For this analysis I use iPump indicator

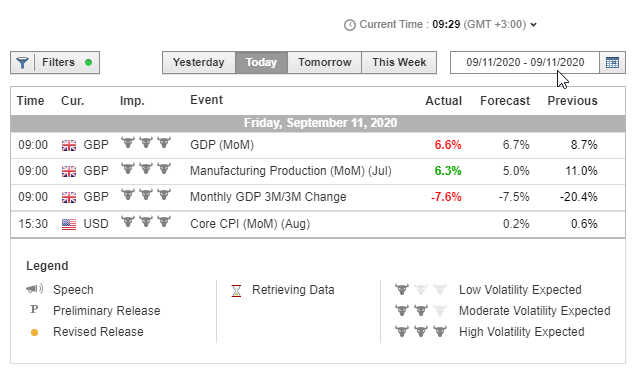

Important news for today

Of course, the most significant event is of course the consumer price index, according to forecasts, it will go down and this indicates a weakening of the dollar and most likely a decrease in the interest rate in the future. All this, of course, is related to the situation in the US economy with the crisis that has spread due to the coronavirus pandemic and this will still have consequences for the US dollar and the foreign exchange market as a whole.

The consumer price index affects the long-term assessment of purchasing power parity by country, as well as the Fed's monetary policy in setting interest rates. The rise in consumer prices usually leads to a decrease in the level of real demand and the volume of retail sales, but this is in the medium term, in the short term, on the contrary, the rise in prices reflects high consumer activity. The indicator is influenced by such indicators as the volume of money supply (aggregate M2) and industrial prices, as well as import prices. The index is analyzed together with the PPI (Industrial Price Index). If the economy is developing under normal conditions, then the rise in CPI and PPI indicators may lead to an increase in the main interest rates in the country. This, in turn, leads to an increase in the dollar rate, as the attractiveness of investing in currency with a higher interest rate increases.

EUR / USD

Yesterday the EUR / USD pair was trading higher and closed the day in positive territory around the $ 1.1820 price. Today the pair was trading in a narrow range of $ 1.1820-40, staying close to yesterday's closing price. On the hourly chart, EUR / USD is testing the resistance - the MA (200) H1 ($ 1.1845) moving average line. On the four-hour chart, the pair remains above the MA 200 H4 line. Based on the foregoing, it is probably worth sticking to the south direction in trading, and while the pair remains below MA 200 H1, it is necessary to look for a sell entry point to form a correction.

An alternative scenario implies consolidation above MA 200 H1, followed by a rise to $ 1.1925 (September 2 high).

And at this the review came to an end. I wish you profitable trades, remember that your success should not depend on any one trade, you need to try to be in the black at the distance, and for this it is enough to earn only 3 out of 10 trades, how? - your reward to risk ratio should be more than one to three. Therefore, always remember about the 📈

risk (use forex calculator), consider it correctly and then your trading will be successful! Wish you a successful trading day your SeniorTrader.

In order not to miss the following market overview, as well as to be aware of the news of the project SeniorTrder Subscribe to our telegram channel 👉Telegram Channnel https://t.me/SeniorTrader_Channel

Tools that I use in trading

The iPump indicator was used for this analysis

https://www.mql5.com/en/market/product/39895

Indicator defining the trend, levels, overbought / oversold

EA Pump and Dump Pro

https://www.mql5.com/en/market/product/51395

https://www.mql5.com/en/market/product/51395

Multifunctional robot (averaging/piramiding/strategy for overclocking a deposit)

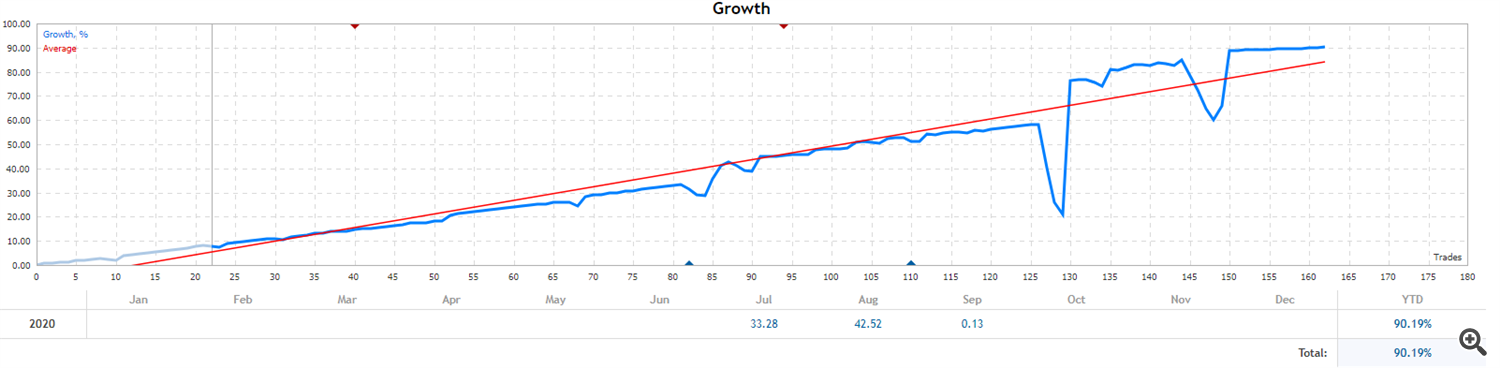

EA Long Term Strategy

https://www.mql5.com/en/market/product/35069

Trading strategy in the EA Long Term Strategy (fix stop loss, safe strategy)

#EURUSD 11.09.2020analysis