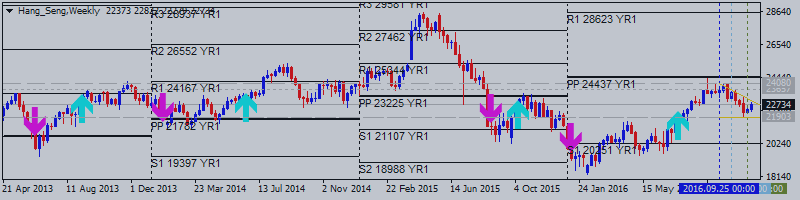

Hang Seng Index Pivot Points Analysis: bounced from Yearly Central Pivot for the bearish trend to be resumed

W1 price was on bearish breakdown since the end of 2015 by breaking Central Pivot to below for the reversal of the price movement to the primary bearish market condition. The bearish breakdown was going to be continuing since the Fenruary this year by the local uptrend as the bear market rally to be started: the price broke S1 Pivot at 20,251 to above for the Central Pivot at 24,437 to be tested for the bullish reversal to be started or for the bearish trend to be continuing.

For now, the price was bounced from Central Pivot at 24,437 for the rimary ebarish market condition to be started with 21,903 support level to be tested for the bearish trend to be continuing.

| Instrument | S1 Pivot | Yearly PP | R1 Pivot |

|---|---|---|---|

| Hang Seng |

20,251 | 24,437 | 28,623 |

Trend:

- W1 - bearish