Decoding the Market Giants:

Identifying Smart Money Points in Forex

The allure of the Forex market lies in its vastness and complexity. But for every retail trader, a nagging question persists: where are the “smart money” players placing their bets? Identifying these Smart Money points can be the key to aligning your strategy with the market movers and potentially boosting your returns.

Unveiling the Smart Money Concept

Smart Money, in Forex, refers to the actions of institutional players like central banks, hedge funds, and market makers. These entities hold significant financial clout and their trades can significantly impact price movements. The Smart Money Concept (SMC) proposes that by understanding their behavior, retail traders can gain an edge in the market.

Here’s the core idea: Smart Money players are constantly accumulating and distributing positions. They create zones of buying and selling interest, influencing future price direction. By identifying these zones, or Smart Money points, traders can anticipate potential breakouts and reversals.

Unveiling the Clues: Methods for Identifying Smart Money Points

While mind-reading institutional giants might seem like a fantasy, SMC offers a framework to analyze price action and infer Smart Money activity. Here are some key methods:

- Order Blocks: These are areas on the chart where price consolidation suggests significant buying or selling interest. Look for repetitive price swings within a defined range, potentially indicating accumulation or distribution.

- Breaker Blocks: These are areas where price convincingly breaks through support or resistance, often followed by a return to test the level. This “fakeout” can be a sign of Smart Money testing liquidity before a larger move.

- Fair Value Gaps (FVGs): These are price gaps on the chart that don’t seem justified by fundamental news. SMC suggests they represent areas of imbalanced supply and demand, and price may revisit these gaps to fill the void.

- Market Structure Analysis: By recognizing underlying trends and identifying swing highs and lows, traders can gauge Smart Money’s intentions. Are they pushing the trend or looking for a reversal?

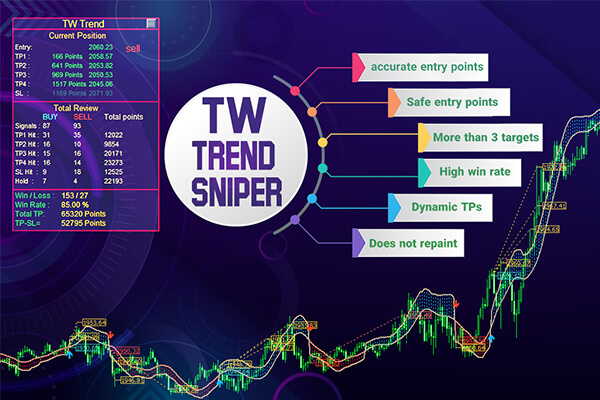

Remember: these methods require practice and a close eye for price action, these methods work best in conjunction with other technical analysis tools such as price patterns, trend lines and volume indicators. that “TW trend sniper” By using the above and using artificial intelligence, it has been able to provide reliable signals.

The Verdict from the Masters: Weighing the Opinions

The concept of Smart Money is a topic of debate among Forex traders. Here’s a glimpse into what some famous traders have to say:

- Price Action Purists: Traders like Al Brooks believe price action itself tells the whole story. By mastering technical analysis, you can decipher Smart Money activity without fancy labels.

- SMC Advocates: proponents like Jhonny Chan believe the SMC framework provides a structured approach to analyzing order flow and market manipulation by big players.

- John Murrey: A proponent of price action trading, Murrey acknowledges the influence of institutional players but emphasizes the importance of understanding market dynamics beyond just their actions.

- George Soros: The legendary hedge fund manager highlights the importance of reflexivity in markets, where investor psychology becomes a self-fulfilling prophecy. By understanding these cycles, traders can potentially anticipate Smart Money behavior.

- Larry Williams: A strong advocate for technical analysis, Williams believes in the power of price patterns and indicators to reveal market sentiment, including the actions of large institutions.

Finally, the effectiveness of Smart Money concepts allows you to retest these ideas against historical data to gauge their effectiveness before risking real capital. And you can use “TW trend sniper “ strategy Check with past data in Metatrader Tester

Here are some parting thoughts:

- Combine SMC with other Strategies: Don’t rely solely on Smart Money points. Integrate them with fundamental analysis and sound risk management practices.

- Backtest and Refine: Test SMC methods on historical data to see how they perform and adjust your approach accordingly.

By understanding Smart Money concepts and incorporating them thoughtfully into your trading strategy, you can gain a valuable perspective on market movements and potentially improve your decision-making in the dynamic world of Forex.

Happy trading

may the pips be ever in your favor!