In the Jobs section, quotations are already being settled between the customer and the contractor. A similar process could be set up on Market, only there may be several winners (buyers) instead of just one. In the following I will try to outline the idea, but it's only an outline for discussion - it shouldn't be taken literally. There are many auction systems out there, but the specifics of our Market do not seem to me to allow you to simply pick up and apply the eBay scheme in particular. So, the idea itself. For example, some development is put up for sale, the author sets the starting price, or even we can assume that it is automatically set equal to the minimum allowable amount of $10. After that, for, say, two weeks, those who want to buy the product make bids for its purchase at that or a higher price. Each of these bids is an obligation of the buyer to pay for the product at the price they have specified or a lower price. At the end of this period, we take the distribution of the offered prices, find the expectation or modulus - the value with the maximum occurrence - and consider this price to be fair. Those buyers who offered this price or more receive the product, and their accounts are debited with this amount. Those who bid less are notified of the final price and are given the opportunity, along with regular users who did not participate in the auction, to buy the product at that price. The seller has the right to remove the product from the auction if the final price is equal to the starting price or has remained somewhere around (also to prevent cheating). Well, or he may specify his minimum price at the beginning of the auction, invisible to others, failing which the auction is cancelled.

And try to put yourself in the buyer's shoes - compared to the seller, he has even less data about the pricing of your product. If I were in the buyer's shoes, I would bid the lowest possible price - that's all the logic, don't forget that buyers haggle with the lowest possible price.

The auction model, in my opinion, is not applicable here, the specifics of the software are poorly honed for it. For a start, you don't make a single copy for each user, you just send them a copy, which takes a few seconds to create.

In my opinion, a good model is implemented on pay.ru. There, the seller sets an initial price and an incremental price after each sale. The very first buyers get the product at the lowest price, which can cause a stir if the programme is successful.

And try to put yourself in the buyer's shoes - compared to the seller, he has even less data about the pricing of your product. If I were in the buyer's shoes, I would bid the lowest possible price - that's all the logic, don't forget that buyers haggle with the lowest possible price.

The auction model, in my opinion, is not applicable here, the specifics of the software are poorly honed for it. For a start, you don't make a single copy for each user, you just send them a copy, which takes a few seconds to create.

In my opinion, a good model is implemented on pay.ru. There, the seller sets an initial price and an incremental price after each sale. The very first buyers get the product at the lowest price, which, if the programme is successful, can cause a stir.

Exactly what the seller and the buyer wanted to do was to bring the seller's interests together. It is possible to declare a floor price, and ideally it would be zero. But then no one will sell. You need a compromise, and the auction offers it.

I have tried to extend the auction model to the case of several (many) equal bidders. There is no laboriousness in copying, but agree that it would be better for all bidders if all copies cost the same, few and many, rather than having one copy, and it covers all the developer's costs. Then the first buyer pays for all of them. And this will not be easy to find. Basically, in normal auctions people sell serial products, copying of which also doesn't cost anything. Why can't software be auctioned in the same way? Then the next round of bidding will start with one more trade item, a new buyer will find it, it might get a new price, etc. Another option is to start with the minimum price, if a certain number of buyers, for example 5, bid on it, the next bidders need to bid more by the "step" of the auction, and so on. In some ways, it's really starting to resemble pay.ru.

In general, I mentioned auctions because it's the most obvious way to determine the market price, to equalise supply and demand. If there are other options to make it profitable for the seller and inexpensive for the buyer to buy, I'd love to hear.

I won't quote you, too many words.

I just have two remarks:

1 As a buyer and seeing that you have put the product up for auction, I will wait until you are full up with your minimum price and then buy your product from the marketplace.

2 The first comes from the second, in an auction (by default) there is a competition between buyers for a product whose quantity is limited. This is the essence of an auction.

If the product is an infinite number then each buyer can wait for the minimum price, there will be no competition. The maximum a buyer could win by overpaying is to buy the product before anyone else.

Now answer the question: how many copies of the product can you sell?

And you will understand why software auctions are a lousy thing.

- www.mql5.com

Urain:

... In an auction (by default), there is a competition between buyers for a product whose quantity is limited.

Hm. I wrote that an auction is not necessarily the best solution, but it's certainly not worse than setting prices from the ceiling. And in the case of software, it is also applicable, take at least the scheme with the above-mentioned pay.ru. The quantity of the product is limited - at a specific price. If you don't have time to buy it cheap, the next limited batch will appear, but at a higher price. Let's say I don't really like this scheme, but it has a right to exist and overrides your objections.

I take it that everyone - sellers and buyers alike - agree with the voluntaristic price fixing? Pity.

Hm. I wrote that an auction is not necessarily the best solution, but it's certainly not worse than setting prices from the ceiling. And in the case of software, it is also applicable, take at least the scheme with the above-mentioned pay.ru. The quantity of the product is limited - at a specific price. If you don't have time to buy it cheap, the next limited batch will appear, but at a higher price. Let's say I don't really like this scheme, but it has a right to exist and overrides your objections.

I take it that everyone - sellers and buyers alike - agree with the voluntaristic price fixing? Pity.

