Andrius Kulvinskas / Profil

- Informations

|

10+ années

expérience

|

0

produits

|

0

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

Online Money maker / Independet Trader

I'm new in this comunity, but not new in the market....

For fastest news, ceck my page, or follow on Twitter

I'm new in this comunity, but not new in the market....

For fastest news, ceck my page, or follow on Twitter

Andrius Kulvinskas

Publication publiéeFOREX forecast 12.01.2015-16.01.2015

Last week EUR recorded a new low at 1.1754 and that was the fourth week in a row with a negative close. Weekly and Daily indicators are bearish, but the H4 ones show some signs of correction...

Andrius Kulvinskas

Publication publiéeSupport & Resistance for NZD/USD

For today R4 - 0.7947 / R3 - 0.7927 / R2 - 0.7890 / R1 - 0.7872 SPOT 0.7848 S1 - 0.7790 / S2 - 0.7755 / S3 - 0.7714 / S4 - 0.7682 BUY AT .7800 FOR .7927; REVISE STOP AT .7755...

Andrius Kulvinskas

Publication publiéeWeek Ahead – Jan 12 2015

Tuesday Jan 13 China New Loans (Dec) market is expecting a decrease from 54.5B to 48.9B in case the number came in red AUDUSD might keep on correcting up currently above 0.82 AUDUSD, support to watch 0.8030 UK Core Consumer Price Index (YoY)(Dec) market is expecting a decrease from 1.0% to0...

Partager sur les réseaux sociaux · 1

126

Andrius Kulvinskas

Publication publiéeDuring The First 7 Hours Of This Week AUDUSD With Steady Steps Kept On Rising

For the 5th day AUDUSD sentiment still bullish, pushing from 0.8205 toward 0.8253till now. From 0.8030 & AUDUSD found strong support & went above 0.81 & 0.82... right now getting far 50 pips from 0.82... if the next hours showed more advance toward0...

Partager sur les réseaux sociaux · 1

138

Andrius Kulvinskas

Publication publiéeSpecs increased overall net long USD - ANZ

The futures positioning data for the week ending 6 Jan 2014, saw leveraged funds increased their overall net long USD positioning by USD1.0bn to register a new record high, notes ANZ. Key Quotes "Leveraged funds increased their overall net long USD positioning by USD1...

Partager sur les réseaux sociaux · 1

124

Andrius Kulvinskas

Publication publiéeBearish EUR/USD theme remains in place - RBS

The firmly bearish EUR/USD theme remains in place, notes the FX Strategy at RBS. Key Quotes "The firmly bearish EUR/USD theme remains in place, and we continue to favour EUR/USD to extend losses ahead of the January 22nd ECB meeting, when we expect a sovereign QE program will be announced...

Partager sur les réseaux sociaux · 1

144

Andrius Kulvinskas

Digging down into the 2014 US job picture

http://www.forexlive.com/blog/2015/01/09/digging-down-into-the-2014-us-job-picture/#comment-1784249338

http://www.forexlive.com/blog/2015/01/09/digging-down-into-the-2014-us-job-picture/#comment-1784249338

Andrius Kulvinskas

Publication publiéeLegal challenge shows rocky path to ECB money-printing

A landmark legal opinion this week will remind the European Central Bank of the limits it faces as it advances towards money printing, while a tumbling oil price saps inflation in debt-strained Europe...

Partager sur les réseaux sociaux · 1

171

Andrius Kulvinskas

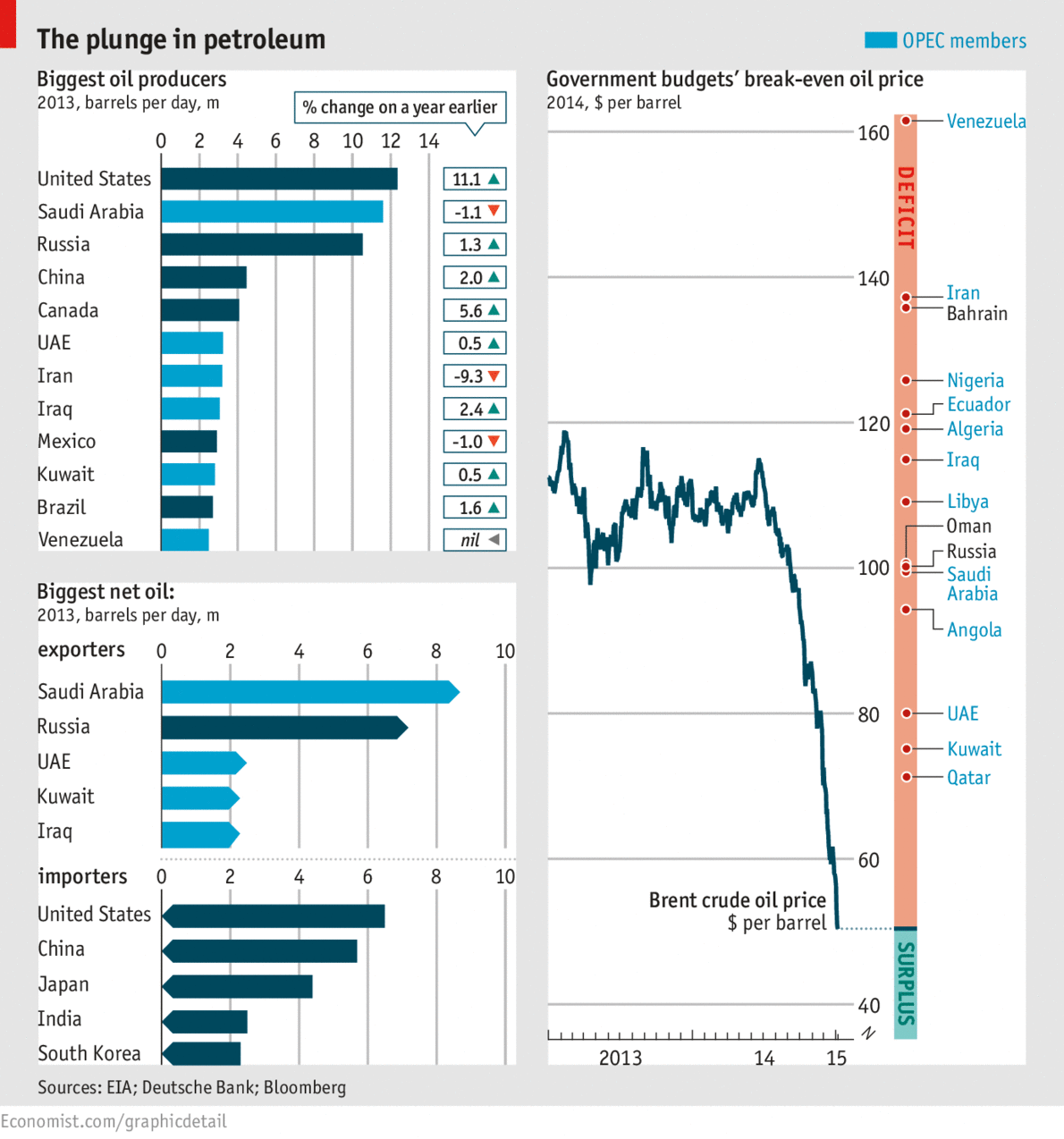

Publication publiéeDeflation grabs the headlines again

Market movers ahead The risk of deflation will again be in focus in the coming week, as inflation figures are scheduled for release in the US, Sweden and Denmark. US inflation in December 2014 looks set to hit a five-year low at 0.8% y/y...

Partager sur les réseaux sociaux · 1

155

Andrius Kulvinskas

Publication publiéeHow Low will Euro Go?

How Low will Euro Go? Investors - Buying Dollars Again GBP - Beware of a Relief Rally CAD: Trade Deficit Balloons, Manufacturing Activity Slows AUD: Supported by Stronger PMI Services...

Partager sur les réseaux sociaux · 1

170

Andrius Kulvinskas

Publication publiéeEUR/USD: watch 1.1900 and 1.1650 next week

The EUR/USD is poised to close the week at its lowest level in almost 10 years, following a tricky US employment report: the headlines had been for the most outstanding, albeit wages ticked lower, anticipating some poor inflation readings for next week...

Partager sur les réseaux sociaux · 1

231

Andrius Kulvinskas

Here's What It's Like In The Most Dangerous City In The World

Read more: http://www.businessinsider.com/san-pedro-sula-is-the-most-violent-city-on-earth-photos-2014-12?op=1#ixzz3OL12J6pL

Read more: http://www.businessinsider.com/san-pedro-sula-is-the-most-violent-city-on-earth-photos-2014-12?op=1#ixzz3OL12J6pL

Andrius Kulvinskas

Publication publiéeUS Nonfarm Payrolls Forecast Jan 09 2015

Outlook in Nonfarm Payrolls remains on the upside as long as 180 K level holds , and further upside towards the 433 K is likely, However ; we have 3 scenarios for today : 1- Any downside move should be contained well by 256 K levels , so any reading within this range , will keep the USD on the up...

Partager sur les réseaux sociaux · 1

190

Andrius Kulvinskas

Publication publiéeSupport & Resistance for NZD/USD

For today R4 - 0.7947 / R3 - 0.7927 / R2 - 0.7872 / R1 - 0.7850 SPOT 0.7823 S1 - 0.7762 / S2 - 0.7714 / S3 - 0.7682 / S4 - 0.7619 LOOK TO SELL WHILE RESISTANCE AT .7849/72 STANDS...

Andrius Kulvinskas

Publication publiéeNFP Prep: Will the Labor Market Build on Last Month's Momentum?

Highlights NFP Prep: Will the Labor Market Build on Last Month’s Momentum? View How Our NFP Forecasts Compare NFP Prep: Will the Labor Market Build on Last Month’s Momentum...

Partager sur les réseaux sociaux · 1

136

Andrius Kulvinskas

Publication publiéeAUDUSD: Why .8145 is the Most Important Level to Watch

The textbook definition of technical analysis is the use of past market data to help determine what future price action will bring. Because markets are driven by mass trader psychology and emotion, the same types of patterns tend to repeat over time...

Partager sur les réseaux sociaux · 1

206

Andrius Kulvinskas

Publication publiéeEUR/USD takes a breather after fresh lows

EUR/USD is taking a breather at the beginning of the New York session, having recovered a few pips after hitting fresh 9-year lows on the back of disappointing Eurozone data. EUR/USD extended losses Thursday and scored a fresh low of 1.1753 before recovering slightly...

Partager sur les réseaux sociaux · 2

173

: