Join our fan page

- Views:

- 21353

- Rating:

- Published:

- 2010.01.26 11:13

- Updated:

- 2021.10.29 13:03

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

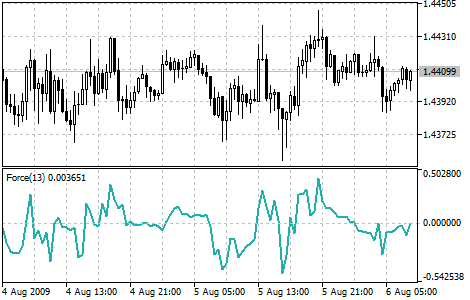

Force Index technical indicator was developed by Alexander Elder.

This index measures the Bulls Power at each increase, and the Bears Power at each decrease. It connects the basic elements of market information: price trend, its drops, and volumes of transactions. This index can be used as it is, but it is better to approximate it with Moving Average. Approximation using the short moving average (the author proposes to use 2 intervals) contributes to finding the best opportunity to open and close positions. If the approximations is made with long moving average (period 13), the index shows the trends and their changes.

- It is better to buy when the forces become minus (fall below zero) in the period of indicator increasing tendency;

- The force index signalizes the continuation of the increasing tendency when it increases to the new peak;

- The signal to sell comes when the index becomes positive during the decreasing tendency;

- The force index signalizes the Bears' Power and continuation of the decreasing tendency when the index falls to the new depth;

- If price changes do not correlate to the corresponding changes in volume, the force indicator stays on one level, which tells you the trend is going to change soon.

Force Index indicator

Calculation:

The force of every market movement is characterized by its direction, scale and volume. If the closing price of the current bar is higher than the preceding bar, the force is positive. If the current closing price if lower than the preceding one, the force is negative. The greater the difference in prices is, the greater the force is. The greater the transaction volume is, the greater the force is.

FORCE INDEX (i) = VOLUME (i) * ((MA (ApPRICE, N, i) - MA (ApPRICE, N, i-1))

where:

- FORCE INDEX (i) - Force Index of the current bar;

- VOLUME (i) - volume of the current bar;

- MA (ApPRICE, N, i) - any Moving Average of the current bar for N periods: Simple, Exponential, Weighted or Smoothed;

- ApPRICE - applied price;

- N - averaging period;

- MA (ApPRICE, N, i-1) - any Moving Average of the previous bar.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/29

Envelopes

Envelopes

The Envelopes Indicator is formed by two Moving Averages, one of them is shifted upward and another one is shifted downward. The selection of optimum relative number of band margins shifting is determined with the market volatility: the higher the latter is, the stronger the shift is.

Detrended Price Oscillator (DPO)

Detrended Price Oscillator (DPO)

The Detrended Price Oscillator eliminates the trend effect of price movement. This simplifies the process of finding out cycles and overbought/oversold levels.

Fractals

Fractals

The Fractal is one of 5 indicators of Bill Williams’ trading system, which allows to detect the bottom or the top.

Gator Oscillator

Gator Oscillator

The Gator Oscillator is based on the Alligator and shows the degree of convergence/divergence of the Balance Lines (Smoothed Moving Average).