Enrique Enguix / Profil

- Informations

|

3 années

expérience

|

4

produits

|

2578

versions de démo

|

|

0

offres d’emploi

|

9

signaux

|

0

les abonnés

|

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

🔴 YOUTUBE: https://bit.ly/3QXYBuy

📈 ALL OUR SIGNALS: https://www.mql5.com/en/signals/author/envex

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

When you trade in FOREX, you are buying or selling two currencies. Long positions involve buying a currency with the expectation that its value will increase, while short positions involve selling it with the expectation that its value will decrease. In both cases, if you keep the position open for more than a day, a swap is applied.

This swap is essentially an interest charge based on the interest rates associated with the currency pair you are trading and the type of position you hold (long or short). If the interest rate of the currency you are selling is higher than that of the one you are buying, you will pay the swap; otherwise, you will gain from the exchange.

It is quite common for people, especially beginners, to make trades expecting good returns, only to be disappointed or even incur losses. The reason behind this often lies in not considering the swap commissions associated with their investments, which accumulate daily.

This factor can have a significant impact on trading profits, for better or for worse, especially on positions held over extended periods.

So, what can we do? The value of the swap is known in advance, so if you like to be active when using an EA, you can semi-automatically control the direction in which trades will be opened. Let's not forget that some of our EAs offer that possibility. For example, in the same backtest, swaps are applied in the first, but not in the second; you will surely notice the difference.

https://forms.gle/RRuEQwByqBewfYQ69

⚠️Even if a (bad) developer does not have that intention, it is common and has an explanation.

Most expert advisors are built on temporary statistical advantages that eventually get exhausted.

The problem of over-optimization

Many developers fall into the trap of tuning their EAs to achieve perfect results in the past, without understanding that this perfection will not work in the future market.

Furthermore, everything is built to make it difficult for retailers to make money: spreads, swaps, commissions, delays, etc.

You'll be surprised to know that those few who make money from trading even pay more than 50% of their profits in one way or another.

