You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

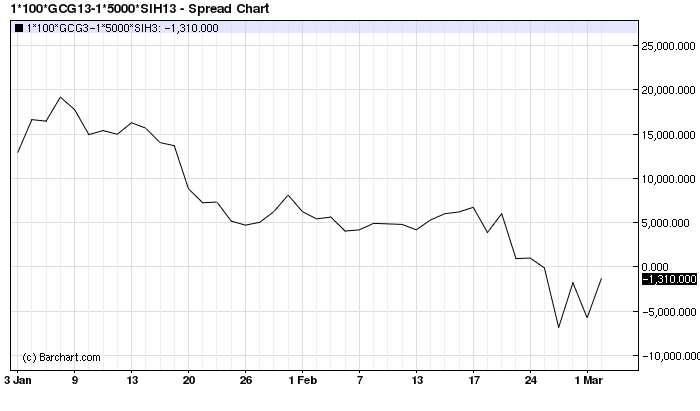

True on the lower chart, in the indicator window!

Because youdid not build the spread correctly on the barchart website! There you have to build the spread according to the formula - which is shown in pale grey at the top left in the indicator window! Taking into account different specification parameters and dimensions of these instruments!

1*100*GCG3 - 1*5000*SIH3 (for position size ratio = 1:1)

---------------------------------------------

And actually, you have to work with this spread by the ratio GC-S1=2^1...

OK, I thought he was substituting the coefficients himself,

And what to do with it - trade till March )

How great it all turns out! It would have been even better if (I know - subjunctive moods are not acceptable in trading) sugar hadn't failed... :-)

Regarding. In GrandCapital, Ind_2_Line+1 shows 1^1. Is this correct?

Or for calendar spreads always 1^1 and don't look at"by volatility (if possible) and opening prices" (VOL.Mode = 3)?

Regarding. In GrandCapital, Ind_2_Line+1 shows 1^1. Is this correct?

Or for calendar spreads always 1^1 and don't look at"by volatility (if possible) and opening prices"?

Calendar spreads are ALWAYS taken with 1:1 and

EquityScale = false;Spread_I_Env spread indicator - put on ticker chart #I.

The Ind_2_Line+1 price line indicator is NOT needed!

On low-liquid markets, e.g. copper HG - set their tickers #I in the indicator.

...

Ind_2_Line+1 price line indicator is NOT needed!

I am currently setting my Expert Advisor on various recommended spreads and using the iCustom to pull data (including debugging data) from"Ind_2_Line+1" is easier for me now.

On low-liquid markets

Uh-huh. :)

I have already encountered one when I have not been able to close SIG3 after closing GCG3. The indicator and advisor were on GCG3#I.

SergNF, remove SIG3 altogether and work on the now liquid long-rangeSIH3.

On platinum PL take the April J-contract!

Calendar spreads are ALWAYS taken from 1:1 and

Spread_I_Env spread indicator - put on ticker chart #I.

The indicator of price lines Ind_2_Line+1 - is NOT needed!

In low liquid markets, e.g. HG copper - set their tickers #I in the indicator.

If the instruments (contracts) are liquid enough, then they can do without the ticker. For example, the spreads of the sugar SB-contracts, or NG-contracts...

Seasonal overview of the LBS timber spread: http://www.procapital.ru/showpost.php?p=1385641&postcount=1069

Enter strictly at the most liquid time, preferably in the midst of US trading. To minimise losses on the asc-bid.

I am currently putting the Expert Advisor on different recommended spreads and pulling data (including debugging data) from"Ind_2_Line+1" with iCustom is easier for me now.

Uh-huh. :)

I've already got into trouble when I've closed GCG3 and couldn't close SIG3. The indicator and EA was on GCG3#I.

Hi all, information for thought:

Prospects for calendar SBH3-SBK3-SBN3 sugar spreads in the first decade of February: http://www.profi-forex.org/birzhi/futures/sugar/entry1008151347.html