You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

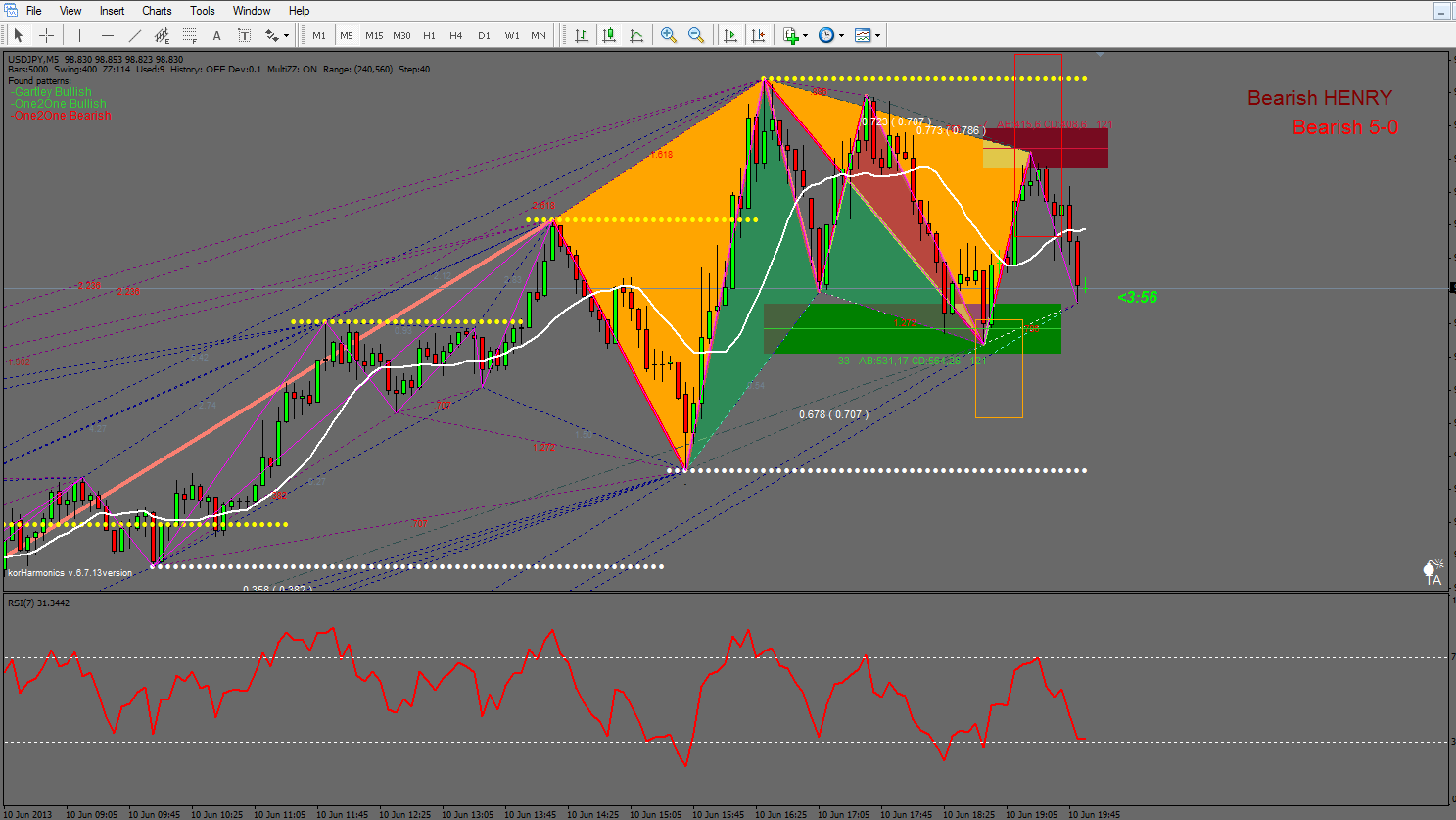

USDJPY M5. As for scalping, look what happened.

In scalping, how do you set the SL?! Any reference point you would use ?!

Bro, I don't know yet. I haven't had a scalpting plan yet. But it would be 10-15pips for SL and 10-30pips for TP. When to enter? With korhamonics 121, when it appears. If there's a pattern like small butterfly or anything, draw fib. With NEXT pattern, use parallel lines. That's what I would do. It could've done that on USDJPY M5.

Here is my version.... ^^

EURUSD and USDCAD M5.

In scalping, how do you set the SL?! Any reference point you would use ?!

In scalping, how do you set the SL?! Any reference point you would use ?!

First of all you must know that scalping is the most difficult way of trading , your emotions can easily get involved so if you don't have enough experince in trading you should stick to large time frames, to scalp in the safest way possible your SL should be 1-2 pips above /below the high of the candle that gave you the signal

your TP should be the closest swing to current price it MUST be minimum of twice the amount of risk , if the swing is too close that it doesnt = 2*SL then its not worth trading .

If the price is heading to your SL never ever adjust it and hope for price to reverse , the only moment you should adjust SL is when you are a few pips in profit should the price go back to BE you should close the trade , the BE trade is as good as a winning trade sometimes .

one more thing to keep in mind is scalping with the direction of big frames can actually generate huge profits , i sometimes use 5-15M timeframe to enter with a very tight stop lose on a signal i see on 4H or daily charts , sometimes you risk 15 pips for 200 pips and it works sometimes .

see the attached picture , a scalp i did as i am writing this , see where i bought and where i took profit , 10 pips for 20 pips TP hit

here is the screenshot ( 100+ pips already from the close of the last daily candle )

here is the indicator ex4 and mq4

please consider looking into their 121 patterns as i find them most profitableThanks mike. 121 pattern will be added in the next version.

Very nice opportunity was on USDCAD M15.

Thanks mike. 121 pattern will be added in the next version.

thanks bro , i have a little question here ,zigzag lines are based on HIGH and LOW so the close and open should not matter right ? i see a pattern of AB=CD on EUR/USD daily on AxiTrader metatrader however i can't see it on FXCM even though the settings are the same on zup113wsv57 .

First of all you must know that scalping is the most difficult way of trading , your emotions can easily get involved so if you don't have enough experince in trading you should stick to large time frames, to scalp in the safest way possible your SL should be 1-2 pips above /below the high of the candle that gave you the signal

your TP should be the closest swing to current price it MUST be minimum of twice the amount of risk , if the swing is too close that it doesnt = 2*SL then its not worth trading .

If the price is heading to your SL never ever adjust it and hope for price to reverse , the only moment you should adjust SL is when you are a few pips in profit should the price go back to BE you should close the trade , the BE trade is as good as a winning trade sometimes .

one more thing to keep in mind is scalping with the direction of big frames can actually generate huge profits , i sometimes use 5-15M timeframe to enter with a very tight stop lose on a signal i see on 4H or daily charts , sometimes you risk 15 pips for 200 pips and it works sometimes .

see the attached picture , a scalp i did as i am writing this , see where i bought and where i took profit , 10 pips for 20 pips TP hitThanks a lot !!

First of all you must know that scalping is the most difficult way of trading , your emotions can easily get involved so if you don't have enough experince in trading you should stick to large time frames, to scalp in the safest way possible your SL should be 1-2 pips above /below the high of the candle that gave you the signal

your TP should be the closest swing to current price it MUST be minimum of twice the amount of risk , if the swing is too close that it doesnt = 2*SL then its not worth trading .

If the price is heading to your SL never ever adjust it and hope for price to reverse , the only moment you should adjust SL is when you are a few pips in profit should the price go back to BE you should close the trade , the BE trade is as good as a winning trade sometimes .

one more thing to keep in mind is scalping with the direction of big frames can actually generate huge profits , i sometimes use 5-15M timeframe to enter with a very tight stop lose on a signal i see on 4H or daily charts , sometimes you risk 15 pips for 200 pips and it works sometimes .

see the attached picture , a scalp i did as i am writing this , see where i bought and where i took profit , 10 pips for 20 pips TP hitThanks for your sharing !!

Would you use another indicators or methods to confirm the Harmonic Signal ?!

As there are so many patterns signal, which one is your favor to trade ?!