Tradersway is the only broker I know that caters to US residents with 1000:1 leverage.

I will try to provide DEMO account footage soon. Maybe $2000 with 5.00 per pip moves.

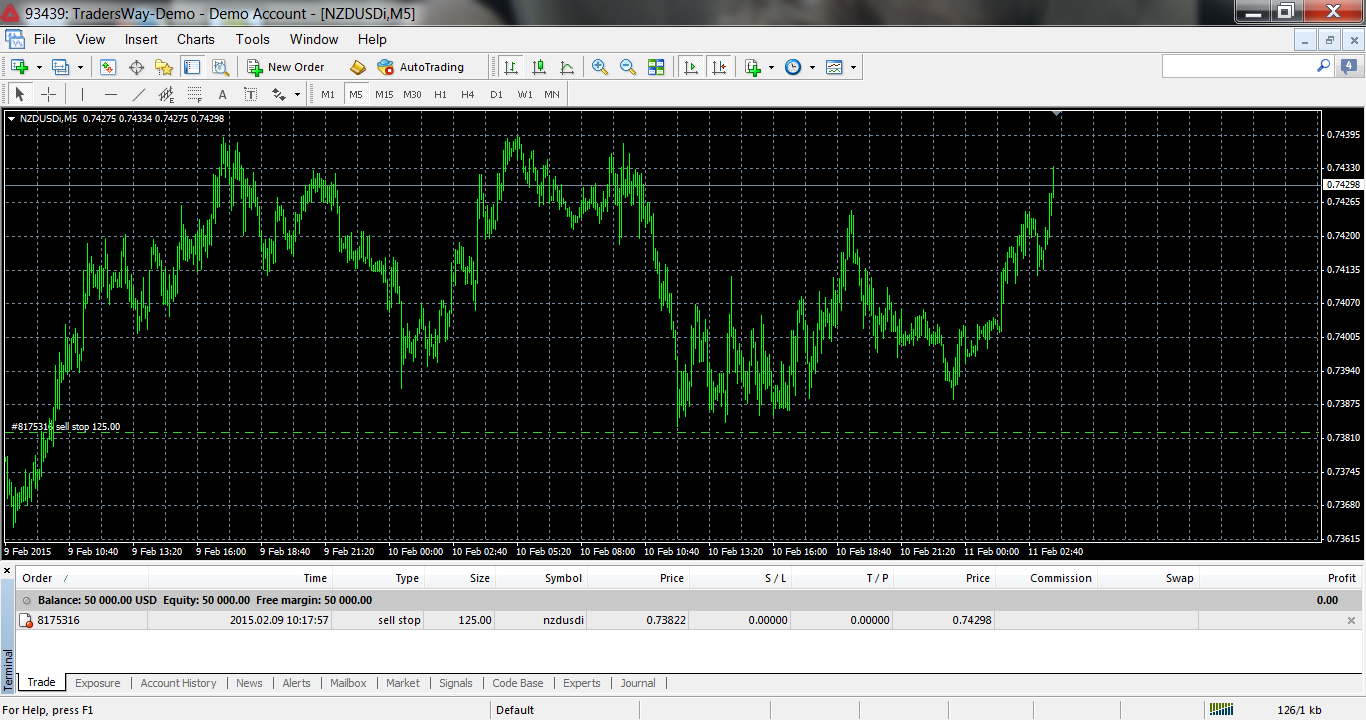

Account type: MT4.ECN. Demo

LEVERAGE: 1:1000

Demo account automatically opens with 50,000.00 USD so I will make trades based on those calculations.

$2000 USD = 5.00 per pip move

$20,000 USD = 50.00 per pip move

$40,000 USD = 100.00 per pip move

with $10,000 extra for Equity insurance.

If $10,000 USD = 25.00 per pip move then I will start with...

$50,000 USD = $125.00 per pip moveThis will give enough room for the 10-15 pip leaks that occur as the market decides it's directions.

Be back tomorrow sometime to check account for profits.

Just checked the account and it looks like the buystop was activated, but suddenly deleted as you can see in the picture.

This trade would of raked in over 30 pips.

Here is a picture of the Account History. I did not delete the trade. Maybe a platform mishap of some sort.

There was not any money loss, but it makes one skeptical to trade anymore in the future because of that risk.

I will place another pending order hedge and continue. Be back soon.

