hopefully the Russians wont be supplying the separatists in Scotland any weapons

good luck to them, its a beautiful place, especially in the summer, had some great holidays there in the past

they ve been governed by the strong arm of the English for far too long,

sure we've all seen Braveheart

its time they were allowed to govern there own affairs, but seems they will be bullied right upto the vote

they seem to be doing a far better job than the English, apart from their rotten banks RBS and HBOS

its a much fairer society and if it was nt so cold in the winter many more would move to Scotland

Sterling Pounded

Sterling has been pounded by the YouGov poll that showed that those favoring Scottish independence have gained a slim majority for the first time. It does not matter that other polls have yet to confirm it. A "yes" vote was widely seen as a high impact event, though calling it a Black Swan probably does not do justice to the long planned event. The major parties in the UK are expected to announce a new devolution agreement for Scotland to entice the rejection of independence.

Sterling gapped sharply lower in Asia. It finished last week just above $1.6325, after having fallen to almost $1.6280 before the disappointing US job growth. It opened near $1.6190 in Asia. Gaps are rare in the 24-hour-a-day foreign exchange market, and we find they are often significant. From a technical perspective, the gap may be of greater significance as it will appear on the weekly bar charts as well. Sterling has yet to stabilize and made new lows in the European morning. The $1.6080 area corresponds with the 100-week moving average. The $1.60 area houses the 200-week moving average and the 50% retracement of sterling's rally since July 2012.

British asset markets have not shown the same dramatic reaction as sterling. The FTSE is under performing, but the 0.65% decline is not significant, and most European bourses are lower in any event. The 10-Year gilt yield is off a little more than 1 bp. Short-term UK interest rates, as reflected in the short-sterling futures strip, have fallen considerably, with the yield on the March 2015 contract falling nearly 7 bp to 78 bp. This is the lowest yield in a year.

The other major currencies are little changed. The euro remains in the trough seen in the reaction to the ECB's initiatives announced last week. It has been unable to find much solace in the softer US employment data. It has been confined essentially to a 15 tick range on either side of $1.2945. While the Sentix survey was disappointing, news of Germany's swelling trade surplus helps ease fears that Europe's largest economy was recession-bound after contracting in Q2.

Exports rose 4.7% after a 0.9% increase in June. Imports slipped 1.8% after a 4.5% rise in June. This produced a 23.4 bln euro trade surplus. The consensus was for 16.8 bln euro surplus after 16.6 bln in June. This follows the stronger than expected industrial production figures reported at the end of last week.

China, Hong Kong, Korea and Taiwan markets are on holiday today. China reported a larger than expected trade surplus of $49.8 bln in August after $47.3 bln in July. Exports rose 9.4% on a year-over-year basis. The consensus was for 9.0% after 14.5% in July. The bigger surprise was with imports. They fell 2.4% year-over-year. The market had expected a 3.0% increase after a 1.6% decline in July. It is the first back-to-back decline in imports since May-June 2013.

Japan revised its Q2 GDP to show a bigger contraction (7.1% vs 6.8%). This was a function of much weaker capital expenditures (-5.1% quarter-over-quarter rather than -2.5% as initially reported). This was only blunted by a larger than expected build of inventories. The net effect was a collapse of private demand (-19.2% quarter-over-quarter). Separately, Japan reported a somewhat smaller than expected July current account surplus of JPY416.7 bln. The consensus had expected a JPY444..2 bln surplus.

The dollar continues to straddle the JPY105 area, though it remains within the pre-weekend trading range today. The driving force is not an increase in US rates, which we had anticipated being the catalyst. The U.S. 10-Year yield is at 2.43%. Rather, it seems that capital outflows from Japan have stepped up and speculators have continued to amass a large short yen position. The divergence between the US and Japan's monetary stance and economic performance are palpable.

The North American calendar is light today with US consumer credit due out late in the session. The disappointing jobs data does not appear to be impacting expectations for next week's FOMC meeting, where the exit from QE and adjustments to the forward guidance are the main talking points. Canada also reported soft jobs data, which is harder to shrug off. Today it reports building permits, which should correct lower after the outsized 13.5% jump in June. A USD/CAD gain above CAD1.0920 may signal a re-test on CAD1.10.

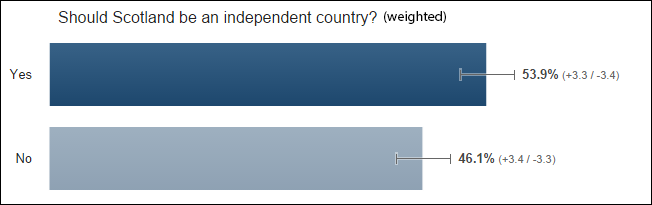

Scotland Poll result: 53.9% Yes

Here are the results of a poll run on a sample of Scottish web users between 7-9 September. The poll reported – when weighted to match the Scottish internet population’s general makeup – a 53.9% ‘Yes’ vote for the question “Should Scotland be an independent country?”

