Muhammad Anas Zainal Abidin / 个人资料

- 信息

|

6+ 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

Just a simple man who trades to fulfill one needs :)

Muhammad Anas Zainal Abidin

EUR/NZD: Ichimoku clouds

Let's look at the four-hour chart. Tenkan-sen line is above Kijun-sen, the red line is directed downwards, while the blue one remains horizontal. Confirmative line Chikou Span is above the price chart, current cloud is ascending. The instrument is trading around upper border of the cloud. One of the previous minimums of Chikou Span line is expected to be a support level (1.6971). The closest resistance level is Kijun-sen line (1.7042).

Let's look at the four-hour chart. Tenkan-sen line is above Kijun-sen, the red line is directed upwards, while the blue one remains horizontal. Confirmative line Chikou Span is above the price chart, current cloud is descending. The instrument has been corrected to the Tenkan-sen line. The closest support level is Kijun-sen line (1.6919). One of the previous maximums of Chikou Span line is expected to be a resistance level (1.7094)

Recommendation

On the four-hour chart the instrument is trading within the cloud. On the daily chart the instrument is trading within the cloud. It is not recommended to open positions at current price. Pending orders should be placed at the cloud’s borders: sell at the level of 1.6920, with Take Profit at 1.6868 and Stop Loss at 1.7018; buy at the level of 1.7043, with Take Profit at 1.7095 and Stop Loss at 1.6971.

Let's look at the four-hour chart. Tenkan-sen line is above Kijun-sen, the red line is directed downwards, while the blue one remains horizontal. Confirmative line Chikou Span is above the price chart, current cloud is ascending. The instrument is trading around upper border of the cloud. One of the previous minimums of Chikou Span line is expected to be a support level (1.6971). The closest resistance level is Kijun-sen line (1.7042).

Let's look at the four-hour chart. Tenkan-sen line is above Kijun-sen, the red line is directed upwards, while the blue one remains horizontal. Confirmative line Chikou Span is above the price chart, current cloud is descending. The instrument has been corrected to the Tenkan-sen line. The closest support level is Kijun-sen line (1.6919). One of the previous maximums of Chikou Span line is expected to be a resistance level (1.7094)

Recommendation

On the four-hour chart the instrument is trading within the cloud. On the daily chart the instrument is trading within the cloud. It is not recommended to open positions at current price. Pending orders should be placed at the cloud’s borders: sell at the level of 1.6920, with Take Profit at 1.6868 and Stop Loss at 1.7018; buy at the level of 1.7043, with Take Profit at 1.7095 and Stop Loss at 1.6971.

Muhammad Anas Zainal Abidin

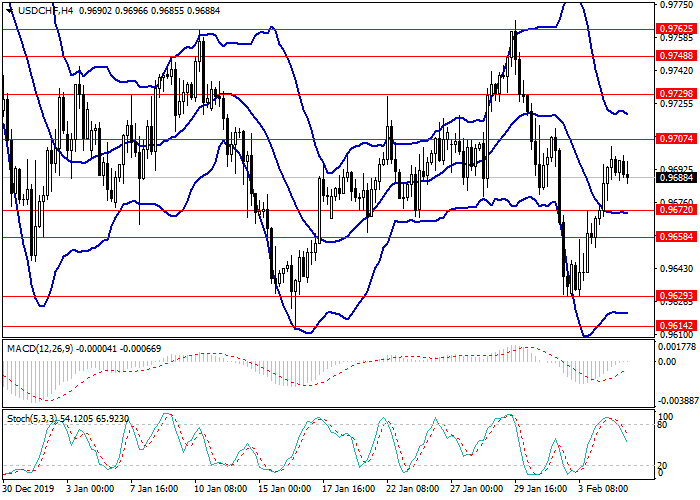

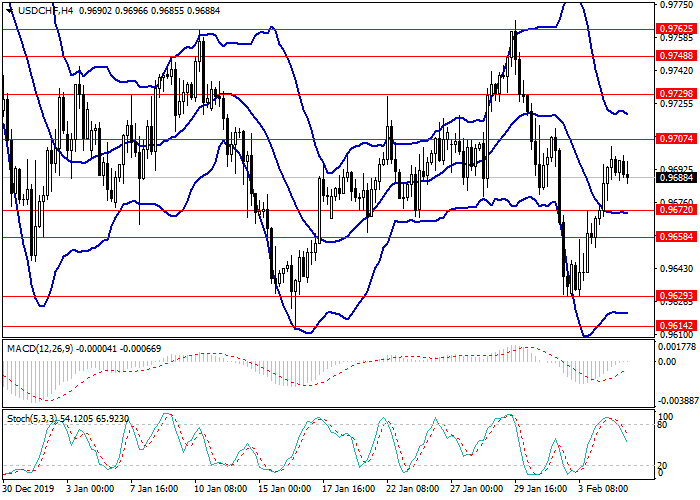

USD/CHF

On Tuesday, the USD/CHF pair strengthened amid rising US Factory Orders data for December by 1.8%, while the rise was only expected to 1.2%. The strengthening of the indicator reflects a high level of activity in the manufacturing sector, which is an important indicator of the current state of the economy.

Today, the upward trend in the instrument slowed after the publication of Swiss data on the change in the consumer confidence index SECO for the first quarter. The value increased from –10.3 to –9.4 points but overall consumer sentiment remains cautious: despite the rise, the indicator again fell below its long-term average value (–5 points).

Today, investors wait for the release of statistics in the US on the change in the ISM Service PMI at 15:30 (GMT+2), high volatility is predicted in the market.

Trading tips

Long positions may be opened from the level of 0.9710 with the target at 0.9760 and stop loss of 0.9680.

Short positions may be opened from the level of 0.9670 with the target at 0.9630 and stop loss of 0.9700.

Implementation period: 1–3 days.

On Tuesday, the USD/CHF pair strengthened amid rising US Factory Orders data for December by 1.8%, while the rise was only expected to 1.2%. The strengthening of the indicator reflects a high level of activity in the manufacturing sector, which is an important indicator of the current state of the economy.

Today, the upward trend in the instrument slowed after the publication of Swiss data on the change in the consumer confidence index SECO for the first quarter. The value increased from –10.3 to –9.4 points but overall consumer sentiment remains cautious: despite the rise, the indicator again fell below its long-term average value (–5 points).

Today, investors wait for the release of statistics in the US on the change in the ISM Service PMI at 15:30 (GMT+2), high volatility is predicted in the market.

Trading tips

Long positions may be opened from the level of 0.9710 with the target at 0.9760 and stop loss of 0.9680.

Short positions may be opened from the level of 0.9670 with the target at 0.9630 and stop loss of 0.9700.

Implementation period: 1–3 days.

Muhammad Anas Zainal Abidin

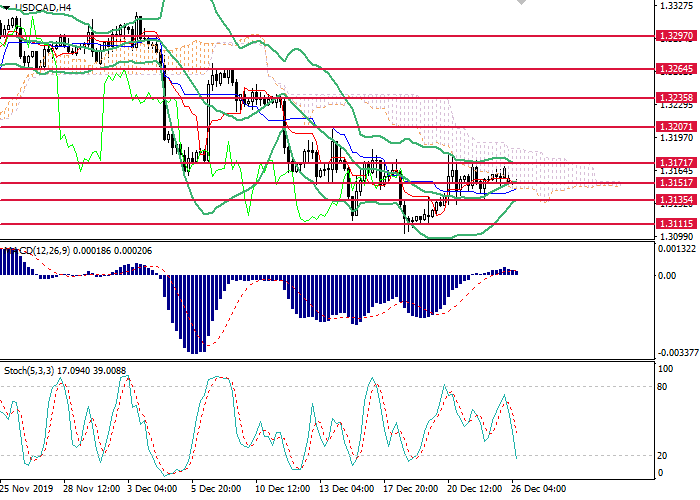

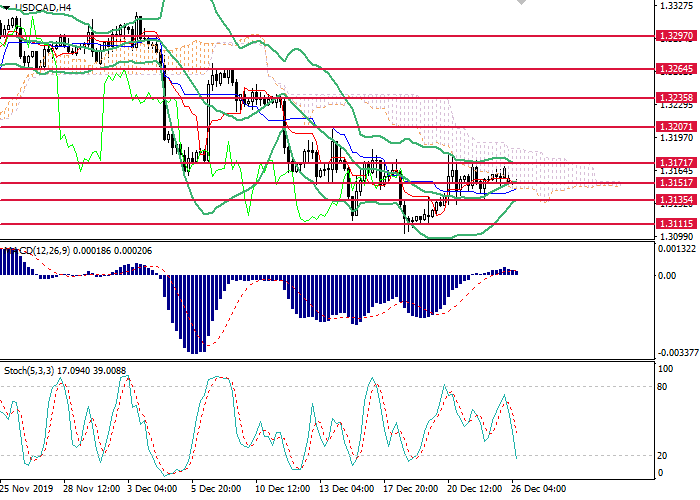

USD/CAD: general review

Current trend

Today, market activity is very low. There's a significant reduction in the price range for pairs, which indicates a low liquidity in the market.

Both currencies are pressured amid weak macroeconomic releases. At the same time, the unexpected decline in Canadian GDP by 0.1% in November ensured minimal growth of the instrument. The strengthening could be more significant, but its potential was limited by rising oil prices.

Today at 15:30 (GMT+2) data on the US labor market will be published. Confirmation of the forecast on the reduction in the number of initial jobless claims from 234K to 224K will contribute to the breakout of the key resistance level of 1.3170. Market participants are also awaiting an API report on a weekly change in crude oil inventories, which will be released at 23:30 (GMT+2).

Support and resistance

On H4 chart, the instrument is consolidating near the moving midline of Bollinger Bands, which is the key support level. The indicator reverses sidewards, and the price range has decreased, indicating low liquidity. MACD histogram is at the zero line, its volumes are growing slightly, but this is not enough to open positions. Stochastic has entered the oversold zone; a strong buy signal is expected before the end of the week.

Trading tips

Long positions may be opened from the current level with the target at 1.3205 and stop-loss at 1.3125. Implementation period: 1-2 days.

Short positions may be opened below the level of 1.3125 with the target at 1.3085 and stop-loss at 1.3145. Implementation period: 1-3 days.

Current trend

Today, market activity is very low. There's a significant reduction in the price range for pairs, which indicates a low liquidity in the market.