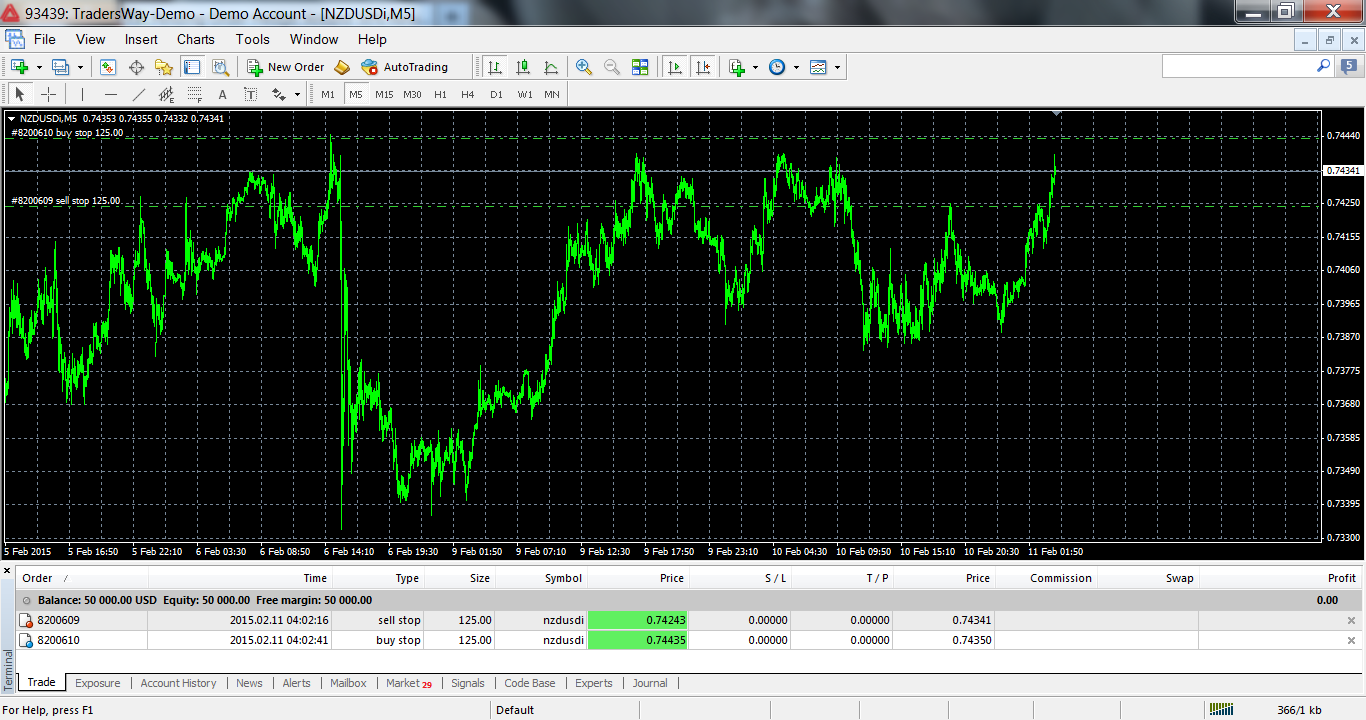

Be back soon to see if this occurrence takes place again.

It happened again. Oh well. The system works though if you can get pending orders to stay open until you can return to the platform.

Hello

I have tried something similar in the past but it didn't work out. I would love to see how your strategy works

Maybe you should try another broker

Brokers don't like hedging! Must be very tolerant broker like I have FX Primus, no problem with hedging but not that high leverage either.

Exnness has 2000:1 leverage but I don't know if hedging allowed.

Hermes

Hedging can not work for US regulated brokers (it is prohibited for them to allow hedging)

Or if you use metatrader 5  That was their "bright" move to make it "modern"

That was their "bright" move to make it "modern"

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Currency Pair: Any

I prefer NZDUSD (Spread is only 3 pips and the cost for trading is less.)

Around 50% Returns Monthly: Price movement is not the same every month.

Pending Order Hedge: Trading with pending orders gives the market opportunity to return with profits. The market will pick which direction it will give profit, not the trader. Always keep amount of pending orders balanced with open trades (Example: Closed 3 buy trades with profit, now place 3 pending buy trades 10-15 pips away, to balance open sell trades and gives opportunity for market to return, also add another buy stop and sell stop pending order to make profits for next day you check account.) Collect profits once a day if any is available at the time you check. Place pending orders around 10-15 pips away, this gives enough space for market to "sometimes" avoid opening the pending orders, that is what will bring in profits. Always place buy and sell pending orders so there will be profits to collect everyday.

Lots:

$200 = .50 cents per pip

$100 = .25 cents per pip

$50 = .10-.15 cents per pip

$25 = .05 cents per pip

* Always keep pending order trades balanced with open trades just in case market goes opposite way. Pending order trades are used instead of stop-loss because market will always return someday. Just walk away from market after checking your account for profits when you feel like it.

I place just one set of NEW! pending orders per day. Example: If you collect profits on 2 sell trades, place 2 pending order sell stops 10-15 pips away just in case market continues in same direction. Also place just one buy stop and sell stop again for profits next time you check. Try not to have more than 5-6 trades open in terminal so margin is ok and Equity is sufficient.

LEVERAGE: 1000:1 is better for margin