Join our fan page

- Published by:

- Nikolay Kositsin

- Views:

- 8896

- Rating:

- Published:

- 2011.10.21 10:51

- Updated:

- 2016.11.22 07:32

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Real author:

MetaQuotes

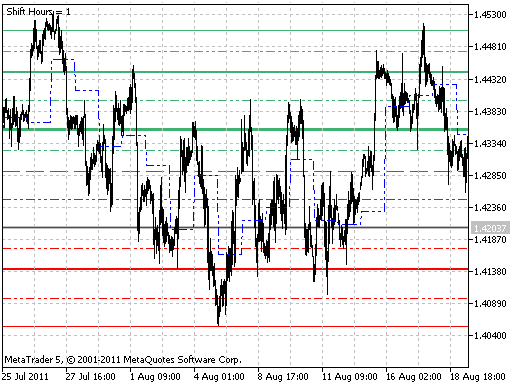

DailyPivot_Shift indicator differs from the common DailyPivot indicator, as the main levels can be calculated with day start shift. Therefore, it is possible to calculate the levels based on the local, not server time, for example, GMT-8. Also, this indicator does not consider information concerning Saturday and Sunday quotes, while generating levels on Monday.

Pivot Point (PP) is the equilibrium point - a level the price is attracted to throughout the day. Having three values for the previous day: maximum, minimum and close price, 13 levels for smaller timeframes can be calculated: equilibrium point, 6 resistance levels and 6 support levels. This levels are called check points. The check points provide the possibilty of easy determining the direction of the minor trend. Three values are most important - levels of equilibrium point, Resistance1 (RES1.0) and Support1 (SUP1.0). The pauses in the movement, or even a roll-back, are frequently seen during the moving of the price betweeen these values.

In such a way, the DailyPivot indicator:

- forecasts the range of prices variation;

- demonstrates the possible price stops;

- demonstrates the possible points of changing the direction of price movement.

If the market on the current day opens above the equilibrium point, then it is the signal for opening long positions. If the market opens below the equilibrium point, then the current day is favourable for opening short positions.

The method of check points consists in the monitoring the possibility of turning and breakthrough when the price collides with the resistance level RES1.0 or with the support level SUP1.0. By the time when the price reaches the RES2.0, RES3.0 or SUP2.0, SUP3.0 levels, the market appears to be overbought or oversold as a rule, so these levels are mostly used as the exit levels.

This indicator was first implemented in MQL4 and published in Code Base at mql4.com 28.07.2006

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/492

XCCX

XCCX

Commodity channel index having possibility to select smoothing algorithm and dynamically changing oversold/overbought levels.

XRSX

XRSX

Relative strength index with dynamically changing oversold/overbought levels and the possibility to select smoothing algorithm.

ATR Channels

ATR Channels

ATR Channels create price movement channels considering ATR (Average True Range).

XCCI

XCCI

Standard Commodity Channel Index with the standard average deviation formula and the possibility to select smoothing algorithm and dynamically changing oversold/overbought levels.