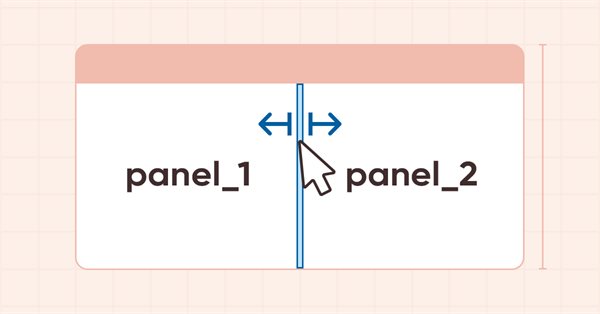

DoEasy. Controls (Part 24): Hint auxiliary WinForms object

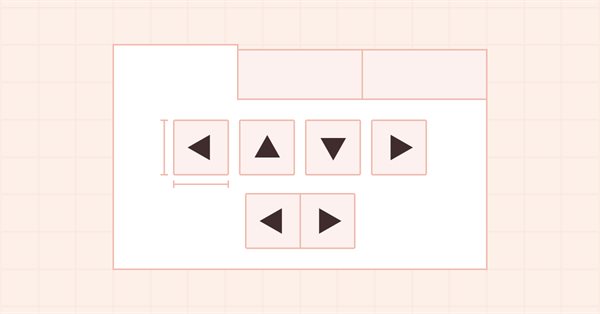

In this article, I will revise the logic of specifying the base and main objects for all WinForms library objects, develop a new Hint base object and several of its derived classes to indicate the possible direction of moving the separator.

Developing an MQTT client for MetaTrader 5: a TDD approach — Part 3

This article is the third part of a series describing our development steps of a native MQL5 client for the MQTT protocol. In this part, we describe in detail how we are using Test-Driven Development to implement the Operational Behavior part of the CONNECT/CONNACK packet exchange. At the end of this step, our client MUST be able to behave appropriately when dealing with any of the possible server outcomes from a connection attempt.

Data Science and ML (Part 40): Using Fibonacci Retracements in Machine Learning data

Fibonacci retracements are a popular tool in technical analysis, helping traders identify potential reversal zones. In this article, we’ll explore how these retracement levels can be transformed into target variables for machine learning models to help them understand the market better using this powerful tool.

Building A Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (II)

Think about an independent Expert Advisor. Previously, we discussed an indicator-based Expert Advisor that also partnered with an independent script for drawing risk and reward geometry. Today, we will discuss the architecture of an MQL5 Expert Advisor, that integrates, all the features in one program.

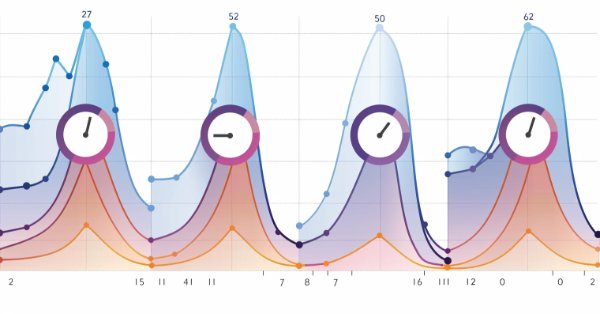

Seasonality Filtering and time period for Deep Learning ONNX models with python for EA

Can we benefit from seasonality when creating models for Deep Learning with Python? Does filtering data for the ONNX models help to get better results? What time period should we use? We will cover all of this over this article.

Category Theory in MQL5 (Part 2)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

Population optimization algorithms: Saplings Sowing and Growing up (SSG)

Saplings Sowing and Growing up (SSG) algorithm is inspired by one of the most resilient organisms on the planet demonstrating outstanding capability for survival in a wide variety of conditions.

Andrey Bolkonsky (abolk): "Any programmer knows that there is no software without bugs"

Andrey Bolkonsky (abolk) has been participating in the Jobs service since its opening. He has developed dozens of indicators and Expert Advisors for the MetaTrader 4 and MetaTrader 5 platforms. We will talk with Andrey about what a server is from the perspective of a programmer.

Developing a Replay System (Part 27): Expert Advisor project — C_Mouse class (I)

In this article we will implement the C_Mouse class. It provides the ability to program at the highest level. However, talking about high-level or low-level programming languages is not about including obscene words or jargon in the code. It's the other way around. When we talk about high-level or low-level programming, we mean how easy or difficult the code is for other programmers to understand.

Neural Networks in Trading: Hierarchical Vector Transformer (HiVT)

We invite you to get acquainted with the Hierarchical Vector Transformer (HiVT) method, which was developed for fast and accurate forecasting of multimodal time series.

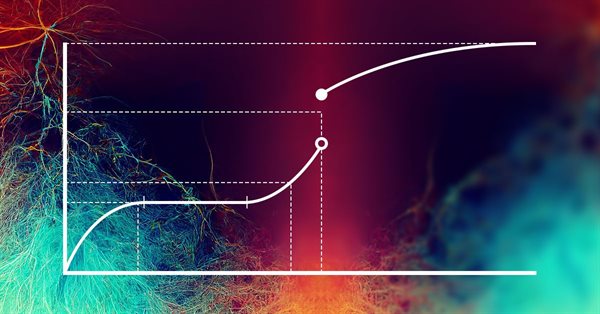

Neural networks made easy (Part 48): Methods for reducing overestimation of Q-function values

In the previous article, we introduced the DDPG method, which allows training models in a continuous action space. However, like other Q-learning methods, DDPG is prone to overestimating Q-function values. This problem often results in training an agent with a suboptimal strategy. In this article, we will look at some approaches to overcome the mentioned issue.

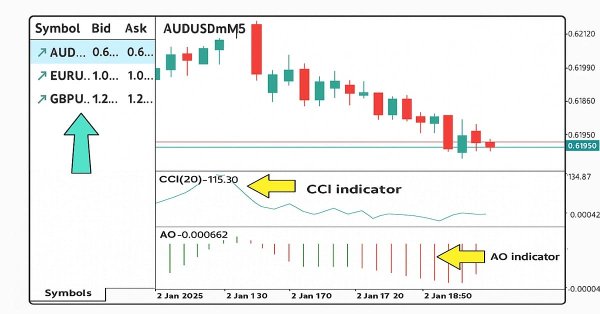

Automating Trading Strategies in MQL5 (Part 20): Multi-Symbol Strategy Using CCI and AO

In this article, we create a multi-symbol trading strategy using CCI and AO indicators to detect trend reversals. We cover its design, MQL5 implementation, and backtesting process. The article concludes with tips for performance improvement

Price Action Analysis Toolkit Development Part (4): Analytics Forecaster EA

We are moving beyond simply viewing analyzed metrics on charts to a broader perspective that includes Telegram integration. This enhancement allows important results to be delivered directly to your mobile device via the Telegram app. Join us as we explore this journey together in this article.

Price Action Analysis Toolkit Development (Part 26): Pin Bar, Engulfing Patterns and RSI Divergence (Multi-Pattern) Tool

Aligned with our goal of developing practical price-action tools, this article explores the creation of an EA that detects pin bar and engulfing patterns, using RSI divergence as a confirmation trigger before generating any trading signals.

William Gann methods (Part I): Creating Gann Angles indicator

What is the essence of Gann Theory? How are Gann angles constructed? We will create Gann Angles indicator for MetaTrader 5.

Dimitar Manov: "I fear only extraordinary situations in the Championship" (ATC 2010)

In the recent review by Boris Odintsov the Expert Advisor of the Bulgarian Participant Dimitar Manov appeared among the most stable and reliable EAs. We decided to interview this developer and try to find the secret of his success. In this interview Dimitar has told us what situation would be unfavorable for his robot, why he's not using indicators and whether he is expecting to win the competition.

Implementing the SHA-256 Cryptographic Algorithm from Scratch in MQL5

Building DLL-free cryptocurrency exchange integrations has long been a challenge, but this solution provides a complete framework for direct market connectivity.

Example of Auto Optimized Take Profits and Indicator Parameters with SMA and EMA

This article presents a sophisticated Expert Advisor for forex trading, combining machine learning with technical analysis. It focuses on trading Apple stock, featuring adaptive optimization, risk management, and multiple strategies. Backtesting shows promising results with high profitability but also significant drawdowns, indicating potential for further refinement.

Integrating Discord with MetaTrader 5: Building a Trading Bot with Real-Time Notifications

In this article, we will see how to integrate MetaTrader 5 and a discord server in order to receive trading notifications in real time from any location. We will see how to configure the platform and Discord to enable the delivery of alerts to Discord. We will also cover security issues which arise in connection with the use of WebRequests and webhooks for such alerting solutions.

DoEasy. Controls (Part 28): Bar styles in the ProgressBar control

In this article, I will develop display styles and description text for the progress bar of the ProgressBar control.

Neural networks made easy (Part 47): Continuous action space

In this article, we expand the range of tasks of our agent. The training process will include some aspects of money and risk management, which are an integral part of any trading strategy.

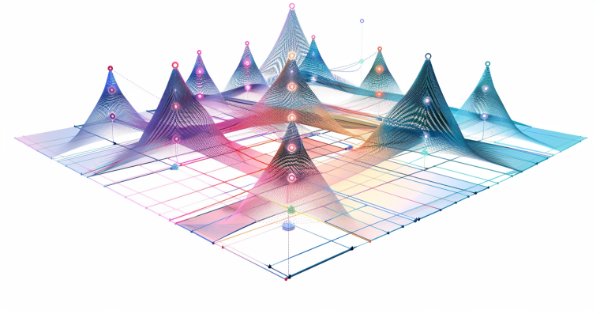

Brain Storm Optimization algorithm (Part II): Multimodality

In the second part of the article, we will move on to the practical implementation of the BSO algorithm, conduct tests on test functions and compare the efficiency of BSO with other optimization methods.

Trading with the MQL5 Economic Calendar (Part 1): Mastering the Functions of the MQL5 Economic Calendar

In this article, we explore how to use the MQL5 Economic Calendar for trading by first understanding its core functionalities. We then implement key functions of the Economic Calendar in MQL5 to extract relevant news data for trading decisions. Finally, we conclude by showcasing how to utilize this information to enhance trading strategies effectively.

MQL5 Wizard Techniques you should know (Part 17): Multicurrency Trading

Trading across multiple currencies is not available by default when an expert advisor is assembled via the wizard. We examine 2 possible hacks traders can make when looking to test their ideas off more than one symbol at a time.

Self Optimizing Expert Advisor With MQL5 And Python (Part V): Deep Markov Models

In this discussion, we will apply a simple Markov Chain on an RSI Indicator, to observe how price behaves after the indicator passes through key levels. We concluded that the strongest buy and sell signals on the NZDJPY pair are generated when the RSI is in the 11-20 range and 71-80 range, respectively. We will demonstrate how you can manipulate your data, to create optimal trading strategies that are learned directly from the data you have. Furthermore, we will demonstrate how to train a deep neural network to learn to use the transition matrix optimally.

Interview with Berron Parker (ATC 2010)

During the first week of the Championship Berron's Expert Advisor has been on the top position. He now tells us about his experience of EA development and difficulties of moving to MQL5. Berron says his EA is set up to work in a trend market, but can be weak in other market conditions. However, he is hopeful that his robot will show good results in this competition.

Gain An Edge Over Any Market (Part II): Forecasting Technical Indicators

Did you know that we can gain more accuracy forecasting certain technical indicators than predicting the underlying price of a traded symbol? Join us to explore how to leverage this insight for better trading strategies.

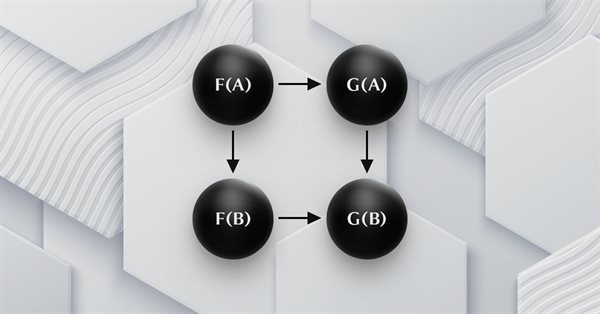

Category Theory in MQL5 (Part 18): Naturality Square

This article continues our series into category theory by introducing natural transformations, a key pillar within the subject. We look at the seemingly complex definition, then delve into examples and applications with this series’ ‘bread and butter’; volatility forecasting.

Interview with Valery Mazurenko (ATC 2011)

The task of writing an Expert Advisor trading on multiple currency pairs is complex both in terms of finding suitable strategies and from the technological side. But if the goal is set clear, nothing is impossible then. It was four times already that Vitaly Mazurenko (notused) submitted his multi-currency Expert Advisor. It seems, he has managed to find the right way this time.

Neural networks made easy (Part 80): Graph Transformer Generative Adversarial Model (GTGAN)

In this article, I will get acquainted with the GTGAN algorithm, which was introduced in January 2024 to solve complex problems of generation architectural layouts with graph constraints.

MQL5 Wizard Techniques you should know (Part 42): ADX Oscillator

The ADX is another relatively popular technical indicator used by some traders to gauge the strength of a prevalent trend. Acting as a combination of two other indicators, it presents as an oscillator whose patterns we explore in this article with the help of MQL5 wizard assembly and its support classes.

Interview with Igor Korepin (ATC 2011)

Appearance of the Expert Advisor cs2011 by Igor Korepin (Xupypr) at the very top of the Automated Trading Championship 2011 was really impressive - its balance was almost twice that of the EA featured on the second place. However, despite such a sound breakaway, the Expert Advisor could not stay long on the first line. Igor frankly said that he relied much on a lucky start of his trading robot in the competition. We'll see if luck helps this simple EA to take the lead in the ATC 2011 race again.

Neural Networks in Trading: Using Language Models for Time Series Forecasting

We continue to study time series forecasting models. In this article, we get acquainted with a complex algorithm built on the use of a pre-trained language model.

DoEasy. Controls (Part 17): Cropping invisible object parts, auxiliary arrow buttons WinForms objects

In this article, I will create the functionality for hiding object sections located beyond their containers. Besides, I will create auxiliary arrow button objects to be used as part of other WinForms objects.

Interview with Boris Odintsov (ATC 2010)

Boris Odintsov is one of the most impressive participants of the Championship who managed to go beyond $100,000 on the third week of the competition. Boris explains the rapid rise of his expert Advisor as a favorable combination of circumstances. In this interview he tells about what is important in trading, and what market would be unfavorable for his EA.

Quantization in machine learning (Part 1): Theory, sample code, analysis of implementation in CatBoost

The article considers the theoretical application of quantization in the construction of tree models and showcases the implemented quantization methods in CatBoost. No complex mathematical equations are used.

Neural networks made easy (Part 34): Fully Parameterized Quantile Function

We continue studying distributed Q-learning algorithms. In previous articles, we have considered distributed and quantile Q-learning algorithms. In the first algorithm, we trained the probabilities of given ranges of values. In the second algorithm, we trained ranges with a given probability. In both of them, we used a priori knowledge of one distribution and trained another one. In this article, we will consider an algorithm which allows the model to train for both distributions.

Monitoring trading with push notifications — example of a MetaTrader 5 service

In this article, we will look at creating a service app for sending notifications to a smartphone about trading results. We will learn how to handle lists of Standard Library objects to organize a selection of objects by required properties.

Interview with Andrey Bobryashov (ATC 2011)

Since the first Automated Trading Championship we have seen plenty of trading robots in our TOP-10 created with the use of various methods. Excellent results were shown both by the Exper Advisors based on standard indicators, and complicated analytical complexes with weekly automatic optimization of their own parameters.

DRAW_ARROW drawing type in multi-symbol multi-period indicators

In this article, we will look at drawing arrow multi-symbol multi-period indicators. We will also improve the class methods for correct display of arrows showing data from arrow indicators calculated on a symbol/period that does not correspond to the symbol/period of the current chart.