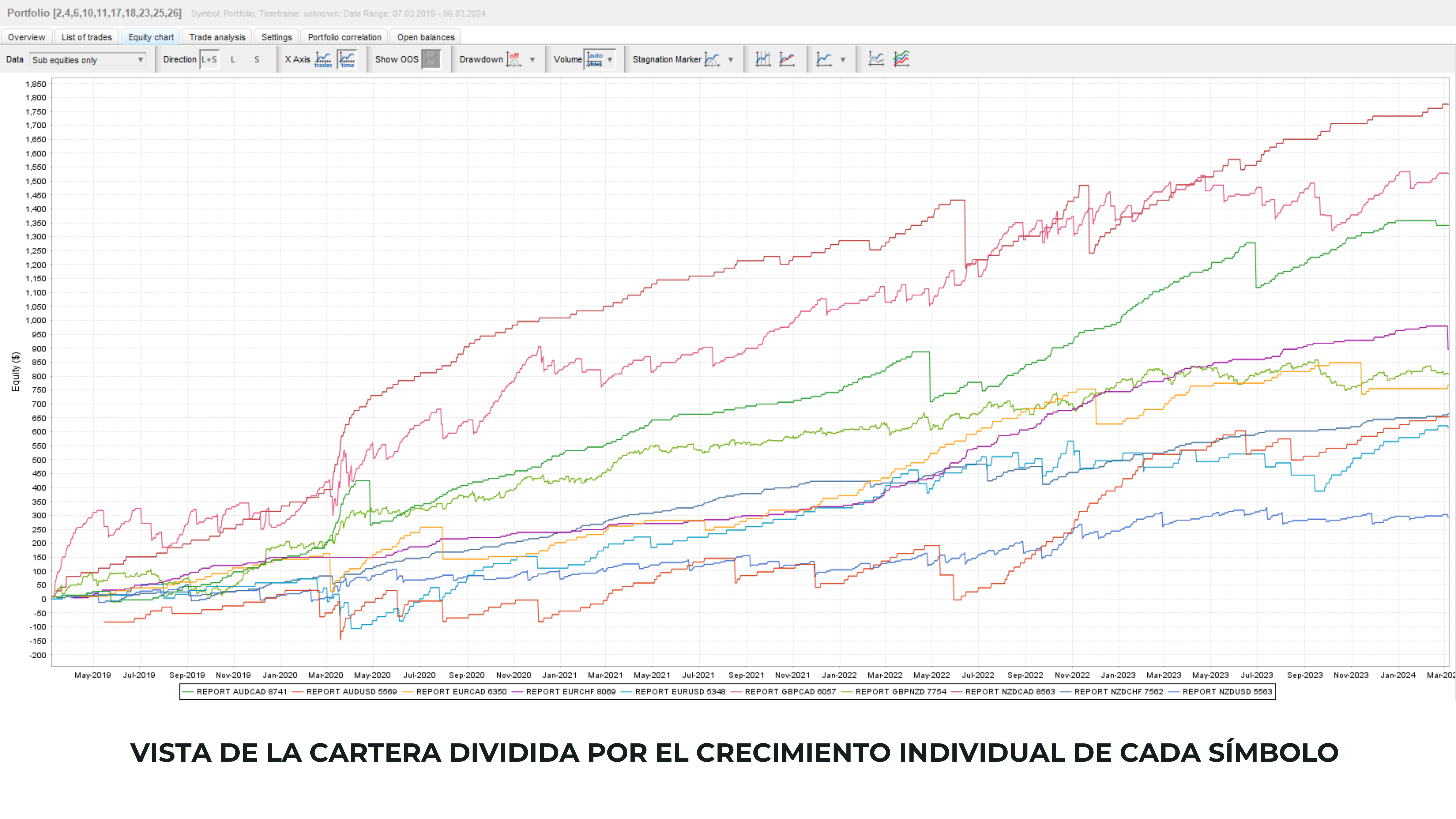

The importance of diversification

And with how difficult it is to profit, most traders do not know how to diversify correctly, either because they do not understand the concept or do not have the necessary tools to do so.

If you use the same EA on EUR/USD and GBP/USD (which are strongly correlated), when EUR/USD trades lose, so will GBP/USD trades.

And what about EAs that compensate losing trades with winning trades?

Developers strive to create an EA that never fails in tests. But the market is never the same, so if the EA fails, this technique will wipe out months of profits in one trade.

Therefore. We need an EA that:

✅Does not exploit a temporary statistical advantage but can read the market and adapt.

✅It does not predict the market but follows it wherever it goes.

✅It does not work in correlated markets, so that when trades are lost in one market, they are not lost in the rest.

✅Allows for failure and assumes losses from time to time.

✅It is not optimized to have a perfect curve in backtests. Because a perfect curve only tells us that the EA has been over-optimized.

