolio targeting 103 with a revised stop at 100.40 and another long in its medium-term macro portfolio targeting 105, with a revised stop at 99.40.

"We hold our long USD/JPY position as the three main drivers of the pair remain supportive. These are, (1) a widening rate differential between the US and Japan, (2) constructive global risk appetite, and (3) optimism on Japan’s structural reforms. Meanwhile, we expect more action from the BoJ next spring as fiscal consolidation begins to take its toll. As real rate expectations fall, Japanese investors are likely to allocate more to risk assets, including those outside of Japan," MS says as rationale behind this call.

分享社交网络 · 1

Mirza Baig

::: Morgan Stanley Sells $10 Million EUR/USD From 1.36 Targeting 1.27 (eFxnews) :::

Morgan Stanley added a short EUR/USD position to its medium-term macro portfolio via selling $10 million in cash from 1.36 with a stop at 1.3830, and a target at 1.2700.

"The ECB continues to push a dovish message, most recently suggesting a numerical negative deposit rate target. While we don’t expect imminent policy action, we do think the growth backdrop will ultimately force the ECB to do more. As such, we like selling the EUR on rallies," MS says as a rationale behind this call.

"The next EMU HICP flash print, which is out on Friday, November 29, will be extremely important – with the last one at 0.7% seemingly provoking the ECB to cut its refi rate. A key risk to our trade could be a lack of action from the ECB to fight disinflationary pressures," MS adds.

"The geographic break down of CPI within Europe shows that the disinflationary pressure is not confined to the periphery (see Exhibit 2) where austerity and constrained credit conditions have been the most extreme, but is broad based with even core EMU countries experiencing a sharp decline in CPI. Draghi has also observed that disinflationary pressure in EMU is broad based. As a result, the ECB is likely to be more sensitive to any further sharp declines in the inflation rate, we believe, leaving the EUR vulnerable to soft inflation indicators," MS clarifies.

Morgan Stanley added a short EUR/USD position to its medium-term macro portfolio via selling $10 million in cash from 1.36 with a stop at 1.3830, and a target at 1.2700.

"The ECB continues to push a dovish message, most recently suggesting a numerical negative deposit rate target. While we don’t expect imminent policy action, we do think the growth backdrop will ultimately force the ECB to do more. As such, we like selling the EUR on rallies," MS says as a rationale behind this call.

"The next EMU HICP flash print, which is out on Friday, November 29, will be extremely important – with the last one at 0.7% seemingly provoking the ECB to cut its refi rate. A key risk to our trade could be a lack of action from the ECB to fight disinflationary pressures," MS adds.

"The geographic break down of CPI within Europe shows that the disinflationary pressure is not confined to the periphery (see Exhibit 2) where austerity and constrained credit conditions have been the most extreme, but is broad based with even core EMU countries experiencing a sharp decline in CPI. Draghi has also observed that disinflationary pressure in EMU is broad based. As a result, the ECB is likely to be more sensitive to any further sharp declines in the inflation rate, we believe, leaving the EUR vulnerable to soft inflation indicators," MS clarifies.

分享社交网络 · 1

Mirza Baig

Exit EUR/USD Longs Into 1.37; Re-Buy Cable & USD/JPY Dips - UBS (eFxnews)

The following are the short-term strategies for EUR/USD, USD/JPY, EUR/JPY, and GBP/USD as provided by the FX Strategy team at UBS.

EUR/USD: The bid tone we have seen lately in EURUSD is intact, and going into month end, we see no reason to fight it. Buyers will still be lined up ahead of 1.3500 and pain will come into play above the high from early October at 1.3646. A break above will open for 1.3700 but will have no interest for being long above there.

USD/JPY: The move in yen was stop-driven in thin market overnight. EURJPY is trading on multi year highs; it is through 139.22 and the next level is the psychological mark of 140 ahead of 141.03, the 61.8% retracement of the 2008-2012 downtrend and the 50% retracement of the July 08-Jan09 drop. The drop in Nikkei stopped the upmove in the pair, and we think there is risk of a short term correction. Look to buy dips to 101.70 and 138.50.