Both currencies are pressured amid weak macroeconomic releases. At the same time, the unexpected decline in Canadian GDP by 0.1% in November ensured minimal growth of the instrument. The strengthening could be more significant, but its potential was limited by rising oil prices.

Today at 15:30 (GMT+2) data on the US labor market will be published. Confirmation of the forecast on the reduction in the number of initial jobless claims from 234K to 224K will contribute to the breakout of the key resistance level of 1.3170. Market participants are also awaiting an API report on a weekly change in crude oil inventories, which will be released at 23:30 (GMT+2).

Support and resistance

On H4 chart, the instrument is consolidating near the moving midline of Bollinger Bands, which is the key support level. The indicator reverses sidewards, and the price range has decreased, indicating low liquidity. MACD histogram is at the zero line, its volumes are growing slightly, but this is not enough to open positions. Stochastic has entered the oversold zone; a strong buy signal is expected before the end of the week.

Trading tips

Long positions may be opened from the current level with the target at 1.3205 and stop-loss at 1.3125. Implementation period: 1-2 days.

Short positions may be opened below the level of 1.3125 with the target at 1.3085 and stop-loss at 1.3145. Implementation period: 1-3 days.

Muhammad Anas Zainal Abidin

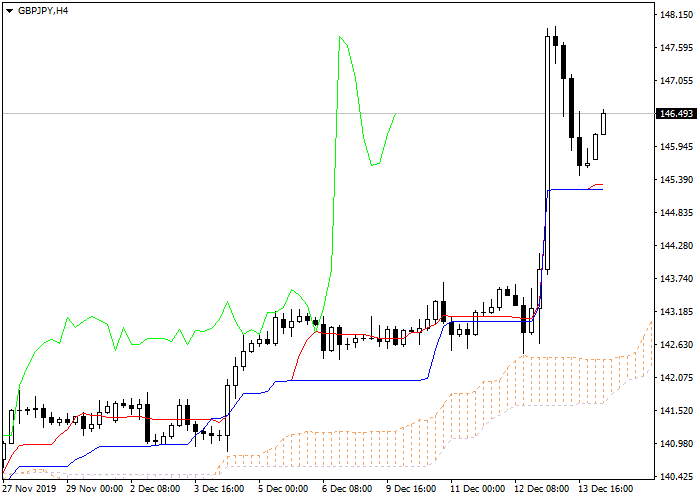

GBP/JPY: Ichimoku clouds

Let's look at the four-hour chart. Tenkan-sen line is above Kijun-sen, the lines are horizontal . Confirmative line Chikou Span is above the price chart, current cloud is ascending. The instrument is trading above Tenkan-sen and Kijun-sen lines; the Bullish trend is still strong. The closest support level is Tenkan-sen line (145.40). One of the previous maximums of Chikou Span line is expected to be a resistance level (147.80).

Recommendation

It is recommended to open long positions at current price with Take Profit at the level of previous maximum of Chikou Span (148.00) line and Stop Loss at the level of Kijun-sen line (144.00).

Let's look at the four-hour chart. Tenkan-sen line is above Kijun-sen, the lines are horizontal . Confirmative line Chikou Span is above the price chart, current cloud is ascending. The instrument is trading above Tenkan-sen and Kijun-sen lines; the Bullish trend is still strong. The closest support level is Tenkan-sen line (145.40). One of the previous maximums of Chikou Span line is expected to be a resistance level (147.80).

Recommendation

It is recommended to open long positions at current price with Take Profit at the level of previous maximum of Chikou Span (148.00) line and Stop Loss at the level of Kijun-sen line (144.00).

Muhammad Anas Zainal Abidin

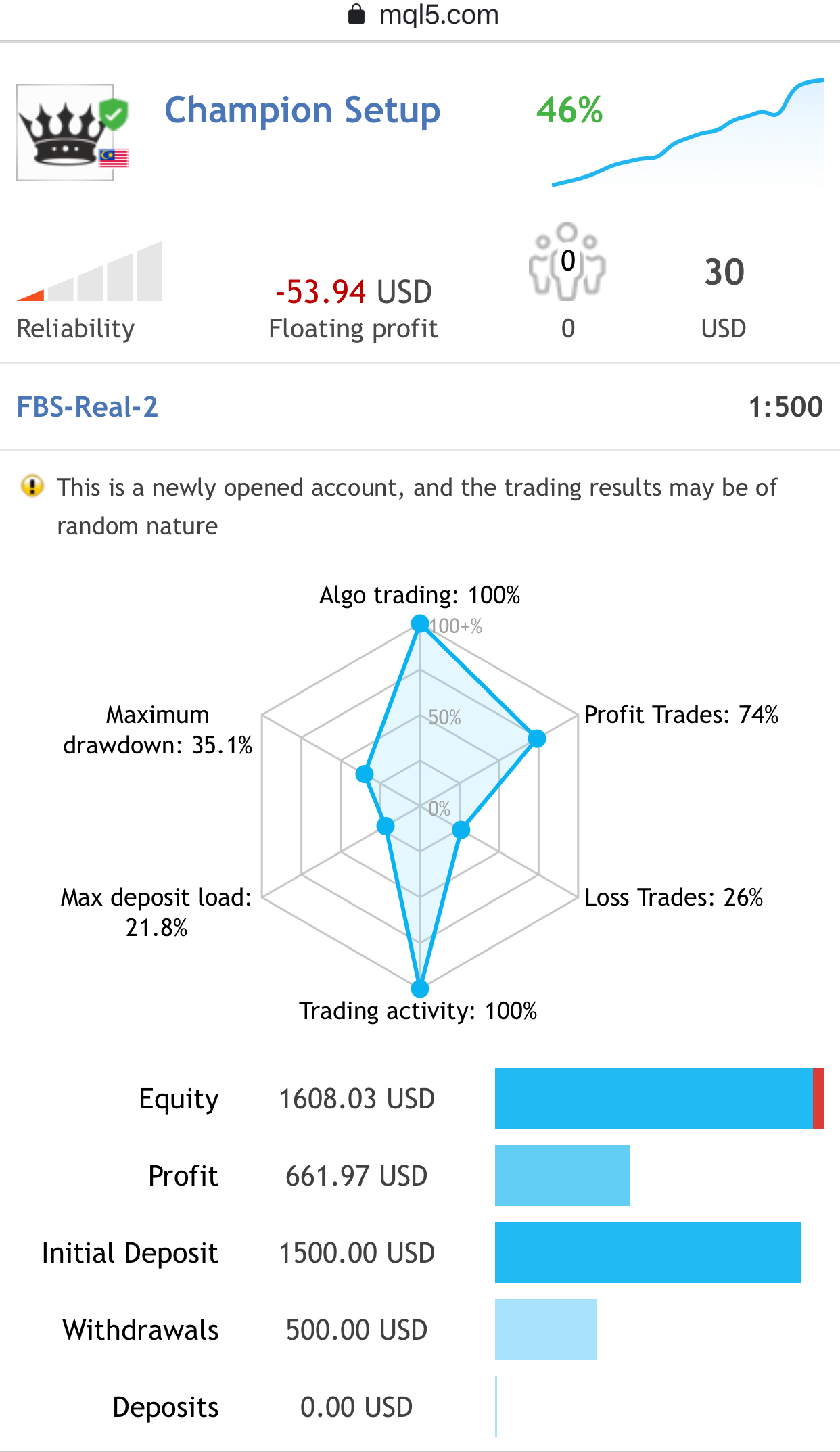

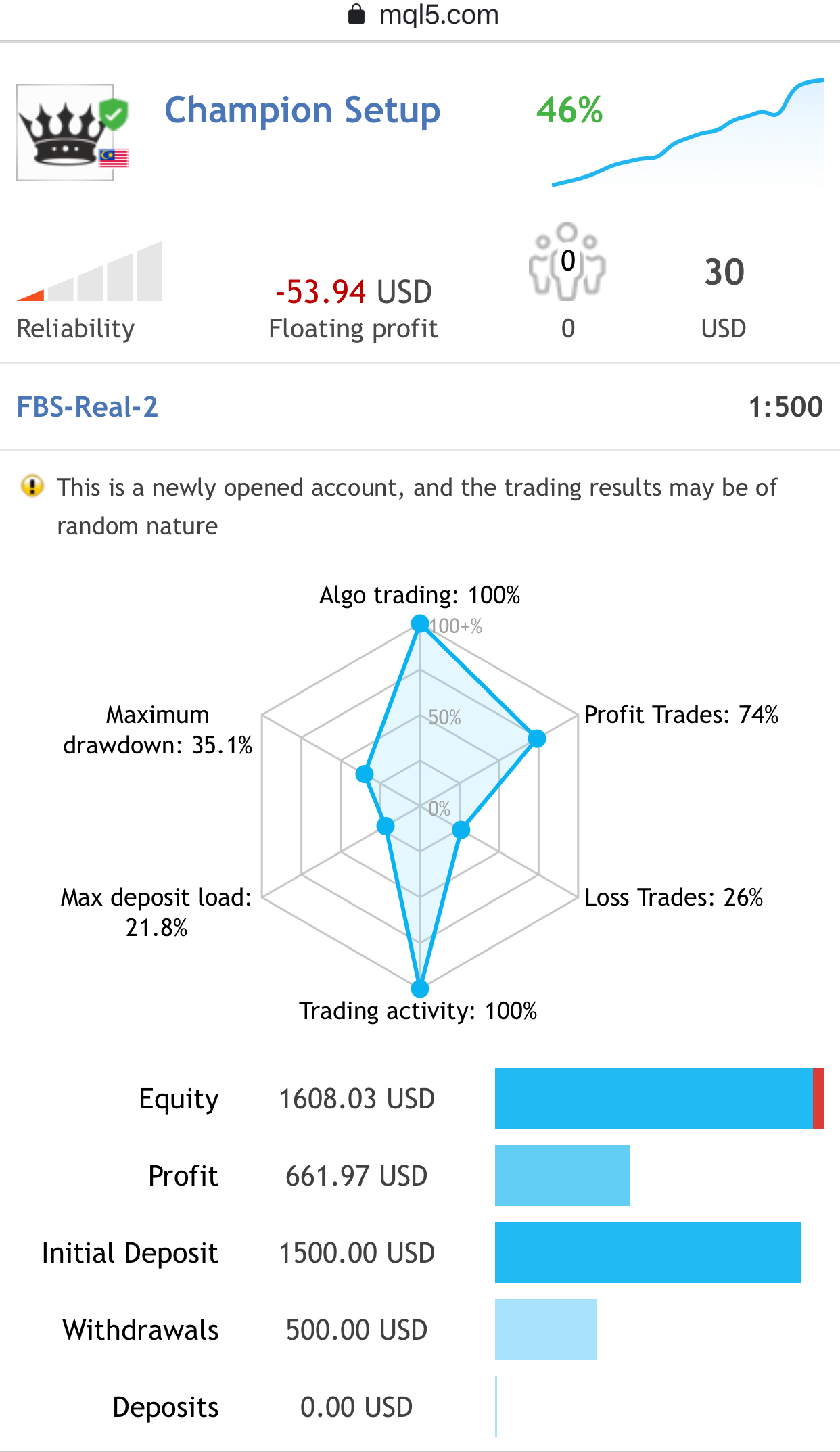

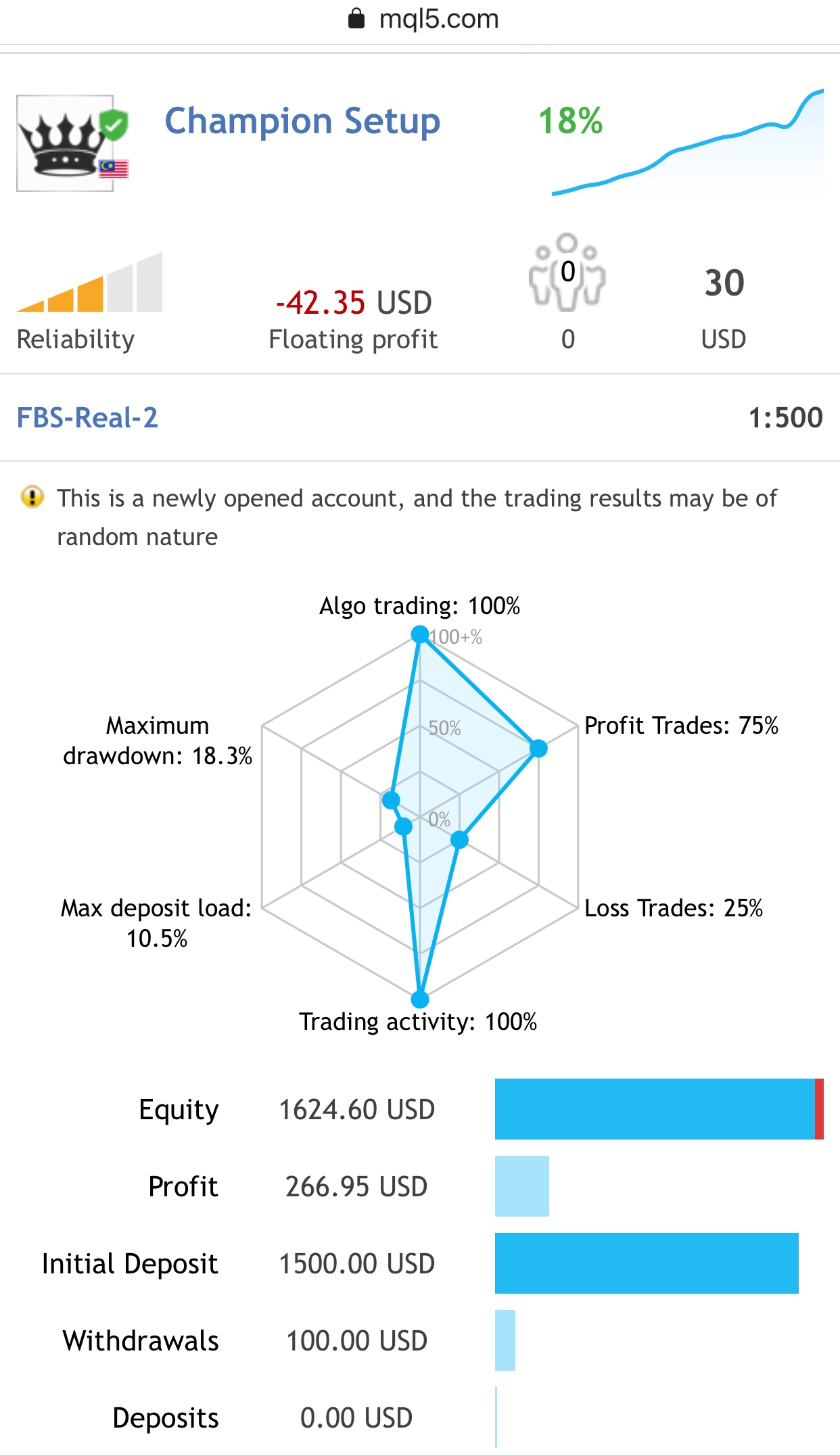

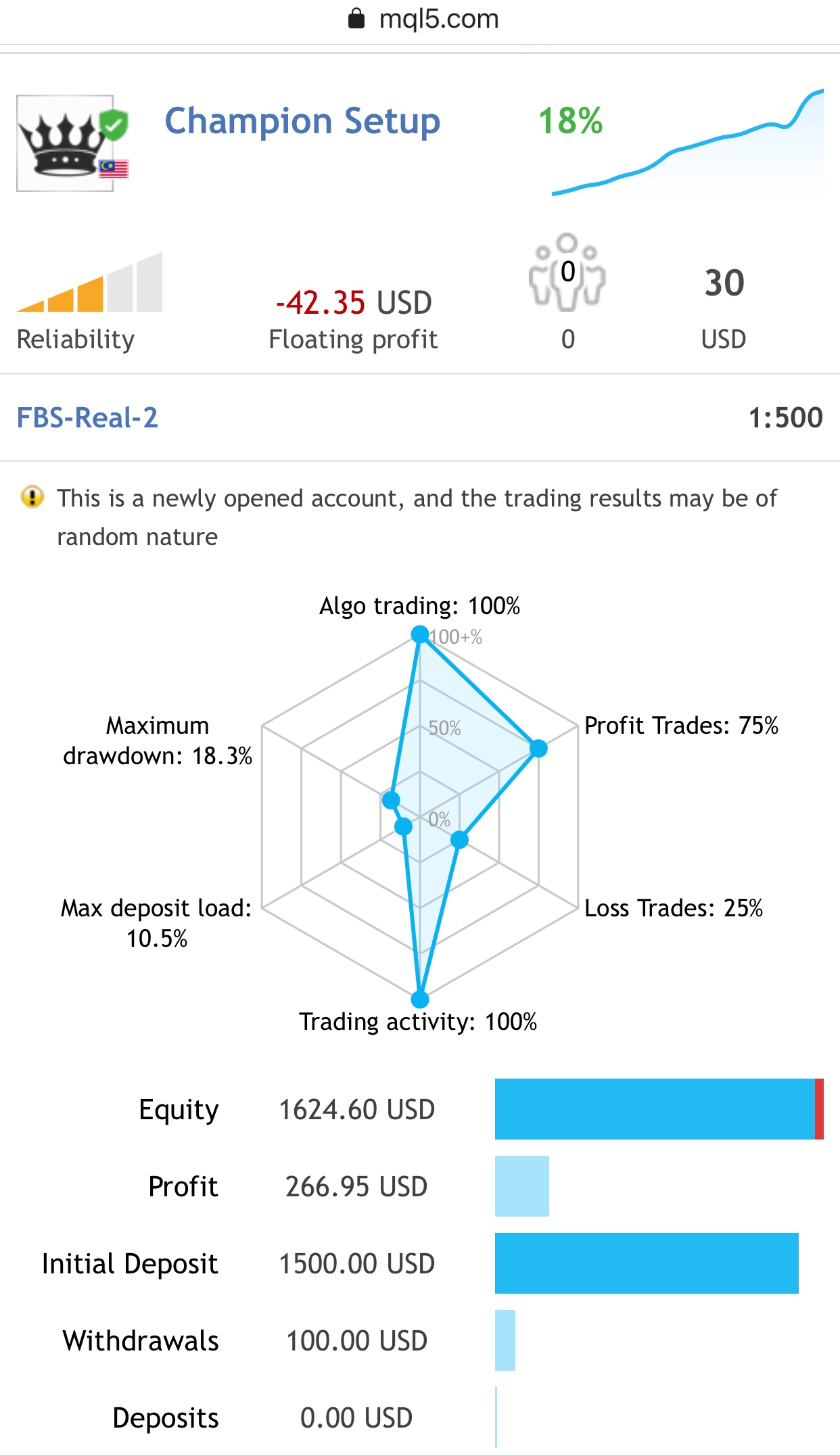

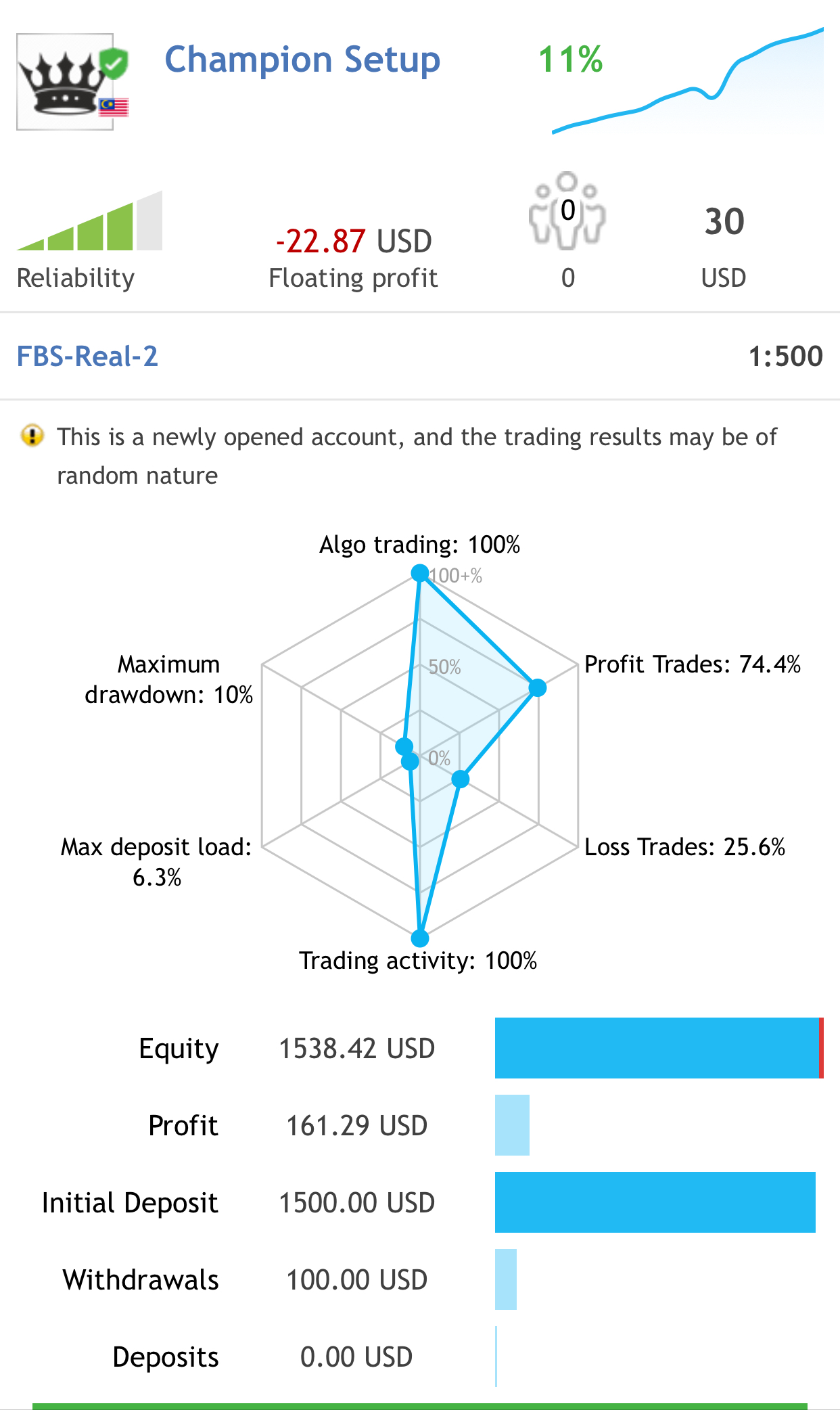

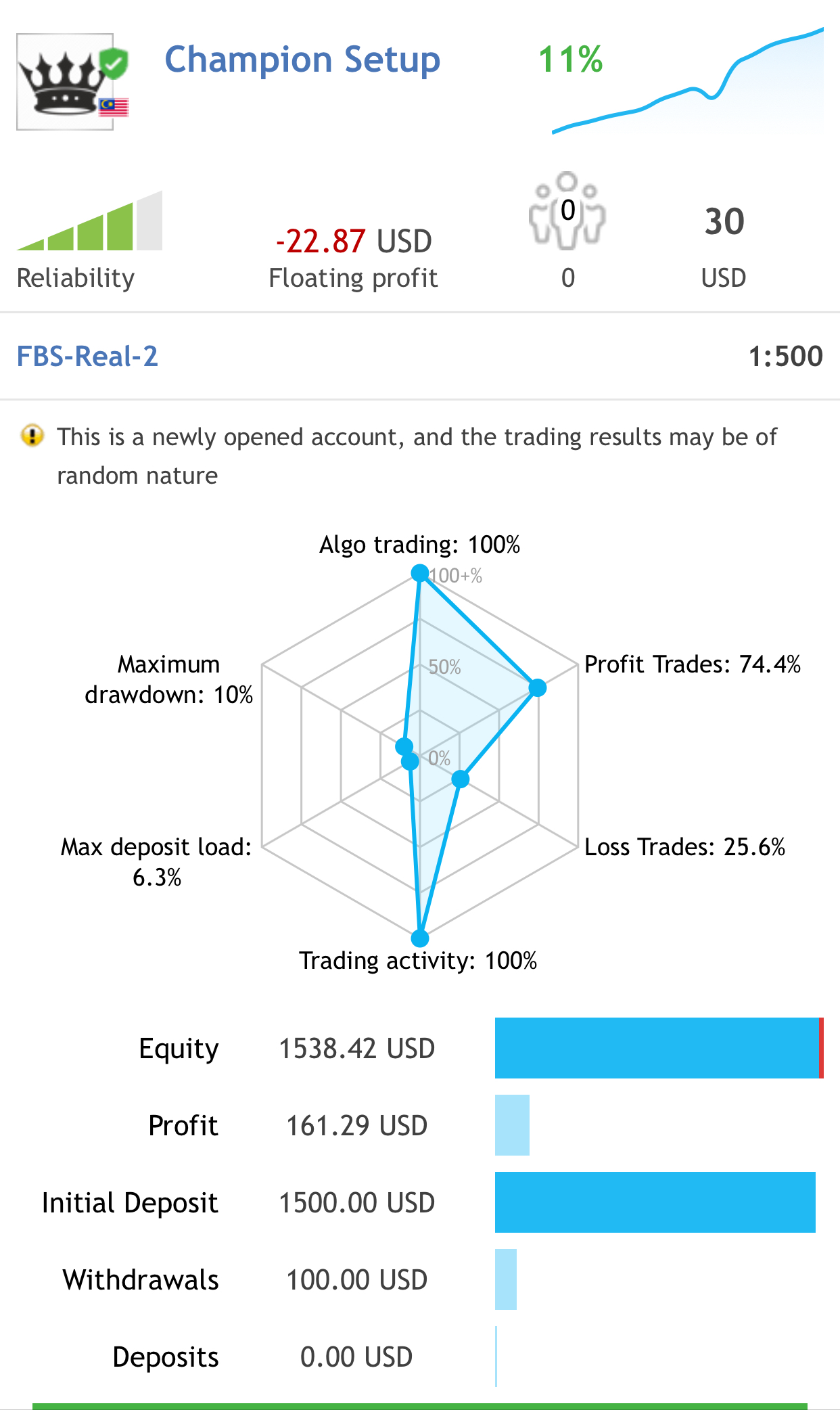

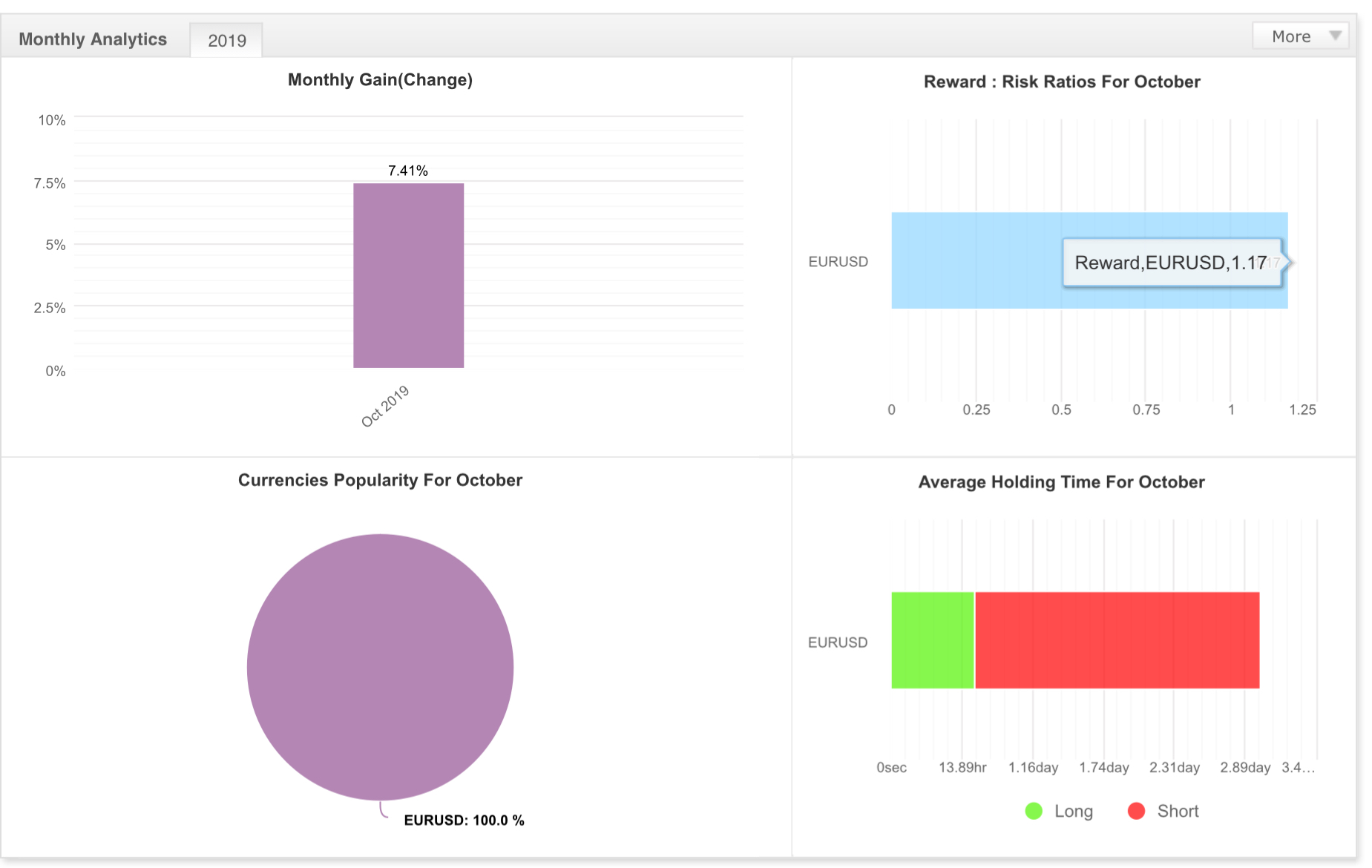

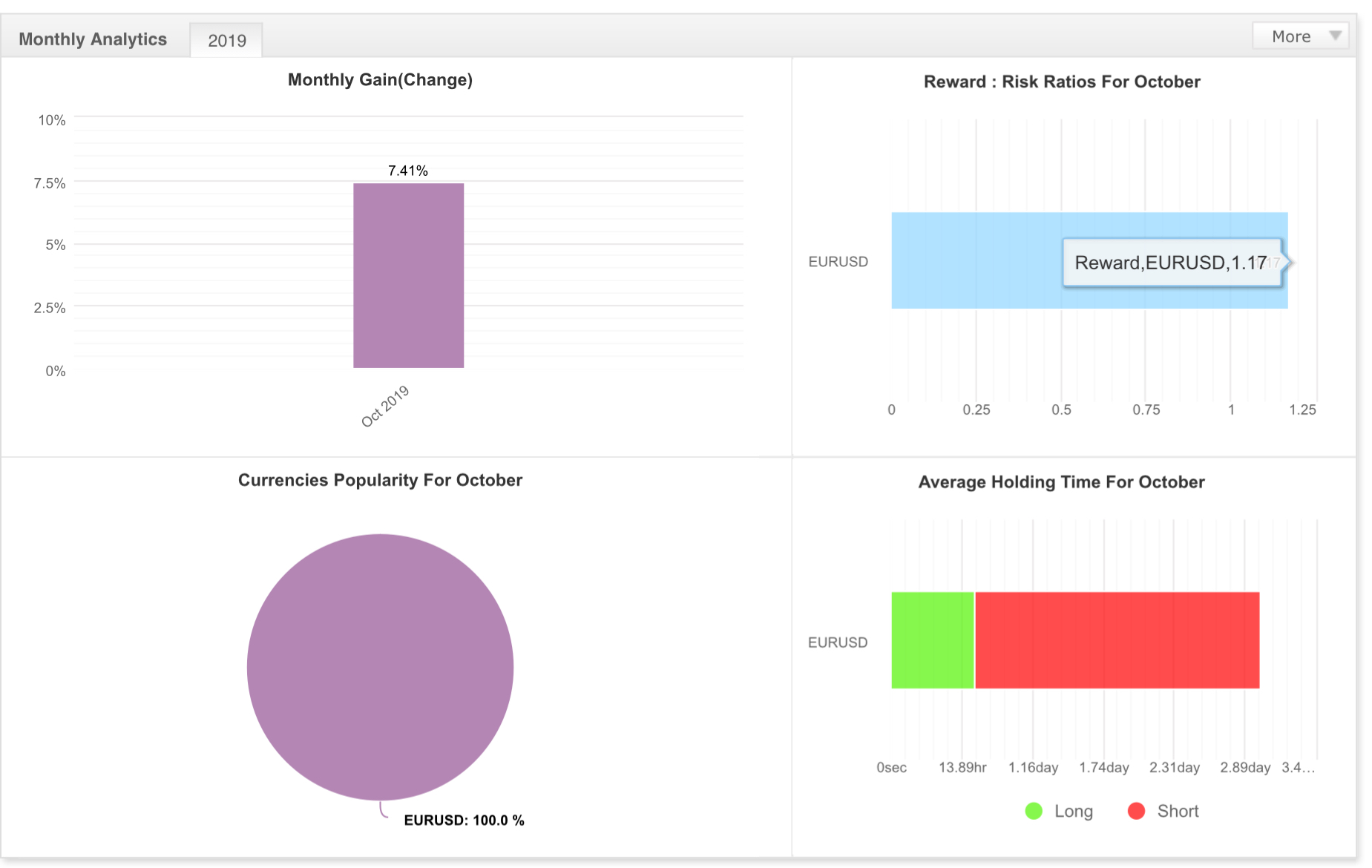

Please do checkout my Signal. Low-Med risk. Use only ONE pair, EURUSD. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

*also please do checkout my other signals that may suits your risk profile 🏋️♂️💵🧲

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

*also please do checkout my other signals that may suits your risk profile 🏋️♂️💵🧲

Muhammad Anas Zainal Abidin

Please do checkout my Signal. Med-high risk. Trade all pairs except Gbp due to Brexit issue. Trade will be more safer until issue settle. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

- Depo amount: USD 100

- Total PROFIT : USD 148.49

- Total Wd: USD 130

- Total period: 1 month Trading

- will continue the performance until my last breaths. ⚰️💨

https://www.mql5.com/en/signals/657560

*Note that the pic below is a peak from my data from mql5 data. 😍📊📉

*also please do checkout my other signals that may suits your risk profile 🏋️♂️💵🧲

- Depo amount: USD 100

- Total PROFIT : USD 148.49

- Total Wd: USD 130

- Total period: 1 month Trading

- will continue the performance until my last breaths. ⚰️💨

https://www.mql5.com/en/signals/657560

*Note that the pic below is a peak from my data from mql5 data. 😍📊📉

*also please do checkout my other signals that may suits your risk profile 🏋️♂️💵🧲

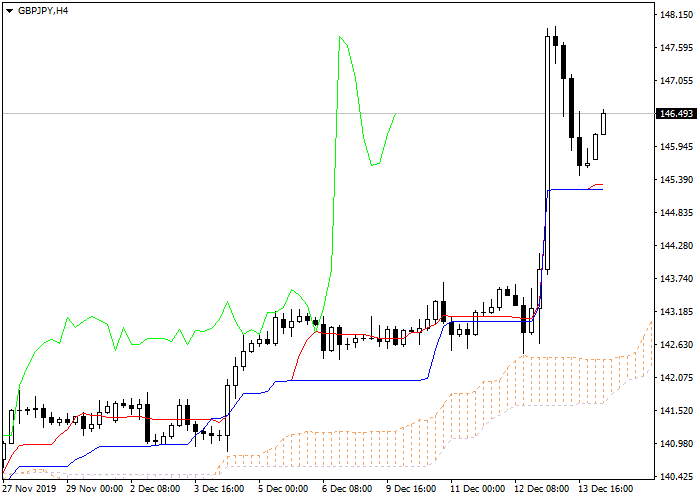

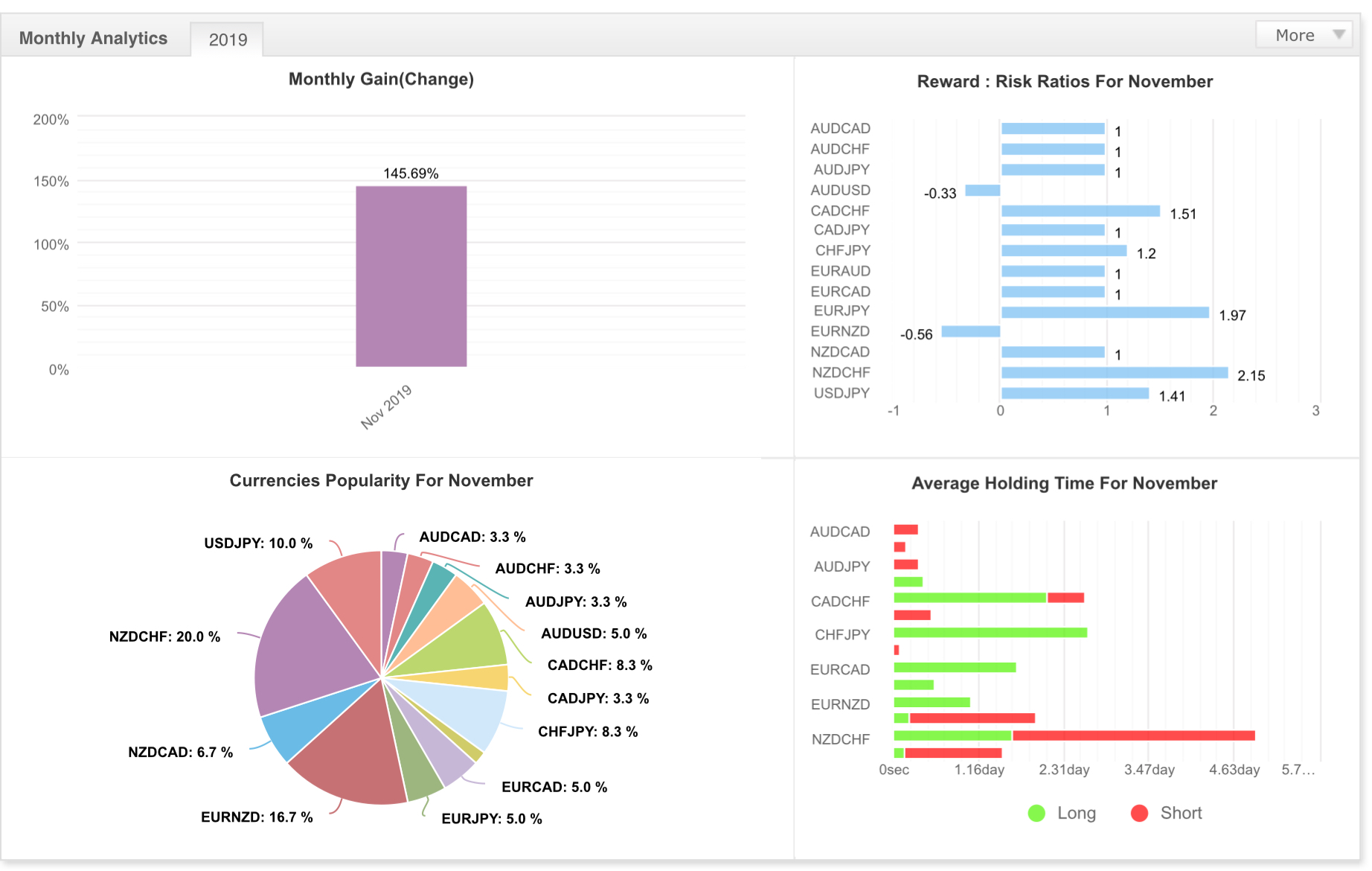

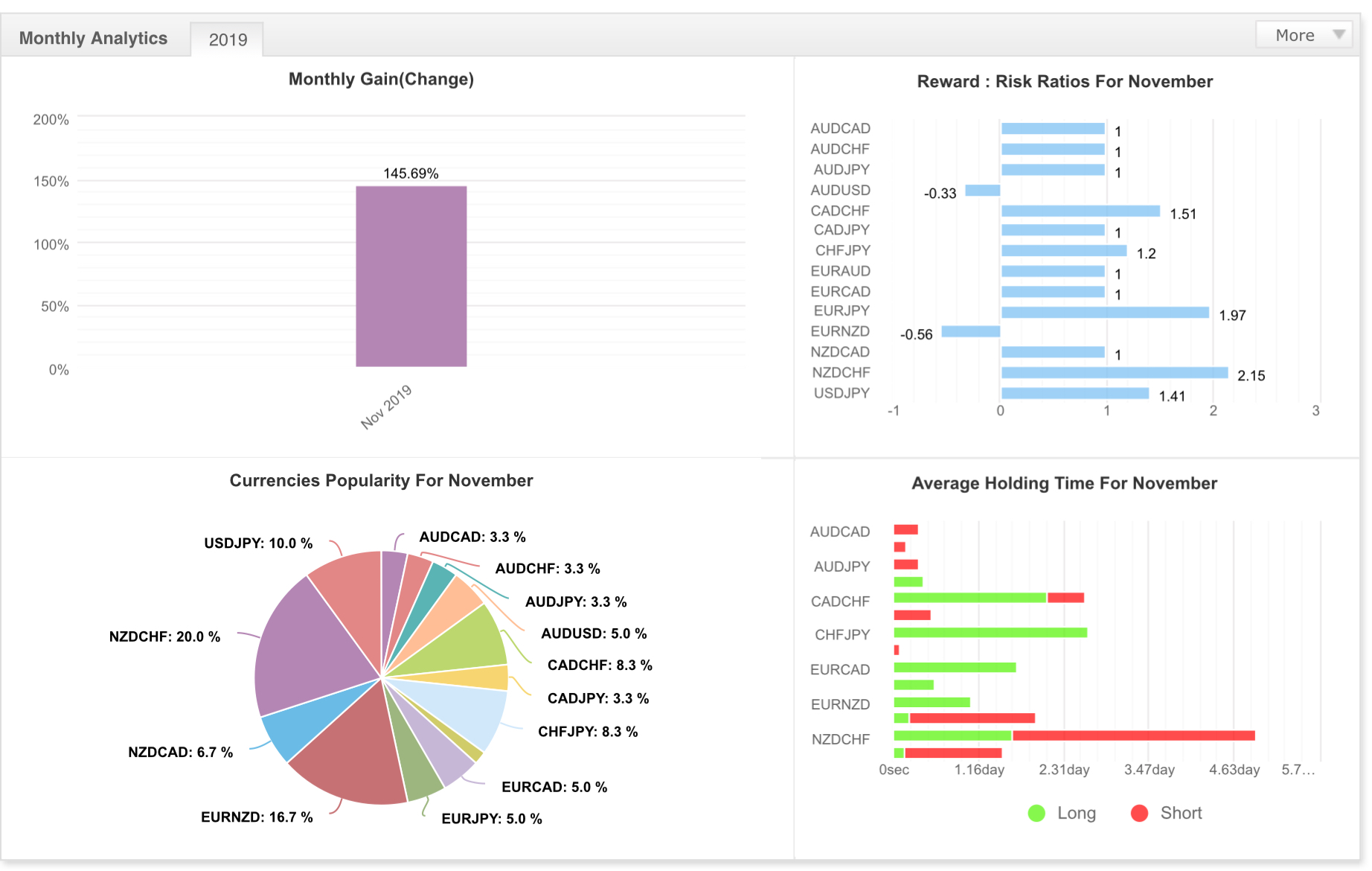

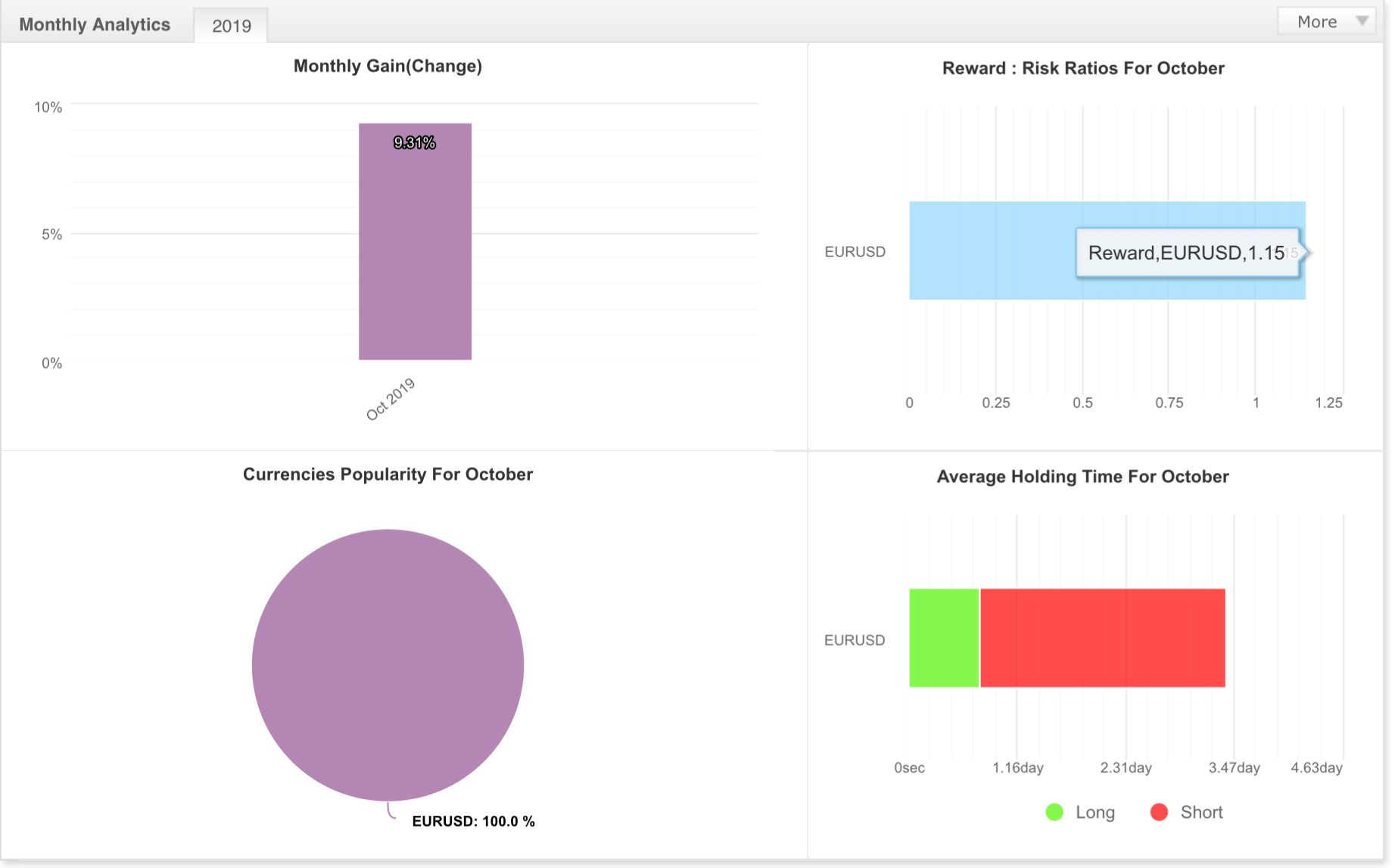

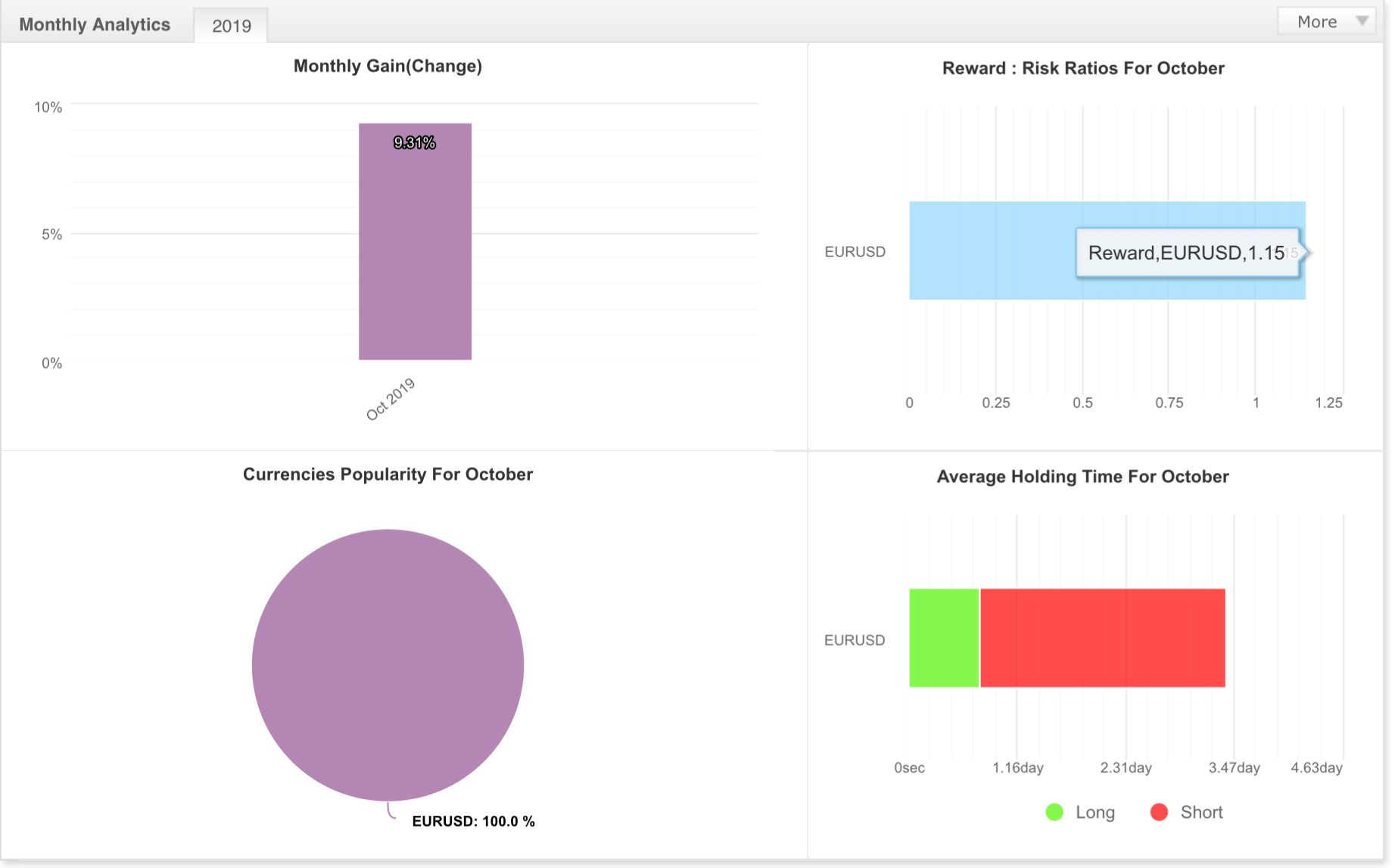

Muhammad Anas Zainal Abidin

Please do checkout my Signal. Med-high risk. Trade all pairs except Gbp due to Brexit issue. Trade will be more safer until issue settle. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

- Depo amount: USD 100

- Total PROFIT : USD 145.69

- Total Wd: USD 130

- Total period: 3 weeks Trading

- will continue the performance until my last breaths. ⚰️💨

https://www.mql5.com/en/signals/657560

*Note that the pic below is a peak from my data from myfxbook also. 😍📊📉

*also please do checkout my other signals that may suits your risk profile 🏋️♂️💵🧲

- Depo amount: USD 100

- Total PROFIT : USD 145.69

- Total Wd: USD 130

- Total period: 3 weeks Trading

- will continue the performance until my last breaths. ⚰️💨

https://www.mql5.com/en/signals/657560

*Note that the pic below is a peak from my data from myfxbook also. 😍📊📉

*also please do checkout my other signals that may suits your risk profile 🏋️♂️💵🧲

Muhammad Anas Zainal Abidin

Please do checkout my Signal. Low-Med risk. Use only ONE pair, EURUSD. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

*also please do checkout my other signals that may suits your risk profile 🏋️♂️💵🧲

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

*also please do checkout my other signals that may suits your risk profile 🏋️♂️💵🧲

Muhammad Anas Zainal Abidin

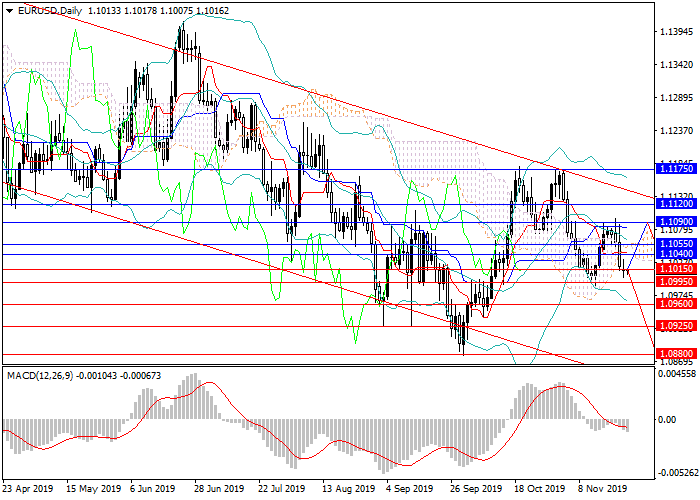

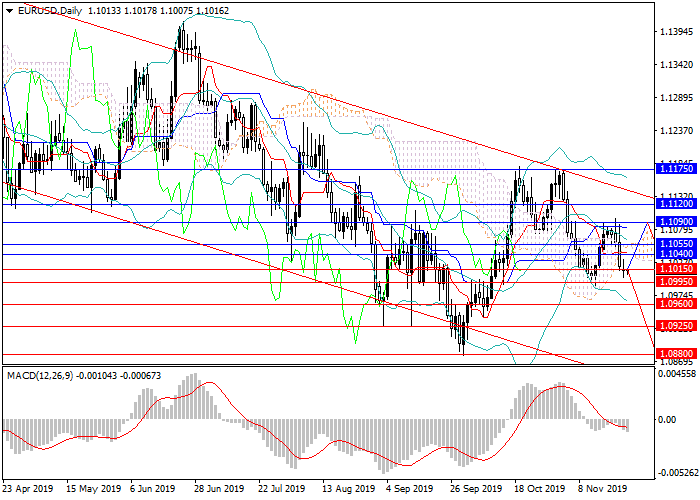

EUR/USD: downward momentum may maintain

After a significant increase in October, the EUR/USD pair again went downwards.

In early November, the price reached a key resistance level and the upper border of the channel around 1.1175. Unable to consolidate above it, the instrument reversed and started to decline, losing more than 150 points over the next three weeks. Now, the course is near the level of 1.1000. The main catalyst for the new downward wave was strong data on major indices and the US construction sector. In November, demand for the US dollar increased significantly, which causes a decrease in major currencies, including the euro, against it.

Today, special attention should be paid to the publication of the indicator of confidence of American consumers, and in the second half of the trading week, data on the growth rates of the US economy, EU labor market and inflation will be released.

Trading tips

Short positions may be opened from the current level with the target at 1.0880 and stop loss 1.1130.

After a significant increase in October, the EUR/USD pair again went downwards.

In early November, the price reached a key resistance level and the upper border of the channel around 1.1175. Unable to consolidate above it, the instrument reversed and started to decline, losing more than 150 points over the next three weeks. Now, the course is near the level of 1.1000. The main catalyst for the new downward wave was strong data on major indices and the US construction sector. In November, demand for the US dollar increased significantly, which causes a decrease in major currencies, including the euro, against it.

Today, special attention should be paid to the publication of the indicator of confidence of American consumers, and in the second half of the trading week, data on the growth rates of the US economy, EU labor market and inflation will be released.

Trading tips

Short positions may be opened from the current level with the target at 1.0880 and stop loss 1.1130.

Muhammad Anas Zainal Abidin

Please do checkout my Signal. Low-Med risk. Use only ONE pair, EURUSD. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

Muhammad Anas Zainal Abidin

NZD/USD: general review

Current trend

The pair continues to strengthen amid weakness in USD, which has fallen against all majors.

The trade conflict has hit the US economy much harder than officials are trying to present. Production fell to 10-year lows, business activity declined, and imports fell to the post-crisis 2009 level. Therefore, the Fed's decision to lower rates seems rational, and a tightening of monetary policy makes no sense. The labor market was an insufficient driver for strengthening of the US dollar; its influence on the dynamics of the instrument is clearly overestimated. Also, on Friday it became known that Washington and Beijing reached an agreement on key issues, which provided additional support for NZD.

Data on the volume of industrial orders from the USA will be published today at 17:00 (GMT+2). The expected reduction in the indicator will allow the pair to consolidate above the strong resistance level of 0.6450. Tomorrow, the report on the New Zealand labor market (23:45 GMT+2) may have a strong impact on the dynamics of the instrument.

Trading tips

Long positions may be opened from the current level with the target at 0.6550 and stop loss at 0.6395.

Short positions may be opened below 0.6395 with the target at 0.6310 and stop loss at 0.6420.

Implementation period: 1-3 days.

Current trend

The pair continues to strengthen amid weakness in USD, which has fallen against all majors.

The trade conflict has hit the US economy much harder than officials are trying to present. Production fell to 10-year lows, business activity declined, and imports fell to the post-crisis 2009 level. Therefore, the Fed's decision to lower rates seems rational, and a tightening of monetary policy makes no sense. The labor market was an insufficient driver for strengthening of the US dollar; its influence on the dynamics of the instrument is clearly overestimated. Also, on Friday it became known that Washington and Beijing reached an agreement on key issues, which provided additional support for NZD.

Data on the volume of industrial orders from the USA will be published today at 17:00 (GMT+2). The expected reduction in the indicator will allow the pair to consolidate above the strong resistance level of 0.6450. Tomorrow, the report on the New Zealand labor market (23:45 GMT+2) may have a strong impact on the dynamics of the instrument.

Trading tips

Long positions may be opened from the current level with the target at 0.6550 and stop loss at 0.6395.

Short positions may be opened below 0.6395 with the target at 0.6310 and stop loss at 0.6420.

Implementation period: 1-3 days.

Muhammad Anas Zainal Abidin

Please do checkout my Signal. Low-Med risk. Use only ONE pair, EURUSD. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

Muhammad Anas Zainal Abidin

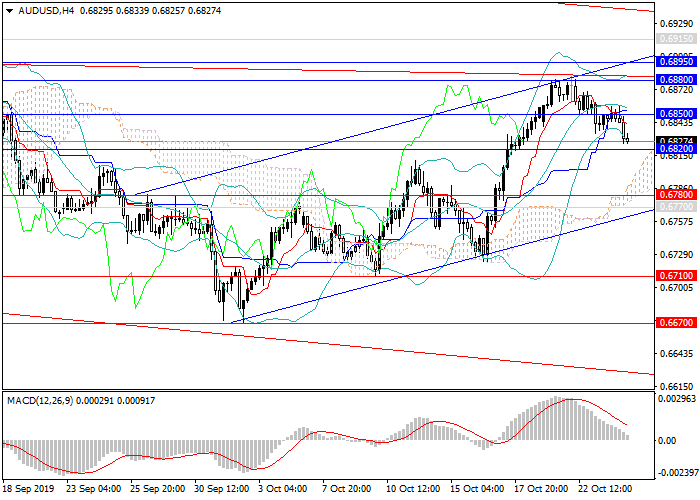

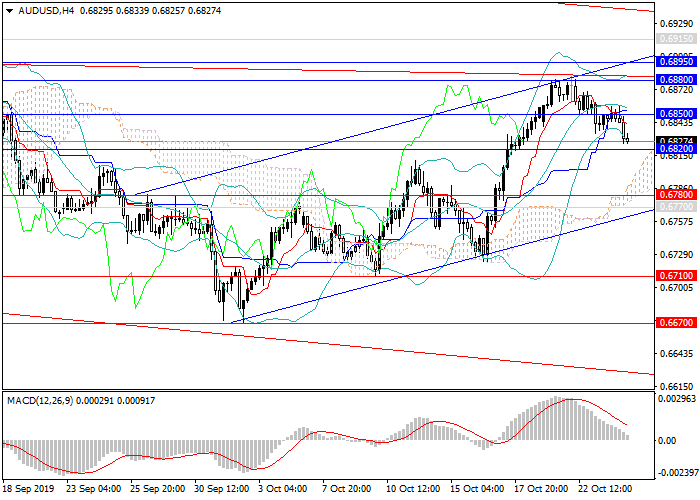

AUDUSD: general review

Current trend

After a significant increase in the first half of October, AUD against USD moved to a downward correction.

Since the beginning of the week, the pair has corrected by more than 50 points. The instrument was pressured by a drop in demand for AUD amid fixing long positions from a local maximum of 0.6880. The US dollar, however, strengthened against all majors due to growth of investor interest. The fundamental background had no effect on the pair at the beginning of the week due to the lack of important releases in the USA and Australia. Today and on Friday, a series of key US macroeconomic data will be published that can enhance the dynamics of decline, or, alternatively, return the pair to highs.

Trading tips

Short positions may be opened from the current level with the target at 0.6780 (0.6670 in the medium term) and stop loss at 0.6930

Current trend

After a significant increase in the first half of October, AUD against USD moved to a downward correction.

Since the beginning of the week, the pair has corrected by more than 50 points. The instrument was pressured by a drop in demand for AUD amid fixing long positions from a local maximum of 0.6880. The US dollar, however, strengthened against all majors due to growth of investor interest. The fundamental background had no effect on the pair at the beginning of the week due to the lack of important releases in the USA and Australia. Today and on Friday, a series of key US macroeconomic data will be published that can enhance the dynamics of decline, or, alternatively, return the pair to highs.

Trading tips

Short positions may be opened from the current level with the target at 0.6780 (0.6670 in the medium term) and stop loss at 0.6930

Muhammad Anas Zainal Abidin

Please do checkout my Signal. Low-Med risk. Use only ONE pair, EURUSD. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

Muhammad Anas Zainal Abidin

USDJPY: the dollar is correcting

Current trend

The US dollar showed a slight decline against the Japanese yen on Thursday, retreating from local highs of early August, updated on the same day. The depreciation of USD was facilitated by the ambiguous macroeconomic statistics from the United States. Industrial Production in September decreased by 0.4% MoM after an increase of 0.8% MoM in August. Philadelphia Fed Manufacturing Index in October fell from 12.0 to 5.6 points, which was worse than market expectations of 8.0 points. Housing Starts fell by 9.4% MoM in September after rising by 15.1% MoM a month earlier. Analysts had expected decline by 8.6% MoM.

Today, the pair maintains negative dynamics; however, weak data from Japan hinder the more confident growth of the yen. Japan's National Consumer Price Index in September showed a slowdown from +0.3% to +0.2% YoY, while the forecast assumed an increase to +0.4% YoY.

Trading tips

To open long positions, one can rely on the breakout of 108.98. Take profit — 109.50 or 109.70. Stop loss — 108.60.

A breakdown of 108.46 may be a signal for new sales with target at 107.77 or 107.51. Stop loss — 108.98.

Implementation time: 2-3 days.

Current trend

The US dollar showed a slight decline against the Japanese yen on Thursday, retreating from local highs of early August, updated on the same day. The depreciation of USD was facilitated by the ambiguous macroeconomic statistics from the United States. Industrial Production in September decreased by 0.4% MoM after an increase of 0.8% MoM in August. Philadelphia Fed Manufacturing Index in October fell from 12.0 to 5.6 points, which was worse than market expectations of 8.0 points. Housing Starts fell by 9.4% MoM in September after rising by 15.1% MoM a month earlier. Analysts had expected decline by 8.6% MoM.

Today, the pair maintains negative dynamics; however, weak data from Japan hinder the more confident growth of the yen. Japan's National Consumer Price Index in September showed a slowdown from +0.3% to +0.2% YoY, while the forecast assumed an increase to +0.4% YoY.

Trading tips

To open long positions, one can rely on the breakout of 108.98. Take profit — 109.50 or 109.70. Stop loss — 108.60.

A breakdown of 108.46 may be a signal for new sales with target at 107.77 or 107.51. Stop loss — 108.98.

Implementation time: 2-3 days.

Muhammad Anas Zainal Abidin

Please do checkout my Signal. Low-Med risk. Use only ONE pair, EURUSD. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

https://www.mql5.com/en/signals/641847

*Note that the pic below is a peak from my data from mql5 😍📊📉

Muhammad Anas Zainal Abidin

USDCAD: wave analysis

The pair may grow.

On the 4-hour chart, the third wave of the higher level (3) develops, within which a correction ended as the wave ii of 1 of (3). Now, the development of the wave iii of 1 has started, within which the wave (i) of iii has formed, and the correction (ii) of iii has ended. If the assumption is correct, the pair will grow to the levels of 1.3450–1.3564. In this scenario, critical stop loss level is 1.3135.

Main scenario

Long positions will become relevant during the correction, above the level of 1.3135 with the targets at 1.3450–1.3564. Implementation period: 7 days and more.

Alternative scenario

The breakout and the consolidation of the price below the level of 1.3135 will let the pair go down to the level of 1.3014 and below.

The pair may grow.

On the 4-hour chart, the third wave of the higher level (3) develops, within which a correction ended as the wave ii of 1 of (3). Now, the development of the wave iii of 1 has started, within which the wave (i) of iii has formed, and the correction (ii) of iii has ended. If the assumption is correct, the pair will grow to the levels of 1.3450–1.3564. In this scenario, critical stop loss level is 1.3135.

Main scenario

Long positions will become relevant during the correction, above the level of 1.3135 with the targets at 1.3450–1.3564. Implementation period: 7 days and more.

Alternative scenario

The breakout and the consolidation of the price below the level of 1.3135 will let the pair go down to the level of 1.3014 and below.

Muhammad Anas Zainal Abidin

Please do checkout my Signal. Low-Med risk. Use only ONE pair, EURUSD. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

https://www.mql5.com/en/signals/641847

*Note that the pic below is from my data from myfxbook 😍 its the same thing as in the MqL5 signal provided, just with more interactive figure 📊📉

https://www.mql5.com/en/signals/641847

*Note that the pic below is from my data from myfxbook 😍 its the same thing as in the MqL5 signal provided, just with more interactive figure 📊📉

Muhammad Anas Zainal Abidin

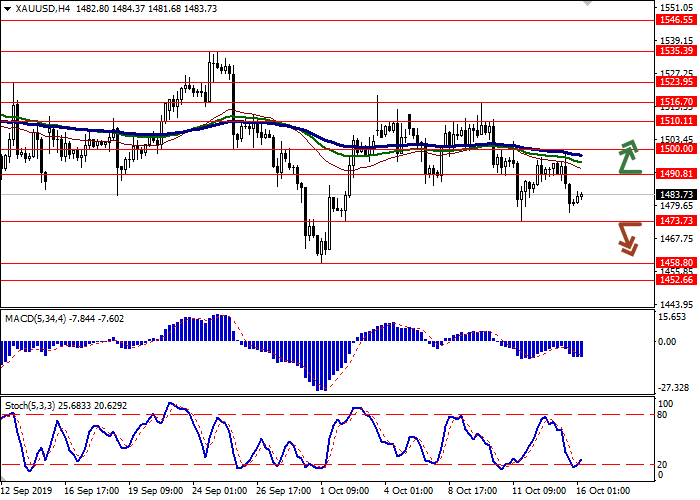

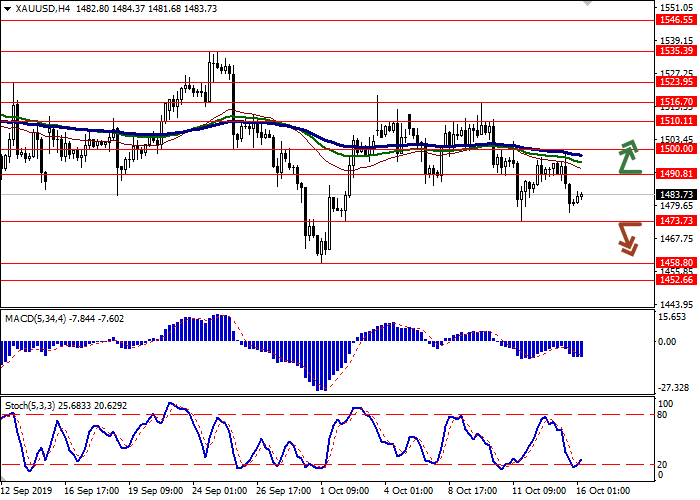

XAUUSD: gold prices remain under pressure

Current trend

Gold prices fell on Tuesday, responding to rising investor demand on stock exchanges. However, a more confident decline in the instrument was hindered by continuing concerns about the possibility of concluding a trade agreement between the United States and China. Despite significant success in the new round of negotiations, the Chinese side is hesitant to sign the agreement, insisting on the cancellation of the planned increase in import duties in December. Donald Trump is unlikely to do this, because the US sees the December tariff increase as an additional guarantee of compliance with all conditions by Beijing.

Another important issue for gold is the situation around Brexit. The UK-EU summit will be held at the end of this week and it is expected that the agreement, if any, will be signed by this time. Otherwise, the parties may again return to the disscussion on the postponement of the process

Trading tips

To open long positions, one can rely on the breakout of 1490.81. Take profit — 1516.70 or 1523.95. Stop loss should be placed no further than 1473.73.

A breakdown of 1473.73 may be a signal for new sales with target at 1452.66 or 1440.00. Stop loss — 1485.00.

Implementation time: 2-3 days.

Current trend

Gold prices fell on Tuesday, responding to rising investor demand on stock exchanges. However, a more confident decline in the instrument was hindered by continuing concerns about the possibility of concluding a trade agreement between the United States and China. Despite significant success in the new round of negotiations, the Chinese side is hesitant to sign the agreement, insisting on the cancellation of the planned increase in import duties in December. Donald Trump is unlikely to do this, because the US sees the December tariff increase as an additional guarantee of compliance with all conditions by Beijing.

Another important issue for gold is the situation around Brexit. The UK-EU summit will be held at the end of this week and it is expected that the agreement, if any, will be signed by this time. Otherwise, the parties may again return to the disscussion on the postponement of the process

Trading tips

To open long positions, one can rely on the breakout of 1490.81. Take profit — 1516.70 or 1523.95. Stop loss should be placed no further than 1473.73.

A breakdown of 1473.73 may be a signal for new sales with target at 1452.66 or 1440.00. Stop loss — 1485.00.

Implementation time: 2-3 days.

Muhammad Anas Zainal Abidin

Please do checkout my Signal. Low-Med risk. Use only ONE pair, EURUSD. Might not make profit everyday, but monthly will produce CONSISTENT profit. ;)

https://www.mql5.com/en/signals/641847

*Note that the pic below is from my data from myfxbook 😍 its the same thing as in the MqL5 signal provided, just with more interactive figure 📊📉

https://www.mql5.com/en/signals/641847

*Note that the pic below is from my data from myfxbook 😍 its the same thing as in the MqL5 signal provided, just with more interactive figure 📊📉

: