You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I've been going on for at least five pages.

that there's a balance if there's more than one pair.

this balance is almost impossible to beat

For example, we trade two pairs EURUSD and USDCHF

between them the cross EURCHF, which is essentially just a coefficient

i.e. a triangle is formed automatically, even if the cross is not traded

in this triangle the total balance is ALWAYS a constant

therefore, starting from the moment you start trading on more than one pair, equity will only start melting

and the more active the trade, the faster

i also told you that strategies designed and developed to work on one pair stop working when there is more than one pair!

I do not think that all

i don't think so, if you study it thoroughly and get to the point, you won't sell out

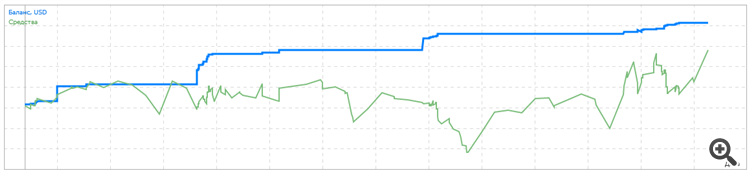

Here's an example of portfolio trading, day 4 is up:

this strategy is good because it allows you to trade high risk

Don't you think you are contradicting yourself in these posts? Or am I missing something?

Don't you find yourself contradicting yourself in these posts? Or am I missing something?

read carefully

compared a strategy written for a portfolio and for one pair

Yusufhoja decided to apply the strategy to a portfolio that does not support multi-currency trading

that's what we're talking about

read carefully

The strategy written for a portfolio and for one pair is being compared

Got it.

read carefully

compared a strategy written for a portfolio and for a single pair

Yusufhodja decided to apply the strategy to a portfolio whose matrix does not support multi-currency trading

about it.

But I think that if the same EA is put on several symbols and each one takes into account peculiarities of the symbol (say its volatility), the result may be good if the EA's strategy is good. And if all advisors are on one account, the diversification effect will appear, and the maximum drawdown will be less than in the case of trading with one EA and the lot equal to the sum of lots of each symbol.

However, I believe that if the same EA is placed on several symbols and each EA takes into account the peculiarities of the symbol (say its volatility), then the result can be good, if the strategy of the EA is good. And if all of the EAs stand on one account, the diversification effect will appear, and the maximum drawdown will be less than in the case of trading one EA and the lot equal to the sum of lots of each symbol.

for the third time it will be said

the mutual influence of pairs on each other should be considered in the portfolio

if no such analysis is available, it is better to trade a single pairfor the third time it will be said

the portfolio must take into account the mutual influence of the pairs on each other

Who cares? If each expert is tuned and tested on the respective symbol and shows good results?

What difference does it make? If each expert is set up and tested on the appropriate symbol and shows good results?

huge

availability of multi-currency analysis draws equi

and lack of - rolls (see previous pages)What difference does it make? If each Expert Advisor is set up and tested on the appropriate symbol and shows good results?

If open positions do not overlap in time, there is no difference.

But where have you seen a large number of profitable Expert Advisors?

huge

Having a multi-currency analysis pulls an equi

You are breaking the logic of reasoning. According to your logic, you have strategy A and strategy B. If some analysis used in strategy B improves its performance, but such analysis is absent in strategy A, it means that strategy A is bad.

Or maybe it is not needed in strategy A. They are completely different strategies.

If we hypothetically assume that a profitable EA is running on each of the symbols forming the loop, then the overall result should also be a profit and not a loss.