Enrique Enguix / Профиль

- Информация

|

3 года

опыт работы

|

4

продуктов

|

2575

демо-версий

|

|

0

работ

|

7

сигналов

|

0

подписчиков

|

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

🔴 YOUTUBE: https://bit.ly/3QXYBuy

📈 ALL OUR SIGNALS: https://www.mql5.com/en/signals/author/envex

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

⚠️Even if a (bad) developer does not have that intention, it is common and has an explanation.

Most expert advisors are built on temporary statistical advantages that eventually get exhausted.

The problem of over-optimization

Many developers fall into the trap of tuning their EAs to achieve perfect results in the past, without understanding that this perfection will not work in the future market.

Furthermore, everything is built to make it difficult for retailers to make money: spreads, swaps, commissions, delays, etc.

You'll be surprised to know that those few who make money from trading even pay more than 50% of their profits in one way or another.

The importance of diversification

And with how difficult it is to profit, most traders do not know how to diversify correctly, either because they do not understand the concept or do not have the necessary tools to do so.

If you use the same EA on EUR/USD and GBP/USD (which are strongly correlated), when EUR/USD trades lose, so will GBP/USD trades.

And what about EAs that compensate losing trades with winning trades?

Developers strive to create an EA that never fails in tests. But the market is never the same, so if the EA fails, this technique will wipe out months of profits in one trade.

Therefore. We need an EA that:

✅Does not exploit a temporary statistical advantage but can read the market and adapt.

✅It does not predict the market but follows it wherever it goes.

✅It does not work in correlated markets, so that when trades are lost in one market, they are not lost in the rest.

✅Allows for failure and assumes losses from time to time.

✅It is not optimized to have a perfect curve in backtests. Because a perfect curve only tells us that the EA has been over-optimized.