Do you want to know more?: https://www.mql5.com/en/market/product/90877

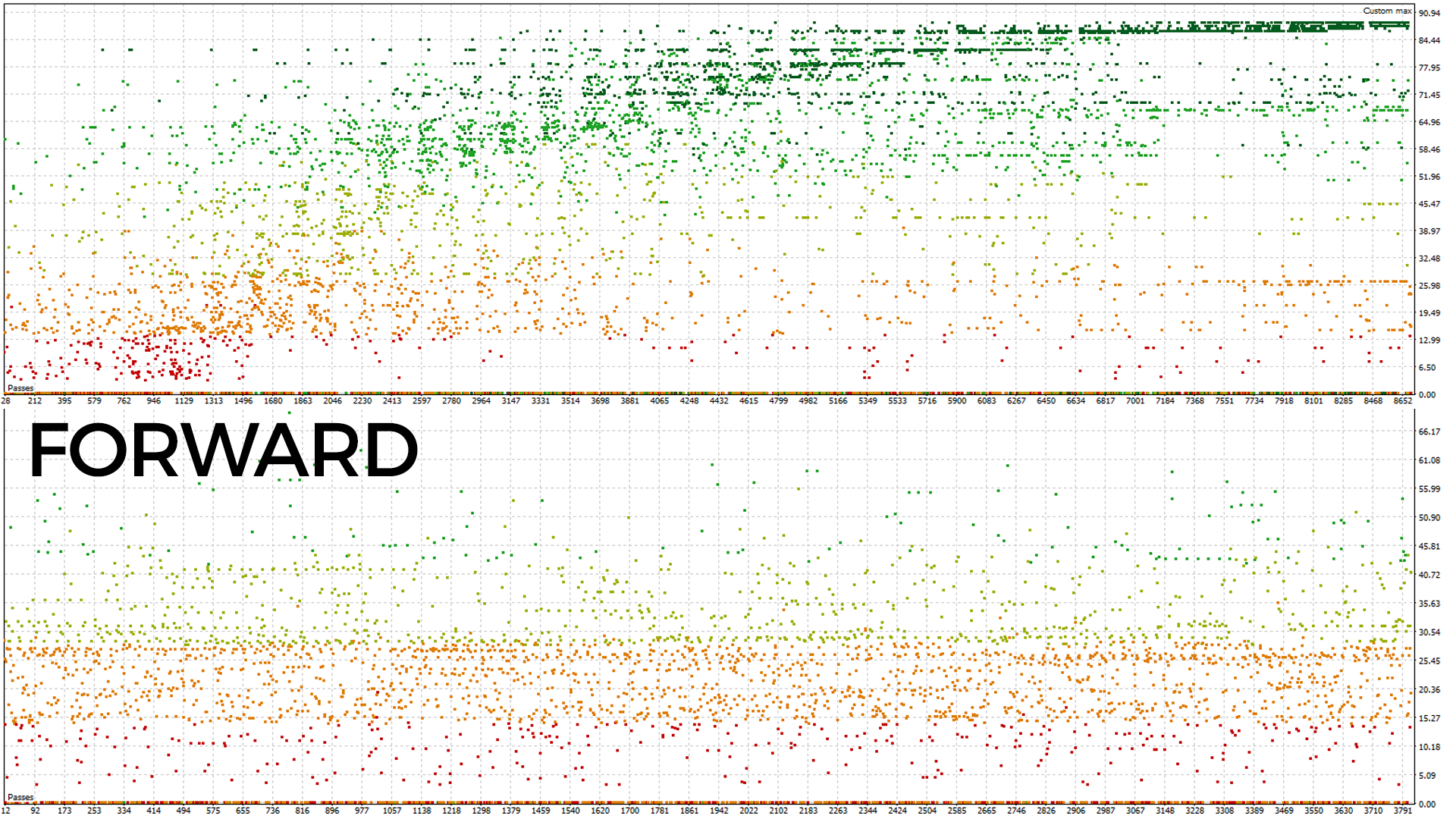

On the other hand, our approach is different: we also optimize over an extended period, but then validate out of sample to verify the real effectiveness of the strategy, which results in more robust sets (although not as visually striking, second image ), generating fewer sales but offering results that are more in line with reality.

Our goal is to attract traders who understand that the important thing is not superficial beauty, but obtaining results that reflect with a higher degree of probability the future conditions of the market.

Even though the strategy has passed robustness tests positioning it as a good strategy, I will be closely monitoring it while testing it in the incubator. I want to determine if we have something that’s over-optimized or if there is a true edge in the market.

In the world of algorithmic trading, accuracy in candle close prices is essential for obtaining reliable results in Expert Advisor (EA) backtests. In this study, we meticulously compared candle close prices between Brokers X and Y, and analyzed how these differences affect EA backtest results.

Study Objectives:

Our main objective was to evaluate discrepancies in candle close prices between these two brokers and understand how these differences influence EA backtest results under identical strategy conditions.

Methodology:

Using specialized tools, we analyzed and compared candle close prices for various currency pairs over a significant period of trading.

Results:

Notable differences were observed in candle close prices between Brokers X and Y, even under similar market conditions. These discrepancies directly impacted EA backtest results, generating significant variations in final outcomes.

Analysis and Interpretation:

It is important to note that these differences in candle close prices between brokers can influence the profitability and effectiveness of automated strategies. While these variations may pose challenges, they can also offer opportunities to optimize strategies and adapt to different market conditions.

Conclusions:

When conducting EA backtests, it is crucial to consider and adjust parameters based on differences in candle close prices between brokers. We recommend conducting comprehensive tests across different brokers to better understand the real impact of these discrepancies on our automated trading strategies.

Share your experiences and observations on this topic in the comments to enrich the discussion!

Best of luck in your analysis and trading operations!

For over 3 years, my Expert Advisor has shown solid results, but I've always been concerned about the risk associated with its strategy.

