from the description provided -if its correct- the :

SYMBOL_SWAP_MODE_INTEREST_CURRENT

and

SYMBOL_SWAP_MODE_INTEREST_OPEN

appear to be charged after 360 days of holding a position -this is probably present in non currency pair instruments or crypto- and

with the interest on the value of the position at different prices (on the deposit currency probably)

So from the docs i deduce if a broker has a cfd with a 3.1% in the swap reading and the price is 3.23$ per volume_unit and you have 100 volume_units

then if the mode is SYMBOL_SWAP_MODE_INTEREST_CURRENT you do :

3.23$ x 100(vol) x 0.031 (%) = 10.013$ interest 360 days after open .

from the description provided -if its correct- the :

SYMBOL_SWAP_MODE_INTEREST_CURRENT

and

SYMBOL_SWAP_MODE_INTEREST_OPEN

appear to be charged after 360 days of holding a position -this is probably present in non currency pair instruments or crypto- and

with the interest on the value of the position at different prices (on the deposit currency probably)

So from the docs i deduce if a broker has a cfd with a 3.1% in the swap reading and the price is 3.23$ per volume_unit and you have 100 volume_units

then if the mode is SYMBOL_SWAP_MODE_INTEREST_CURRENT you do :

3.23$ x 100(vol) x 0.031 (%) = 10.013$ interest 360 days after open .

Hi Lorentzos,

Yeah , well the 360 days are given for a reason . To either find the "per day swap" , i.e. interest like previously calculated / 360 and then i guess apply it to the daily swaps (or triple swaps) or it applies on close of the position on the current price held_days*(interest/360) or it applies every 360 days.

Best approach would be to find a broker that offers these types (or better docs with examples)

Yeah , well the 360 days are given for a reason . To either find the "per day swap" , i.e. interest like previously calculated / 360 and then i guess apply it to the daily swaps (or triple swaps) or it applies on close of the position on the current price held_days*(interest/360) or it applies every 360 days.

Best approach would be to find a broker that offers these types (or better docs with examples)

Hey, thanks for your reply.

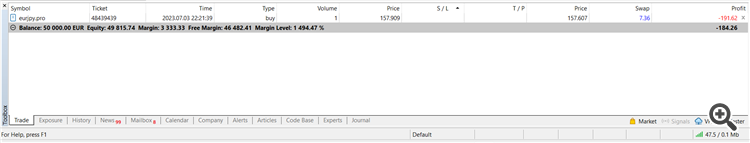

Yes, I reckon your calculation may actually be correct, I just need to divide it by 360 days to get the swap per day. I know a few brokers with these kind of swap mode. I just bought on a demo account 1 lot on the EURJPY (see attached picture), I'll see what it'll refund me tomorrow and I'll post it to confirm this calculation is correct.

I mean, the issue I feel like I am facing too is how reliable are the swaps given by the brokers ? They seem like they are very often all over the place, only tested on demo account, maybe on live they may be a bit more reliable?

I've attached the swap refunded on the demo account. The swap rate is 1 and not 3 at time of calculation (3 is on Wednesday).So, I did not have enough time to check how to calculate it properly yet but I don't think I can get my head around it still.

Okay so swap Long is 2.65%

You bought 100000 , and the price was in yen @ 157.909

The price "now" is 157.607

so (( 100000 x 156.607 ) x 0.0265(2.65%) )/360 = 1152.80 yen , divided by 156.607 you get 7.36 euros

Okay so swap Long is 2.65%

You bought 100000 , and the price was in yen @ 157.909

The price "now" is 157.607

so (( 100000 x 156.607 ) x 0.0265(2.65%) )/360 = 1152.80 yen , divided by 156.607 you get 7.36 euros

Excellent , the SYMBOL_SWAP_MODE_INTEREST_OPEN is the same but with the entry price then .

Very helpful thank you!

unfortunately nurr

The docs are cryptic on those 2 as well .

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi,

Fist of all thank you for everyone's help in the past, this forum has been very beneficial to me.

I did research on the forum but I could not find an answer to my questions, please send me a link to the post if it already has been answered before.

I basically want to convert every swap modes into the deposit currency, I do think that I will be able to manage the identifier 0,1,2,3 and obviously 4 as it is already the right swap mode (https://www.mql5.com/en/docs/constants/environment_state/marketinfoconstants#enum_symbol_swap_mode) but the identifiers 5 to 8, I am very unsure how to tackle them. Identifier 5 must be calculated depending on the annual interest specified in the symbol specification, the current price (at time of calculation) and the 360 days but I can not link them together, any tips on that please ? For identifier 6 it would obviously be something similar than ID 5 but instead of current price it would be based on the open price. Regarding ID 7 & 8, I am not sure at all how I can convert these into deposit currency.

Any help on how to convert these swap modes mentioned into the deposit currency mode would be well appreciated. If I manage to figure out how in the mean time, I will post my thought about it.

Thank you.