Sergey Golubev / Profilo

Newdigital

Amici

3895

Richieste

In uscita

Sergey Golubev

Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets

Rogerio Figurelli

Commento all'argomento Por que os indicadores técnicos falham?

rafaeltoscano : Olá figurelli, li este artigo que você recomendou, muito bom, principalmente pra quem não é dessa área como eu kkkkkk, mas pro Malacarne já deve ser ultrapassado, como ele disse

Sergey Golubev

周小川在G20会议上提出7%至8%的增长速度适合中国

Sergey Golubev

Commento all'argomento 报刊评论

周小川在G20会议上提出7%至8%的增长速度适合中国 星期一, 二月 24 2014, 03:29 GMT 中国央行行长周小川在悉尼表示,中国将致力于平衡GDP增长、结构改革和稳定之间的关系。7%-8%的增长速度不仅适合于中国,也有利于促进全球经济增长、使全球环境更可持续。 2月22日至23日,二十国集团(G20)财长和央行行长会议在澳大利亚悉尼举行。

Sergey Golubev

Bitcoin spikes almost 200% on Mt. Gox withdrawal rumors (based on investing article)

Bitcoin prices spiked almost 200% on the Tokyo-based Mt. Gox Exchange on Sunday to hit an intraday high above $300, amid speculation withdrawals on the troubled exchange will soon resume.

BTC/USD rallied to a session high of $348.98 on Mt. Gox, before trimming gains to trade at $278.00 during U.S. morning hours, up 151.4%.

Investors returned to the market after a rumor posted on internet message board website Reddit said that Mt. Gox was in the process of testing Bitcoin withdrawals again.

Prices on Mt. Gox plunged to $91.50 on February 21 as investors were disappointed with a lack of concrete details regarding progress made on resuming withdrawals on the struggling exchange.

Mt. Gox was forced to halt all Bitcoin withdrawals on February 7 due to a technical issue, leading to steep declines as traders shied away from the virtual currency.

Elsewhere, the price of a Bitcoin last traded at $627.95 on Slovenia-based BitStamp, up 10.3%, while prices on BTC-e jumped 10% to trade at $610.00.

BitStamp is the world’s largest second-largest Bitcoin exchange, while Bulgaria-based BTC-e is the third-biggest by volume.

According to the CoinDesk Bitcoin Price Index, which averages prices from the major exchanges, prices of the crypto-currency picked up 2.3% to trade at $618.60.

Bitcoin is digital cash for the internet and it is not backed by a government or central bank to regulate or issue it. It can be used to purchase goods and services from stores and online retailers.

Prices of the virtual currency soared to an all-time high of $1,241.10 on November 29.

Bitcoin prices spiked almost 200% on the Tokyo-based Mt. Gox Exchange on Sunday to hit an intraday high above $300, amid speculation withdrawals on the troubled exchange will soon resume.

BTC/USD rallied to a session high of $348.98 on Mt. Gox, before trimming gains to trade at $278.00 during U.S. morning hours, up 151.4%.

Investors returned to the market after a rumor posted on internet message board website Reddit said that Mt. Gox was in the process of testing Bitcoin withdrawals again.

Prices on Mt. Gox plunged to $91.50 on February 21 as investors were disappointed with a lack of concrete details regarding progress made on resuming withdrawals on the struggling exchange.

Mt. Gox was forced to halt all Bitcoin withdrawals on February 7 due to a technical issue, leading to steep declines as traders shied away from the virtual currency.

Elsewhere, the price of a Bitcoin last traded at $627.95 on Slovenia-based BitStamp, up 10.3%, while prices on BTC-e jumped 10% to trade at $610.00.

BitStamp is the world’s largest second-largest Bitcoin exchange, while Bulgaria-based BTC-e is the third-biggest by volume.

According to the CoinDesk Bitcoin Price Index, which averages prices from the major exchanges, prices of the crypto-currency picked up 2.3% to trade at $618.60.

Bitcoin is digital cash for the internet and it is not backed by a government or central bank to regulate or issue it. It can be used to purchase goods and services from stores and online retailers.

Prices of the virtual currency soared to an all-time high of $1,241.10 on November 29.

