Choppa bot

- Эксперты

- Tyler Wayne Henry

- Версия: 1.1

- Активации: 20

This code snippet is a comprehensive Expert Advisor (EA) developed for the MetaTrader platform, utilizing or MQL5 programming languages. The EA, named "CHOPPA BOT," is designed to automate trading strategies based on a combination of technical indicators, including the Relative Strength Index (RSI), Parabolic SAR, Exponential Moving Averages (EMA), Simple Moving Average (SMA), and the Average Directional Movement Index (ADX). Here's an overview of its functionality:

-

Initialization and Setup: Upon initialization, the EA sets up various trading parameters and indicator handles for RSI, Parabolic SAR, EMA, SMA, and ADX. These indicators are used to generate buy or sell signals based on the market conditions.

-

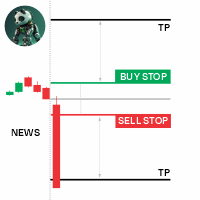

Open Position Logic: The EA checks for trading signals based on the criteria specified by the combination of indicators. For instance, a buy signal might be generated if the current price is above the Parabolic SAR value, the EMA is above the SMA, the RSI is below the overbought level, and the ADX indicates a strong uptrend. Sell signals are generated under opposite conditions.

-

Management of Open Positions: The EA continuously monitors open positions and implements logic to close positions based on several conditions. It considers the current market price relative to the Parabolic SAR, EMA, and SMA values, as well as the position's profit or loss. The code includes commented-out logic for closing positions when specific profit or loss criteria are met, or when the market trends reverse as indicated by the indicator values.

-

Risk Management: The EA incorporates risk management features, such as calculating the maximum loss and profit percentages to determine when to close all positions and stop trading. This is aimed at protecting the account from significant losses and securing profits.

-

Trade Execution and Management: The EA executes trades with predefined lot sizes, and sets stop loss and take profit levels based on the strategy's requirements. It also includes functions to count the number of open buy and sell positions and to close all positions if necessary.

-

Event Handling: There's a placeholder for handling trade transactions, allowing for further customization to respond to trade events, such as successful trade executions or errors.