- Why this price changed on this way?

- Gold - XAUUSD --- News

- Market Condition Evaluation based on standard indicators in Metatrader 5

Hello everybody ,a very long period of time i triyng to understand how the (economical events) news affect the market , and i never seen some logical effect in this. For example today for GBP is no news at all but he is rising against USD,on USD we have a lot of positive news,why EUR going rise if there is bad news for today...??? it is somebody who can explain this unlogical events ?

Usually how it goes is :

Someone leaks the figure to big players , the market makes a massive move . We think "what a massive move out of nowhere"

Then the day of the print comes and most of it ,volume-wise, is priced in .

(you can also substitute "leaks figure" with "expect it to be")

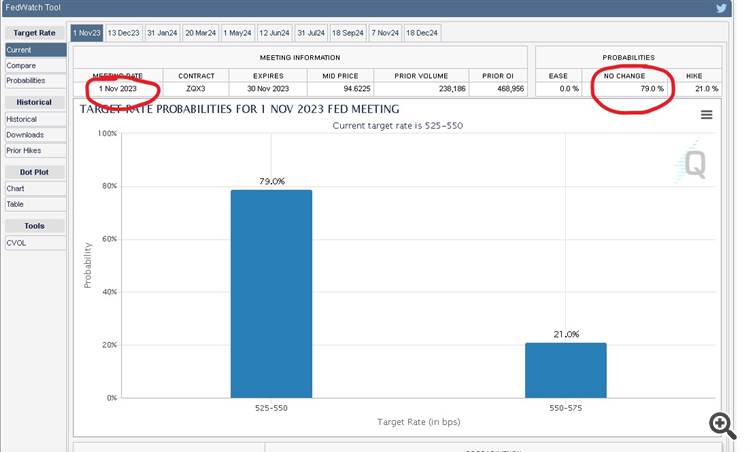

Theres also this : https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html , which shows you the probabilities for a rate hike or not and how much . I thinks its based on polling data.

See trading during the news depends on the data of that particular economic news. for example -

If the technical analysis of gold says that gold might go upwards if the breaks the resistance, and the news comes with negative data with respect to the previous data, then the gold will probably go upwards.

Like for 27th Feb, we have "Consumer Confidence" economic news coming up, so if that particular news has a positive data then the gold will go downwards. You can take a look at some GOLD analysis and get an fair idea about the resistance zones, and can trade on gold. But I prefer to trade with smaller lots and with proper risk management during the economic events.

Let’s look at a practical example. We will use the EUR/USD currency pair as our guide.

The Starting Point: What Does EUR/USD at 1.1000 Mean?

When we see EUR/USD trading at 1.1000, it tells us the exchange rate between the Euro and the US Dollar. Therefore, to buy 1 Euro (base), you need to spend 1.10 US Dollars (quote).

Scenario 1: Eurozone Reports Higher Than Expected GDP Growth (Good News)

Why It’s Good News -> When the GDP growth exceeds expectations, it’s a clear signal of economic strength.

Higher GDP growth means the economy is expanding more rapidly than anticipated, reflecting higher consumer spending, increased industrial production, and more job creation.

The Effect -> This upswing makes the Euro more attractive to investors as a stronger economy suggests better returns on investment in Euro-denominated assets.

As confidence in the Eurozone’s economy increases, so does demand for the Euro, driving up its value on the global stage.

Simplified Example -> Following the announcement of unexpectedly high GDP growth, optimism surges. This boosts the EUR/USD price from 1.1000 to 1.1200. Now, 1 Euro is equal to 1.12 US Dollars, showing that the Euro has strengthened against the Dollar.

Scenario 2: The Eurozone’s Economy Grows Less Than Expected (Negative News)

Why It’s Negative News -> If the Eurozone’s economy isn’t growing as much as people thought it would, it suggests that the Euro might not be as strong in the future. Lower growth can mean fewer jobs, less income, and overall, a weaker economy.

The Effect -> It can make the Euro less attractive to investors who might start selling their Euros in exchange for a currency from a stronger economy. This selling lowers the Euro’s value.

Simplified Example -> Following the news of slow economic growth, the demand for Euros decreases. People start selling their Euros, and the price of EUR/USD drops from 1.1000 to 1.0800. Now, 1 Euro is equal to 1.08 US Dollars, showing that the Euro has weakened against the Dollar.

Want to know more? Comment on the thread and let's discuss/learn together!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use