- www.mql5.com

Thanks for that, but I am afraid after reading it i am still none the wiser

I think the below info matched what you are looking for.

If your broker lot size calculate 0.1 pips = $1 and your broker leverage is 100:1 . and you have $100 account balance and you open a position 0.1/pips, your trade will close when your balance remain $49-$50 that is margin call. which means you don't have enough balance to continue trading with the volume of your trade.

- www.mql5.com

Hi All,

It kills me that I don't quite understand this. Could someone put it really simply for me. I have leverage of 500:1. If I run an EA, and get a "margin level" of say 5000... what does this mean exact. If I run it a second time and get 3000... which time did I use more margin? What is the highest, or lowest it can get if my leverage is 500:1? I'd really appreciate if someone could just spell it out for me in plain english (or mathematics :))

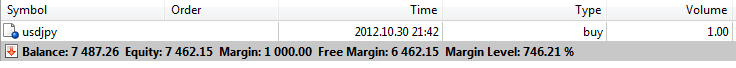

OK, to put it easy - I guess that you you know that in order to open a position, you must secure it with your broker using a margin. On the leveraged markets, e.g. forex, futures or CFDs, there is a leverage which allows you to control a specific amount worth of an instrument with just a percentage of it used as margin. For example, if your leverage is 1:100, it means that in order to buy or sell 1 lot (100 000$) of USDJPY, you need only 1% of it - which is 1 000$ as margin. See below screenshot of MetaTrader5 "Trade" tab, showing account parameters for 1 lot of USDJPY, on an account with 1:100 leverage:

So now you can easily see that Margin Level = Equity / Margin *100 [%]

Obviously you need to be aware of the fact that there are two margin levels at which your broker could intervene:

Margin Call level - level at which your broker will inform you that you have to either close at least some of the existing positions or deposit more funds because your margin felt below some fixed % e.g. below 50%

Margin Stop Out level - level at which your broker will forcibly close your position(s) in order to protect himself from covering your losses if you continue to wipe-out your account (remember that you can trade such huge amounts of money only thanks to leverage - and that means that if your account is gone, then if there were no margin calls or stop-outs forcibly closing your positions, your broker would have to pay money to the other side of transaction if the instrument price would still go the "wrong" way)

Hope that it makes it a little bit clearer for you.

OK, to put it easy - I guess that you you know that in order to open a position, you must secure it with your broker using a margin. On the leveraged markets, e.g. forex, futures or CFDs, there is a leverage which allows you to control a specific amount worth of an instrument with just a percentage of it used as margin. For example, if your leverage is 1:100, it means that in order to buy or sell 1 lot (100 000$) of USDJPY, you need only 1% of it - which is 1 000$ as margin. See below screenshot of MetaTrader5 "Trade" tab, showing account parameters for 1 lot of USDJPY, on an account with 1:100 leverage:

So now you can easily see that Margin Level = Equity / Margin *100 [%]

Obviously you need to be aware of the fact that there are two margin levels at which your broker could intervene:

Margin Call level - level at which your broker will inform you that you have to either close at least some of the existing positions or deposit more funds because your margin felt below some fixed % e.g. below 50%

Margin Stop Out level - level at which your broker will forcibly close your position(s) in order to protect himself from covering your losses if you continue to wipe-out your account (remember that you can trade such huge amounts of money only thanks to leverage - and that means that if your account is gone, then if there were no margin calls or stop-outs forcibly closing your positions, your broker would have to pay money to the other side of transaction if the instrument price would still go the "wrong" way)

Hope that it makes it a little bit clearer for you.

Could someone tell what is the best broker to work with MT5?

You can search in http://www.forexpeacearmy.com/public/forex_broker_reviews and http://www.forexfactory.com/forumdisplay.php?f=74.

You can also google MT5 broker review or something

And please don't hijack someone else topic asking something that is of topic.

- www.forexpeacearmy.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi All,

It kills me that I don't quite understand this. Could someone put it really simply for me. I have leverage of 500:1. If I run an EA, and get a "margin level" of say 5000... what does this mean exact. If I run it a second time and get 3000... which time did I use more margin? What is the highest, or lowest it can get if my leverage is 500:1? I'd really appreciate if someone could just spell it out for me in plain english (or mathematics :))