Enrique Enguix / プロファイル

- 情報

|

3 年

経験

|

4

製品

|

2578

デモバージョン

|

|

0

ジョブ

|

9

シグナル

|

0

購読者

|

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

🔴 YOUTUBE: https://bit.ly/3QXYBuy

📈 ALL OUR SIGNALS: https://www.mql5.com/en/signals/author/envex

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

When you trade in FOREX, you are buying or selling two currencies. Long positions involve buying a currency with the expectation that its value will increase, while short positions involve selling it with the expectation that its value will decrease. In both cases, if you keep the position open for more than a day, a swap is applied.

This swap is essentially an interest charge based on the interest rates associated with the currency pair you are trading and the type of position you hold (long or short). If the interest rate of the currency you are selling is higher than that of the one you are buying, you will pay the swap; otherwise, you will gain from the exchange.

It is quite common for people, especially beginners, to make trades expecting good returns, only to be disappointed or even incur losses. The reason behind this often lies in not considering the swap commissions associated with their investments, which accumulate daily.

This factor can have a significant impact on trading profits, for better or for worse, especially on positions held over extended periods.

So, what can we do? The value of the swap is known in advance, so if you like to be active when using an EA, you can semi-automatically control the direction in which trades will be opened. Let's not forget that some of our EAs offer that possibility. For example, in the same backtest, swaps are applied in the first, but not in the second; you will surely notice the difference.

https://forms.gle/RRuEQwByqBewfYQ69

⚠️Even if a (bad) developer does not have that intention, it is common and has an explanation.

Most expert advisors are built on temporary statistical advantages that eventually get exhausted.

The problem of over-optimization

Many developers fall into the trap of tuning their EAs to achieve perfect results in the past, without understanding that this perfection will not work in the future market.

Furthermore, everything is built to make it difficult for retailers to make money: spreads, swaps, commissions, delays, etc.

You'll be surprised to know that those few who make money from trading even pay more than 50% of their profits in one way or another.

The importance of diversification

And with how difficult it is to profit, most traders do not know how to diversify correctly, either because they do not understand the concept or do not have the necessary tools to do so.

If you use the same EA on EUR/USD and GBP/USD (which are strongly correlated), when EUR/USD trades lose, so will GBP/USD trades.

And what about EAs that compensate losing trades with winning trades?

Developers strive to create an EA that never fails in tests. But the market is never the same, so if the EA fails, this technique will wipe out months of profits in one trade.

Therefore. We need an EA that:

✅Does not exploit a temporary statistical advantage but can read the market and adapt.

✅It does not predict the market but follows it wherever it goes.

✅It does not work in correlated markets, so that when trades are lost in one market, they are not lost in the rest.

✅Allows for failure and assumes losses from time to time.

✅It is not optimized to have a perfect curve in backtests. Because a perfect curve only tells us that the EA has been over-optimized.

