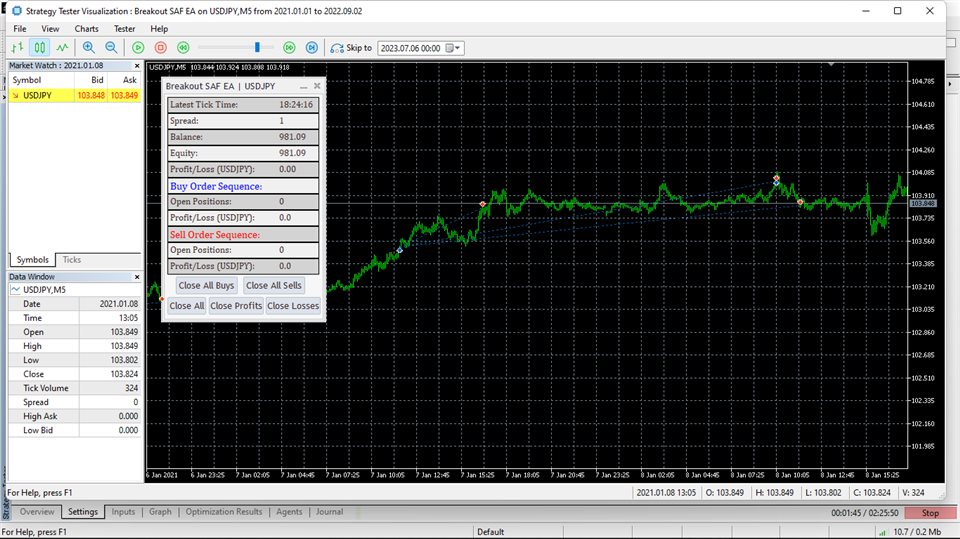

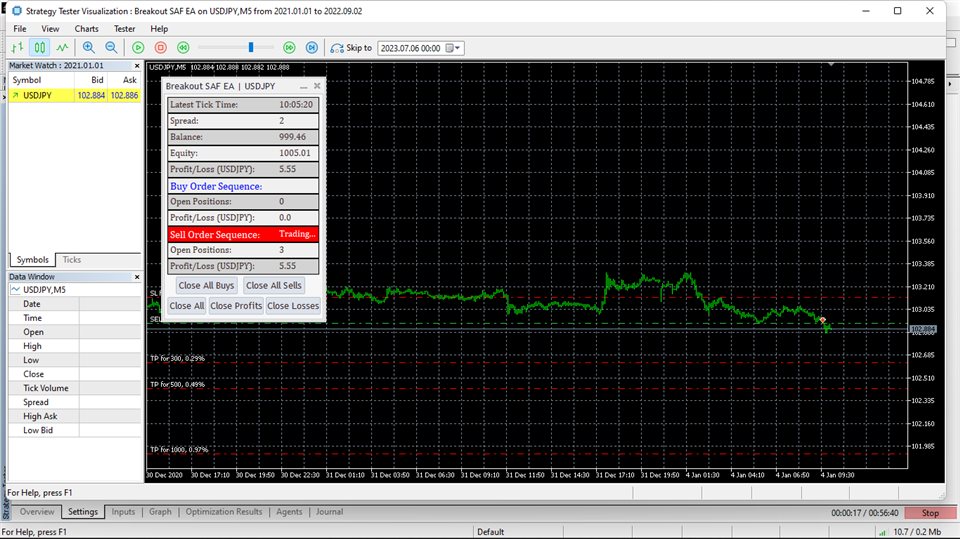

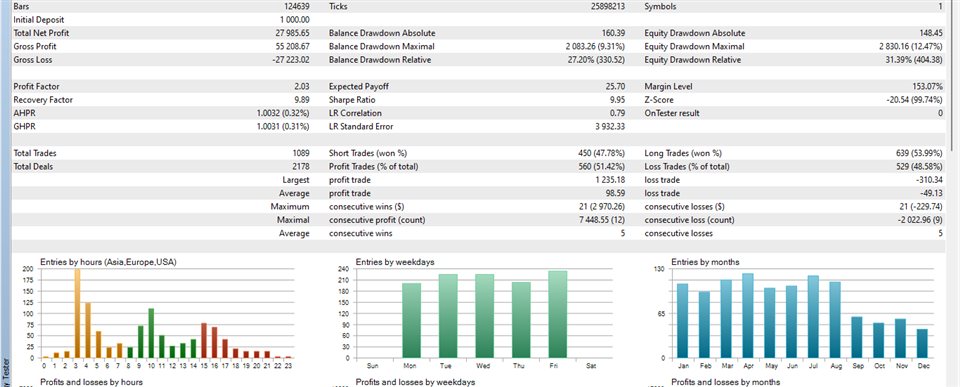

This strategy offers a disciplined and systematic approach to capitalize on price movements after periods of consolidation, presenting an excellent opportunity for profit generation. The strategy provides well-defined entry triggers based on price breakouts above resistance or breakdowns below support levels. This clarity allows for precise execution and eliminates guesswork, ensuring timely and efficient trades.

In contrast to numerous other programs available in the mql5 market, this strategy is a genuine day trading approach. It refrains from employing any martingale or grid techniques and adheres to a rational concept. Works for market pairs and brokers

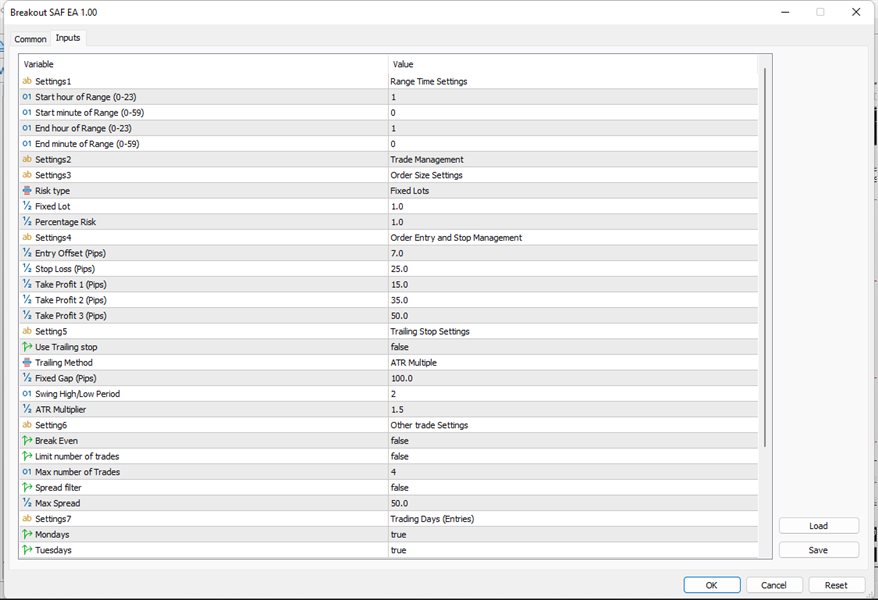

Start hour of Range (0-23) - Start hour of the time range

Start minute of Range (0-59) - Start minute of the time range

End hour of Range (0-23) - End hour of the time range

End minute of Range (0-59) - End minute of the time range

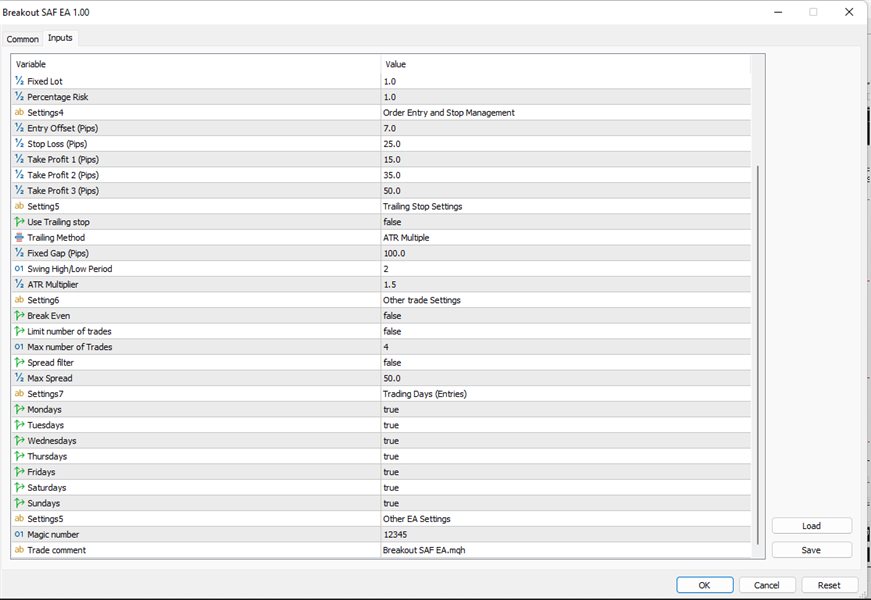

Risk type - Type of Order sizing to use (Percentage of Equity or Fixed lot)

Fixed Lot - Lot size to use if or type is Fixed lots

Percentage Risk - Percentage of Equity to use if or type is dynamic lots

Entry Offset (Pips) - Offset of trades from entry signal in Pips

Stop Loss (Pips) - Stop loss in Pips

Take Profit 1 (Pips) - Take profit of first trade in Pips

Take Profit 2 (Pips) - Take profit of second trade in Pips

Take Profit 3 (Pips) - Take profit of third trade in Pips

Use Trailing stop - Whether to use a trailing stop

Trailing Method - Type of trailing stop to use (Fixed gap or ATR based or Swing High/low)

Fixed Gap (Pips) - Fixed trailing gap in pips (required if trailing type is fixed gap)

Swing High/Low Period - Number of candle to consider for Highs and lows (required if trailing type is Swing High/low)

ATR Multiplier - ATR multiplier to use (required if trailing type is ATR Based)

Break Even - whether the EA should move trades 2 and 3 to break even after TP1 is hit

Open Price Offset - Break even offset from the open price of the trades (important due to spread)

Limit number of trades - Whether to limit the total number of trades the EA can open

Max number of Trades - Maximum of trades EA is allowed to open (required if trades are being limited)

Spread filter - Whether to consider spread when trade is being opened

Max Spread - Maximum spread allowed

Mondays - Whether or not EA should open trades on this Mondays

Tuesdays - Whether or not EA should open trades on this Tuesdays

Wednesdays - Whether or not EA should open trades on this Wednesdays

Thursdays - Whether or not EA should open trades on this Thursdays

Fridays - Whether or not EA should open trades on this Fridays

Saturdays - Whether or not EA should open trades on this Saturdays

Sundays - Whether or not EA should open trades on this Sundays

Magic number - Magic number of the EA

Trade comment - Comment left on the trade being opened

Upon purchasing the EA the user shall receive a step by step instruction manual explaining the strategy in depth, how to best use it, optimization tips as well as best input values for to use for the major currency pairs. The user shall also receive a license file based on their purchase. Please message us with a proof of purchase and all the information shall be shared with you.

Thank you