Sergey Golubev / Profil

Newdigital

Sergey Golubev

Sergey Golubev

Commentaire sur le thème Интересное и Юмор

Франко Маттичино (Franco Matticchio) - итальянский иллюстратор

Denis Shestakov

2014.03.24

Жопе)

Sergey Golubev

Sergey Golubev

Commentaire sur le thème Informações e Dicas Relacionadas ao Terminal MetaTrader 5

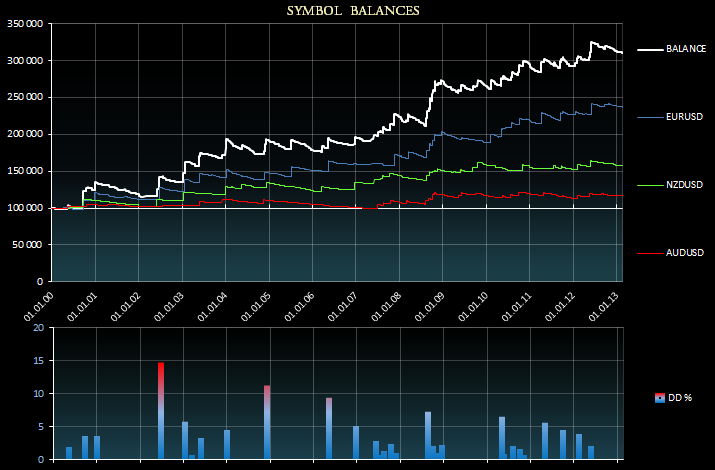

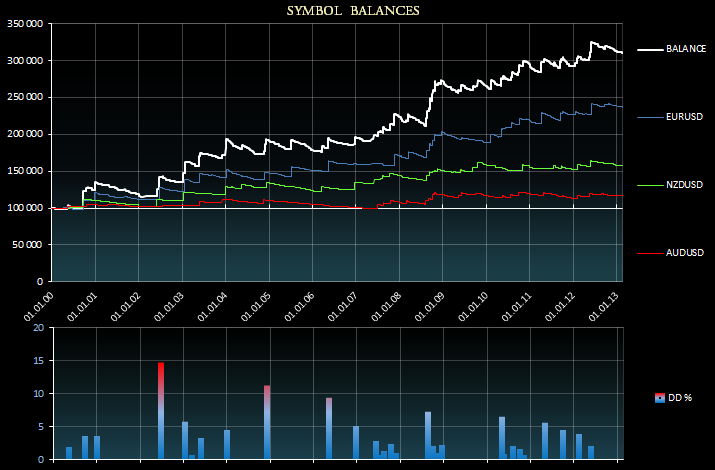

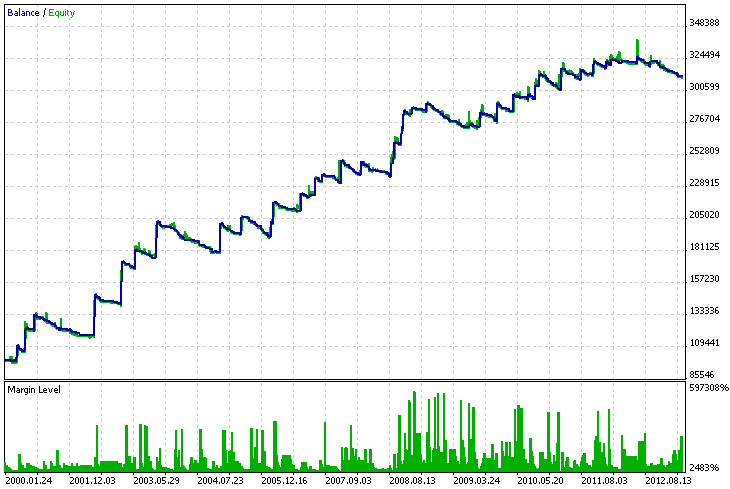

Guia prático do MQL5: Registrando o histórico de negociações em um arquivo e criando gráficos de saldo para cada símbolo no Excel Ao me comunicar em vários fóruns, utilizei frequentemente exemplos de

