Good reading!

There are some indies and posts on public section but we don't have any on Elite.

The rest of articles by Ed Thorp on the same subject

To remind who Ed Thorp is : Edward O. Thorp - Wikipedia, the free encyclopedia

He is by all means an interesting man (at the least) and not to mention that he was the first one to mathematically prove that house can be beaten in blackjack if one counts the cards

...

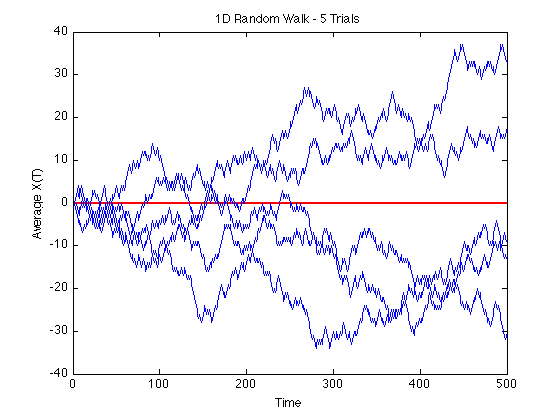

For all wondering what Monte Carlo probability and all the stuff related to it is all about, here are some very useful links. Did not upload the files here even though they are free of charge and are available publicly (they are posted at Florida State University site) simply because of their sizes (from 2 to almost 6 MB). Just one example of what can be found in these :Looks familiar?

Books are very well written so even the ones without math inclinations will find it interesting

_______________________

The links :

probability - http://people.sc.fsu.edu/~jburkardt/presentations/monte_carlo_probability.pdf

sampling - http://people.sc.fsu.edu/~jburkardt/presentations/monte_carlo_sampling.pdf

simulation - http://people.sc.fsu.edu/~jburkardt/presentations/monte_carlo_simulation.pdf

...

We have often heard of GARCH (generalized autoregressive conditional heteroskedasticity )

We have often been told by experts that it is complicated and that whoever knows what is it all about gets a great job at great brokerage firms with a great salary. And that those "wizards" are able to calculate GARCH without computers ...

Oh well. Of course they are. We all are  Just read this (especially the end of the document) Ready for a new job?

Just read this (especially the end of the document) Ready for a new job?

Something that all are interested in (and even more ones that are denying it without even doing any kind of test) Not a holly grail but it certainly is interesting to see, read and to clarify some things (especially the "what time frames to use in trading" type of questions)

Thorp's roulette edge and Fortune's Formula

Not directly related to trading the forex, but still fascinating, is Thorp's story on how he teamed up with Claude Shannon (who invented information theory in his master's thesis) to build the first wearable computer that provided an exploitable edge in roulette gambling. The author of the attached article is Thorp himself.

Another very interesting highly recommended reading featuring Thorp nad many others is the book "Fortune's Formula" telling the story of Kelly's formula for money management. See Amazon's entry.

The rest of articles by Ed Thorp on the same subject

To remind who Ed Thorp is : Edward O. Thorp - Wikipedia, the free encyclopedia

He is by all means an interesting man (at the least) and not to mention that he was the first one to mathematically prove that house can be beaten in blackjack if one counts the cardsI cannot imagine how he made money - the maths in article 1 are pitiful. Either the author or he is wonderful with mis-stating the numbers. Certainly both are responsible for not correcting them.

He claims 1 billion shares traded a year by this one broker - who handled 66% of the traded shares for his firm.

He claims $1,600,000 savings in brokerage fees from a 16 cents cost reduction per share from the broker.

He claims an average 1,500 shares trade size, $36 per share average.

He claims they make 4,000 such average trades a day, 1,000,000 trades a year, 1,500,000,000 shares traded.

1,000,000,000 shares traded a year get the $0.16 per share broker saving.

Do the maths.

That's either $160,000,000 saving or it is not.

Did they mean $0.16 saving per trade (of 1,500 shares each) at 4,000 trades a day? No! The 4,000 trades a day x $0.16 x 253 trading days is only $161,920 per year.

He claims a saving of $1,600,000 a year.

How does the inventor of card counting miss the decimal place by TWO places!

Put another way, that ALLEGED 16 cents saving per 1,000,000,000 shares traded per year equals nearly 50% of their entire invested capital of the "temporarily high" $340,000,000!

All total frog's doodoo!

It is a very interesting series of articles and does define arbitrage well - having read all of them now. But leave the maths alone, they bare no resemblance to realty.

...

dancingphil

As far as I see he claims 0.16¢ per share not $0.16 per share, so there is no flaw in that part of math

@ Mladen: You are 100% right, and the error is entirely my fault. I did read 0.16c as $0.16.

I stand corrected!

Phil

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

In a last couple of days we have be exchanging some documents which is very good (learning, learning, learning ...).

But it made me realize that we do not have a separate thread for stuff like this : readings about trading. So I decided to open a thread for it

To start with : this is an article from Willmot site (articles are free, but I feel that we can benefit if some of the stuff posted there is posted here too). This is an article from Ed Thorp about Statistical Arbitrage. What made me post it are the last 2 sentences, but please read the rest too