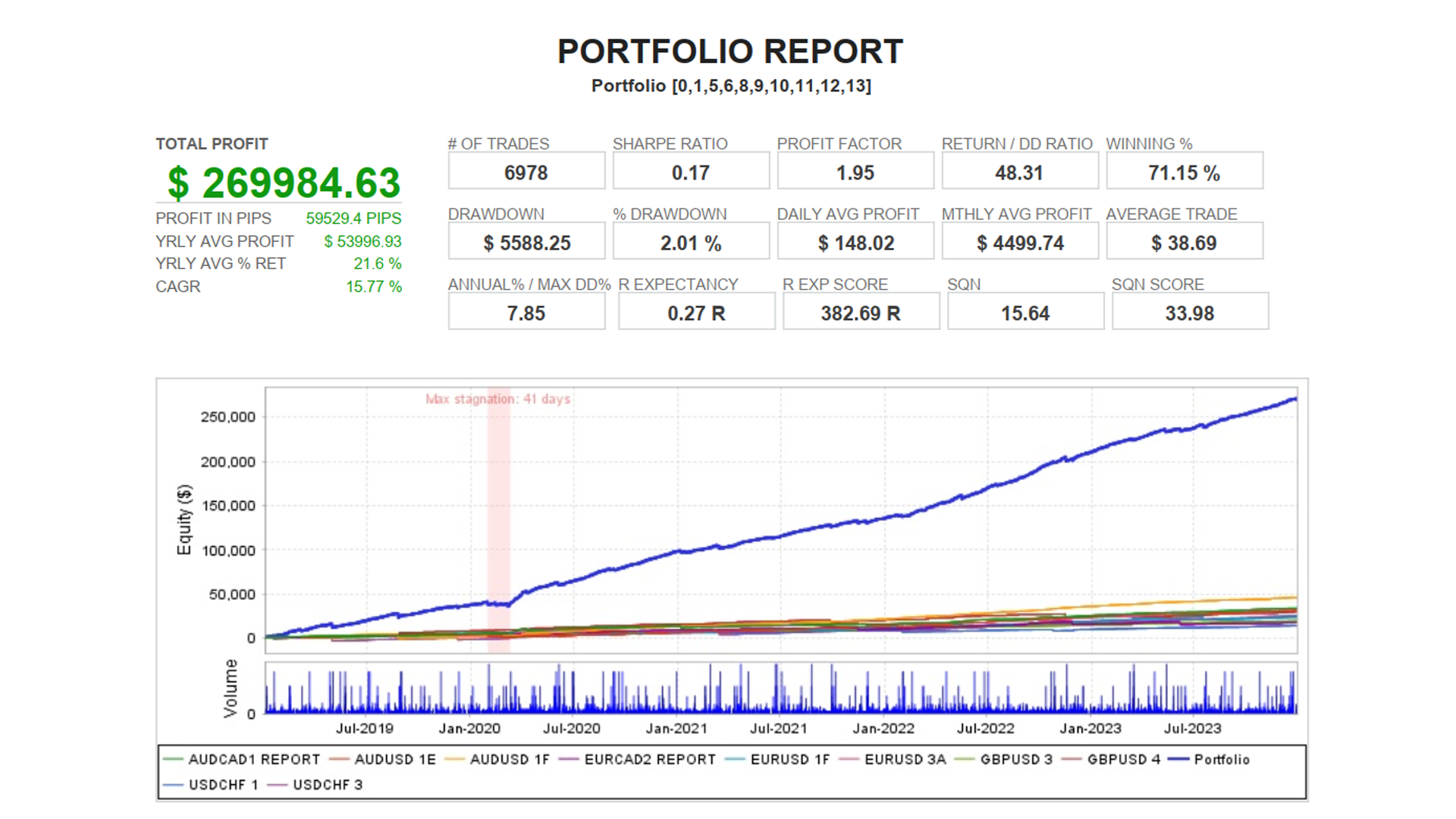

So, from a new perspective, I've created more robust strategies and less over-optimized sets. I've also developed my own formulation to evaluate results, considering 10 key parameters such as Sharpe Ratio, number of trades, and Drawdown.

The incorporation of Software #QuantAnalyzer and its Portfolio Master has been crucial, allowing me to evaluate results from different angles, including asset decorrelation.

Moreover, the Monte Carlo evaluation has confirmed the strength of my new portfolio.

I'll soon begin testing this third phase with my own capital!

Pourquoi la plupart des EAs échouent-ils ? De nombreux Experts Advisors s'appuient sur des avantages statistiques temporaires qui disparaissent lorsque le marché change, ce qui arrive continuellement. Le problème de la sur-optimisation De plus, la plupart des développeurs tombent dans le piège de peaufiner leurs EAs pour obtenir des résultats parfaits dans le passé, sans réaliser que cela ne se traduira pas par des performances futures sur le marché. Il est crucial de réaliser des tests qui

Voulez-vous trader comme un professionnel ? Le Tank v1 EA est conçu pour répondre aux besoins des investisseurs et des passionnés de finances, alliant simplicité et performances robustes. Principales caractéristiques : - 1 opération quotidienne - Stop Loss et Take Profit pour chaque opération - Ordres en attente tels que Buy Stop et Sell Stop - Gérez le risque avec précision. - Clôture des ordres en fin de journée - Ne trade pas le vendredi Adaptez-le à vos besoins : Bien qu'initialement

Découvrez la puissance d'Atomic79 dans le trading de l'or ! Imaginez avoir investi dans un lingot d'or il y a deux ans pour 1850 $. Vous auriez vécu les hauts et les bas du marché : une chute à 1630 $ en six mois, suivie d'une lente reprise jusqu'à sa valeur initiale en janvier 2023. Mais la vraie victoire serait venue en novembre 2023, lorsque son prix aurait atteint 2400 $, générant un profit de 550 $ en 24 mois. Que aurait fait entre-temps Atomic79 ? Profiter des mouvements de hausse et de

Découvrez la puissance de Center EA et dominez le marché du Forex ! Trading basé sur l'action des prix avec une analyse approfondie des mouvements du marché. Center se distingue par ses caractéristiques de tendance. Téléchargement instantané : Rejoignez plus de 30 000 personnes qui ont déjà profité de cette opportunité et téléchargez Center EA instantanément. Profitabilité prouvée : Jusqu'à 80 % des trades peuvent être réussis avec Center EA ! Stratégie basée sur l'action des prix : Maximisez