Do you want to know more?: https://www.mql5.com/en/market/product/90877

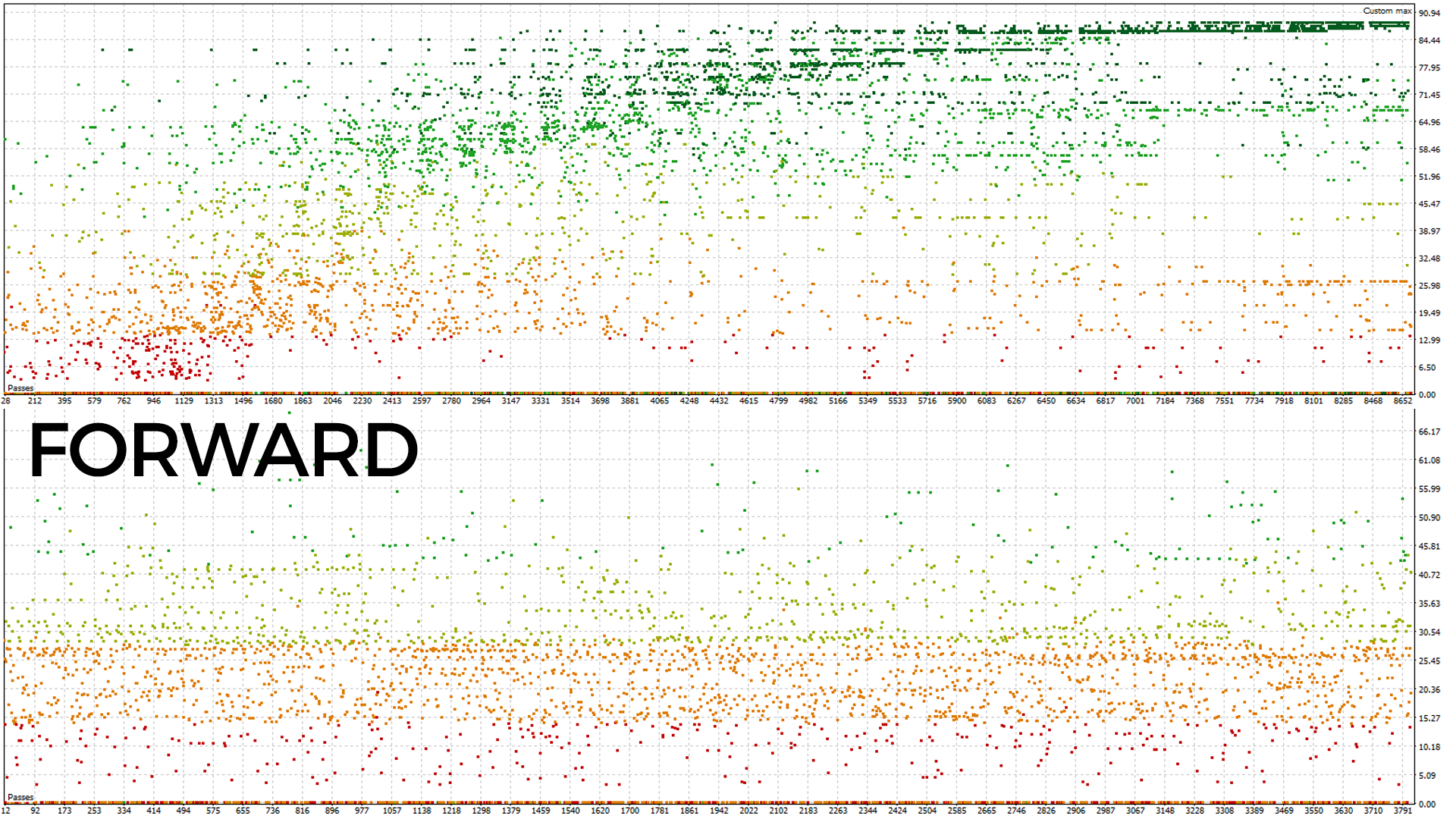

On the other hand, our approach is different: we also optimize over an extended period, but then validate out of sample to verify the real effectiveness of the strategy, which results in more robust sets (although not as visually striking, second image ), generating fewer sales but offering results that are more in line with reality.

Our goal is to attract traders who understand that the important thing is not superficial beauty, but obtaining results that reflect with a higher degree of probability the future conditions of the market.

Even though the strategy has passed robustness tests positioning it as a good strategy, I will be closely monitoring it while testing it in the incubator. I want to determine if we have something that’s over-optimized or if there is a true edge in the market.

In the world of algorithmic trading, accuracy in candle close prices is essential for obtaining reliable results in Expert Advisor (EA) backtests. In this study, we meticulously compared candle close prices between Brokers X and Y, and analyzed how these differences affect EA backtest results.

Study Objectives:

Our main objective was to evaluate discrepancies in candle close prices between these two brokers and understand how these differences influence EA backtest results under identical strategy conditions.

Methodology:

Using specialized tools, we analyzed and compared candle close prices for various currency pairs over a significant period of trading.

Results:

Notable differences were observed in candle close prices between Brokers X and Y, even under similar market conditions. These discrepancies directly impacted EA backtest results, generating significant variations in final outcomes.

Analysis and Interpretation:

It is important to note that these differences in candle close prices between brokers can influence the profitability and effectiveness of automated strategies. While these variations may pose challenges, they can also offer opportunities to optimize strategies and adapt to different market conditions.

Conclusions:

When conducting EA backtests, it is crucial to consider and adjust parameters based on differences in candle close prices between brokers. We recommend conducting comprehensive tests across different brokers to better understand the real impact of these discrepancies on our automated trading strategies.

Share your experiences and observations on this topic in the comments to enrich the discussion!

Best of luck in your analysis and trading operations!

For over 3 years, my Expert Advisor has shown solid results, but I've always been concerned about the risk associated with its strategy.

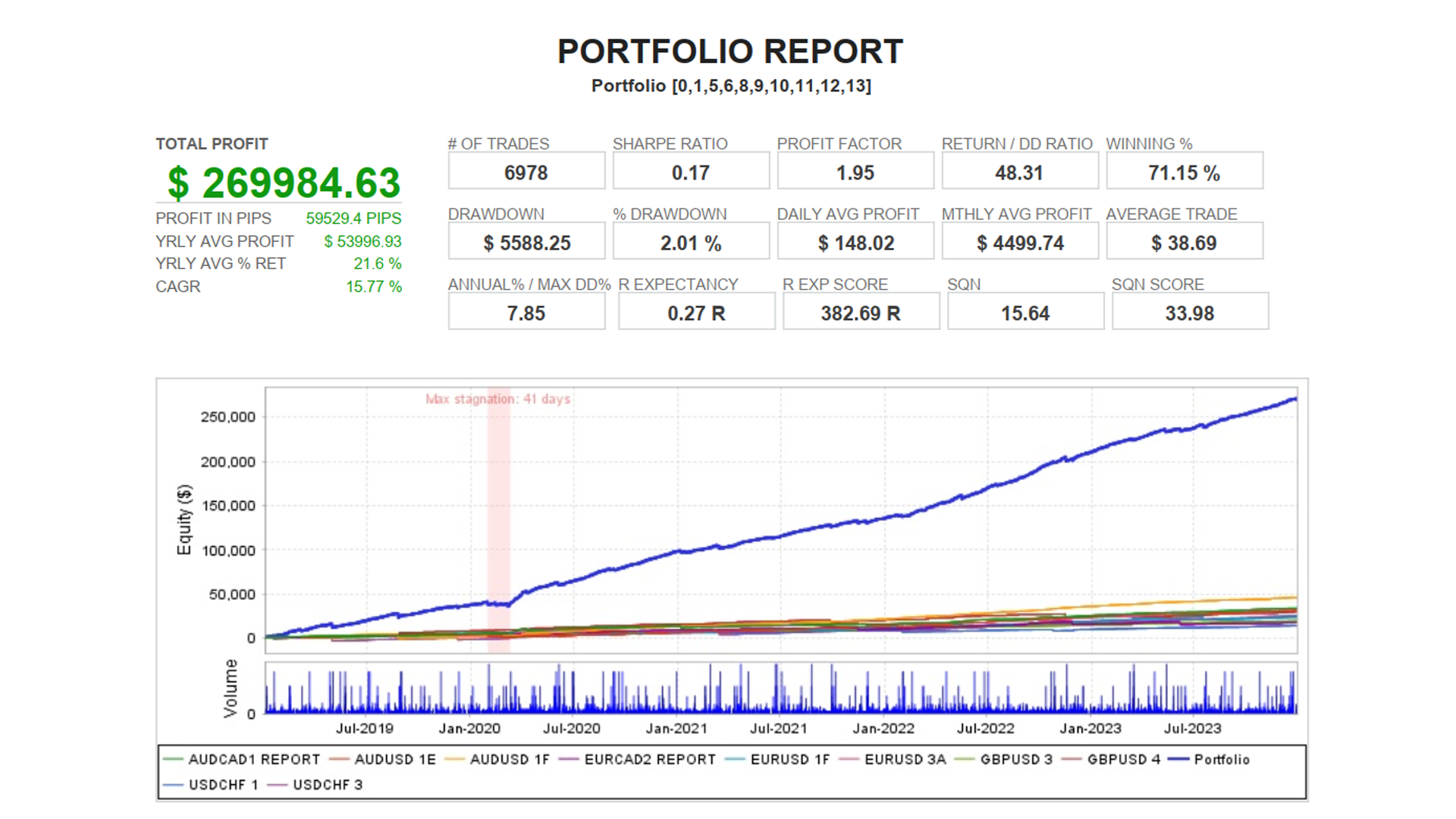

So, from a new perspective, I've created more robust strategies and less over-optimized sets. I've also developed my own formulation to evaluate results, considering 10 key parameters such as Sharpe Ratio, number of trades, and Drawdown.

