You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

AUDIO - Trading Currencies with Merlin Rothfeld (based on fxstreet article)

Alone in studio, Merlin looks to answer several listener questions covering a wide variety of currencies and commodities. Merlin focuses on the Euro, and offers some insights as to what to expect from the ECB press conference on Thursday. He also looks at gold and the potential to jump on the momentum.

Daily Forex Market Update: NZD/USD Signaling Long (based on forexmagnates article)

Early trading saw the Euro, Pound, Kiwi and Dollar indexes all sell off. The Aussie and Swiss remain relatively flat. From a macro perspective I still like the Kiwi for a cyclical move higher. The Aussie, Euro, Pound and Dollar are also signaling cyclical moves higher but their price action is much more neutral which impacts the risk profile. I’d prefer to see them at a more substantial support level than they are right now.

PRE-TRADE ANALYSIS

The Pre-Trade Matrix has 14 regression signals, seven of those have cyclical support, only the NZD/USD isn’t displaying counter momentum as we head into the US Session. That pair is currently signaling long.

TRADE RECAP

The GBP/JPY and the NZD/CAD were closed in the Asian session for a loss of just over half a percent. The NZD never really went anywhere but the Pound did retrace and eventually came to an adjusted support zone, which, by that time, was into negative territory. This morning I’ve entered the long NZD/USD and will let this grind a while and evaluate again this evening.

if actual > forecast (or actual data) = good for currency (for GBP in our case)

[NZD - Performance of Manufacturing Index] = Level of a diffusion index based on surveyed manufacturers. Survey of manufacturers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories.

==========

"The seasonally adjusted PMI for December was 57.7(a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 2.1 points higher than November, and a positive end to the year for the sector."

BNZ senior economist Doug Steel said, "The PMI results for manufacturing are consistent with broader indicators showing that the economy is in good heart. There is a lot to like with activity expanding at a solid clip with no inflation."

Kiwi To Fall In Line? (based on dailyfx article)

The NZD/USD daily chart is beginning to look interesting again. Over the past few months while other developed market currencies have been in a virtual free fall against the Greenback, NZD/USD has held its own and traded in a fairly well defined range. With the exchange rate testing the bottom end of the range today we can’t help but wonder if the Bird is about to fall in line with the rest of the currency world? We say this mostly because of the sentiment picture. This outperformance by the Kiwi over the past few months has seen sentiment towards NZD rise well above 50% bulls on the DSI when most other currencies are sporting bullish sentiment levels closer to 10%. In our view this neutral sentiment profile makes the Kiwi much more vulnerable to a decent move lower if the range lows break as there will be plenty of “fuel” for the decline. The .7607 December low looks key with weakness below needed to trigger this negative scenario.

Trading the News: European Central Bank (ECB) Interest Rate Decision (based on dailyfx article)

EUR/USD may face fresh monthly lows over the next 24-hours of trade as the European Central Bank (ECB) is widely expected to announce more non-standard measures to further mitigate the risk for deflation.

What’s Expected:

Why Is This Event Important:

Despite headlines for a EUR 50B/month asset-purchase program, the details surrounding the new initiative may play a greater role in driving EUR/USD especially as the Governing Council struggles to achieve its one and only mandate for price stability.

However, the ECB may provide limited details and make an attempt to buy more time as President Mario Draghi struggles to produce a unanimous vote within the Governing Council, and we may see a more meaningful rebound in EUR/USD should the central bank disappoint.

How To Trade This Event Risk

Bearish EUR Trade: ECB Unveils Open-Ended QE Program

- Need red, five-minute candle following the policy announcement to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Attempts to Buy More Time- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

Potential Price Targets For The ReleaseEURUSD Daily

- Despite the string of closing prices above the 1.1500

handle, downside targets remain favored for EUR/USD as the RSI retains

the bearish momentum and holds in oversold territory.

- Interim Resistance: 1.1720 (23.6% retracement) to 1.1740 (161.8% expansion)

- Interim Support: 1.1458 (January low) to 1.1500 pivot

Impact that the ECB rate decision has had on EUR/USD during the last meeting(1 Hour post event )

(End of Day post event)

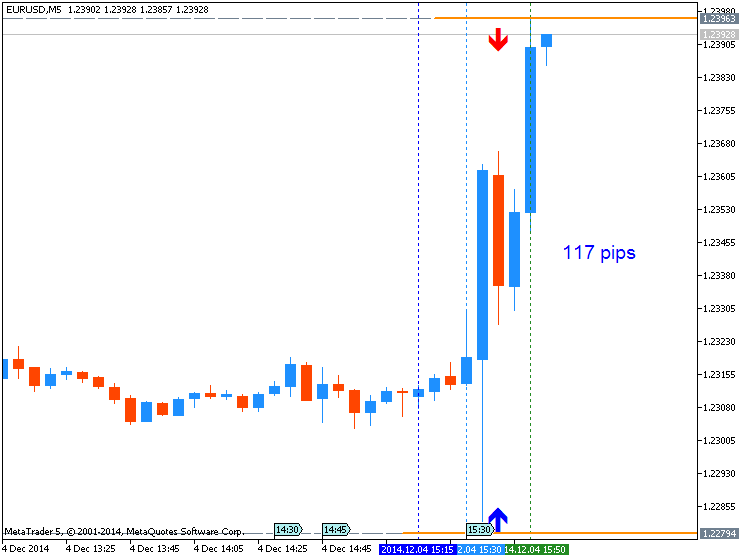

EURUSD M5: 117 pips range price movement by EUR - ECB Press Conference news event

As expected, the European Central Bank (ECB) kept the benchmark rate at the record low of 0.05%, but announced it would consider a broad-based asset purchase program which could including sovereign debt next month in order to achieve a EUR 1T expansion in its balance sheet. At the same time, the ECB also lowered its economic outlook of the euro-area, with the central bank lowering its 2014/2015 forecasts for growth and inflation. Despite the dovish remarks, the Euro strengthened after the statement as the ECB further delays the QE program, with EUR/USD closing the day at 1.2376.MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.01.22

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 62 pips price movement by EUR - Interest Rate news event

Daring Draghi's Massive Stimulus Beats Expectations (based on rttnews article)

European Central Bank President Mario Draghi unleashed a massive quantitative easing programme on Thursday, the size of which exceeded market expectations, determined to combat the threat of deflation and revive the euro area economy.

The widely expected quantitative easing measure was described by Draghi as "an expanded asset purchase programme". Under the plan, the combined monthly purchases of public and private sector securities will amount to EUR 60 billion ($70 billion), he said.

In response to the ECB announcement, the euro weakened and the Euro Stoxx strengthened to fresh 7-year highs. Earlier today, the bank left its interest rates unchanged for the fourth straight month.

The main refi rate was kept at a record low 0.05 percent and the deposit rate at -0.20 percent. The marginal lending rate was retained at 0.30 percent.

The size of monthly asset purchases exceeded the EUR 50 billion reported in the press since Wednesday. With the latest decision, Draghi has crossed the Rubicon to join ECB's peers US Federal Reserve and Bank of Japan who took the QE route long back.

Previously, Draghi revealed his daring by entering the uncharted territory of negative interest rates last June in his mission to defend the ECB's price stability target.

His resolve must have been strengthened by last week's EU court backing for ECB's earlier bond-buying programme known as the Outright Monetary Transactions. That said, the German opposition to stimulus, especially ECB purchases of state debt, remains.

Adding pressure, Eurozone inflation turned negative in December for the first time in more than five years in December with consumer prices falling 0.2 percent. Falling oil prices are set to make the picture murkier. High unemployment is another grave concern.

The asset purchases are intended to be carried out until end-September 2016. They will remain in place until there is "a sustained adjustment in the path of inflation which is consistent with" the ECB's aim of achieving inflation rates below, but close to, 2 percent over the medium term, Draghi said in his customary post-decision press conference in Frankfurt.

"In March 2015 the Eurosystem will start to purchase euro-denominated investment-grade securities issued by euro area governments and agencies and European institutions in the secondary market," he added.

Video: ECB Move Drives EURUSD to 11-Year Low, EURJPY On the Edge (based on dailyfx article)

The monetary policy ranks provided the markets another large injection with the news that the ECB was following its largest counterparts down the path of QE. The response for the Euro was decisive as EURUSD marked its worst daily tumble in over three years on the way to the lowest exchange rate since 2003. This pair will be particularly important to monitor moving forward as we gauge the net influence of stimulus as well as its relative effectiveness. With EURUSD, we now pair the most accommodative central bank (ECB) pitted against the most hawkish (Fed). Will the European authority be effective - even through the upcoming Greek election? Will the FOMC maintain its drive towards a mid-2015 hike next week? Meanwhile, the net impact of global stimulus on speculator interest may be better reflected in a pair like EURJPY. With new stimulus upgrade and a high-level sensitivity to risk trends, a 135 break can signal a broader tide change. We talk big themes, upcoming event risk and well-placed currency pairs in today's Trade Video.

Trading the News: Canada Consumer Price Index (CPI) (based on dailyfx article)

A slowdown in Canada’s Consumer Price Index (CPI) may spur fresh monthly highs in USD/CAD especially as the Bank of Canada (BoC) reverts back to its easing cycle.

What’s Expected:

Why Is This Event Important:

After unexpectedly cutting the benchmark interest rate at the January 21 meeting, a marked slowdown in Canada price growth may put increased pressure on the BoC to further reduce borrowing costs, and the Canadian dollar remains at risk of facing more headwinds over the near to medium-term as Governor Stephen Poloz keeps the door open to implement additional monetary support.

Nevertheless, the pickup in economic activity may generate a stronger-than-expected CPI print, and an uptick in the core rate of inflation may spur a near-term correction in USD/CAD as the stickiness limits the BoC’s scope to further reduce the benchmark interest rate.

How To Trade This Event Risk

Bearish CAD Trade: Weak CPI Print Drags on Interest Rate Expectations

- Need green, five-minute candle following a dismal CPI report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish CAD Trade: Sticky Core Inflation Dampens Bets for Another Rate Cut- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

Potential Price Targets For The ReleaseUSD/CAD Daily

- Bullish RSI structure continues to favor the approach

to buy-dips in USD/CAD especially as the oscillator pushes deeper into

overbought territory.

- Interim Resistance: 1.2390 (161.8% expansion) to 1.2430 (1.618% expansion)

- Interim Support: 1.1990 (78.6% expansion) to 1.2000 pivot

Impact that the Canada CPI report has had on CAD during the last month(1 Hour post event )

(End of Day post event)

2014

November 2014 Canada Consumer Price Index (CPI)

USDCAD M5: 28 pips price movement by CAD - CPI news event

Canada’s Consumer Price Index (CPI) slowed to an annualized rate of 2.0% in November from 2.4% the month prior, while the core rate of inflation slipped to 2.1% from 2.3% during the same period. Indeed, falling energy prices attributed to a 1.7% decline in transportation costs, but we may see Canadian firms continue to offer discounted prices in an effort to draw greater demand. As a result, the Bank of Canada (BoC) may further delay normalizing monetary policy, and Governor Stephen Poloz may continue to endorse the accommodative policy stance over the near to medium-term in order to encourage a stronger recovery. The market reaction was short-lived as USD/CAD quickly slipped back below the 1.1625 region, and the pair continued to consolidate throughout the North American trade as it ended the day at 1.1602.

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2015.01.23

MetaQuotes Software Corp., MetaTrader 5

USDCAD M5: 51 pips price movement by CAD - CPI news event

NZD/USD Technical Analysis: Selloff Extends for Fifth Day (adapted from dailyfx article)

The New Zealand Dollar fell against its US namesake as expected, with prices now hitting levels unseen since May 2012. A daily close below the 38.2% Fibonacci expansion at 0.7420 exposes the 38.2% level at 0.7275. Alternatively, a move above channel floor support-turned-resistance at 0.7529 opens the door for a challenge of the 23.6% Fib at 0.7599.

US Dollar Fundamentals (based on dailyfx article)

Fundamental Forecast for Dollar: Bullish

In the past few weeks, we have seen a nearly universal dovish shift in global monetary policy. The ECB, BoE, BoJ, BoC and other central banks have offered up either actions or commentary that is tangiably more accommodative in its policy slant. This is reaction to cooler global growth winds, stagnant inflation pressures and perhaps even in response to an unofficial currency war. Yet, through this broad effort to head off economic trouble and financial crisis, there is one policy body standing firmly on the opposite end of the spectrum: the Fed. Can the US central bank continue to carve such a divergent path? And, what does this mean for the Dollar and capital markets?

When the scope of a market is international – as the FX market is – capital flows are driven by relative demand along national borders. The relative appeal of the US market and Dollar has grown exceptional over the past six months. Taking the temperature of the developed and emerging world’s health, we have seen economic forecasts – recently refreshed by the IMF’s WEO – downgraded. Meanwhile, the US was one of the few that continues to win upgrades. That bodes well for investor returns when market participants are still vying for higher yield even as confidence wavers.

A direct measure of returns itself, monetary policy is also leaning heavily in the Dollar’s favor. Working off the Fed’s remarks that a move towards normalization was justify as recently as the last FOMC minutes, there is a hawkish (if moderate) intention from the US authority. This represents a particularly dramatic contrast in the global scales following the introduction of a new, large-scale stimulus program from the ECB this past week. But it isn’t just the ECB that is on a sharply divergent path. The BoJ is maintining its own QQE program (recently upgraded in October), the BoE minutes showed hawks quieted their voice at the last meeting, the BoC surprised with a rate cut, the SNB failed to hold its EURCHF floor, and the RBA tipped back from neutral to dovish rhetoric.

The question that should be on traders’ minds this week is whether or not the Fed can maintain its push towards the eventual rate hike when the rest of the world is reverting to accommodation. Given a rise swell of cross-asset volatility these past months, the ECB’s dramatic moves and semi-regular shocks in the headlines; it would seem that a softening of stance would be likely. However, many of these issues were already in play or expected during the last meeting when the Fed gave its optimistic remarks. In the US, conditions continue to show considerable improvement (even if it is slow) without financial shocks that instigated the unorthodox policy in the first place. What’s more, there is an opportunity one of the primary players in the global central bank community to make a move to normalize under relatively steady conditions with a backdrop where other major participants are readily offsetting the possible negative rammifications.

When the Fed meets on Wednesday, the primary question is whether the group maintains its tone to fuel speculation of a ‘mid-2015’ rate hike. That doesn’t require pre-commitment nor any rhetoric materially more hawkish than the last gathering. Rather, the market needs to simply see a lack of dovish cues in the monetary policy statement. If that is the case, the Dollar’s rate bearing will push it even farther off course of its counterparts.

Beyond, the forward rate advantage traders will be looking to glean from the event, the broader market will also measure the sentiment impact this event holds. If the Fed doesn’t push back a hike to 2016, it can upset a carefully crafted status quo and stimulus-smoothed investment environment. In other words, a ‘hawkish’ Fed generate risk aversion sentiment and perhaps finally turn holdout speculative benchmarks (like the S&P 500 and US equities) lower. If that is the case, the Dollar could also gain on a safe haven / liquidity bid.