GBP/USD: The hawkish tone from BOE's Carney and the Financial Policy Committee taking steps cutting the FLS for households gave Sterling another boost yesterday. Flows are light in holiday markets. European corporates bought the dip in EURGBP while overnight private money demand took Cable just shy of 1.6381, the January high. Square Cable longs ahead of 1.6381, looking to re buy towards 1.6260 next week.

The following are the short-term strategies for EUR/USD, USD/JPY, EUR/JPY, and GBP/USD as provided by the FX Strategy team at UBS.

EUR/USD: The bid tone we have seen lately in EURUSD is intact, and going into month end, we see no reason to fight it. Buyers will still be lined up ahead of 1.3500 and pain will come into play above the high from early October at 1.3646. A break above will open for 1.3700 but will have no interest for being long above there.

USD/JPY: The move in yen was stop-driven in thin market overnight. EURJPY is trading on multi year highs; it is through 139.22 and the next level is the psychological mark of 140 ahead of 141.03, the 61.8% retracement of the 2008-2012 downtrend and the 50% retracement of the July 08-Jan09 drop. The drop in Nikkei stopped the upmove in the pair, and we think there is risk of a short term correction. Look to buy dips to 101.70 and 138.50.

GBP/USD: The hawkish tone from BOE's Carney and the Financial Policy Committee taking steps cutting the FLS for households gave Sterling another boost yesterday. Flows are light in holiday markets. European corporates bought the dip in EURGBP while overnight private money demand took Cable just shy of 1.6381, the January high. Square Cable longs ahead of 1.6381, looking to re buy towards 1.6260 next week.

分享社交网络 · 1

Mirza Baig

::: A Daring GBP/JPY Trade That’s Well Worth the Risk ::: DailyFX :::

*******************************************************

Talking Points:

> 3 Patterns That Justify a Countertrend Trade

> Controversial Pattern on GBP/JPY Daily Chart

> The Clearest Reason of All to Take This Trade

The market has proven a little gun shy lately, avoiding entering safe support and resistance zones where risk on new positions can be better controlled. This happened twice this week, both in the EURGBP short set-up we targeted on Monday and the GBPCAD long set-up we spotted Tuesday. Both trades turned sharply profitable just before price touched the support/resistance zones we identified as potential entry areas.

This is usually when more inexperienced traders start thinking about how a small tweak to their strategy would have allowed them to catch those trades. However, without serious testing, this is very ill-advised, as even "small" tweaks to a working strategy usually result in only a few more winners while opening the floodgates to more losing trades and a bevy of unforeseen problems.

Instead, the best thing to do is keep plugging away using the existing strategy, even if it means narrowly missing new entry opportunities. As there have been no trades, there have been no losses, either, and that is far preferable to suffering through losing trades.

As experienced traders will have noticed, virtually every strategy goes through periods of being miraculously correct, being dead wrong, and being everything in between. This is just one of those "in-between" phases.

In sticking with the current strategy, today, we highlight a countertrend trade on the “big kahuna” of volatility, GBPJPY.

On the weekly chart below, price is reaching upwards to test the resistance offered by the top of a very large wedge pattern.

Indeed, this pattern is so large that it could qualify as a monthly wedge.

*******************************************************

Talking Points:

> 3 Patterns That Justify a Countertrend Trade

> Controversial Pattern on GBP/JPY Daily Chart

> The Clearest Reason of All to Take This Trade

The market has proven a little gun shy lately, avoiding entering safe support and resistance zones where risk on new positions can be better controlled. This happened twice this week, both in the EURGBP short set-up we targeted on Monday and the GBPCAD long set-up we spotted Tuesday. Both trades turned sharply profitable just before price touched the support/resistance zones we identified as potential entry areas.

This is usually when more inexperienced traders start thinking about how a small tweak to their strategy would have allowed them to catch those trades. However, without serious testing, this is very ill-advised, as even "small" tweaks to a working strategy usually result in only a few more winners while opening the floodgates to more losing trades and a bevy of unforeseen problems.

Instead, the best thing to do is keep plugging away using the existing strategy, even if it means narrowly missing new entry opportunities. As there have been no trades, there have been no losses, either, and that is far preferable to suffering through losing trades.

