Market Condition Evaluation based on standard indicators in Metatrader 5 - page 107

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.11 07:41

EUR/USD Forecast May 11-15 (based on forexcrunch article)

EUR/USD moved up to new highs, but shed the gains in a volatile week. The upcoming week features yet another chapter in the Greek drama as well as important GDP data . Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Forum on trading, automated trading systems and testing trading strategies

Gold is Reaching at 1270

Sergey Golubev, 2013.07.01 21:04

How can we know: correction, or bullish etc (in case of using indicator for example)?

well ... let's take AbsoluteStrength indicator from MT5 CodeBase.

bullish (Bull market) :

bearish (Bear market) :

ranging (choppy market - means: buy and sell on the same time) :

flat (sideways market - means: no buy and no sell) :

correction :

correction in a bear market (Bear Market Rally) :

bonus just for signing up , great support.

don't wait...

Aussie rises to 3-1/2 month highs

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.19 11:43

Goldman Sachs technical analysis says EUR/USD looking constructive: oscillators, Elliot Wave (based on forexlive article)

"EUR/USD is looking increasingly stable/constructive as weekly and monthly oscillators are crossing positively from the bottom of their multi-year range."

"The low (which reached 1.0485) came close enough to satisfying a very big ABC that started at the Jul. '08 high. The month of April formed a bullish outside/engulfing pattern. The month of May has already made a new high. All of this suggests that there is a strong likelihood that the market will remain stable/constructive in the near-to-medium term time horizon."

Forum on trading, automated trading systems and testing trading strategies

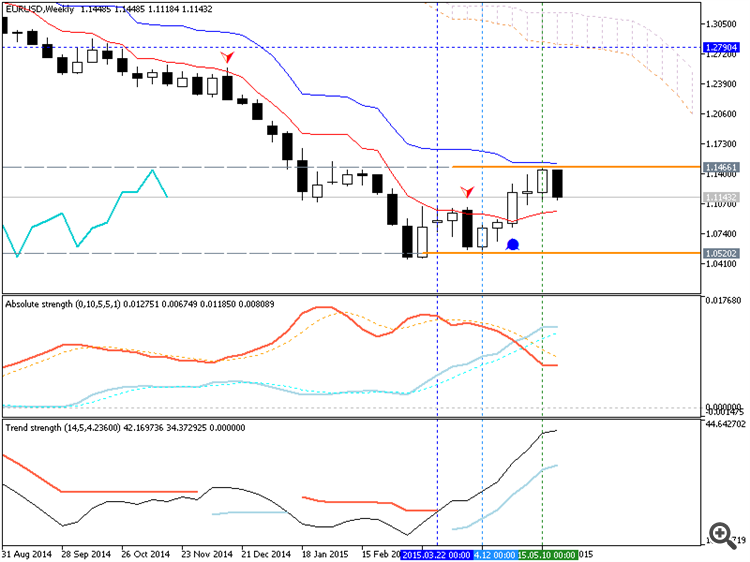

EURUSD Technical Analysis 2015, May: Bearish with Weekly Rally and Monthly Ranging with 1.0461 Key Support Level

Sergey Golubev, 2015.05.20 04:55

This week's candle was opened in 1.1200 and W1 price is breaking next resistance levels for now: 1.1391

So, if someone used my suggestion and opened buy stop order at 1.1240 (see first post of this thread) - it should be +180 pips in profit for now (based on 'equity open trades').

This week's candle was opened in 1.1448 after the price broke 1.1391 resistance in the last week. Next resistance level is 1.1466

W1 price is going to be ranging between 1.1448 resistance and 1.0520 support levels.

-------------

If we look at Brainwashing system setup so it is not confirmed uptrend was started on ranging:

------------

If wee use PriceChannel Parabolic system so we can get same information: market rally may be started in ranging way:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.22 09:26

2015-05-22 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - German GDP]if actual > forecast (or previous data) = good for currency (for EUR in our case)

[EUR - German GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

"The German economy continued to grow at a slightly slower pace. As the Federal Statistical Office (Destatis) already reported in its first release of 13 May 2015, the gross domestic product (GDP) increased 0.3% - upon price, seasonal and calendar adjustment - in the first quarter of 2015 compared with the fourth quarter of 2014. A marked increase of +0.7% was recorded in the last quarter of 2014, as reported earlier. For the entire year of 2014, GDP values did not change as compared with the figures published so far (+1.6%)."MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.05.22

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 24 pips price movement by EUR - German GDP news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.22 15:04

2015-05-22 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Consumer Price Index]if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in April on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index declined 0.2 percent before seasonal adjustment.

The index for all items less food and energy rose 0.3 percent in April and led to the slight increase in the seasonally adjusted all items index. The index for shelter rose, as did the indexes for medical care, household furnishings and operations, used cars and trucks, and new vehicles. In contrast, the indexes for apparel and airline fares declined in April."

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2015.05.22

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 59 pips price movement by USD - Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.23 10:55

Holiday Conditions and Record Equities Remind of Bigger Liquidity Risks (based on dailyfx article)

If capital markets correct under risk aversion - inevitable over a long enough period - will the retreat be orderly or chaotic? There is usually at least a little panic in a bearish phase after a long build up, but conditions behind the current six-year bull trend suggest there may be more acute trouble when speculative appetites cool. Liquidity risks may have been fostered by the aggressive risk-taking and incredible policy intervention through these past years. We've seen how important liquidity is in the post-Lehman collapse and SNB's withdrawal of its exchange rate floor. But, what happens when the traditional outlets for safety are distorted? We consider the risks - and perhaps some opportunities - of liquidity issues in the unavoidable, next market bear wave in this weekend Strategy Video.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video February 2014

Sergey Golubev, 2014.02.10 11:15

06: DURABLE GOODS

This is the 6th video in a series on economic reports created for all markets, or for those who simply have an interest in economics. In this lesson we cover the Durable Goods report.

============

Previous parts:

============

Durable Goods OrdersDurable Goods Orders (DGO) is an indicator of orders placed for relatively long lasting goods. Durable goods are expected to last more than three years, e.g.: cars, furniture, appliances, etc.

This indicator is important for the market because it gives an idea of the consumers' confidence in the current economic situation. Since durable goods are expensive, the increase in the number of orders for them shows the willingness of consumers to spend their money on them. Thus, the growth of this indicator is a positive factor for economic development and leads to growth of the national currency.

============

USDJPY M5 : 47 pips price movement by USD - Durable Goods Orders news event

EURUSD M5 : 32 pips price movement by USD - Durable Goods Orders news event :