Sergey Golubev

Sergey Golubev

Commento all'argomento Indicators: FP channel

How to Trade Gold Yearly Pivot Points (adapted from dailyfx article ) Commodity pit traders have used pivot points for decades to determine potential support and resistance areas, Gold yearly pivot

Sergey Golubev

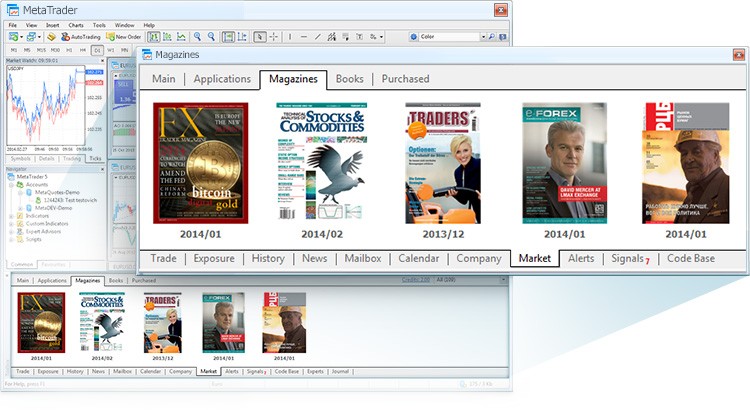

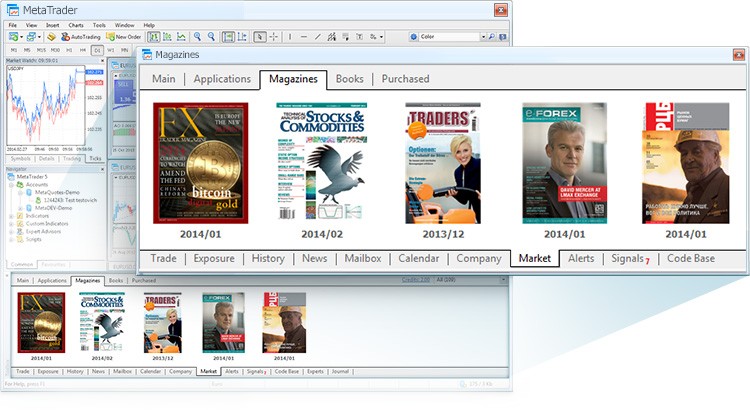

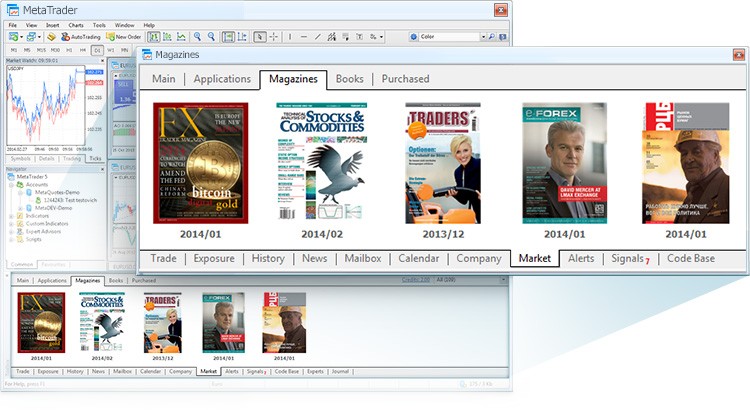

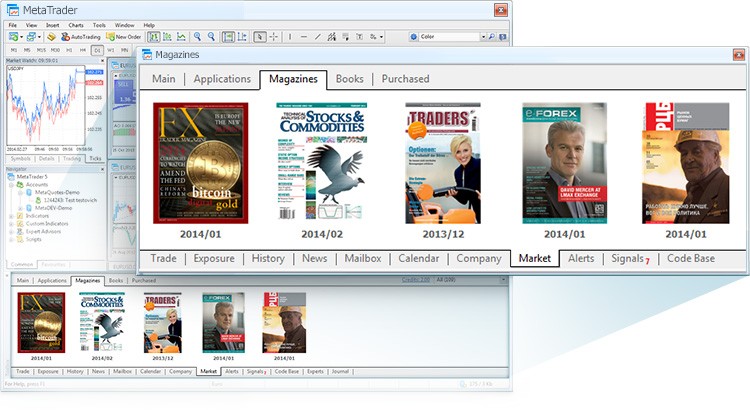

MetaQuotes

Commento all'argomento List of changes in MetaTrader 5 Client Terminal builds

MetaTrader 5 Platform Update Build 900: Magazines in MetaTrader Market and New MetaViewer MetaTrader 5 platform update is to be released on Friday, February 28, 2014. It will contain the following