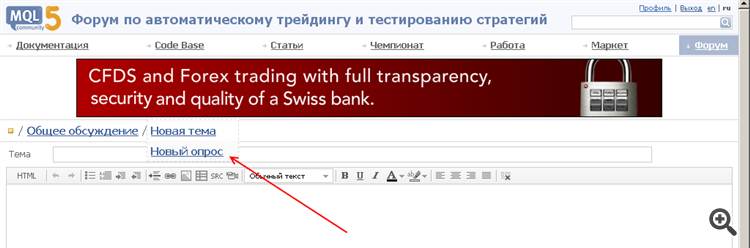

A "What price would I buy this product at?" poll would work better, preferably directly in the product profile.

In my opinion, the seller should put the highest possible price. Because as soon as he sells at least one copy of his product, there is a non-zero chance that this copy will appear on other sites at other, lower prices. And the author will have nothing to do with these sales. There is no respect for copyright. This is the reality.

It's behind such vague wording "there is a non-zero probability" that you sneak doubts into the platform's defence.

Say directly ~70% ~30% ~5% ~0.00000001% and you will immediately see what this danger is worth.

But you are right (probability never equals 0) and conclusions turn out to be paranoid. Just like a universal conspiracy to steal your software.

SZY Have you ever tried to upload to another site and then download and run from it?

It is strange to see such a question from someone associated with programming and computer software. For reference, go to a hacking site (any) and look at the number of hacked programs. And now the answer to your question, can I immediately write a confession and come with this statement to the police? Who will answer such a question on a public site?

About probability. It's not determined by percentages, but by people's respect for copyrights. If the person who doesn't care about the copyright downloaded the tool, he would do it with the probability of 100%, if it would reduce his expenses.

PS: the MT4 decompiler has not dispelled your doubts?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Of course the Market is a good service, no one disputes that, but there are some nuances which make me wary, to put it mildly. I've written about some things here and some in the service-desk, but that's not really important now, because there's still one more point I'm talking about - pricing. Suppose I have some original indicators for 4, which I plan to translate to 5 and have already done it partially. But I wouldn't be interested in trading them for $10. If it was possible to figure out in advance that a certain product would not be bought for more than $10, then I'd rather not put it up, and if there are most of them, then not bother with Market at all. Here's an example, there's an improved SomSemSyomych cluster indicator. The new features: an arbitrary number and set of analyzed symbols, synchronization on the bars. You may watch Russian cluster (USDRUR,GBPRUR,EURRUR), our oil industry (#LKOH,#ROSN,#SGNS,#SIBN) with ruble as a base, metals, strategic food (wheat, corn, soy), indices and others. My target price is $50. But will it be paid? How to find out? The first way is to ask here on the forum, which I do, but arranging the same for each product seems impractical. So the second way comes to mind, which depends on the will and desire of MetaQuotes, is to expand the functionality of the Marketplace, namely the auction.

Prices between the customer and the contractor are already being adjusted in the Jobs section. A similar process can be organized on the Market, but there can be more than one winner (buyer). In the following I will try to outline the idea, but it's only an outline for discussion - it shouldn't be taken literally. There are many auction systems out there, but the specifics of our Market do not seem to me to allow you to simply pick up and apply the eBay scheme in particular. So, the idea itself. For example, some development is put up for sale, the author sets the starting price, or even we can assume that it is automatically set equal to the minimum allowable amount of $10. After that, for, say, two weeks, those who want to buy the product make bids for its purchase at that or a higher price. Each of these bids is an obligation of the buyer to pay for the product at the price they have specified or a lower price. At the end of this period, we take the distribution of the offered prices, find the expectation or modulus - the value with the maximum occurrence - and consider this price to be fair. Those buyers who offered this price or more receive the product, and their accounts are debited with this amount. Those who bid less are notified of the final price and are given the opportunity, along with regular users who did not participate in the auction, to buy the product at that price. The seller has the right to remove the product from the auction if the final price is equal to the starting price or has remained somewhere around (also to prevent cheating). Well, or he may, at the beginning of the auction, specify his minimum price, invisible to others, failing which the auction is cancelled.

It's also likely that the auction could have some minimum "representativeness" set by the seller so that it's considered valid. On a marketplace, both sellers and buyers are interested in finding some common denominator that suits both parties. As was rightly pointed out in the above-mentioned thread, it's not even the price itself that matters from the seller's point of view, but the total revenue for the product, and therefore it is more profitable for him to sell 100 pieces at 10 than 5 at 50. It is also more profitable for buyers to buy cheaper, but they have to create mass numbers to do so. Suppose the seller can set this "representativeness" as the total desired revenue. As those who are willing "subscribe" to the product by specifying their price, the system calculates the current price as the quotient of the total revenue and the number of "subscribers". When the unit price multiplied by the number of "subscribers" who have indicated her or a higher price (let's call them A) becomes equal to "representativeness", the auction ends and the product is delivered to group A, at its unit price. Again, this leaves group B, who have indicated a lower price - they can walk away with nothing or accept the unit price.

Who has any thoughts? I think many developers present on this forum, who made interesting products for themselves and could share them with customers, have a similar dilemma, because Forex is not their core business. Anyway, it's really about making the Market highly efficient and making it a working platform rather than an exhibition of inaccessible gems or a warehouse of unnecessary cheap stuff, selling more, and buying cheaper.