The poll results were from 1,000 people in Scotland (for context, the last YouGov poll was of 1084 poeple). The poll was displayed to web users as they browsed media, mobile, arts & entertainment websites. The question was displayed to 2,873 people, from which 1,000 responded. The “Yes” result was reported with 95% significance (meaning if the same poll were run 100 times, the answer would be “Yes” on at least 95 occasions).

Weighted Results: “Should Scotland be an independent country?

53.9% ‘Yes’

46.1% ‘No’

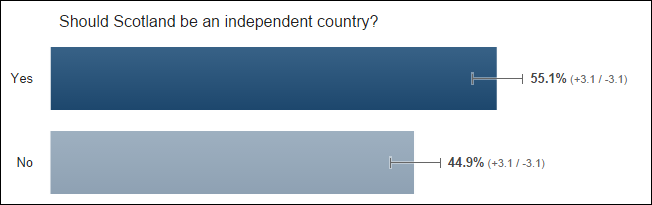

Unweighted Results: “Should Scotland be an independent country?”

The 1,000-person sample didn’t exactly match the makeup of the Scottish population (by age & gender), and therefore the above ‘weighted’ results have been altered to take that into account. For complete disclosure I’ve included the ‘unweighted’ results below, which actually lean further toward ‘Yes’. By unweighted results, I mean the results below are the ‘raw’ data, ignoring whether or not the age/gender of respondents matched the general internet users of Scotland.

55.1% ‘Yes’

44.9% ‘No’.

Latest poll :

47.6% no

42.4% yes

Scottish independence: new poll gives no vote six-point lead | Politics | The Guardian

Of course that they are going to let Scotland go

:)

Latest poll :

47.6% no

42.4% yes

Scottish independence: new poll gives no vote six-point lead | Politics | The Guardian

Of course that they are going to let Scotland go

That was obvious from day one

Nobody is going to let Scotland become independent

That was obvious from day one Nobody is going to let Scotland become independent

I can see it now.

Support for Scots' independence slips behind with days to go: poll

Supporters of keeping Scotland in the United Kingdom have clawed back a 4 percentage point lead over separatists, a YouGov poll showed on Friday, with less than a week to go before Scots vote in a referendum on independence.

The YouGov survey for The Times and Sun newspapers put Scottish support for the union at 52 percent versus support for independence at 48 percent, excluding those who said they did not know how they would vote.

"The 'no' campaign has moved back into the lead in Scotland's referendum campaign," YouGov President Peter Kellner said in a commentary on the survey. "This is the first time 'no' has gained ground since early August."

The indication that support for keeping the United Kingdom intact has drawn slightly ahead in Scotland is of only meagre comfort to unionists; the broader picture painted by recent surveys is that the vote is still too close to call.

Pollsters YouGov and TNS have shown a surge in support for independence since late August as the secessionist campaign led by Alex Salmond won over supporters of the traditionally unionist Labour party and some female voters in Scotland.

So far only one poll this year, from YouGov last weekend, has put the separatists in front. That survey, with a margin of error of plus or minus 2 to 3 percentage points, showed a 2 percentage point lead for the independence campaign.

"Although 'no' is back in front, the 'yes' campaign has held on to most of its gains since early August," Kellner said of YouGov's latest survey, which polled 1,268 people in Scotland between Tuesday and Thursday.

The sudden collapse of the strong unionist lead has prompted investors to sell sterling, shares in companies with Scottish exposure and British government bonds on fears that the United Kingdom might break up.

In the event of a vote for independence on Sept. 18, Britain and Scotland would have to begin work on dividing up the $2.5 trillion UK economy, North Sea oil and the national debt, while Prime Minister David Cameron would face calls to resign.

Scotland would have to decide what currency it would use after London said it could not use the pound in a currency union, while Britain would have to decide what to do about its main nuclear submarine base on the Clyde, which the nationalists would like to eject.

Scotland Referendum: 2 polls say No, 1 says Yes on Saturday’s polls

The picture regarding the Scottish referendum is getting muddier, if we look at the latest polls. One poll shows a clear victory for the Yes campaign, while two others go for No.

As both campaigns are mobilizing their troops in a last minute effort to swing the undecideds, markets are expected to remain jittery.

Here are the three polls:

The Opinium/Observer shows a 53% / 47% lead for the No campaign when excluding the undecideds.

The ICM online poll for the Telegraph shows a lead of 54% / 46% for the Yes campaign.

A Survation poll commissioned by the No campaign shows a 54% / 46% lead for the No campaign.

Needless to say, polling companies have different methods of polling, factoring age differences, extracting answers etc. And, there is a of course a difference between a poll commissioned by a newspaper and one commissioned by one of the sides.

According to the latest odds at the bookies’, a No vote is still priced with 4.75 vs. 1.25, or around 80% of No.

Bookies know the best

Scottish Independence: Ignore The Doomsayers

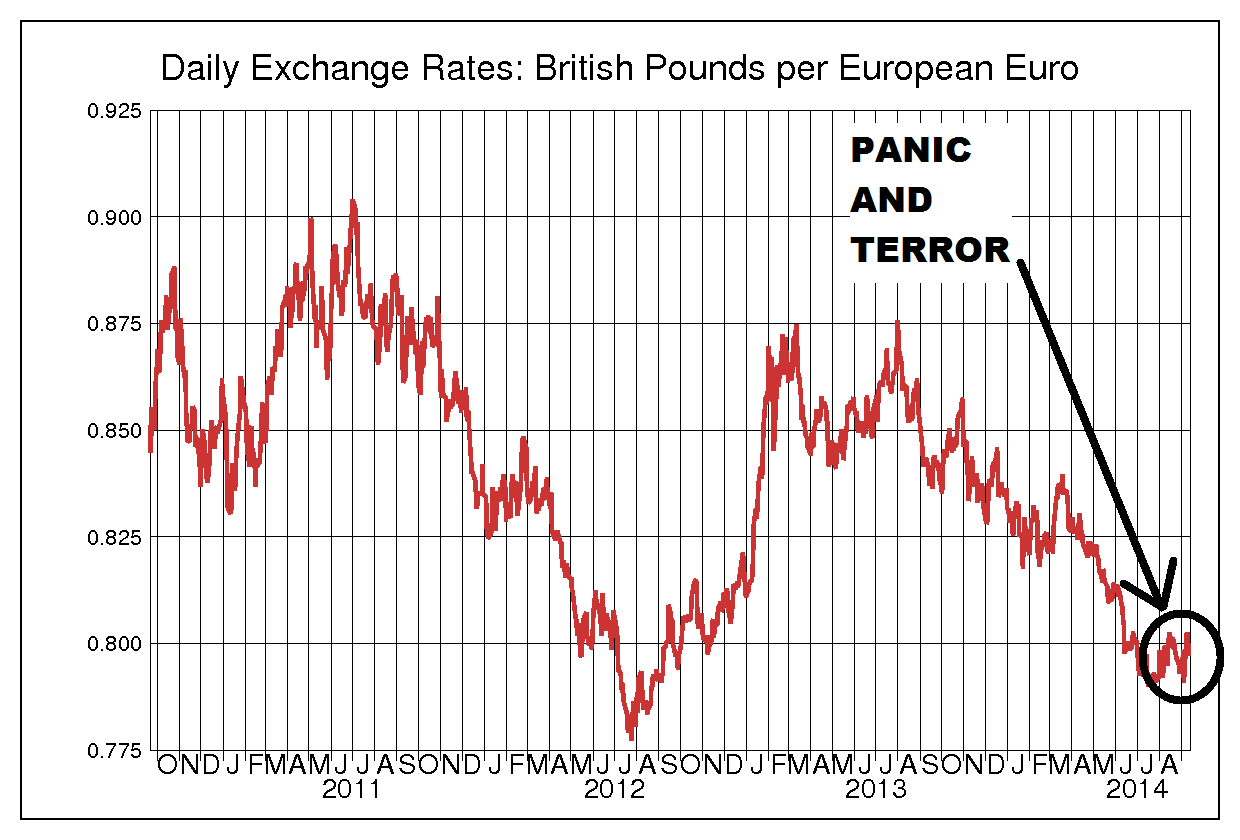

Do you want to see wholesale panic on the world’s financial markets?

Do you want to see terror, despair, and mayhem?

Do you want to see grown men desperately stuffing their money under the mattress, riots in the streets, banks set ablaze, and women running down the road screaming and flapping their hands in terror?

If so, take a look at this chart.

It shows the panic in the financial markets at the risk of Scottish independence.

The chart shows the exchange rate of the British pound against the European euro. All that panic and terror? Look closely at the blip on the right.

Can’t see it? Grab a magnifying glass. The “mayhem” and “turmoil” are that tiny flicker, when the pound dips from 0.80 euros down to 0.79 euros and then back up again.

Aaaaaaarrrrrrrrrrggggggghhhhhhhhhh! Save yourself, Alice! Run for the hills!!!!!!!

Ridiculous, isn’t it?

Yet in the past few days all sorts of people, some of them serious, have been trying to terrify the Scots into rejecting independence with threats that it will lead to financial and economic catastrophe.

The standout so far is the chief economist for Deutsche Bank , who said in a report that if Scotland voted for independence it would be a disastrous economic move that ranked alongside the worst of all time – the blunders of the British Treasury and the U.S. Federal Reserve between 1925 and 1933 that effectively caused the Wall Street Crash and the Great Depression – paving the way for the rise of Hitler, and the Second World War, and so on.

Number of World War Two dead? About fifty million. That’s ten times the entire population of Scotland. This would be quite a feat.

Scots would do well to remember the wise words of Warren Buffett, the world’s second richest man: Most professional economic forecasts compare unfavorably with the fortune-telling you can get at any circus.

When I heard of the report I was so fascinated that I hunted it out online. You can read it here. I was interested to see the detailed Deutsche Bank analysis that led to their alarming conclusion.

And?

The report is simply a series of suppositions and hypotheses. It is an exercise in the subjunctive mood.

If Scotland declares independence, some Scottish people might panic and move their money into English or other foreign banks, the economists say.

Some overseas companies might think twice about investing in Scotland, especially now that it’s is no longer regulated by the likes of Westminster’s magnificent Department of Timidity & Inaction and the Serious Farce Office.

If a Scottish pound existed and if it got into trouble on foreign markets, a Scottish government might have to tighten its budget to prove its mettle to the world, hurting the economy.

If the oil runs out, and over the next thirty or forty years Scotland never produces new industries or enterprises to replace it, they might end up in trouble.

Well, er, yes. But there is no reason to assume any of this is actually likely to happen.

The Deutsche Bank report also suggested that Scotland was dicing with the fate of Ireland, Spain and Portugal, arguing that their recent crises were caused by a threat of leaving the Euro bloc.

Actually, the reverse is true. If Ireland, Spain and Portugal had been truly independent, and kept their own currencies, they would have avoided the boom and busts of the past twenty years. Instead they were cemented to a larger financial bloc, and had to suffer interest rates and exchange rates imposed on them from the center.

The mention of the European woes is timely.

The same arguments being marshaled against Scotland now were pretty much the ones marshaled back in the 1990s against Britain keeping the pound.

If Britain stays out of the euro it risks economic disaster, we were all told.

The big financial institutions will all leave London for Frankfurt, said the wise heads. London will end up as a backwater.

Foreign companies will think twice about investing in the U.K.

You simply cannot go it alone, said the great and the good.

Britain might be forced to impose austerity to establish its credibility on foreign markets.

In the event, none of these things happened. Quite the reverse. Keeping the pound proved an economic boon. It allowed interest and exchange rates to be set locally.

Today the people who wisely rebuffed these arguments from Brussels are now some of the same people wielding them against Edinburgh.

Life no longer imitates art. These days, it imitates irony.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Sterling dropped the most in more than a year versus the dollar as opinion polls highlighted the risk Scotland will vote for independence next week, potentially splintering the U.K.’s 307-year-old union.

Britain’s currency slid to the weakest against its U.S. counterpart since November after a poll by YouGov Plc showed the Scottish independence campaign gained a lead for the first time this year with the referendum due Sept. 18. A “Yes” vote would raise the prospect of a more cautious approach from the Bank of England, which this month kept its key interest rate at a record low as slowing inflation reinforced the case for maintaining emergency stimulus. U.K. government bonds were little changed.

“There seems to be plenty of scope for further pound declines given the pronounced degree of uncertainty and unknowns related to a break up,” said Derek Halpenny, the head of global-markets research at Bank of Tokyo-Mitsubishi UFJ Ltd. in London, said via e-mailed comments. “A ‘Yes’ victory is still hardly priced in as this only has become a focus since the middle of last week when we had the first surprise poll. I see little upside for the pound now through to” Sept. 18.

The pound slid 1 percent to $1.6171 at 9:26 a.m. in London after reaching $1.6145, the weakest since Nov. 26. It was set for its biggest one-day decline since July 5, 2013. Sterling slid 1 percent to 80.08 pence per euro. The yield on 10-year (GUKG10) gilts was at 2.48 percent.

Market Roiled

Following months of surveys that showed Scotland was unlikely to vote to leave the U.K., the latest results have roiled the currency market. One-month implied volatility, a measure of future price swings used to determine the cost of options, surged to 9.315 percent, the most since August 2013.

“The referendum is on a knife edge,” Nick Stamenkovic, an Edinburgh-based fixed-income strategist at broker RIA Capital Markets Ltd., said yesterday. “Markets have been too complacent but are now waking up to the increased risk of Scotland voting for independence.”

The question of whether a go-it-alone Scotland will be able to keep the pound in partnership with the remaining parts of the U.K. has dominated the independence debate with all the major parties in London saying they would oppose it. Scottish First Minister Alex Salmond has argued they would change their view once negotiations began in the event of a vote favoring independence and has said Scotland would refuse to pay its share of the U.K. national debt if they didn’t give in.

read more