Strategy

Forex on lines of a trend of Demark

Practically all traders use the trend lines noting the range of the price movement. It very much helps with trade, saving from many mistakes. However specifics of creation of lines of a trend such is that on the same schedule different traders will build them differently. In this regard and strategy Forex on lines of a trend at all will differ. One of ways of creation of trend lines was described by Thomas Demark, having called them the TD-lines.

Search

of reference points for strategy Forex on lines of a trend

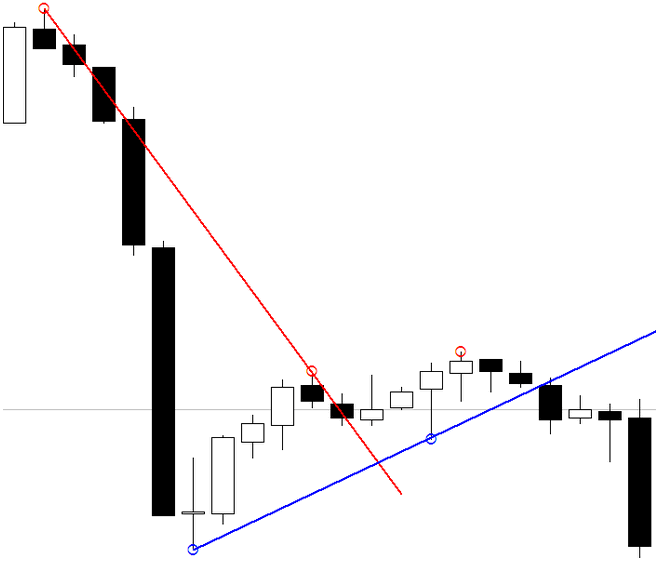

During the researches Demark has output one important rule consisting that for the correct creation of trend lines it is necessary to define reference points competently. On them construction is also conducted. As reference points he has suggested to use maxima and minima for trading day, above and below which, respectively, a price this day didn't rise. Only in this case strategy Forex on lines of a trend can be considered, according to Demark, effective.

The graph control points are presented in the form of red (highs) and blue (minima) points. Note that the anchor points and well-known Fractals often coincide, but not always.

To build independently Demark's points absolutely optional as there is a ready indicator "Compass Demark" which will construct them for you. Download indicator can be the link at the end of the article.

Building

Forex strategies on trend lines

Having defined reference points, it is possible to start creation of trend lines. The descending line of a trend is under construction on maxima so that each subsequent reference point was lower than previous. For the ascending trend on the contrary, i.e. basic points minima undertake so that the subsequent point was higher than previous. After that strategy Forex on lines of a trend can already be used.

Signal

to trade on strategy Forex on lines of a trend

Generally strategy Forex on lines of a trend is quite simple as it gives quite unambiguous signals for an entrance to the market. Signal on opening of a long position will be probity the descending trend line and closing of a candle is higher than the punched level.

Signal on opening of a short position will be probity the ascending trend line and closing of a candle is lower than this level.

Installation

of a take-profit on strategy Forex on lines of a trend

Take profit it can be exposed in several ways. They depend on your style of trade and differ in a ratio of profit to risk and accuracy.

1. Aggressive way. Having received a signal to purchase, it is necessary to find a minimum which is spaced far apart all from the line of a trend. This distance is laid off from a break point up and notes take-profit level for the opened transaction. In case of a signal for sale the maximum with the greatest distance to the line of a trend undertakes.

2. Conservative way. After break of the descending trend line the intra day minimum located under the line of a trend undertakes. This size is postponed from a point of break and notes the level of exposure of a take-profit. At the descending trend strategy Forex on lines of a trend is applied on the contrary, i.e. from the price of an entrance the distance between an intra day maximum and the line of a trend is laid off.

3. One more conservative way. For installation of a take-profit when opening a long position the distance between the line of a trend and the price of closing located below than this line that day in which the next intra day minimum was observed undertakes. It is necessary to take the closing price, but not value of an intra day minimum. Similarly the distance and for a short position pays off, but the closing price in day of formation of an intra day

False

breakdowns in strategy Forex on lines of a trend

False breakdown call a situation when the price contrary to forecasts has returned for the punched level, without having allowed the transaction to achieve the objectives. We will consider two such situations:

1. The price punches the line of a trend then already new line for opposite directed trend is under construction. However soon occurs probity and the new line that speaks about a repeated turn of the price movement. In this case new break is considered more actual, than old, and strategy Forex on lines of a trend recommends to close all positions opened earlier better at the current price.

On an example the situation when the price has punched the descending line of a trend with closing of a candle above her in the beginning is presented. It has given a signal to purchase. However soon the price was developed to punch the built ascending line of a trend. As the open transaction hasn't worked, strategy on lines of a trend recommends it to close Forex and to open already new position for sale according to a new signal.

2. In certain cases the price, having punched the line of a trend, sharply is developed and comes back to borders of the channel. It can happen because of an exit of any news capable to break balance between bulls and bears.

The

validity of price breaks at strategy Forex on lines of a trend

There are several rules by determination of the validity of break of the line of a trend.

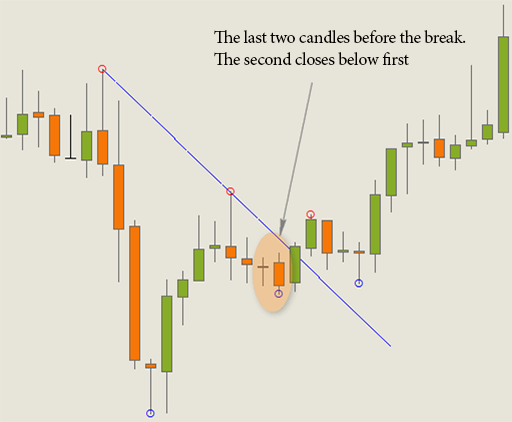

1. If the second of the last two candles before break was closed below, than the first, then the validity of such break is more probable. On an example it is shown that before breakdown of the descending line of a trend two bear candles were formed. Here the described rule closing of the second candle below closing of the first has worked that has confirmed the validity of breakdown. This strategy Forex on lines of a trend is applicable both for ascending, and for the descending trend.

2. Break can be considered true if the breakdown candle opens under the ascending line of a trend or over the descending line of a trend. On an example it is shown how the price at once opens outside a trend, but doesn't punch his line the candle.

Strategy Forex on lines of a trend generally on an hour time frame of H1 is applied. Only in this case it is possible to achieve the best result. However for check of the validity of breakdown nevertheless it is better to be guided also on more smaller time frame.

Now perhaps and all!

Perhaps I will shortly lay out one more strategy for T. Demark

To get acquainted with the “Compass Demark” indicator

I wish all profitable trade :)

P. s and here is the promised sequel to: "Strategy for trend line Demark II"