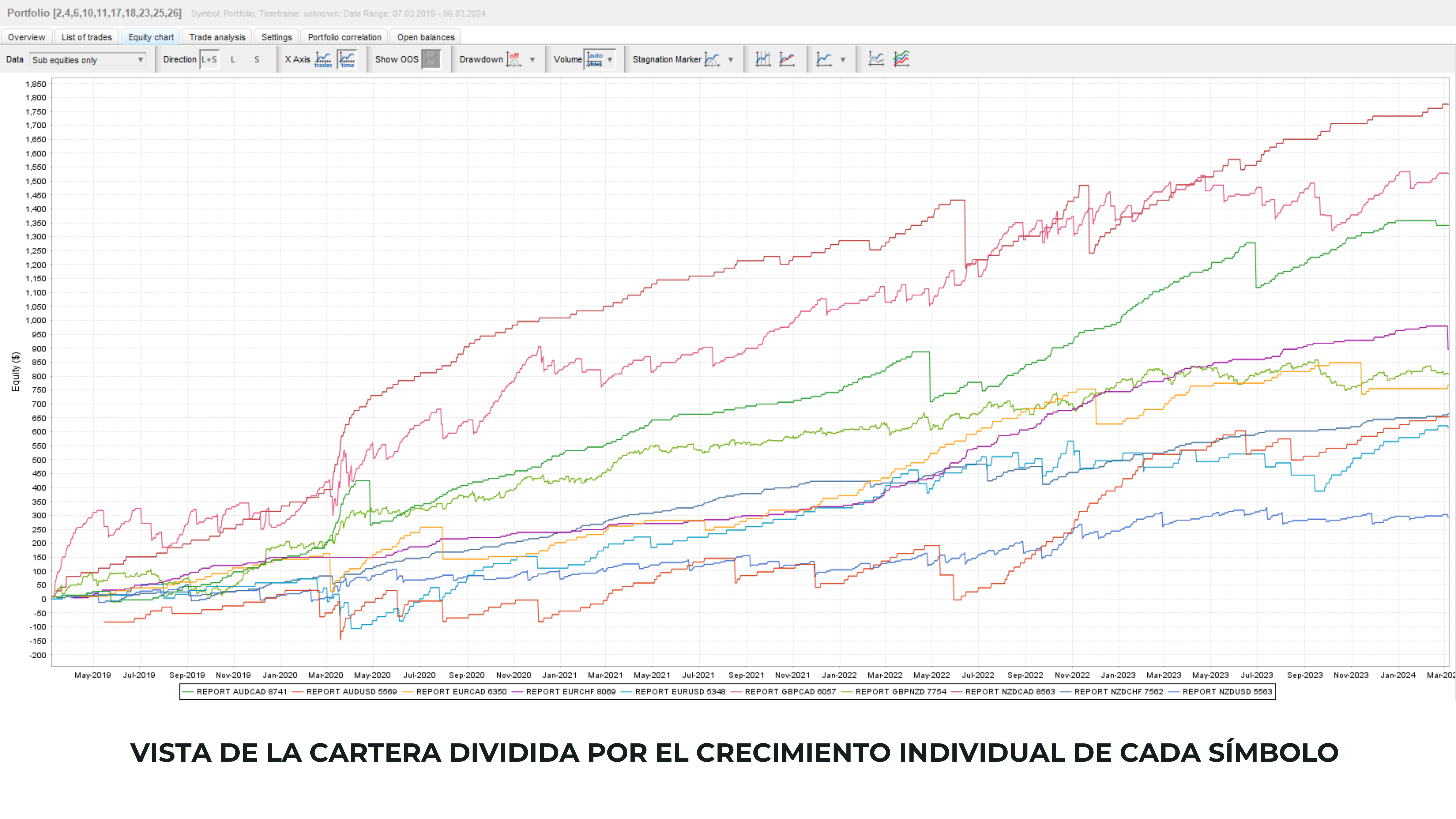

The incorporation of Software #QuantAnalyzer and its Portfolio Master has been crucial, allowing me to evaluate results from different angles, including asset decorrelation.

Moreover, the Monte Carlo evaluation has confirmed the strength of my new portfolio.

I'll soon begin testing this third phase with my own capital!

Почему большинство СЭ не удаются? Многие советники полагаются на временные статистические преимущества, которые исчезают, когда меняется рынок, что происходит непрерывно. Проблема чрезмерной оптимизации Более того, большинство разработчиков попадают в ловушку тонкой настройки своих СЭ для достижения идеальных результатов в прошлом, не понимая, что это не переведется на будущую рыночную производительность. Крайне важно проводить тесты, учитывающие будущие сценарии. Важность диверсификации Крайне

Хотите торговать как профессионал? Экспертный советник Tank v1 создан, чтобы удовлетворить потребности инвесторов и финансовых энтузиастов, объединяя простоту и надежную производительность. Основные характеристики: - 1 ежедневная сделка - Стоп-лосс и тейк-профит для каждой сделки - Ордера отложенного типа Buy Stop и Sell Stop - Точное управление риском. - Закрытие сделок в конце дня - Не торгует по пятницам Приспособьте его под свои нужды: Хотя изначально оптимизирован для валютной пары

Откройте для себя мощь Atomic79 в торговле золотом! Представьте, что два года назад вы инвестировали в золотой слиток за $1850. Вы бы испытали подъемы и падения рынка: падение до $1630 за шесть месяцев, за которым последовало медленное восстановление до его первоначальной стоимости к январю 2023 года. Но настоящая победа пришла бы в ноябре 2023 года, когда его цена поднялась до $2400, принося прибыль в $550 за 24 месяца. Что бы сделал между тем Atomic79? Пользуйтесь восходящими и нисходящими

Опыт мощи Center EA и доминирование на рынке Forex! Торговля на основе ценового движения с глубоким анализом движения рынка. Center выделяется своими тенденциями. Мгновенная загрузка: Присоединяйтесь к более чем 30 000 людям, которые уже воспользовались этой возможностью, и мгновенно загрузите Center EA. Доказанная прибыльность: До 80% сделок могут быть успешными с Center EA! Стратегия на основе ценового движения: Максимизируйте свою прибыль с использованием стратегии Center EA. Что говорят наши