Do you want to know more?: https://www.mql5.com/en/market/product/90877

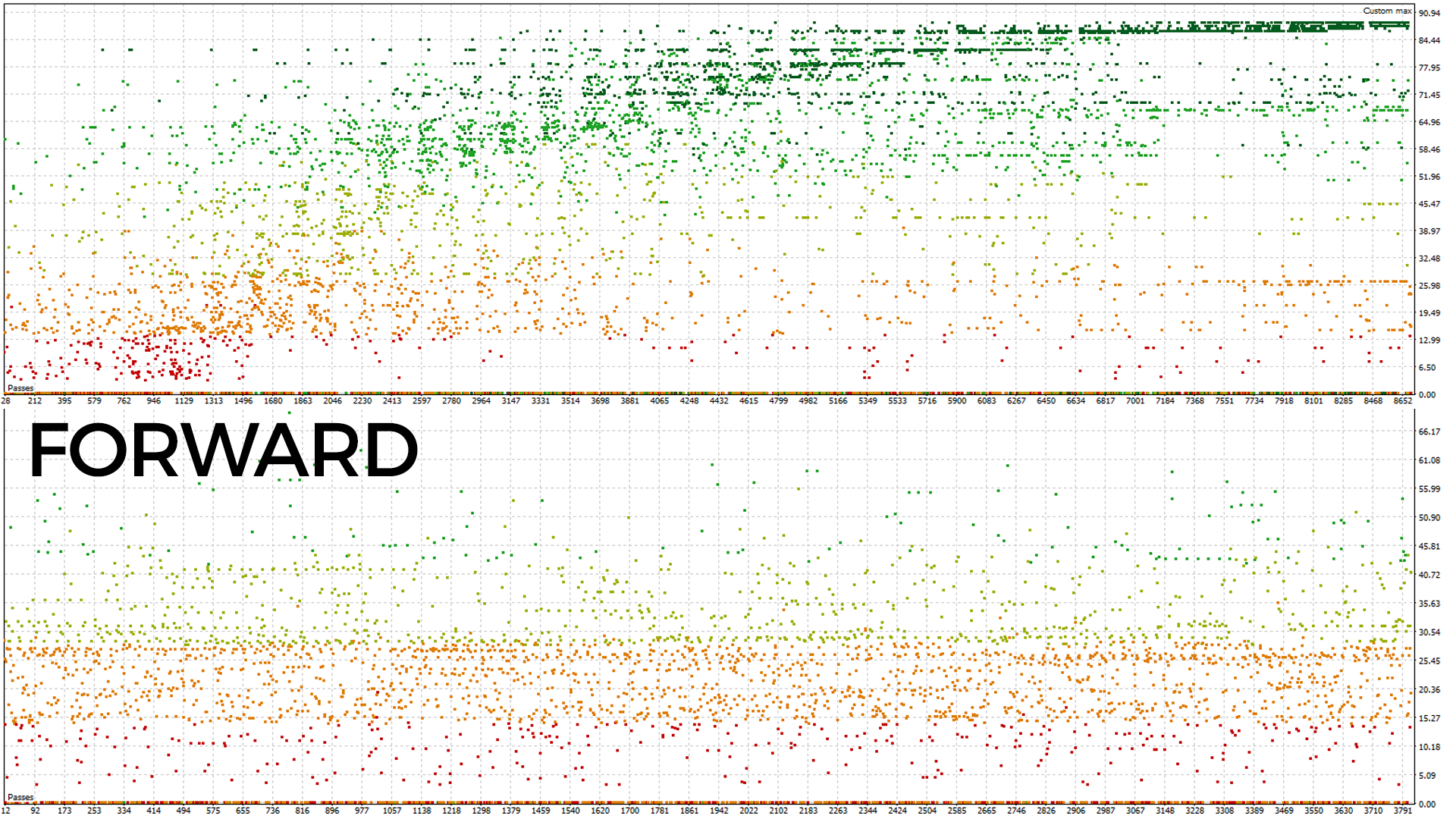

On the other hand, our approach is different: we also optimize over an extended period, but then validate out of sample to verify the real effectiveness of the strategy, which results in more robust sets (although not as visually striking, second image ), generating fewer sales but offering results that are more in line with reality.

Our goal is to attract traders who understand that the important thing is not superficial beauty, but obtaining results that reflect with a higher degree of probability the future conditions of the market.

Even though the strategy has passed robustness tests positioning it as a good strategy, I will be closely monitoring it while testing it in the incubator. I want to determine if we have something that’s over-optimized or if there is a true edge in the market.

In the world of algorithmic trading, accuracy in candle close prices is essential for obtaining reliable results in Expert Advisor (EA) backtests. In this study, we meticulously compared candle close prices between Brokers X and Y, and analyzed how these differences affect EA backtest results.

Study Objectives:

Our main objective was to evaluate discrepancies in candle close prices between these two brokers and understand how these differences influence EA backtest results under identical strategy conditions.

Methodology:

Using specialized tools, we analyzed and compared candle close prices for various currency pairs over a significant period of trading.

Results:

Notable differences were observed in candle close prices between Brokers X and Y, even under similar market conditions. These discrepancies directly impacted EA backtest results, generating significant variations in final outcomes.

Analysis and Interpretation:

It is important to note that these differences in candle close prices between brokers can influence the profitability and effectiveness of automated strategies. While these variations may pose challenges, they can also offer opportunities to optimize strategies and adapt to different market conditions.

Conclusions:

When conducting EA backtests, it is crucial to consider and adjust parameters based on differences in candle close prices between brokers. We recommend conducting comprehensive tests across different brokers to better understand the real impact of these discrepancies on our automated trading strategies.

Share your experiences and observations on this topic in the comments to enrich the discussion!

Best of luck in your analysis and trading operations!

For over 3 years, my Expert Advisor has shown solid results, but I've always been concerned about the risk associated with its strategy.

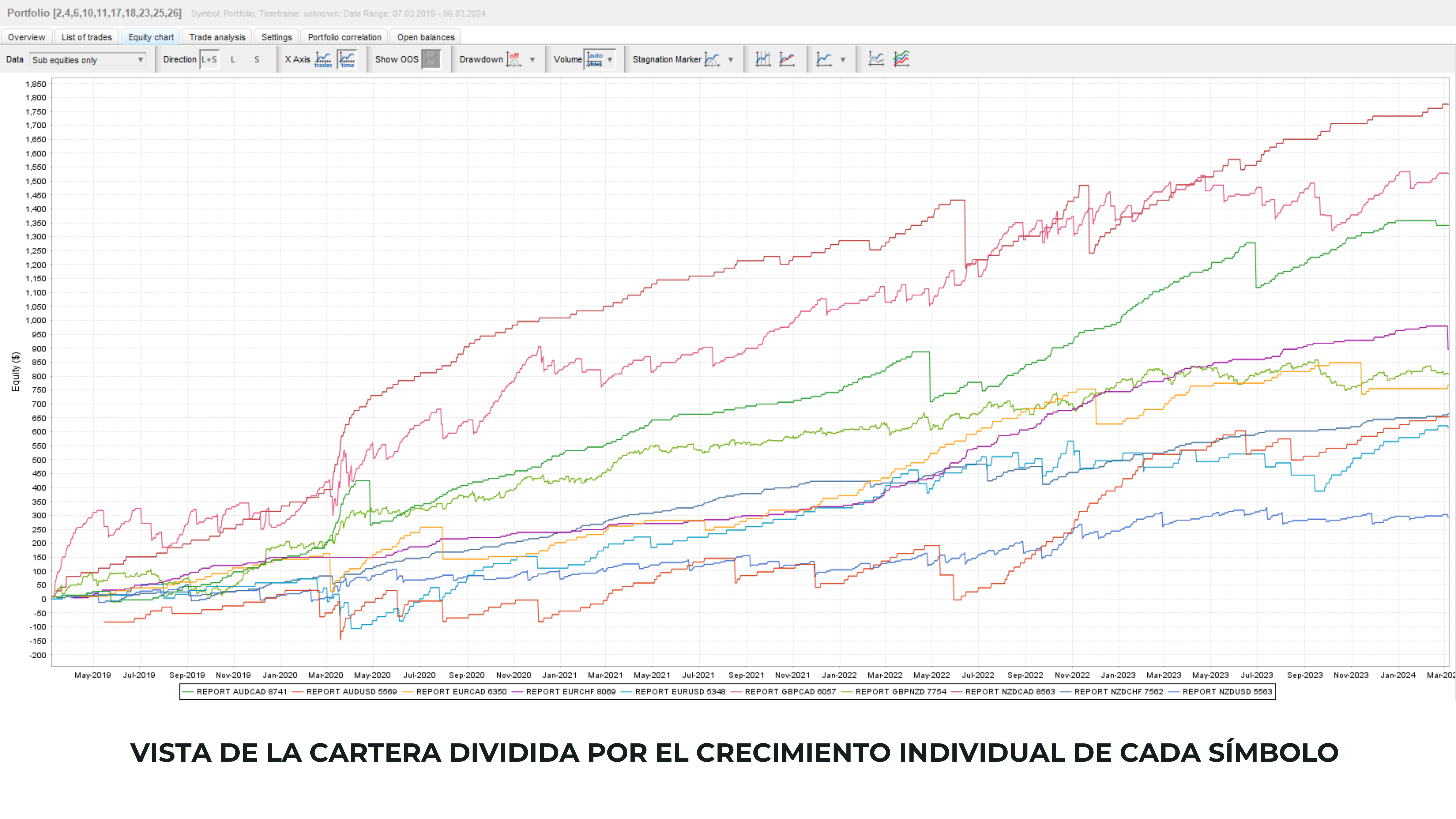

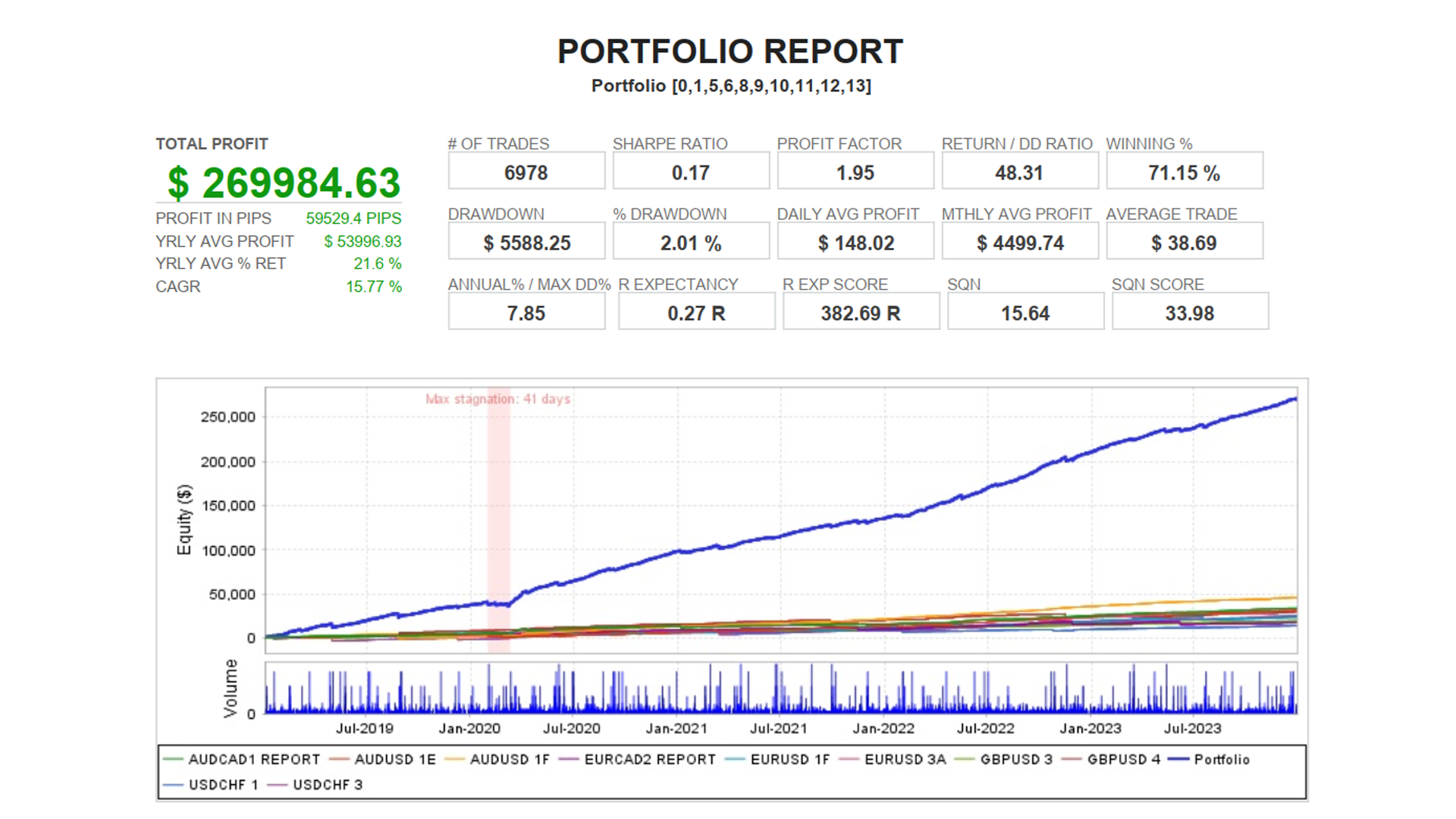

So, from a new perspective, I've created more robust strategies and less over-optimized sets. I've also developed my own formulation to evaluate results, considering 10 key parameters such as Sharpe Ratio, number of trades, and Drawdown.

The incorporation of Software #QuantAnalyzer and its Portfolio Master has been crucial, allowing me to evaluate results from different angles, including asset decorrelation.

Moreover, the Monte Carlo evaluation has confirmed the strength of my new portfolio.

I'll soon begin testing this third phase with my own capital!

なぜほとんどのEAが失敗するのでしょうか? 多くのエキスパートアドバイザーは、市場が変化すると一時的な統計的な利点に依存しており、これは継続的に起こります。 過度最適化の問題 さらに、ほとんどの開発者は、過去に完璧な結果を得るためにEAを微調整する罠に陥りますが、これが将来の市場パフォーマンスに翻訳されないことに気付いていません。 将来のシナリオを考慮したテストを行うことが重要です。 多様化の重要性 すべての投資を1つのオプションに集中させないことが重要です。これは、連動する市場で特にリスクが高くなります。 たとえば、EUR/USDやGBP/USDなどの2つの密接に関連する通貨ペアで同じ戦略を使用すると、何かがうまくいかないと損失が増える可能性があります。 したがって、投資戦略を多様化することは資金を守るための鍵です。 Stop LossのないEAについてはどうですか? 一部のEAはテストでの失敗を避けようとしますが、いつでも口座を保護することが重要です。 適切な保護措置を取らなかったため、多くのトレーダーが突然口座を失っています。 それでは、NEXUSはどんなものですか? 1

Want to trade like a professional? The Tank v1 EA is designed to meet the needs of investors and financial enthusiasts, merging simplicity and robust performance. Key Features: - 1 Daily trade - Stop Loss and Take Profit for each trade - Pending orders like Buy Stop and Sell Stop - Manage risk with precision. - Close orders at the end of the day - Does not trade on Fridays Adapt it to Your Needs: Although initially optimized for the GBP/USD pair on the H1 timeframe, Tank v1 invites you to

ゴールドトレーディングでのAtomic79のパワーを発見しよう! 2年前に1850ドルで金のバーに投資したと想像してみてください。 市場の上下を経験することになります:6ヶ月で1630ドルに下落し、その後2023年1月までに元の価値にゆっくりと回復します。 しかし、本当の勝利は2023年11月に訪れるでしょう。その時、価格は2400ドルに上昇し、24ヶ月で550ドルの利益をもたらします。 その間、Atomic79は何をしていたでしょうか? 上昇と下降の動きを利用し、最適なタイミングで取引を行います。 私たちの回顧的分析によれば、その1850ドルは今日3192ドルになっているでしょう。大きな差です! Atomic79の特徴: 市場適応性: Atomic79は金市場の変化に迅速に対応し、チャレンジを利益の機会に変えます。 戦略的統合: 3つの強力な戦略を組み合わせ、利益を最大化しリスクを最小化します。 効果的なリスク管理: 高い波乱時に投資を保護するために高度なツールを使用します。 ポジションクローズ:

Center EAの力を体感して、Forex市場を制覇しましょう! 市場の動きを深く分析した価格アクションベースのトレード。 Centerはそのトレンド特性で際立っています。 即時ダウンロード: この機会に既に利用した30,000人以上に加わり、Center EAを即座にダウンロードしてください。 確かな収益性: Center EAを使用すれば取引の80%が成功する可能性があります! 価格アクションベースの戦略: Center EAの戦略を使用して正確に利益を最大化します。 満足のいくユーザーの声は? "Center EAは私のForex取引のアプローチを変えました。おすすめです!" "Center EAのおかげで、取引に自信を持っています。素晴らしいです!" "非常に、非常に良い、素晴らしいとさえ言います。ブラボー。" "パフォーマンスと結果に驚いています。開発者におめでとうございます。" 優れた エキスパートアドバイザーをお探しですか? こちらで提供しているものを見つけてください !