Sergey Golubev

MetaQuotes

Commento all'argomento Список изменений в билдах MetaTrader 5 Client Terminal

MetaTrader 5 Client Terminal build 900: Журналы в MetaTrader Market и новый MetaViewer В пятницу 28 февраля 2014 года будет опубликовано обновление платформы MetaTrader 5. Обновление будет содержать

Sergey Golubev

codice condiviso dell'autore GT788

Indicatori tecnici e filtri digitali

In questo articolo, gli indicatori tecnici sono trattati come filtri digitali. Vengono spiegati i principi di funzionamento e le caratteristiche di base dei filtri digitali. Inoltre, vengono considerati alcuni modi pratici per ricevere il kernel del filtro nel terminale MetaTrader 5 e l'integrazione con un analizzatore di spettro già pronto proposto nell'articolo "Costruire un analizzatore di spettro". Vengono utilizzate come esempi le caratteristiche di impulso e spettro dei tipici filtri digitali.

Sergey Golubev

How Social Media Affects The Forex Market

Sergey Golubev

Commento all'argomento Press review

How Social Media Affects The Forex Market (based on dailyforex article ) The Forex market, as you probably know by now, is the biggest market in the world. Yet, somehow, the average citizen, who is

Sergey Golubev

Sergey Golubev

Commento all'argomento Something Interesting to Read February 2014

Technical Trading Mastery: 7 Steps To Win With Logic Paperback – February 1, 2014 This book, written for both traders and investors, explores the tools and techniques that discretionary and

Sergey Golubev

Sergey Golubev

Commento all'argomento Press review

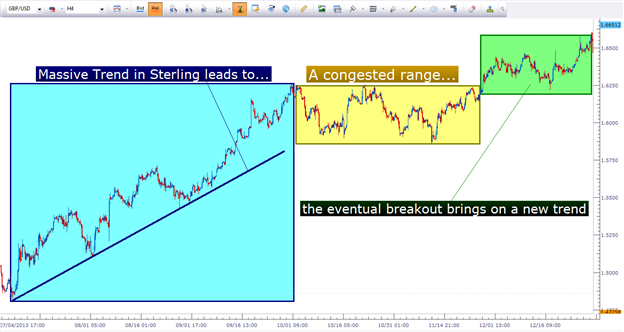

Your Strategy and the Market Condition (based on dailyfx article ) Traders should look to focus their strategies in appropriate market conditions, Multiple time frame analysis can offer a

Sergey Golubev

Sergey Golubev

Commento all'argomento Something Interesting to Read February 2014

The Trend Following Bible : How Professional Traders Compound Wealth & Manage Risk by Andrew Abraham Profiting from long-term trends is the most common path to success for traders. The challenge is

Sergey Golubev

世界黄金协会:2013年全球黄金需求下滑15%至四年低点3756吨

星期二, 二月 18 2014, 06:28 GMT

世界黄金协会:2013年全球黄金需求下滑15%至四年低点3756吨;中国2013年黄金需求触及纪录高位1065.8吨,成全球最大黄金消费国;2013年黄金投资需求下降51%,至773.3吨;去年黄金ETF结算量达到881吨。

星期二, 二月 18 2014, 06:28 GMT

世界黄金协会:2013年全球黄金需求下滑15%至四年低点3756吨;中国2013年黄金需求触及纪录高位1065.8吨,成全球最大黄金消费国;2013年黄金投资需求下降51%,至773.3吨;去年黄金ETF结算量达到881吨。

Sergey Golubev

Gold Rises to 3-Month High on Haven Demand as Silver Extends Run (bloomberg article)

Gold advanced to the highest level in more than three months as speculation the U.S. economic recovery will slow spurred demand for a haven. Silver headed for the longest run of gains since at least 1968.

Bullion climbed 4.1 percent last week, the most since the period ended Aug. 16. U.S. factory production unexpectedly declined in January by the most since May 2009, according to a report released on Feb. 14. Gold will establish a new range above $1,300 an ounce and U.S. investors are becoming friendlier to the metal, UBS AG said in a report today.

Bullion tumbled the most since 1981 last year after some investors lost faith in the metal as a store of value and as U.S. policy makers signaled they will slow stimulus. Gold rebounded 9.9 percent this year as emerging-market equities and currencies weakened and lower prices of the metal spurred more physical demand, particularly from Asia.

“It is the insurance product against further emerging market turmoil, more bad U.S. data, potentially too frothy equity markets and unforeseen market shocks,” UBS analysts in London, who met with U.S. clients last week, wrote in the report. “With positioning so light and the sentiment turn in gold’s favor so recent, we expect that gold will remain bid.”

Bullion for immediate delivery rose 0.6 percent to $1,326.81 an ounce by 11:40 a.m. in London. It reached $1,330.03, the highest since Oct. 31. Gold for April delivery gained 0.6 percent to $1,327.10 in electronic trading on the Comex in New York, where futures trading volume was 15 percent above the average for the past 100 days for this time of day, data compiled by Bloomberg showed.

Markets in the U.S. will be closed for a holiday today.

Gold advanced to the highest level in more than three months as speculation the U.S. economic recovery will slow spurred demand for a haven. Silver headed for the longest run of gains since at least 1968.

Bullion climbed 4.1 percent last week, the most since the period ended Aug. 16. U.S. factory production unexpectedly declined in January by the most since May 2009, according to a report released on Feb. 14. Gold will establish a new range above $1,300 an ounce and U.S. investors are becoming friendlier to the metal, UBS AG said in a report today.

Bullion tumbled the most since 1981 last year after some investors lost faith in the metal as a store of value and as U.S. policy makers signaled they will slow stimulus. Gold rebounded 9.9 percent this year as emerging-market equities and currencies weakened and lower prices of the metal spurred more physical demand, particularly from Asia.

“It is the insurance product against further emerging market turmoil, more bad U.S. data, potentially too frothy equity markets and unforeseen market shocks,” UBS analysts in London, who met with U.S. clients last week, wrote in the report. “With positioning so light and the sentiment turn in gold’s favor so recent, we expect that gold will remain bid.”

Bullion for immediate delivery rose 0.6 percent to $1,326.81 an ounce by 11:40 a.m. in London. It reached $1,330.03, the highest since Oct. 31. Gold for April delivery gained 0.6 percent to $1,327.10 in electronic trading on the Comex in New York, where futures trading volume was 15 percent above the average for the past 100 days for this time of day, data compiled by Bloomberg showed.

Markets in the U.S. will be closed for a holiday today.

Sergey Golubev

Sergey Golubev

Commento all'argomento Something Interesting to Read February 2014

The Master Swing Trader by Alan Farley Today’s top market players understand that our "efficient" markets are actually highly inefficient, driven by insiders with hidden agendas and an irrational pack

Sergey Golubev

OPUS - Live Is Life - Original video recorded in January 1985 at Arena Vienna, Austria,

directed by Anders Stenmo, produced by OPUS - music renewed

watch here : http://youtu.be/pATX-lV0VFk

================

Good morning

directed by Anders Stenmo, produced by OPUS - music renewed

watch here : http://youtu.be/pATX-lV0VFk

================

Good morning

Sergey Golubev

Sergey Golubev

Commento all'argomento Press review

Gold and Oil Prices Go Up the Most in three Months (based on forexminute article ) The year 2014 so far has been good for gold and oil. This week, both i.e. oil and gold have hit multi-month peaks

Grzegorz Korycki

2014.02.16

we are facing many years of inflationary depression, (in 1-3 years) so the inflating capital will look for safe heaven. Silver and gold will skyrocket, when the size of fraud relating fractional "paper" gold, national gold (leased=gone), silver price manipulation sooner or later is exposed. Fiat currencies are ponzi schemes, and we will see how illusive their value is in the coming years. Paper gold and silver is useless for other uses than speculation. Buy real silver and gold now while they are cheap and their prices are being manipulated! (thank the bankers) This is your last chance. The comming years are going be the years of greatest wealth transfer in earth's history (bigger than 1929) so prepare yourself to be on the right side, not like those morons in 1929 commiting suicides later.

: