Malheureusement, "Effort and Result JPY" n'est pas disponible

Vous pouvez consulter d'autres produits de Pavel Milicka :

Description by chatGPT:

In the dance of flames, a candle transforms,

From the close of old, a new light is born.

A derivative of candles, changing forms,

Unveiling secrets in the flickering morn.

Like indicators, patterns do precede,

On charts of price, where future paths are sown.

The candle's dance, a signal to take heed,

Foretelling tales in fiery lines shown.

I trust the candlemakers to discern,

Using indicators as their guiding light.

In every flame, a lesson to be learned,

FREE

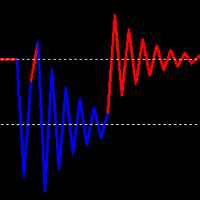

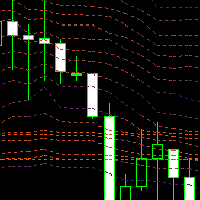

The indicator enables very quick orientation in the market phase (re/accumulation, re/distribution, up/down trend). It is counted only

from price data (without volume).

It is based on the assumptions of Wyckoff's law of Causa and Effect. Oscillations are an expression of the level of market uncertainty and point to the presence of Big Money. Such a "storm" is followed by a calmer trend that needs to be exited. You need to use other tools or shorter period of the same indicator for that.

I kee

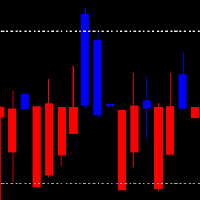

This indicator shows the MACD line and the difference WMACD - MACD to it. that is, the divergence between price and weighted acceleration. Divergence is shown with a histogram. It took a bit of math to get a readable result.

What does the histogram say?

If the course is consistent with the price movement, then the price is driven by volumes. It is passing through an area of higher liquidity, the market is being manipulated by strong money. Within Wyckoff's theory, these are typically climax an

Market Profile, Volume Profile? Extra paid in TradingView, displayed for the last moment in time or discreetly, e.g. after 24 hours. Counting super-accurate values from a histogram...?

None of these ways suited me. I was looking for an expression of the dynamics of the market, its liquidity, I just wanted to clearly see where the money was flowing. I thought I would calculate the volume weighted price percentiles for a certain period.

To make the calculation more accurate, I calculate from a l

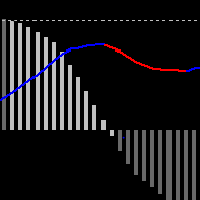

The Fat and Slim indicator tracks strong and weak money in the market. It is derived from RSI, MFI and many similar indicators. Input values are closing prices and volumes. The RSI (yellow curve) is in the range -100 ... 100. It is additionally multiplied by a coefficient so that the curve is not compressed to the middle values at higher periods (a problem with the classic RSI with different periods). Strong/Fat red curve is RSI weighted by higher volumes. Weak/Slim blue curve is calculated so t