Sergey Golubev

Sergey Golubev

Commentaire sur le thème Informações e Dicas Relacionadas ao Terminal MetaTrader 5

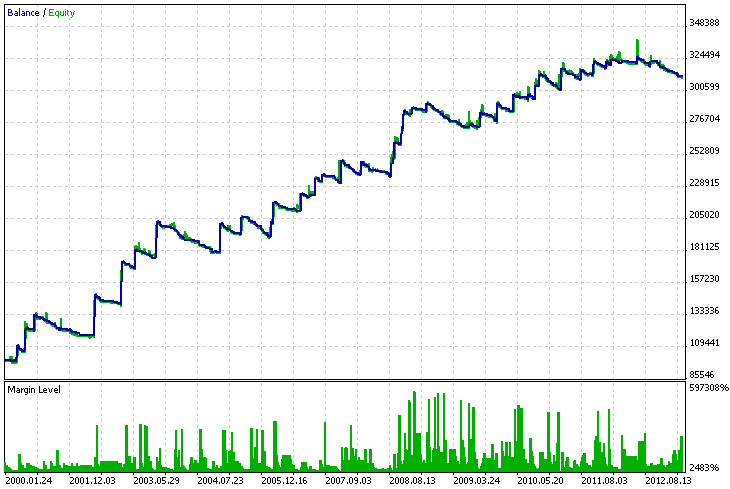

Guia prático do MQL5: Desenvolvendo um Consultor Especialista multi-moeda com um número ilimitado de parâmetros O Consultor Especialista multi-moeda considerado no arquivo anterior "Guia prático do

Sergey Golubev

Sergey Golubev

Commentaire sur le thème How to Start with Metatrader 5

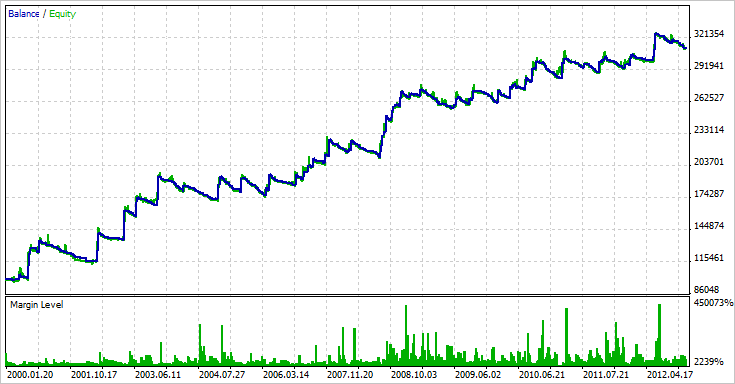

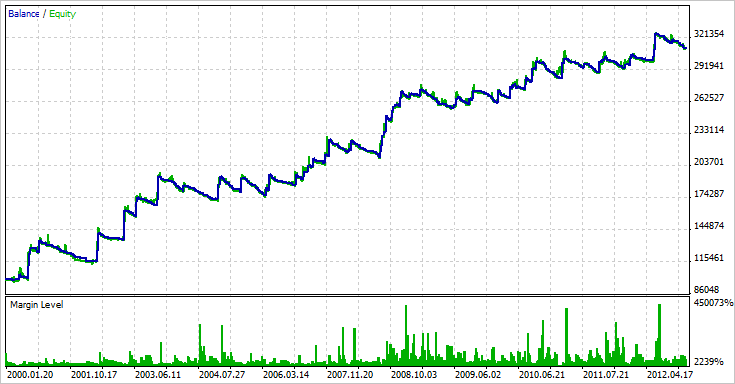

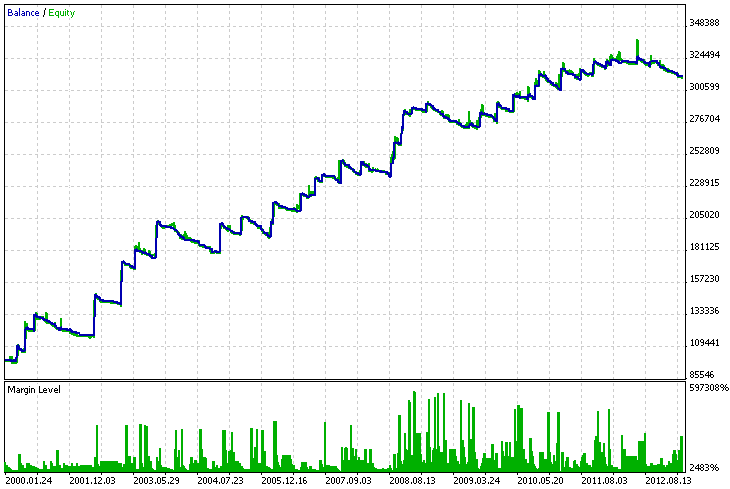

MQL5 Cookbook: Multi-Currency Expert Advisor - Simple, Neat and Quick Approach This article will describe an implementation of a simple approach suitable for a multi-currency Expert Advisor. This

Sergey Golubev

Sergey Golubev

Commentaire sur le thème Informações e Dicas Relacionadas ao Terminal MetaTrader 5

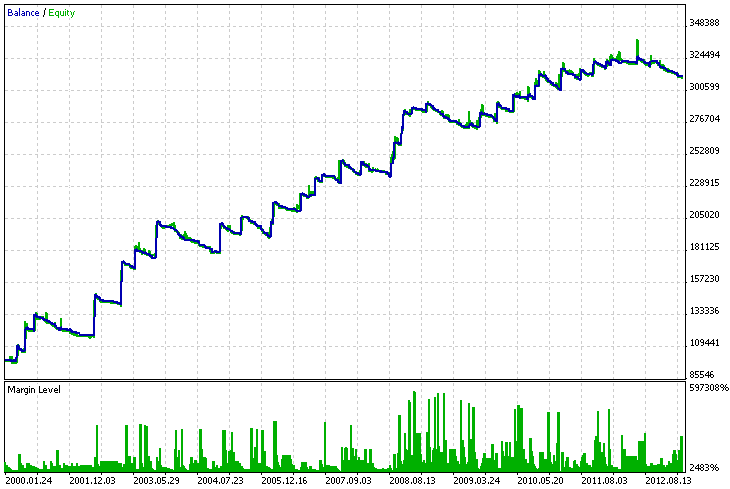

Guia prático do MQL5: Consultor Especialista multi-moeda - Abordagem simples, organizada e rápida" Este artigo descreverá uma implementação de uma abordagem simples, adequada para um Consultor

Sergey Golubev

低于预期的中国3月汇丰制造业PMI公布后,澳元快速回落,铜小幅走高,标普500指数期货上涨

Sergey Golubev

Commentaire sur le thème 报刊评论

低于预期的中国3月汇丰制造业PMI公布后,澳元快速回落,铜小幅走高,标普500指数期货上涨

Sergey Golubev

中金:将中国2014年GDP增速预测从7.6%下调至7.3%; 将2014年CPI和PPI预测从此前的3.1%和0%下调至2.5%和-1.0%

Sergey Golubev

Commentaire sur le thème 报刊评论

中金:将中国2014年GDP增速预测从7.6%下调至7.3%; 将2014年CPI和PPI预测从此前的3.1%和0%下调至2.5%和-1.0%

Sergey Golubev

Choosing a Forex Broker (based on fxempire article)

It might seem like it goes without saying that it is important to do your due diligence before committing to a market broker in any asset class — be it forex, commodities, options or stocks. But what is most surprising is the fact that most traders choose their brokers without giving it much thought because they feel the need to jump right into the markets and start making amazing gains. Those of us with experience in these markets know that there are some important reasons to have patience in these areas because not all forex brokers are created equal. Additionally, the potential for destructive losses in many cases is even greater in forex markets because most traders (especially new traders) will utilize large levels of leverage in order to maximize gains. Unfortunately these practices have the potential to maximize losses as well — so it is highly important to understand the inner workings of your broker before taking on real market risk.

Stops and Execution

When you want to choose a forex broker, the first area to monitor is the broker’s ability to execute trade and honor specific order levels. For example, if you have a stop loss in a EUR/USD trade that is placed at 1.35, it will be critical to have that stop loss filled correctly if prices trade at the 1.35 level. If this does not happen, you can undergo unnecessary losses or even encounter a margin call that you were not prepared to experience. Some brokers offer guaranteed stop losses, while others offer variable stop losses that may or may not be filled (depending on overall market liquidity). This is an important difference that must be understood before any real trades are placed.

If you are not prepared for the arrangement that is offered by your broker, you could begin to experience losses at a rate that is much faster than you were initially expecting. Looking at stop loss arrangements and trading execution is one of the quickest and easiest ways you can determine whether or not a specific broker is right for you. But you will also need to spend some time using that broker’s demo account in order to determine whether or not you are seeing slippage between the order level you were expecting and the one that was actually filled in your trading account.

Spreads

The second important factor to watch is the spread that is offered on your most commonly traded currency pairs. In pairs like the EUR/USD these will usually be somewhere between 1 and 3 pips, but there are brokers that offer even lower rates and this can only help your trading account. One sacrifice that is often made when getting lower spreads is weaker trading execution, so you will need to determine which aspect of the broker arrangement is most important to you before you open a live trading account and begin establishing positions. Spreads, Stop Losses, and Trading execution are a few of the most important factors to consider when choosing your main forex broker.

It might seem like it goes without saying that it is important to do your due diligence before committing to a market broker in any asset class — be it forex, commodities, options or stocks. But what is most surprising is the fact that most traders choose their brokers without giving it much thought because they feel the need to jump right into the markets and start making amazing gains. Those of us with experience in these markets know that there are some important reasons to have patience in these areas because not all forex brokers are created equal. Additionally, the potential for destructive losses in many cases is even greater in forex markets because most traders (especially new traders) will utilize large levels of leverage in order to maximize gains. Unfortunately these practices have the potential to maximize losses as well — so it is highly important to understand the inner workings of your broker before taking on real market risk.

Stops and Execution

When you want to choose a forex broker, the first area to monitor is the broker’s ability to execute trade and honor specific order levels. For example, if you have a stop loss in a EUR/USD trade that is placed at 1.35, it will be critical to have that stop loss filled correctly if prices trade at the 1.35 level. If this does not happen, you can undergo unnecessary losses or even encounter a margin call that you were not prepared to experience. Some brokers offer guaranteed stop losses, while others offer variable stop losses that may or may not be filled (depending on overall market liquidity). This is an important difference that must be understood before any real trades are placed.

If you are not prepared for the arrangement that is offered by your broker, you could begin to experience losses at a rate that is much faster than you were initially expecting. Looking at stop loss arrangements and trading execution is one of the quickest and easiest ways you can determine whether or not a specific broker is right for you. But you will also need to spend some time using that broker’s demo account in order to determine whether or not you are seeing slippage between the order level you were expecting and the one that was actually filled in your trading account.

Spreads

The second important factor to watch is the spread that is offered on your most commonly traded currency pairs. In pairs like the EUR/USD these will usually be somewhere between 1 and 3 pips, but there are brokers that offer even lower rates and this can only help your trading account. One sacrifice that is often made when getting lower spreads is weaker trading execution, so you will need to determine which aspect of the broker arrangement is most important to you before you open a live trading account and begin establishing positions. Spreads, Stop Losses, and Trading execution are a few of the most important factors to consider when choosing your main forex broker.

Sergey Golubev

Sergey Golubev

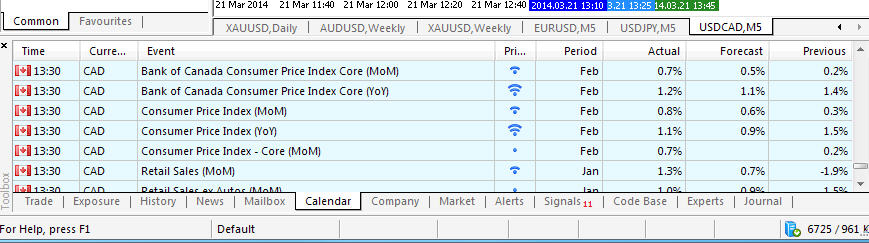

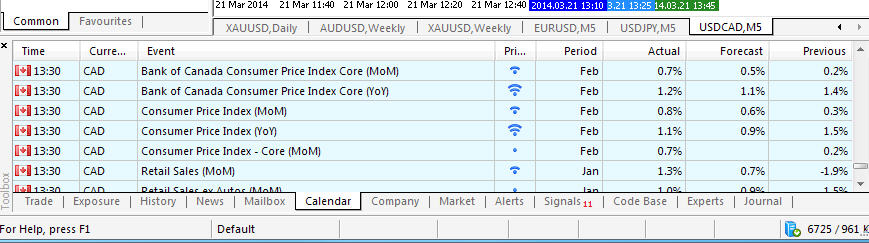

Commentaire sur le thème USDCAD Technical Analysis 16.03 - 23.03: Ranging or Possible Breakout?

USDCAD M5 : 55 pips price movement by CAD - CPI news event

Sergey Golubev

Sergey Golubev

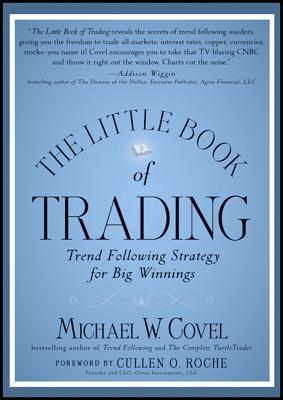

Commentaire sur le thème Something Interesting to Read March 2014

The Little Book Of Trading : Michael W. Covel The last decade has left people terrified of even the safest investment opportunities. This fear is not helping would-be investors who could be making

Sergey Golubev

Sergey Golubev

Commentaire sur le thème 如何开始学习MQL5

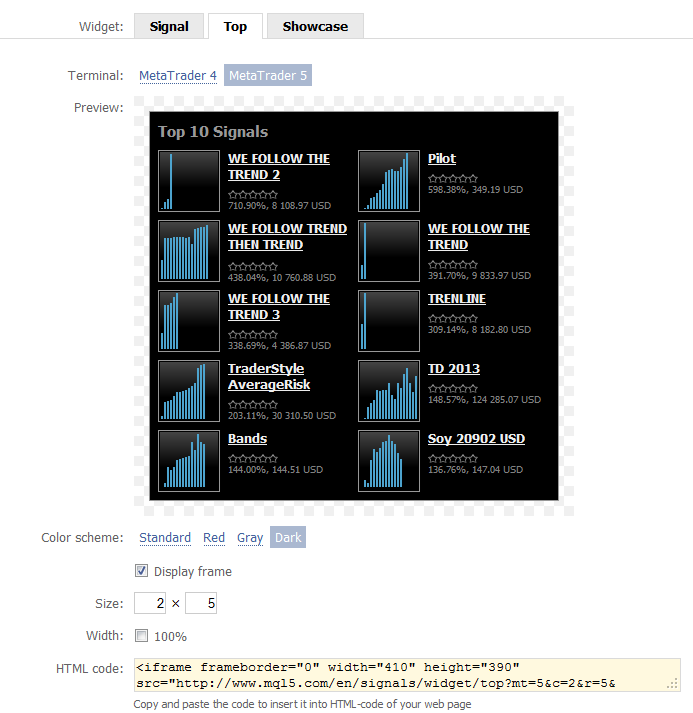

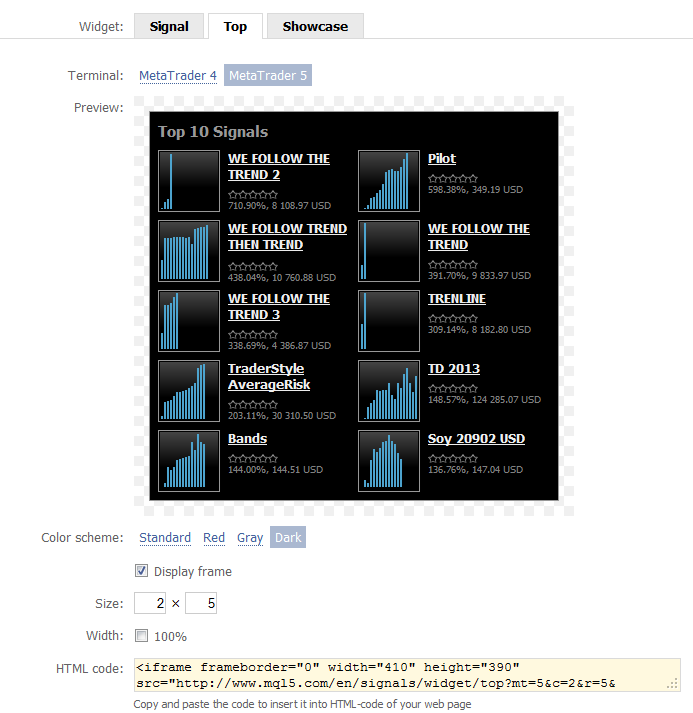

MetaTrader 4 与 MetaTrader 5 交易信号组件 MetaTrader 4 和 MetaTrader 5 用户最近得到了 成为“信号提供者”并赚取更多收益的机会 。现在,您可以利用新组件,在您的网站、博客或社交网络上展示您的成功交易了。

Sergey Golubev

Sergey Golubev

Commentaire sur le thème 如何开始学习MQL5

购买 MQL5 市场产品的安全程度如何? MQL5 市场 是一项服务,专门用于安全购买 MetaTrader 5 应用程序。整个购买过程(从产品在市场中上架到下载至终端)都受到严密的保护。付款后,您立即就能在 MetaTrader 5 终端中使用购得的应用程序。您可以永久使用。

Sergey Golubev

Sergey Golubev

Commentaire sur le thème 如何开始学习MQL5

MetaTrader 5 中的交易信号:PAMM 帐户的更佳选择! 我们很高兴地宣布,MetaTrader 5 现在有了 交易信号 ,从而为投资人员和管理人员带来一款强大的工具。当您追踪成功交易人员的交易时,终端将自动在您的帐户中复制交易! 随着新的功能和选装功能的加入, MetaTrader 5

Sergey Golubev

Sergey Golubev

Commentaire sur le thème Informações e Dicas Relacionadas ao Terminal MetaTrader 5

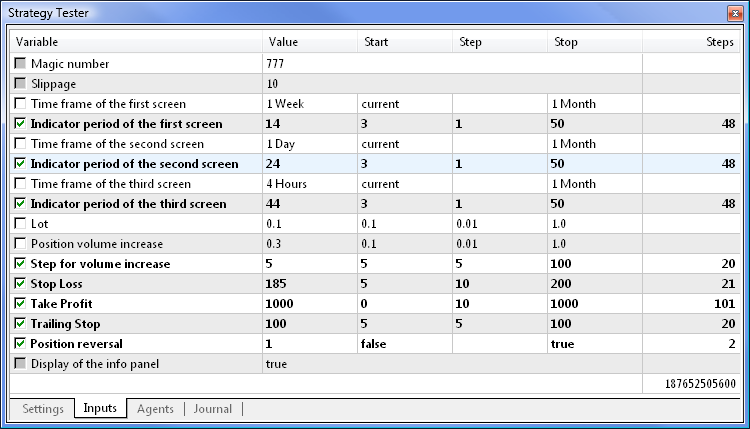

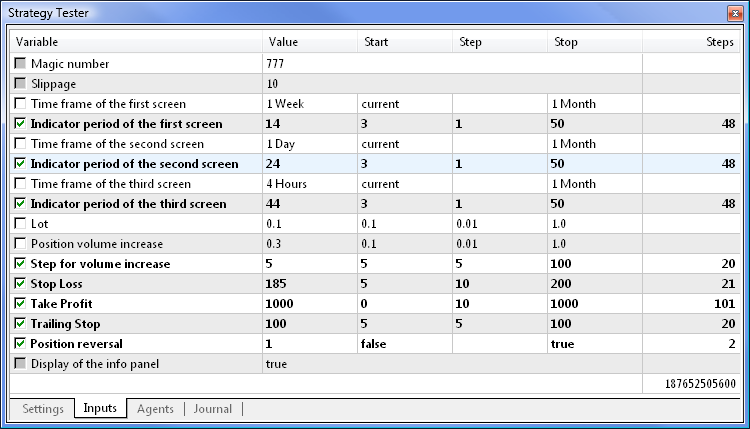

Guia prático do MQL5: Desenvolvendo uma estrutura para um sistema de negócios baseado na estratégia de tela tripla Ao buscar ou desenvolver sistemas de negócios, muitos investidores devem ter ouvido

Sergey Golubev

Sergey Golubev

Commentaire sur le thème Informações e Dicas Relacionadas ao Terminal MetaTrader 5

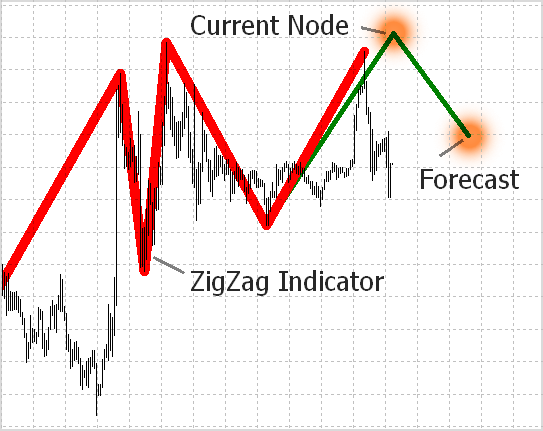

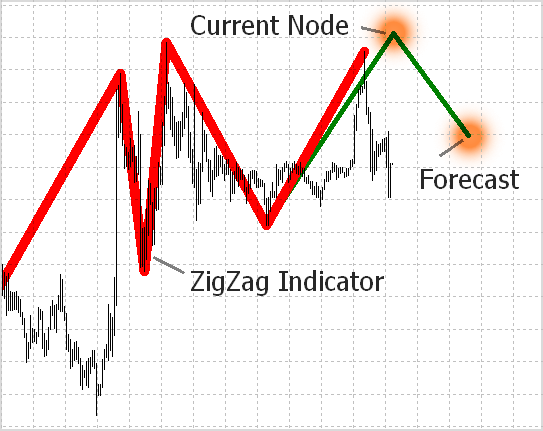

O indicador ZigZag: Nova abordagem e novas soluções Todo investidor conhece certamente o indicador ZigZag destinado à análise dos movimentos de preço de uma dada amplitude ou maior. A linha ZigZag é

Sergey Golubev

Sergey Golubev

Commentaire sur le thème Informações e Dicas Relacionadas ao Terminal MetaTrader 5

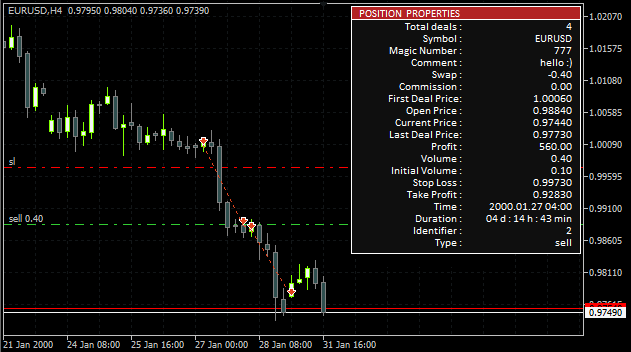

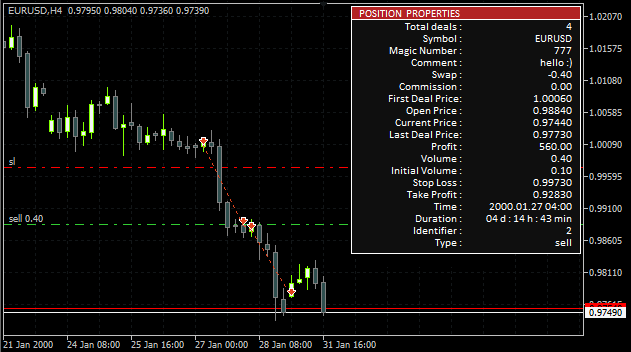

Guia prático do MQL5: O Histórico de transações e a biblioteca de função para obter propriedades de posição É hora de brevemente resumir a informação fornecida nos artigos anteriores sobre as

Sergey Golubev

Sergey Golubev

Commentaire sur le thème Press review

Technicals and Fundamentals for USD/TRY (based on forexminute article ) US Dollar (USD) on Wednesday rose sharply against the Turkish Lira (TRY) after the Federal Reserve’s announcement to reduce the

Sergey Golubev

Sergey Golubev

Commentaire sur le thème 如何开始学习MQL5

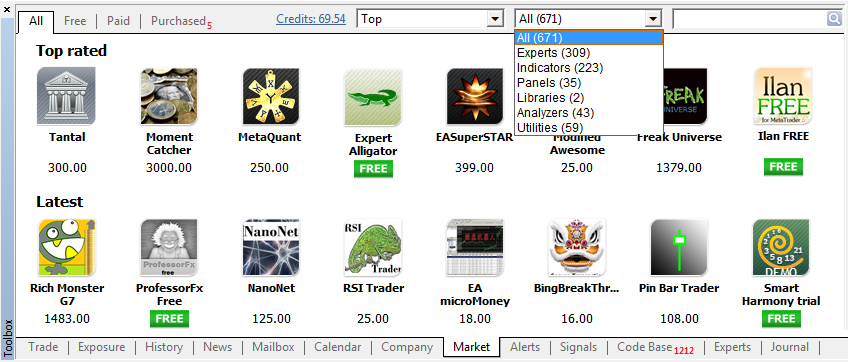

如何在 MetaTrader 应用商店中购买自动交易? 现在,您也可以将自动交易及任何技术指标与 MetaTrader 5 一起使用。您只需要启动 MetaTrader 5 交易端 ,然后打开 Toolbox(工具箱)窗口的 Market(市场)选项卡。

Sergey Golubev

Sergey Golubev

Commentaire sur le thème 如何开始学习MQL5

神经网络:从理论到实践 现在,每一位交易者肯定听说过神经网络并知道使用它们有多酷。大多数人相信那些能够使用神经网络的人是某种超人。在本文中,我将尝试向您解释神经网络架构,描述其应用并提供几个实践例子。

Sergey Golubev

Sergey Golubev

Commentaire sur le thème 如何开始学习MQL5

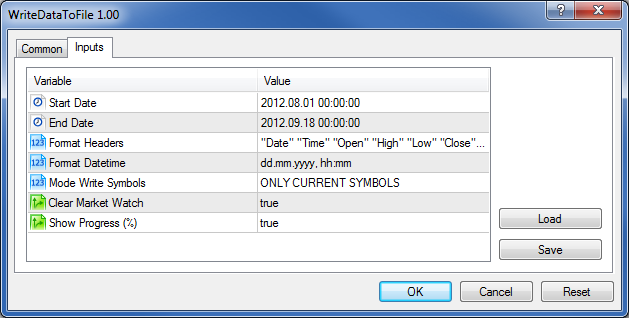

如何准备 MetaTrader 5 报价用于其他应用程序 简介 1. 涵盖主题 2. 数据格式 3. 程序的外部参数 4. 检查用户输入的参数 5. 全局变量 6. 信息面板 7. 应用程序的主体 8. 创建文件夹和归档数据 总结

: