Everse

- エキスパート

- Ubaidillah

- バージョン: 1.1

- アップデート済み: 3 4月 2019

- アクティベーション: 5

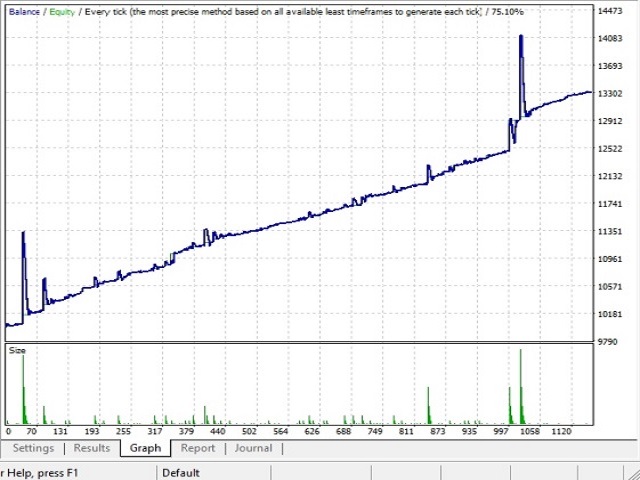

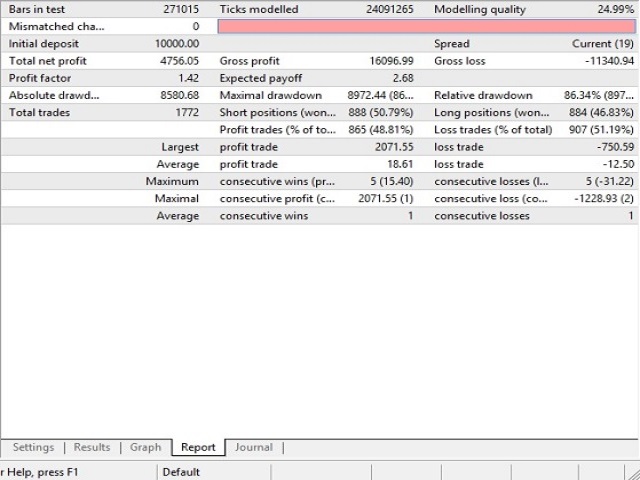

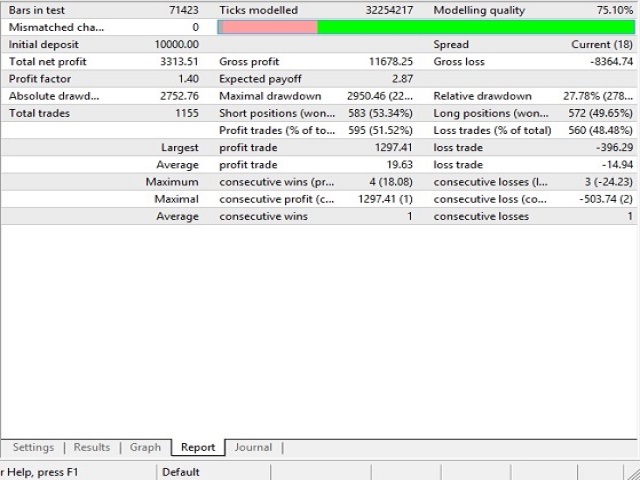

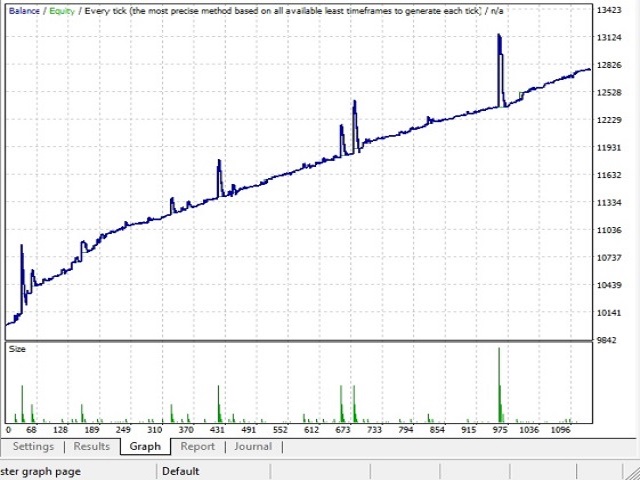

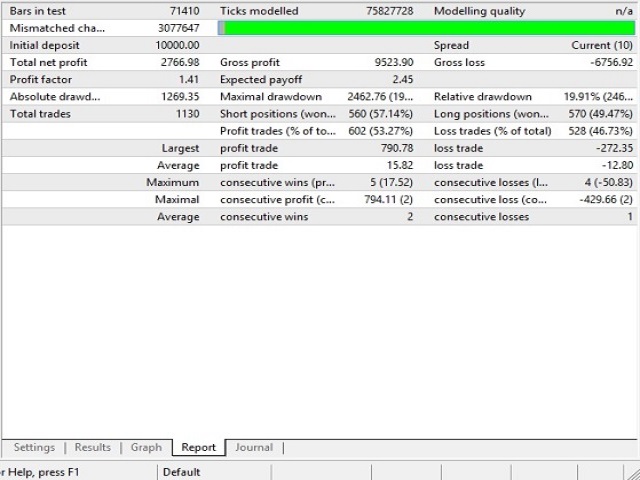

Everse is an Expert Advisor (EA) that build based on martingale, anti-martingale and hedging method.

The main idea is place buy and sell in parallel, save the unprofitable positions with martingale, and take profitable positions as a bonus.

The RSI, iClose, iHighest and iLowest indicators are used for entries. The highest and lowest prices are to indicate the range of new orders, where the next order, with same type must be higher than 75% of difference between this lowest and highest prices.

And the anti-martingale method is actually part of the martingale strategy, its a backup strategy when the market price sudden change to reverse, or there is any huge spread during crossing the market.

Pairs and timeframes

This EA is recommended for use on GPBUSD at M5 timeframes, with 10000 of initial balance, lot=0.02 and broker must allow hedging.

Parameters

- MagicNumber - the mark number used to identify orders, which are sent and managed by this EA. If this EA runs on multiple pairs, every pair must be run with different magic number, for example: GBPUSD - 100001, EURUSD - 200002, XAUUSD - 300003.

- NumCandle - the number of candles that used for calculate highest and lowest prices. For example NumCandle = 60 at M1 timeframes, its mean the range of order to new order depend on the highest and lowest price of candle one hour before. If its set to 0, then default value of EA will be taken.

- CloseAtStop - the option to close or not all orders at Remove EA action. Only remove orders that have magic number that specified by MagicNumber above.

- ShowHighLowLines - display or not the highest and the lowest lines based on NumCandle above.

- OrderLots - initial lots value used for the initial orders. For example: OrderLots = 0.01, 0.02, 0.04, 0.08, etc.

- Slip - slippage value that used for every new order request.

- RsiMinimum - minimum value of RSI Indicator that allow new sell order.

- RsiMaximum - maximum value of RSI Indicator that allow new buy order.