Sergey Golubev / Profil

Exchange accepts blame for outage, but says rival NYSE and broader industry structure were also big factors.

Je ne vais pas énumérer toutes les nouvelles possibilités et fonctionnalités du nouveau terminal et du nouveau langage. Elles sont nombreuses, et certaines nouveautés méritent d'être discutées dans un article séparé. De plus, il n'y a aucun code d’écrit avec une programmation orientée objet, c'est un sujet trop sérieux pour être simplement mentionné dans un contexte comme des avantages supplémentaires pour les développeurs. Dans cet article, nous examinerons les indicateurs, leur structure, leur dessin, leurs types et leurs détails de programmation, par rapport à MQL4. J'espère que cet article sera utile aussi bien aux débutants qu'aux développeurs expérimentés, peut-être que certains d'entre eux trouveront quelques éléments d’apprentissage.

MetaTrader 5 nous permet de simuler le trading automatique, au sein d’un testeur de stratégie intégré, en utilisant l’Expert Advisors et le MQL5 language. Ce type de simulation est appelé test d’Expert Advisors, et peut être mis en œuvre en utilisant l’optimisation multithread, ainsi que simultanément sur un certain nombre d’instruments. Afin de fournir un test approfondi, une génération de ticks basée sur l’historique des minutes disponibles doit être effectuée. Cet article fournit une description détaillée de l’algorithme, par lequel les ticks sont générés pour les tests historiques dans le terminal client MetaTrader 5.

"For years now at Alt-Market (and Neithercorp.us) I have carefully outlined the most likely path of collapse to take place within the U.S., and a vital part of that analysis included economic destabilization caused by a loss of the dollar’s world reserve status and petro-status. I have also always made clear that this fiscal crisis event would not occur in the midst of a political vacuum. The central banks and international financiers that created our ongoing and developing disaster are NOT going to allow the destruction of the American economy, the dollar, or global markets without a cover event designed to hide their culpability. They need something big. Something so big that the average citizen is overwhelmed with fear and confusion. A smoke and mirrors magic trick so raw and soul shattering it leaves the very population of the Earth mesmerized and helpless to understand the root of the nightmare before them. The elites need a fabricated Apocalypse".

read more here http://www.shtfplan.com/headline-news/what-to-expect-during-the-next-stage-of-collapse_08292013

星期四, 八月 29 2013, 08:43 GMT

========

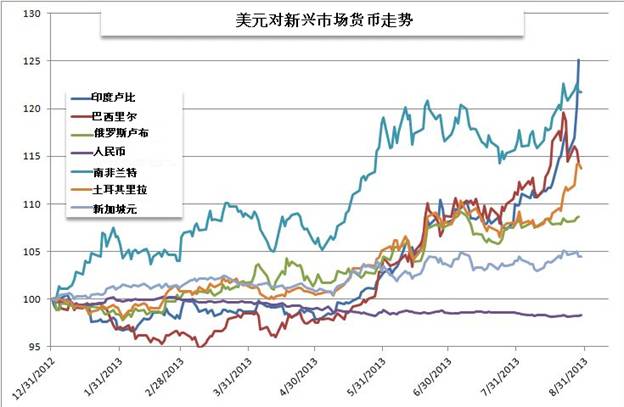

印度央行采取措施後,印度卢比/美元自昨日低点反弹2.5%

澳大利亚二季度私人资本支出年率下降2.3%,季率上涨4%

15:55公布德国8月失业数据

20:30公布美国二季度GDP修正值

==========

“Leverage” in general terms simply means borrowed funds. Leverage is widely used not just to acquire physical assets like real estate or automobiles, but also to trade financial assets such as equities and foreign exchange (“forex”).

Forex trading by retail investors has grown by leaps and bounds in recent years, thanks to the proliferation of online trading platforms and the availability of cheap credit. The use of leverage in trading is often likened to a double-edged sword, since it magnifies gains and losses. This is more so in the case of forex trading, where high degrees of leverage are the norm. The examples in the next section illustrate how leverage magnifies returns for both profitable and unprofitable trades.

Examples of Forex Leverage

Let’s assume that you are an investor based in the U.S. and have an account with an online forex broker. Your broker provides you the maximum leverage permissible in the U.S. on major currency pairs of 50:1, which means that for every dollar you put up, you can trade $50 of a major currency. You put up $5,000 as margin, which is the collateral or equity in your trading account. This implies that you can put on a maximum of $250,000 ($5,000 x 50) in currency trading positions initially. This amount will obviously fluctuate depending on the profits or losses that you generate from trading. (To keep things simple, we ignore commissions, interest and other charges in these examples.)

Example 1: Long USD / Short Euro. Trade amount = EUR 100,000

Assume you initiated the above trade when the exchange rate was EUR 1 = USD 1.3600 (EUR/USD = 1.36), as you are bearish on the European currency and expect it to decline in the near term.

Leverage: Your leverage in this trade is just over 27:1 (USD 136,000 / USD 5,000 = 27.2, to be exact).

Pip Value: Since the euro is quoted to four places after the decimal, each “pip” or basis point move in the euro is equal to 1 / 100th of 1% or 0.01% of the amount traded of the base currency. The value of each pip is expressed in USD, since this is the counter currency or quote currency. In this case, based on the currency amount traded of EUR 100,000, each pip is worth USD 10. (If the amount traded was EUR 1 million versus the USD, each pip would be worth USD 100.)

Stop-loss: As you are testing the waters with regard to forex trading, you set a tight stop-loss of 50 pips on your long USD / short EUR position. This means that if the stop-loss is triggered, your maximum loss is USD 500.

Profit / Loss: Fortunately, you have beginner’s luck and the euro falls to a level of EUR 1 = USD 1.3400 within a couple of days after you initiated the trade. You close out the position for a profit of 200 pips (1.3600 – 1.3400), which translates to USD 2,000 (200 pips x USD 10 per pip).

Forex Math: In conventional terms, you sold short EUR 100,000 and received USD 136,000 in your opening trade. When you closed the trade, you bought back the euros you had shorted at a cheaper rate of 1.3400, paying USD 134,000 for EUR 100,000. The difference of USD 2,000 represents your gross profit.

Effect of Leverage: By using leverage, you were able to generate a 40% return on your initial investment of USD 5,000. What if you had only traded the USD 5,000 without using any leverage? In that case, you would only have shorted the euro equivalent of USD 5,000 or EUR 3,676.47 (USD 5,000 / 1.3600). The significantly smaller amount of this transaction means that each pip is only worth USD 0.36764. Closing the short euro position at 1.3400 would have therefore resulted in a gross profit of USD 73.53 (200 pips x USD 0.36764 per pip). Using leverage thus magnified your returns by exactly 27.2 times (USD 2,000 / USD 73.53), or the amount of leverage used in the trade.

Example 2: Short USD / Long Japanese Yen. Trade amount = USD 200,000

The 40% gain on your first leveraged forex trade has made you eager to do some more trading. You turn your attention to the Japanese yen (JPY), which is trading at 85 to the USD (USD/JPY = 85). You expect the yen to strengthen versus the USD, so you initiate a short USD / long yen position in the amount of USD 200,000. The success of your first trade has made you willing to trade a larger amount, since you now have USD 7,000 as margin in your account. While this is substantially larger than your first trade, you take comfort from the fact that you are still well within the maximum amount you could trade (based on 50:1 leverage) of USD 350,000.

Leverage: Your leverage ratio for this trade is 28.57 (USD 200,000 / USD 7,000).

Pip Value: The yen is quoted to two places after the decimal, so each pip in this trade is worth 1% of the base currency amount expressed in the quote currency, or 2,000 yen.

Stop-loss: You set a stop-loss on this trade at a level of JPY 87 to the USD, since the yen is quite volatile and you do not want your position to be stopped out by random noise.

Remember, you are long yen and short USD, so you ideally want the yen to appreciate versus the USD, which means that you could close out your short USD position with fewer yen and pocket the difference. But if your stop-loss is triggered, your loss would be substantial: 200 pips x 2,000 yen per pip = JPY 400,000 / 87 = USD 4,597.70.

Profit / Loss: Unfortunately, reports of a new stimulus package unveiled by the Japanese government leads to a swift weakening of the yen, and your stop-loss is triggered a day after you put on the long JPY trade. Your loss in this case is USD 4,597.70 as explained earlier.

Forex Math: In conventional terms, the math looks like this:

Opening position: Short USD 200,000 @ USD 1 = JPY 85, i.e. + JPY 17 million

Closing position: Triggering of stop-loss results in USD 200,000 short position covered @ USD 1 = JPY 87, i.e. – JPY 17.4 million

The difference of JPY 400,000 is your net loss, which at an exchange rate of 87, works out to USD 4,597.70.

Effect of Leverage: In this instance, using leverage magnified your loss, which amounts to about 65.7% of your total margin of USD 7,000. What if you had only shorted USD 7,000 versus the yen (@ USD1 = JPY 85) without using any leverage? The smaller amount of this transaction means that each pip is only worth JPY 70. The stop-loss triggered at 87 would have resulted in a loss of JPY 14,000 (200 pips x JPY 70 per pip). Using leverage thus magnified your loss by exactly 28.57 times (JPY 400,000 / JPY 14,000), or the amount of leverage used in the trade.

Tips When Using Leverage

While the prospect of generating big profits without putting down too much of your own money may be a tempting one, always keep in mind that an excessively high degree of leverage could result in you losing your shirt and much more. A few safety precautions used by professional traders may help mitigate the inherent risks of leveraged forex trading:

Cap Your Losses: If you hope to take big profits someday, you must first learn how to keep your losses small. Cap your losses to within manageable limits before they get out of hand and drastically erode your equity.

Use Strategic Stops: Strategic stops are of utmost importance in the around-the-clock forex market, where you can go to bed and wake up the next day to discover that your position has been adversely affected by a move of a couple hundred pips. Stops can be used not just to ensure that losses are capped, but also to protect profits.

Don’t Get In Over Your Head: Do not try to get out from a losing position by doubling down or averaging down on it. The biggest trading losses have occurred because a rogue trader stuck to his guns and kept adding to a losing position until it became so large, it had to be unwound at a catastrophic loss. The trader’s view may eventually have been right, but it was generally too late to redeem the situation. It's far better to cut your losses and keep your account alive to trade another day, than to be left hoping for an unlikely miracle that will reverse a huge loss.

Use Leverage Appropriate to Your Comfort Level: Using 50:1 leverage means that a 2% adverse move could wipe out all your equity or margin. If you are a relatively cautious investor or trader, use a lower level of leverage that you are comfortable with, perhaps 5:1 or 10:1.

Conclusion

While the high degree of leverage inherent in forex trading magnifies returns and risks, using a few safety precautions used by professional traders may help mitigate these risks.

The euro slipped lower against the dollar on Wednesday as escalating geopolitical tensions between the U.S. and Syria continued to underpin demand for safe haven assets.

EUR/USD hit 1.3374 during late Asian trade, the session low; the pair subsequently consolidated at 1.3377, slipping 0.12%.

The pair was likely to find support at 1.3321, Tuesday’s low and resistance at 1.3426, the high of August 21.

Market sentiment was hit by growing expectations for U.S. military strikes against Syria’s government. U.S. Vice-President Joe Biden said Tuesday there is "no doubt" that the Syrian government used chemical weapons against civilians and added that it must be held accountable.

The dollar also found support as concerns over the timing of a reduction in Federal Reserve stimulus eased after data on Tuesday showed that U.S. consumer confidence rose more than expected in August, hitting the highest level since January 2008.

The Conference Board said its index of consumer confidence rose to 81.5 in August from an upwardly revised 81.0 in July. Analysts had expected the index to tick down to 79.0.

Elsewhere, the euro was slightly higher against the pound and the yen, with EUR/GBP easing up 0.12% to 0.8625 and EUR/JPY climbing 0.16% to 130.15.

The U.S. was to release data on pending home sales later Wednesday.

With today’s fast paced trading options, choosing the best Forex robot has taken on a major role in Forex trading. The use of a Forex robot is basically one of the methods employed by a trader to buy or sell on the Forex spot market. It is often referred to as ‘autotrading.’ Although autotrading was originally used on the Chicago Mercantile Exchange as far back the 1970’s, it emerged big time with the advent of the internet in 1999. Today, most online brokerages offer Forex robots.

There continues to be a debate, however, as to which is a more beneficial manner for placing Forex trades—using autotrading or employing the service of a human trader. Obviously, an automated trading situation can accommodate more trades per market than any human can cope with. Additionally, with autotrading, trades are placed in real time and a trader can replicate these actions across several timeframes and on more than one market. What’s more, robots are not subject to the emotional ups and downs of human traders.

On the other hand, even the best Forex robot can be subject to scams and frauds. Traders do not always understand how the system works and this leaves them vulnerable to all sorts of broker rip-offs. It can lead not only to traders placing inappropriate trades but can result also in shrewd brokers closing up shop and absconding with clients’ funds. In addition, robots are not easy to set up and choices for customized trading strategies can be complicated for novice traders. If not fully understood, trading activity can go unmonitored and consequently lead to losses.

The Best Forex Robots

Choosing the best Forex robot is not always an easy task. There are hundreds of online brokers with each one touting to offer the best Forex robot software, the most outstanding platforms and the finest technical analysts. The most advantageous way to reach a decision is to speak to people who have used Forex robots for a while. Referrals from experienced traders go a long way in weeding out brokers who do not abide by industry regulation or who are not bona fide Forex brokers. Ongoing Forex traders are also privy to information concerning brokers who have not performed in the manner they promised or are rumored to have conducted business in an unacceptable manner. After all, the robot is only as good as the brokerage offering it.

Likewise, there are literally hundreds of Forex robots that are offered not by brokers, but by individual traders looking to make a quick buck. While some of them may be profitable, there’s a higher chance with these robots that losses may occur. Make sure to verify the robot’s success before registering, and if possible, see if the company is registered or regulated anywhere. If these things aren’t available but the Forex robot still seems interesting, try asking for references or seeing if the company offers reliable testimonials. Without some sort of validating feature, your service of interest may not actually be the best Forex robot available.

XAU/USD overcame more important resistance last week. The latest key level to give way was the 6th square root progression of the year’s low in the 1385 area. The weekly close over this level is potentially important and is further evidence that a more significant uptrend is in the making. Looking further out, the June high near 1424 is the next resistance point of note ahead of the all-important 161.8% projection of the July advance in the 1440 area. We doubt the metal will be able to test this resistance without backfilling, however, as we see cyclical headwinds getting stronger around the second half of the week.

read more here http://www.dailyfx.com/forex/technical/article/forex_strategy_corner/2013/08/26/PT_Gold_breaks.html