As experienced traders will have noticed, virtually every strategy goes through periods of being miraculously correct, being dead wrong, and being everything in between. This is just one of those "in-between" phases.

In sticking with the current strategy, today, we highlight a countertrend trade on the “big kahuna” of volatility, GBPJPY.

On the weekly chart below, price is reaching upwards to test the resistance offered by the top of a very large wedge pattern.

Indeed, this pattern is so large that it could qualify as a monthly wedge.

分享社交网络 · 1

Mirza Baig

****************************************************

::: Sharpening Your Trading Skills: Moving Average (Kitco.com) :::

****************************************************

I take a “toolbox” approach to analyzing and trading markets. The more technical and analytical tools I have in my trading toolbox at my disposal, the better my chances for success in trading. One of my favorite "secondary" trading tools is moving averages. First, let me give you an explanation of moving averages, and then I’ll tell you how I use them.

Moving averages are one of the most commonly used technical tools. In a simple moving average, the mathematical median of the underlying price is calculated over an observation period. Prices (usually closing prices) over this period are added and then divided by the total number of time periods. Every day of the observation period is given the same weighting in simple moving averages. Some moving averages give greater weight to more recent prices in the observation period. These are called exponential or weighted moving averages. In this educational feature, I’ll only discuss simple moving averages.

The length of time (the number of bars) calculated in a moving average is very important. Moving averages with shorter time periods normally fluctuate and are likely to give more trading signals. Slower moving averages use longer time periods and display a smoother moving average. The slower averages, however, may be too slow to enable you to establish a long or short position effectively.

Moving averages follow the trend while smoothing the price movement. The simple moving average is most commonly combined with other simple moving averages to indicate buy and sell signals. Some traders use three moving averages. Their lengths typically consist of short, intermediate, and long-term moving averages. A commonly used system in futures trading is 4-, 9-, and 18-period moving averages. Keep in mind a time interval may be ticks, minutes, days, weeks, or even months. Typically, moving averages are used in the shorter time periods, and not on the longer-term weekly and monthly bar charts.

The normal moving average “crossover” buy/sell signals are as follows: A buy signal is produced when the shorter-term average crosses from below to above the longer-term average. Conversely, a sell signal is issued when the shorter-term average crosses from above to below the longer-term average.

Another trading approach is to use closing prices with the moving averages. When the closing price is above the moving average, maintain a long position. If the closing price falls below the moving average, liquidate any long position and establish a short position.

Here is the important caveat about using moving averages when trading futures markets: They do not work well in choppy or non-trending markets. You can develop a severe case of whiplash using moving averages in choppy, sideways markets. Conversely, in trending markets, moving averages can work very well.

In futures markets, my favorite moving averages are the 9- and 18-day. I have also used the 4-, 9- and 18-day moving averages on occasion.

When looking at a daily bar chart, you can plot different moving averages (provided you have the proper charting software) and immediately see if they have worked well at providing buy and sell signals during the past few months of price history on the chart.

I said I like the 9-day and 18-day moving averages for futures markets. For individual stocks, I have used (and other successful veterans have told me they use) the 100-day moving average to determine if a stock is bullish or bearish. If the stock is above the 100-day moving average, it is bullish. If the stock is below the 100-day moving average, it is bearish. I also use the 100-day moving average to gauge the health of stock index futures markets.

One more bit of sage advice: A veteran market watcher told me the “commodity funds” (the big trading funds that many times seem to dominate futures market trading) follow the 40-day moving average very closely--especially in the grain futures. Thus, if you see a market that is getting ready to cross above or below the 40-day moving average, it just may be that the funds could become more active.

I said earlier that simple moving averages are a "secondary" tool in my trading toolbox. My primary (most important) tools are basic chart patterns, trend lines and fundamental analysis.

::: Sharpening Your Trading Skills: Moving Average (Kitco.com) :::

****************************************************

I take a “toolbox” approach to analyzing and trading markets. The more technical and analytical tools I have in my trading toolbox at my disposal, the better my chances for success in trading. One of my favorite "secondary" trading tools is moving averages. First, let me give you an explanation of moving averages, and then I’ll tell you how I use them.

Moving averages are one of the most commonly used technical tools. In a simple moving average, the mathematical median of the underlying price is calculated over an observation period. Prices (usually closing prices) over this period are added and then divided by the total number of time periods. Every day of the observation period is given the same weighting in simple moving averages. Some moving averages give greater weight to more recent prices in the observation period. These are called exponential or weighted moving averages. In this educational feature, I’ll only discuss simple moving averages.

The length of time (the number of bars) calculated in a moving average is very important. Moving averages with shorter time periods normally fluctuate and are likely to give more trading signals. Slower moving averages use longer time periods and display a smoother moving average. The slower averages, however, may be too slow to enable you to establish a long or short position effectively.

Moving averages follow the trend while smoothing the price movement. The simple moving average is most commonly combined with other simple moving averages to indicate buy and sell signals. Some traders use three moving averages. Their lengths typically consist of short, intermediate, and long-term moving averages. A commonly used system in futures trading is 4-, 9-, and 18-period moving averages. Keep in mind a time interval may be ticks, minutes, days, weeks, or even months. Typically, moving averages are used in the shorter time periods, and not on the longer-term weekly and monthly bar charts.

The normal moving average “crossover” buy/sell signals are as follows: A buy signal is produced when the shorter-term average crosses from below to above the longer-term average. Conversely, a sell signal is issued when the shorter-term average crosses from above to below the longer-term average.

Another trading approach is to use closing prices with the moving averages. When the closing price is above the moving average, maintain a long position. If the closing price falls below the moving average, liquidate any long position and establish a short position.

Here is the important caveat about using moving averages when trading futures markets: They do not work well in choppy or non-trending markets. You can develop a severe case of whiplash using moving averages in choppy, sideways markets. Conversely, in trending markets, moving averages can work very well.

In futures markets, my favorite moving averages are the 9- and 18-day. I have also used the 4-, 9- and 18-day moving averages on occasion.

When looking at a daily bar chart, you can plot different moving averages (provided you have the proper charting software) and immediately see if they have worked well at providing buy and sell signals during the past few months of price history on the chart.

I said I like the 9-day and 18-day moving averages for futures markets. For individual stocks, I have used (and other successful veterans have told me they use) the 100-day moving average to determine if a stock is bullish or bearish. If the stock is above the 100-day moving average, it is bullish. If the stock is below the 100-day moving average, it is bearish. I also use the 100-day moving average to gauge the health of stock index futures markets.

One more bit of sage advice: A veteran market watcher told me the “commodity funds” (the big trading funds that many times seem to dominate futures market trading) follow the 40-day moving average very closely--especially in the grain futures. Thus, if you see a market that is getting ready to cross above or below the 40-day moving average, it just may be that the funds could become more active.

I said earlier that simple moving averages are a "secondary" tool in my trading toolbox. My primary (most important) tools are basic chart patterns, trend lines and fundamental analysis.

分享社交网络 · 1

Mirza Baig

Sharpening Your Trading Skills: The MACD Indicator (Kitco.com)

The Moving Average Convergence Divergence (MACD) indicator has the past few years become one of the more popular computer-generated technical indicators.

The MACD, developed by Gerald Appel, is both a trend follower and a market momentum indicator (an oscillator). The MACD is the difference between a fast exponential moving average and a slow exponential moving average. An exponential moving average is a weighted moving average that usually assigns a greater weight to more recent price action.

The name “Moving Average Convergence Divergence” originated from the fact that the fast exponential moving average is continually converging toward or diverging away from the slow exponential moving average. A third, dotted exponential moving average of the MACD (the "trigger" or the signal line) is then plotted on top of the MACD.

Parameters:

Mov1: The time period for the first exponential moving average. The default value is usually 12, referring to 12 bars of whatever timeframe plotted on the chart. (This is the fast moving average.)

Mov2: The time period for the subtracted exponential moving average. The default value is usually 26, referring to 26 bars. (This is the slow moving average.)

Trigger: The period of 9 bars for the signal line representing an additional exponential moving average.

The MACD study can be interpreted like any other trend-following analysis: One line crossing another indicates either a buy or sell signal. When the MACD crosses above the signal line, an uptrend may be starting, suggesting a buy. Conversely, the crossing below the signal line may indicate a downtrend and a sell signal. The crossover signals are more reliable when applied to weekly charts, though this indicator may be applied to daily charts for short-term trading.

The MACD can signal overbought and oversold trends, if analyzed as an oscillator that fluctuates above and below a zero line. The market is oversold (buy signal) when both lines are below zero, and it is overbought (sell signal) when the two lines are above the zero line.

The MACD can also help identify divergences between the indicator and price activity, which may signal trend reversals or trend losing momentum. A bearish divergence occurs when the MACD is making new lows while prices fail to reach new lows. This can be an early signal of a downtrend losing momentum. A bullish divergence occurs when the MACD is making new highs while prices fail to reach new highs. Both of these signals are most serious when they occur at relatively overbought/oversold levels. Weekly charts are more reliable than daily for divergence analysis with the MACD indicator.

For more details on the MACD, Appel has a book in print, entitled: "The Moving Average Convergence-Divergence Trading Method."

As with most other computer-generated technical indicators, the MACD is a "secondary" indicator in my trading toolbox. It is not as important as my "primary" technical indicators, such as trend lines, chart gaps, chart patterns and fundamental analysis. I use the MACD to help me confirm signals that my primary indicators may be sending.

That's it for now. Next time, we'll examine another important topic on your road to increased trading success.

The Moving Average Convergence Divergence (MACD) indicator has the past few years become one of the more popular computer-generated technical indicators.

The MACD, developed by Gerald Appel, is both a trend follower and a market momentum indicator (an oscillator). The MACD is the difference between a fast exponential moving average and a slow exponential moving average. An exponential moving average is a weighted moving average that usually assigns a greater weight to more recent price action.

The name “Moving Average Convergence Divergence” originated from the fact that the fast exponential moving average is continually converging toward or diverging away from the slow exponential moving average. A third, dotted exponential moving average of the MACD (the "trigger" or the signal line) is then plotted on top of the MACD.

Parameters:

Mov1: The time period for the first exponential moving average. The default value is usually 12, referring to 12 bars of whatever timeframe plotted on the chart. (This is the fast moving average.)

Mov2: The time period for the subtracted exponential moving average. The default value is usually 26, referring to 26 bars. (This is the slow moving average.)

Trigger: The period of 9 bars for the signal line representing an additional exponential moving average.

The MACD study can be interpreted like any other trend-following analysis: One line crossing another indicates either a buy or sell signal. When the MACD crosses above the signal line, an uptrend may be starting, suggesting a buy. Conversely, the crossing below the signal line may indicate a downtrend and a sell signal. The crossover signals are more reliable when applied to weekly charts, though this indicator may be applied to daily charts for short-term trading.

The MACD can signal overbought and oversold trends, if analyzed as an oscillator that fluctuates above and below a zero line. The market is oversold (buy signal) when both lines are below zero, and it is overbought (sell signal) when the two lines are above the zero line.

The MACD can also help identify divergences between the indicator and price activity, which may signal trend reversals or trend losing momentum. A bearish divergence occurs when the MACD is making new lows while prices fail to reach new lows. This can be an early signal of a downtrend losing momentum. A bullish divergence occurs when the MACD is making new highs while prices fail to reach new highs. Both of these signals are most serious when they occur at relatively overbought/oversold levels. Weekly charts are more reliable than daily for divergence analysis with the MACD indicator.

For more details on the MACD, Appel has a book in print, entitled: "The Moving Average Convergence-Divergence Trading Method."

As with most other computer-generated technical indicators, the MACD is a "secondary" indicator in my trading toolbox. It is not as important as my "primary" technical indicators, such as trend lines, chart gaps, chart patterns and fundamental analysis. I use the MACD to help me confirm signals that my primary indicators may be sending.

That's it for now. Next time, we'll examine another important topic on your road to increased trading success.

分享社交网络 · 1

Mirza Baig

Buy EUR/USD At 1.3550, EUR/CHF At 1.2280, & Sell USD/CHF At 0.9120 - UBS (eFXnews)

The following are the short-term (mostly intra-day) strategies for EUR/USD, USD/CHF, and EUR/CHF, as provided by the FX strategy team at UBS.

EUR/USD has closed higher in 10 out of the last 12 sessions and with the continuous rumors of sovereign interest it seems like 'mission impossible' to play this from the short side. Buyers will be lined up ahead of yesterday's low with more interest around 1.3500, and another move above 1.3600 will take it back to the high from early October at 1.3646. We are flat but will be looking to enter longs near 1.3550 and only cut if it trades below 1.3500

USD/CHF is trading above its support of 0.9060, and although comments from ECB regarding negative rates are up in the air every day creating uncertainty, we remain a seller on rallies towards 0.9100-20.

EUR/CHF remains in range but the downside is vulnerable usually towards the end of the month, so wait for 1.2280, to go long.

The following are the short-term (mostly intra-day) strategies for EUR/USD, USD/CHF, and EUR/CHF, as provided by the FX strategy team at UBS.

EUR/USD has closed higher in 10 out of the last 12 sessions and with the continuous rumors of sovereign interest it seems like 'mission impossible' to play this from the short side. Buyers will be lined up ahead of yesterday's low with more interest around 1.3500, and another move above 1.3600 will take it back to the high from early October at 1.3646. We are flat but will be looking to enter longs near 1.3550 and only cut if it trades below 1.3500

USD/CHF is trading above its support of 0.9060, and although comments from ECB regarding negative rates are up in the air every day creating uncertainty, we remain a seller on rallies towards 0.9100-20.

EUR/CHF remains in range but the downside is vulnerable usually towards the end of the month, so wait for 1.2280, to go long.

分享社交网络 · 1

Mirza Baig

EUR/USD Tensions Very Elevated As Currency Wars Inflict Gridlock - BMO (eFXnews)

This is an in-depth piece on the ‘currency wars’ theme and the EUR.The main thrust of the piece in its entirety is decomposed as follows:

The ECB needs to be highly strategic in managing the value of the EUR, but the evidence suggests that for the time being it will have some but limited success in weakening the EUR’s nominal effective exchange rate.

If necessary, programmes of well-timed, staggered injections of unsterilised liquidity would appear to be the better options. There is not enough growth in the Euro Area, and the damages that would be inflicted by a re-fragmentation of banking systems are too treacherous for key exporting nations to waste time trying to engineer a ‘sweet spot’ in EURUSD.

Evidence of short-run pass-through from EUR fluctuations to domestic prices is scant. If the ECB is seeking to cap EUR strength, we think the main issue of consideration is one of politics, and of France. The ECB’s referee-like status within the bloc is probably being solidified with each passing day.

Global trade and financial interconnectedness seem to be a factor behind disinflationary pressures, as do cyclical negative commodity price shocks. ‘Currency wars’ and the impact of QE on asset prices appear to be adding to those disinflationary pressures. Debt dynamics in the developed world will keep the ‘currency wars’ theme in vogue for the foreseeable future.

Cointegration and correlation properties between EURUSD and GBPUSD suggest there may be a looming battle on the horizon between the ECB and the BoE. EURGBP may prove itself to be a ‘key battle ground’ in the global ‘currency wars’ theme.

EURUSD tensions will fade markedly once the Fed begins to taper its QE3 programm.

This is an in-depth piece on the ‘currency wars’ theme and the EUR.The main thrust of the piece in its entirety is decomposed as follows:

The ECB needs to be highly strategic in managing the value of the EUR, but the evidence suggests that for the time being it will have some but limited success in weakening the EUR’s nominal effective exchange rate.

If necessary, programmes of well-timed, staggered injections of unsterilised liquidity would appear to be the better options. There is not enough growth in the Euro Area, and the damages that would be inflicted by a re-fragmentation of banking systems are too treacherous for key exporting nations to waste time trying to engineer a ‘sweet spot’ in EURUSD.

Evidence of short-run pass-through from EUR fluctuations to domestic prices is scant. If the ECB is seeking to cap EUR strength, we think the main issue of consideration is one of politics, and of France. The ECB’s referee-like status within the bloc is probably being solidified with each passing day.

Global trade and financial interconnectedness seem to be a factor behind disinflationary pressures, as do cyclical negative commodity price shocks. ‘Currency wars’ and the impact of QE on asset prices appear to be adding to those disinflationary pressures. Debt dynamics in the developed world will keep the ‘currency wars’ theme in vogue for the foreseeable future.

Cointegration and correlation properties between EURUSD and GBPUSD suggest there may be a looming battle on the horizon between the ECB and the BoE. EURGBP may prove itself to be a ‘key battle ground’ in the global ‘currency wars’ theme.

EURUSD tensions will fade markedly once the Fed begins to taper its QE3 programm.

分享社交网络 · 1

Mirza Baig

Open an account with Larson & Holz and get $100 no-deposit bonus for free, no deposits required

http://bit.ly/IfnRH3

Thanks

http://bit.ly/IfnRH3

Thanks

分享社交网络 · 1

Mirza Baig

The Fed Won't Derail USD/JPY; Stay Long - Morgan Stanley (eFXnews)

Last week minutes from the October FOMC meeting suggested that the FOMC is still concerned about communication regarding tapering and tightening while market pricing on rate expectations has already become more consistent with the Fed’s expected hiking path, notes Morgan Stanley.

"Credible forward guidance, a market that is more prepared for tapering, and growing evidence that the US economy is gaining momentum provides a positive rate and risk backdrop for USD/JPY," MS argues.

"When the Fed tapers, we do not expect a repeat of the May/June bond volatility and USD weakness against JPY. The market has adjusted to the Fed’s forward guidance, and the FOMC is likely to solidify that guidance even further," MS clarifies.

"With the front-end anchored, there is room for some steepening in the belly of the curve as the US economy improves. Indeed, the lessening fiscal drag and gradually recovering labor market should provide a lift to the US economy and the greenback," MS adds.

"All of this should happen in a constructive risk environment, which is a key component of JPY weakness, given its status as a global funding currency. Developments in Japan, including pension reform and the potential for more BoJ action next year, only strengthen the case," MS concludes.

In line with this view, MS maintains a long USD/JPY in its short-term macro portfolio targeting 103 and another long in its medium-term macro portfolio targeting 105.

Last week minutes from the October FOMC meeting suggested that the FOMC is still concerned about communication regarding tapering and tightening while market pricing on rate expectations has already become more consistent with the Fed’s expected hiking path, notes Morgan Stanley.

"Credible forward guidance, a market that is more prepared for tapering, and growing evidence that the US economy is gaining momentum provides a positive rate and risk backdrop for USD/JPY," MS argues.

"When the Fed tapers, we do not expect a repeat of the May/June bond volatility and USD weakness against JPY. The market has adjusted to the Fed’s forward guidance, and the FOMC is likely to solidify that guidance even further," MS clarifies.

"With the front-end anchored, there is room for some steepening in the belly of the curve as the US economy improves. Indeed, the lessening fiscal drag and gradually recovering labor market should provide a lift to the US economy and the greenback," MS adds.

"All of this should happen in a constructive risk environment, which is a key component of JPY weakness, given its status as a global funding currency. Developments in Japan, including pension reform and the potential for more BoJ action next year, only strengthen the case," MS concludes.

In line with this view, MS maintains a long USD/JPY in its short-term macro portfolio targeting 103 and another long in its medium-term macro portfolio targeting 105.

分享社交网络 · 1

Mirza Baig

Sharpening Your Trading Skills: Using Bollinger Bands (Kitco.com)

The Bollinger Bands (B-Bands) technical study was created by John Bollinger, the president of Bollinger Capital Management Inc., based in Manhattan Beach, California. Bollinger is well respected in the futures and equities industries.

Traders generally use B-Bands to determine overbought and oversold zones, to confirm divergences between prices and other technical indicators, and to project price targets. The wider the B-bands on a chart, the greater the market volatility; the narrower the bands, the less market volatility.

B-Bands are lines plotted on a chart at an interval around a moving average. They consist of a moving average and two standard deviations charted as one line above and one line below the moving average. The line above is two standard deviations added to the moving average. The line below is two standard deviations subtracted from the moving average.

Some traders use B-Bands in conjunction with another indicator, such as the Relative Strength Index (RSI). If the market price touches the upper B-band and the RSI does not confirm the upward move (i.e. there is divergence between the indicators), a sell signal is generated. If the indicator confirms the upward move, no sell signal is generated, and in fact, a buy signal may be indicated.

If the price touches the lower B-band and the RSI does not confirm the downward move, a buy signal is generated. If the indicator confirms the downward move, no buy signal is generated, and in fact, a sell signal may be indicated.

Another strategy uses the Bollinger Bands without another indicator. In this approach, a chart top occurring above the upper band followed by a top below the upper band generates a sell signal. Likewise, a chart bottom occurring below the lower band followed by a bottom above the lower band generates a buy signal.

B-Bands also help determine overbought and oversold markets. When prices move closer to the upper band, the market is becoming overbought, and as the prices move closer to the lower band, the market is becoming oversold.

Importantly, the market’s price momentum should also be taken into account. When a market enters an overbought or oversold area, it may become even more so before it reverses. You should always look for evidence of price weakening or strengthening before anticipating a market reversal.

Bollinger Bands can be applied to any type of chart, although this indicator works best with daily and weekly charts. When applied to a weekly chart, the Bands carry more significance for long-term market changes. John Bollinger says periods of less than 10 days do not work well for B-Bands. He says that the optimal period is 20 or 21 days.

Like most computer-generated technical indicators, I use B-Bands as mostly an indicator of overbought and oversold conditions, or for divergence--but not as a specific generator of buy and sell signals for my trading opportunities. It's just one more "secondary" trading tool, as opposed to my "primary" trading tools that include chart patterns and trend lines and fundamental analysis.

The Bollinger Bands (B-Bands) technical study was created by John Bollinger, the president of Bollinger Capital Management Inc., based in Manhattan Beach, California. Bollinger is well respected in the futures and equities industries.

Traders generally use B-Bands to determine overbought and oversold zones, to confirm divergences between prices and other technical indicators, and to project price targets. The wider the B-bands on a chart, the greater the market volatility; the narrower the bands, the less market volatility.

B-Bands are lines plotted on a chart at an interval around a moving average. They consist of a moving average and two standard deviations charted as one line above and one line below the moving average. The line above is two standard deviations added to the moving average. The line below is two standard deviations subtracted from the moving average.

Some traders use B-Bands in conjunction with another indicator, such as the Relative Strength Index (RSI). If the market price touches the upper B-band and the RSI does not confirm the upward move (i.e. there is divergence between the indicators), a sell signal is generated. If the indicator confirms the upward move, no sell signal is generated, and in fact, a buy signal may be indicated.

If the price touches the lower B-band and the RSI does not confirm the downward move, a buy signal is generated. If the indicator confirms the downward move, no buy signal is generated, and in fact, a sell signal may be indicated.

Another strategy uses the Bollinger Bands without another indicator. In this approach, a chart top occurring above the upper band followed by a top below the upper band generates a sell signal. Likewise, a chart bottom occurring below the lower band followed by a bottom above the lower band generates a buy signal.

B-Bands also help determine overbought and oversold markets. When prices move closer to the upper band, the market is becoming overbought, and as the prices move closer to the lower band, the market is becoming oversold.

Importantly, the market’s price momentum should also be taken into account. When a market enters an overbought or oversold area, it may become even more so before it reverses. You should always look for evidence of price weakening or strengthening before anticipating a market reversal.

Bollinger Bands can be applied to any type of chart, although this indicator works best with daily and weekly charts. When applied to a weekly chart, the Bands carry more significance for long-term market changes. John Bollinger says periods of less than 10 days do not work well for B-Bands. He says that the optimal period is 20 or 21 days.

Like most computer-generated technical indicators, I use B-Bands as mostly an indicator of overbought and oversold conditions, or for divergence--but not as a specific generator of buy and sell signals for my trading opportunities. It's just one more "secondary" trading tool, as opposed to my "primary" trading tools that include chart patterns and trend lines and fundamental analysis.

分享社交网络 · 1

Mirza Baig

留下反馈给开发人员为工作 Stop Loss EA

Excellent developer, properly understood my requirements and demonstrated the EA too. Will work with him again.

分享社交网络 · 1

: