Piyush Lalsingh Ratnu / Profilo

- Informazioni

|

1 anno

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

2

segnali

|

0

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm 130+ parameters.

Core focus: XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Ai Verified Track Record since 2021:

https://www.piyushratnu.com/most-accurate-xauusd-spot-gold-price-projection-and-ai-verified-research-generated-by-piyush-ratnu-gold-market-research/

XAUUSD Daily Price Projection:

https://www.piyushratnu.com/xauusd-spot-gold-daily-analysis/

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Amici

19

Richieste

In uscita

Piyush Lalsingh Ratnu

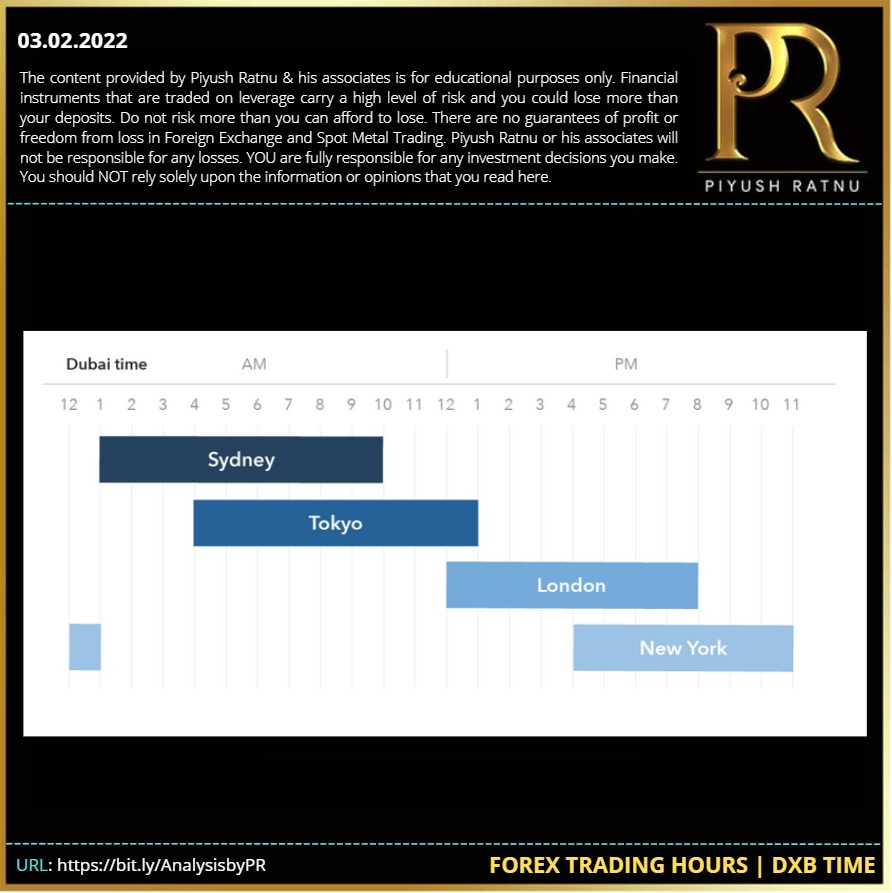

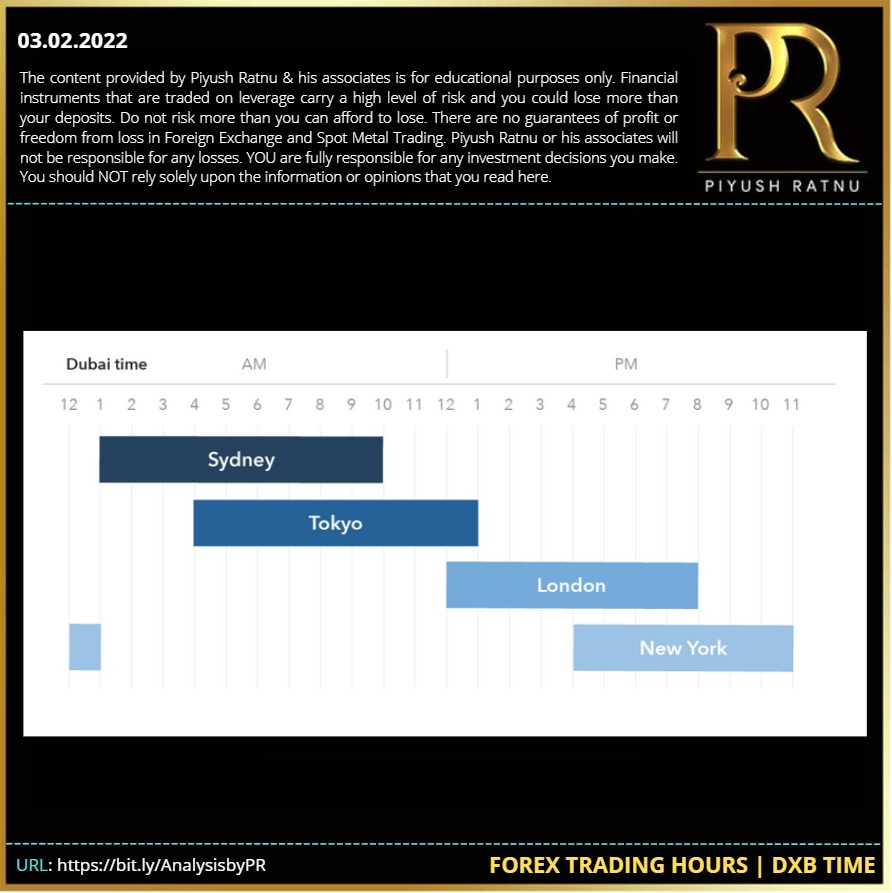

Forex Trading Hours | DXB Time

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

T/P: Stands for “take profit.” Refers to limit orders that look to sell above the level that was bought, or buy back below the level that was sold.

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

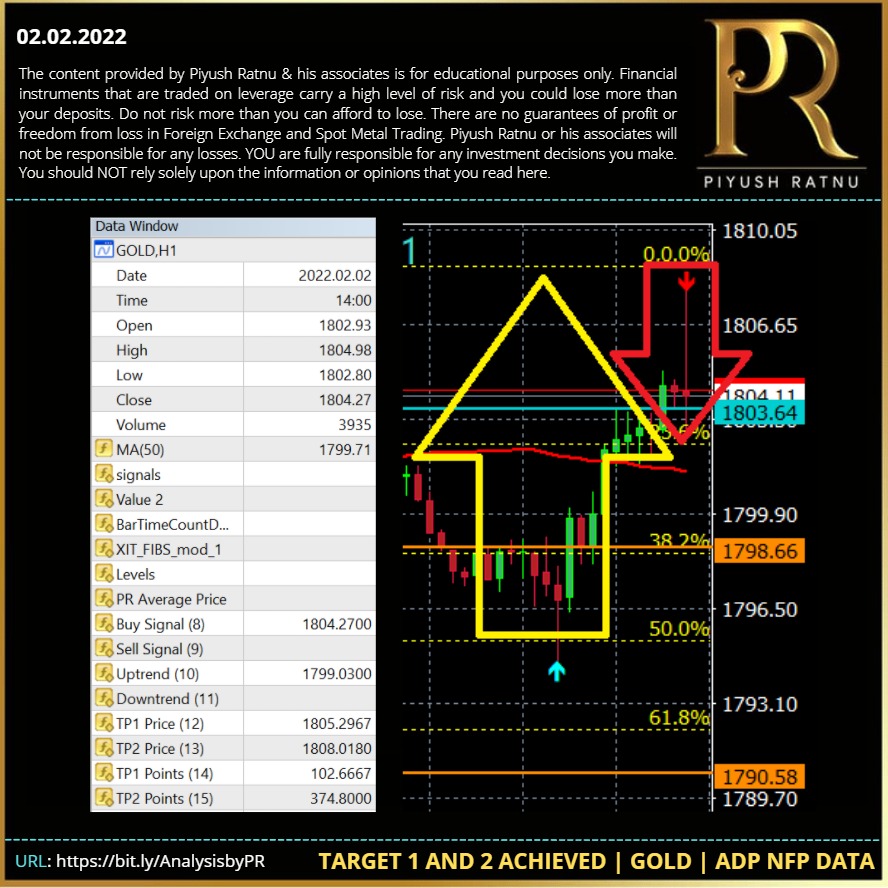

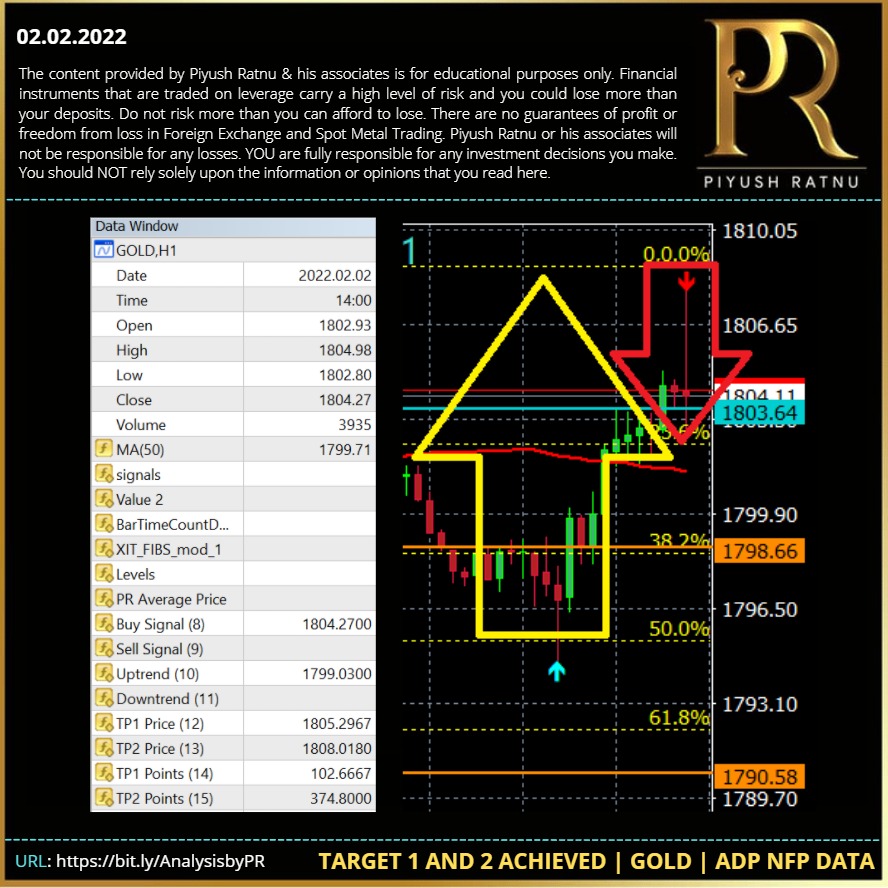

Accuracy proved once again. Perfect BUY and SELL entries with target price traced before ADP NFP data today.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

02.02.2022 Possible Crash Reversal RT Zone | PR Spot Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

02.02.2022 | Co- relations | PR Spot Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

02.02.2022 GTPS | PRS | SR | PR Spot Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

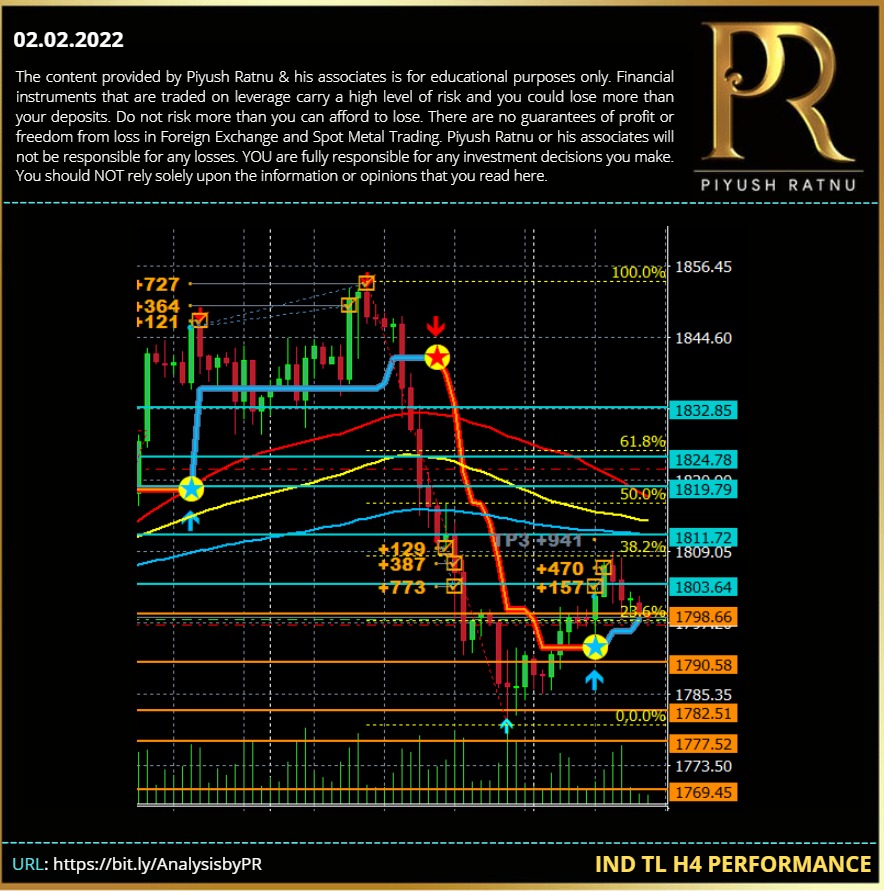

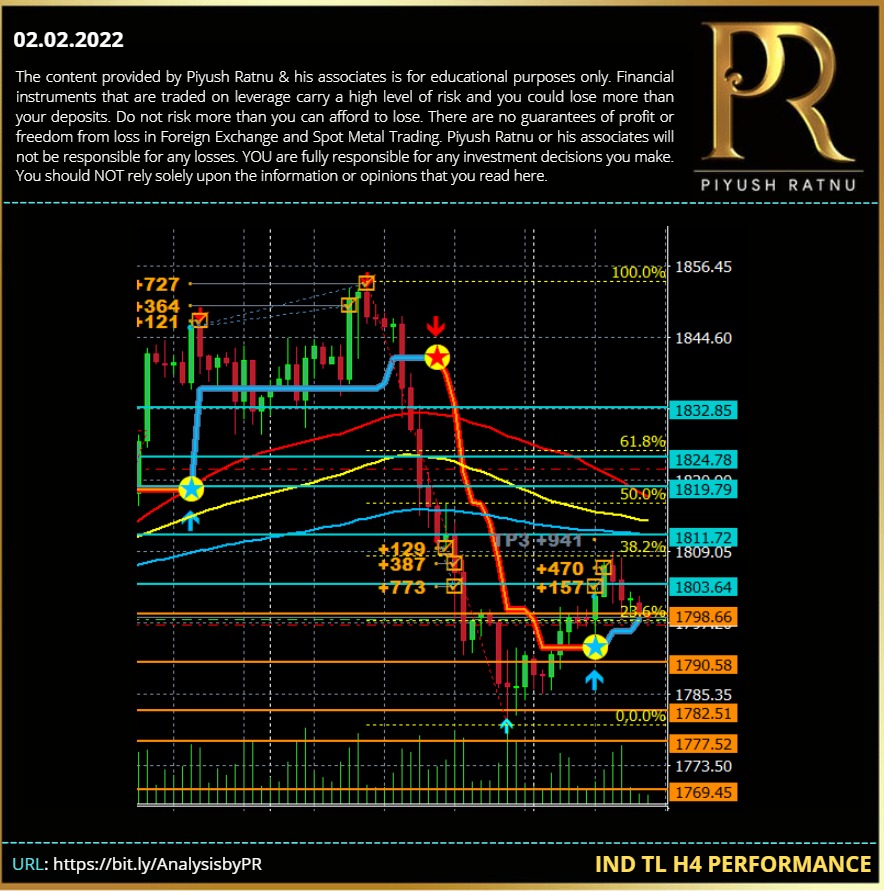

02.02.2022 | IND TL H4 Performance | PR Spot Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

02.02.2022 | ST | SOK | MTD | MP | FF | SR | PR Spot Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

02.02.2022 | Price Channel | Support and Resistance Zone | PR Spot Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

THIRTY (30) YR: UK government-issued debt which is repayable in 30 years. For example, a UK 30-year gilt.

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

01.02.2022 | FIB Channel | Support and Resistance Zone | PR Spot Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

01.02.2022 | MP | SR | MTD | FF | PR Spot Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

01.02.2022 | PR Spot Gold Analysis | XAUUSD Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

US30: A name for the Dow Jones index.

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

UK JOBLESS CLAIMS CHANGE: Measures the change in the number of people claiming unemployment benefits over the previous month.

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

I will start trading from 01 February, 2022.

In the last four days we saw the repetition of January trend, after a new high, Gold crashed in same pattern: 1850-1830-1818-1808-1796.

Last year too Gold crashed in first week and then from third week till mid March Gold failed to recover the price levels.

FOMC, interest rate related Policy formats, higher yields and dollar strength are together driving the Gold prices for now.

The numbers remain the same:

2020

1966

1947

1926

1907

1888

1866

1830 (newly formed level)

1818

1808

1796

1777

1745

1717

1666

1636

1616

1596

1555

1515

1496

1444

1414

The crash and rise will be observed at these levels just like last two years.

Interest rate decision related statements and asset purchase related policies might result in a price movement of upto $100, stay alert and keep price gaps, target net average and observe SR zone strictly before taking a decision.

I thank you all for your prayers and wishes, and am glad I am recovering well by the grace of God.

Have a great weekend!

- PR

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

In the last four days we saw the repetition of January trend, after a new high, Gold crashed in same pattern: 1850-1830-1818-1808-1796.

Last year too Gold crashed in first week and then from third week till mid March Gold failed to recover the price levels.

FOMC, interest rate related Policy formats, higher yields and dollar strength are together driving the Gold prices for now.

The numbers remain the same:

2020

1966

1947

1926

1907

1888

1866

1830 (newly formed level)

1818

1808

1796

1777

1745

1717

1666

1636

1616

1596

1555

1515

1496

1444

1414

The crash and rise will be observed at these levels just like last two years.

Interest rate decision related statements and asset purchase related policies might result in a price movement of upto $100, stay alert and keep price gaps, target net average and observe SR zone strictly before taking a decision.

I thank you all for your prayers and wishes, and am glad I am recovering well by the grace of God.

Have a great weekend!

- PR

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

VIX OR VOLATILITY INDEX: Shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge."

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

WEDGE CHART PATTERN: Chart formation that shows a narrowing price range over time, where price highs in an ascending wedge decrease incrementally, or in a descending wedge, price declines are incrementally smaller. Ascending wedges typically conclude with a downside breakout and descending wedges typically terminate with upside breakouts.

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

XAU/USD: Symbol for Gold Index | Important Forex Terms | Piyush Ratnu Trading Tutorial | Spot Gold | Forex Glossary

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Read more at: https://www.piyushratnu.com/forex-glossary/

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

YIELD: The percentage return from an investment.

Piyush Ratnu Forex Trading Tips | Forex Glossary | Forex Education | Forex Terms

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Ratnu Forex Trading Tips | Forex Glossary | Forex Education | Forex Terms

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

: