Setup 91 Larry Williams With Notifications

- Göstergeler

- Rafael Henrique Capati

- Sürüm: 1.12

- Güncellendi: 31 Mart 2021

- Etkinleştirmeler: 5

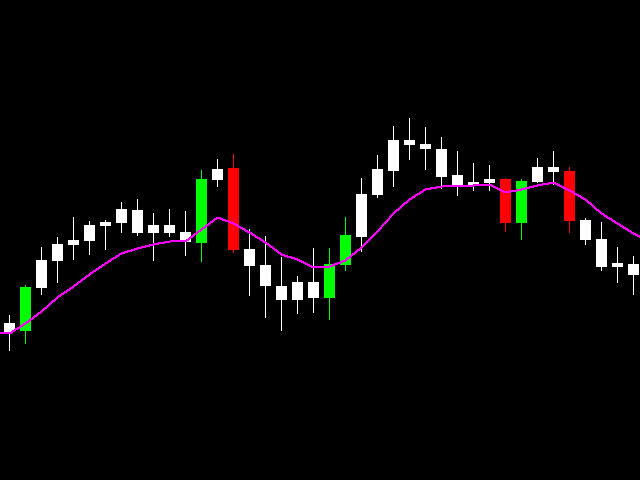

Setup 9.1 strategy created by the North American trader Larry Williams.

SIMPLE setup, effective, with a good level of accuracy and excellent return.

Buy Signal:

- Exponential moving average of 9 (MME9) is falling, wait it to TURN UP (in closed candle).

- Place a buy stop order 1 tick above the HIGH of the candle that caused the turn to occur.

- Entry is performed on the next candle that breaks that high. If it does not break on the next candle, you can cancel the order and wait for a new signal or if the MME9 continues to fall, the entry remains valid (optional). If the moving average turns down (oposite signal), the setup is canceled.

- Stop-loss 1 tick below the low of the candle that gave the signal. After the buy, the trade is conducted by MME9, that is, until it turns down and the candle that caused this turn loses the low.

Sell Signal:

- Exponential moving average of 9 (MME9) is rising, expect it to TURN DOWN (in closed candle).

- Place a sell stop 1 tick below the LOW of the candle that caused the turn to occur.

- Confirmation of entry is performed on the next candle that breaks this low. If it doesn't break on the next candle, the order can be canceled. However, if the moving average continues to rise, it is possible to keep the order open until the break occurs. If the moving average turns up (oposite signal), the setup is canceled.

- Stop-Loss 1 tick above the high of the candle that gave the signal.

- After the sell, the trade is conducted by MME9, that is, until it turns up and the candle that caused this turn loses its high.

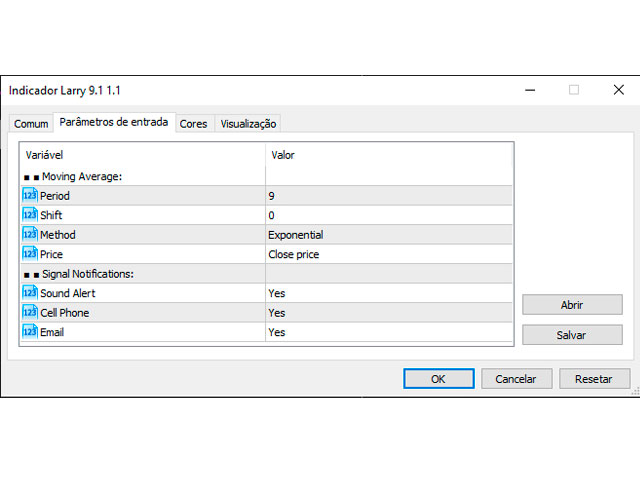

Notifications

You do not need to be staring at the chart all the time waiting for a signal, it is now possible to receive signal notifications on your cell phone, email or a sound alert on the platform. This can help you a lot if you don't have a lot of time to stay on the screen or are simply waiting for confirmation to position yourself.

This is done so that investors do not have to wait long to obtain a perfect configuration. At the right time, they will receive the indicator alert and will be able to analyze the setup formation.