Enrique Enguix / Profil

- Bilgiler

|

3 yıl

deneyim

|

5

ürünler

|

2217

demo sürümleri

|

|

0

işler

|

9

sinyaller

|

1

aboneler

|

In the world of algorithmic trading, I know that many Expert Advisors (EAs) face significant challenges.

Why? Because they often rely on strategies that only work in the short term or get lost in over-optimization. My approach breaks that mold.

I adopt an adaptive strategy, always ready to adjust to the constant changes in the market.

I believe in intelligent diversification and rigorous risk management, protecting your investment at all times.

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

🔴 YOUTUBE: https://bit.ly/3QXYBuy

📈 ALL OUR SIGNALS: https://www.mql5.com/en/signals/author/envex

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

⚠️ NEW MQL5 GROUP: https://www.mql5.com/en/messages/01c72081307dda01

Why? Because they often rely on strategies that only work in the short term or get lost in over-optimization. My approach breaks that mold.

I adopt an adaptive strategy, always ready to adjust to the constant changes in the market.

I believe in intelligent diversification and rigorous risk management, protecting your investment at all times.

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

🔴 YOUTUBE: https://bit.ly/3QXYBuy

📈 ALL OUR SIGNALS: https://www.mql5.com/en/signals/author/envex

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

⚠️ NEW MQL5 GROUP: https://www.mql5.com/en/messages/01c72081307dda01

Arkadaşlar

3453

İstekler

Giden

Enrique Enguix

Have you also felt like you were being cheated when buying an EA?

⚠️Even if a (bad) developer does not have that intention, it is common and has an explanation.

Most expert advisors are built on temporary statistical advantages that eventually get exhausted.

The problem of over-optimization

Many developers fall into the trap of tuning their EAs to achieve perfect results in the past, without understanding that this perfection will not work in the future market.

Furthermore, everything is built to make it difficult for retailers to make money: spreads, swaps, commissions, delays, etc.

You'll be surprised to know that those few who make money from trading even pay more than 50% of their profits in one way or another.

The importance of diversification

And with how difficult it is to profit, most traders do not know how to diversify correctly, either because they do not understand the concept or do not have the necessary tools to do so.

If you use the same EA on EUR/USD and GBP/USD (which are strongly correlated), when EUR/USD trades lose, so will GBP/USD trades.

And what about EAs that compensate losing trades with winning trades?

Developers strive to create an EA that never fails in tests. But the market is never the same, so if the EA fails, this technique will wipe out months of profits in one trade.

Therefore. We need an EA that:

✅Does not exploit a temporary statistical advantage but can read the market and adapt.

✅It does not predict the market but follows it wherever it goes.

✅It does not work in correlated markets, so that when trades are lost in one market, they are not lost in the rest.

✅Allows for failure and assumes losses from time to time.

✅It is not optimized to have a perfect curve in backtests. Because a perfect curve only tells us that the EA has been over-optimized.

Do you want to know more?: https://www.mql5.com/en/market/product/90877

⚠️Even if a (bad) developer does not have that intention, it is common and has an explanation.

Most expert advisors are built on temporary statistical advantages that eventually get exhausted.

The problem of over-optimization

Many developers fall into the trap of tuning their EAs to achieve perfect results in the past, without understanding that this perfection will not work in the future market.

Furthermore, everything is built to make it difficult for retailers to make money: spreads, swaps, commissions, delays, etc.

You'll be surprised to know that those few who make money from trading even pay more than 50% of their profits in one way or another.

The importance of diversification

And with how difficult it is to profit, most traders do not know how to diversify correctly, either because they do not understand the concept or do not have the necessary tools to do so.

If you use the same EA on EUR/USD and GBP/USD (which are strongly correlated), when EUR/USD trades lose, so will GBP/USD trades.

And what about EAs that compensate losing trades with winning trades?

Developers strive to create an EA that never fails in tests. But the market is never the same, so if the EA fails, this technique will wipe out months of profits in one trade.

Therefore. We need an EA that:

✅Does not exploit a temporary statistical advantage but can read the market and adapt.

✅It does not predict the market but follows it wherever it goes.

✅It does not work in correlated markets, so that when trades are lost in one market, they are not lost in the rest.

✅Allows for failure and assumes losses from time to time.

✅It is not optimized to have a perfect curve in backtests. Because a perfect curve only tells us that the EA has been over-optimized.

Do you want to know more?: https://www.mql5.com/en/market/product/90877

Enrique Enguix

In recent weeks, I have been dedicating efforts to improve one of my systems, while simultaneously working on several others. My goal was to identify a condition or filter that could mitigate stagnation and promote stability across all systems equally. The premise was simple: find a universal filter that would benefit each of them.

An article by Jaume Antolí has been an invaluable source of inspiration for me. His statement that "the immediate future is more likely to resemble the recent past than the distant past" resonated deeply with me. This idea led to a significant shift in my approach: I decided to refrain from opening new operations in the next few hours if the previous ones had not been successful. This simple adjustment has proven to be a true turning point, as I have noticed a significant improvement in my results. What's most intriguing is that this strategy has been effective in other systems as well, further bolstering my confidence in this new idea.

An article by Jaume Antolí has been an invaluable source of inspiration for me. His statement that "the immediate future is more likely to resemble the recent past than the distant past" resonated deeply with me. This idea led to a significant shift in my approach: I decided to refrain from opening new operations in the next few hours if the previous ones had not been successful. This simple adjustment has proven to be a true turning point, as I have noticed a significant improvement in my results. What's most intriguing is that this strategy has been effective in other systems as well, further bolstering my confidence in this new idea.

Enrique Enguix

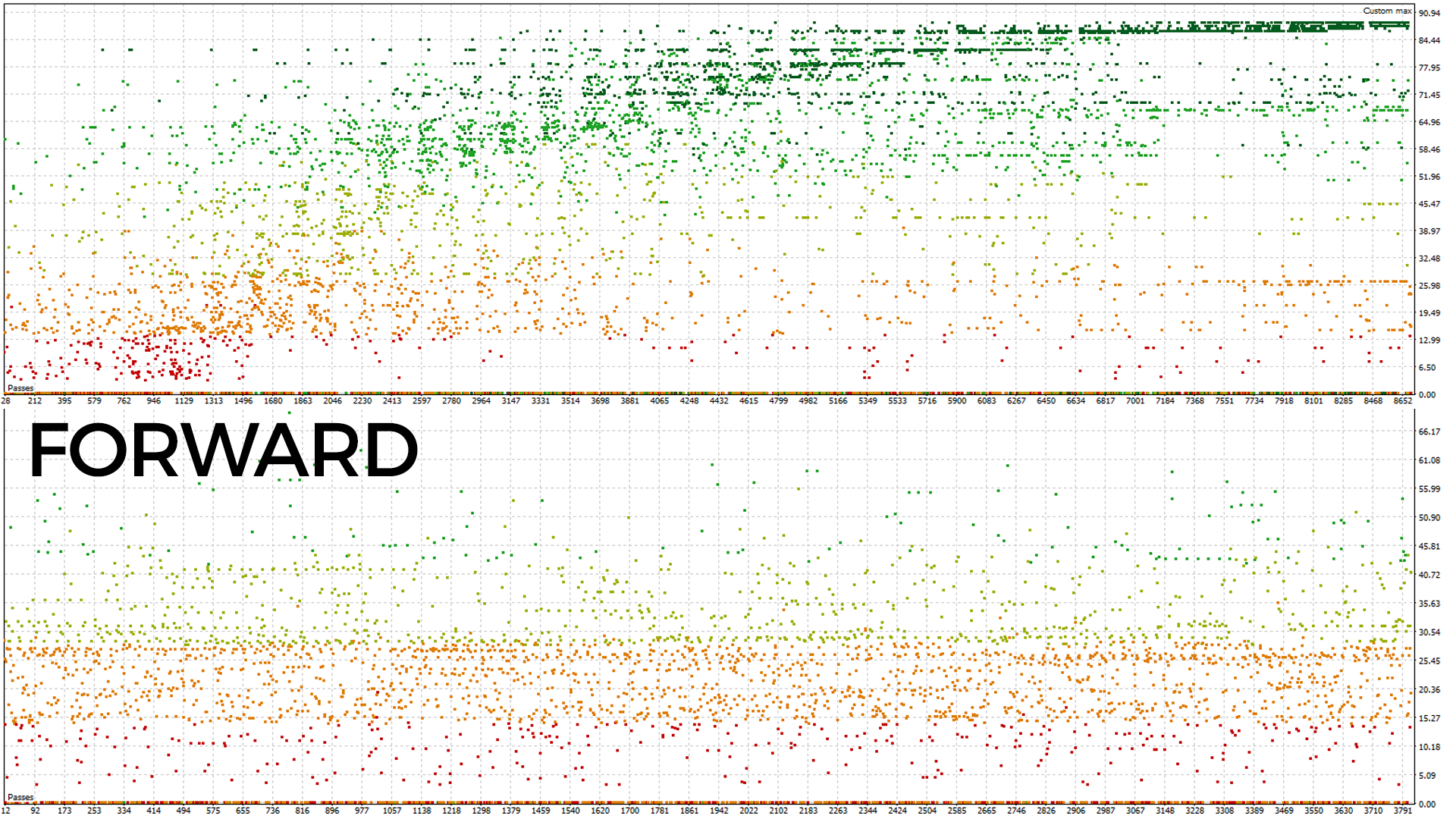

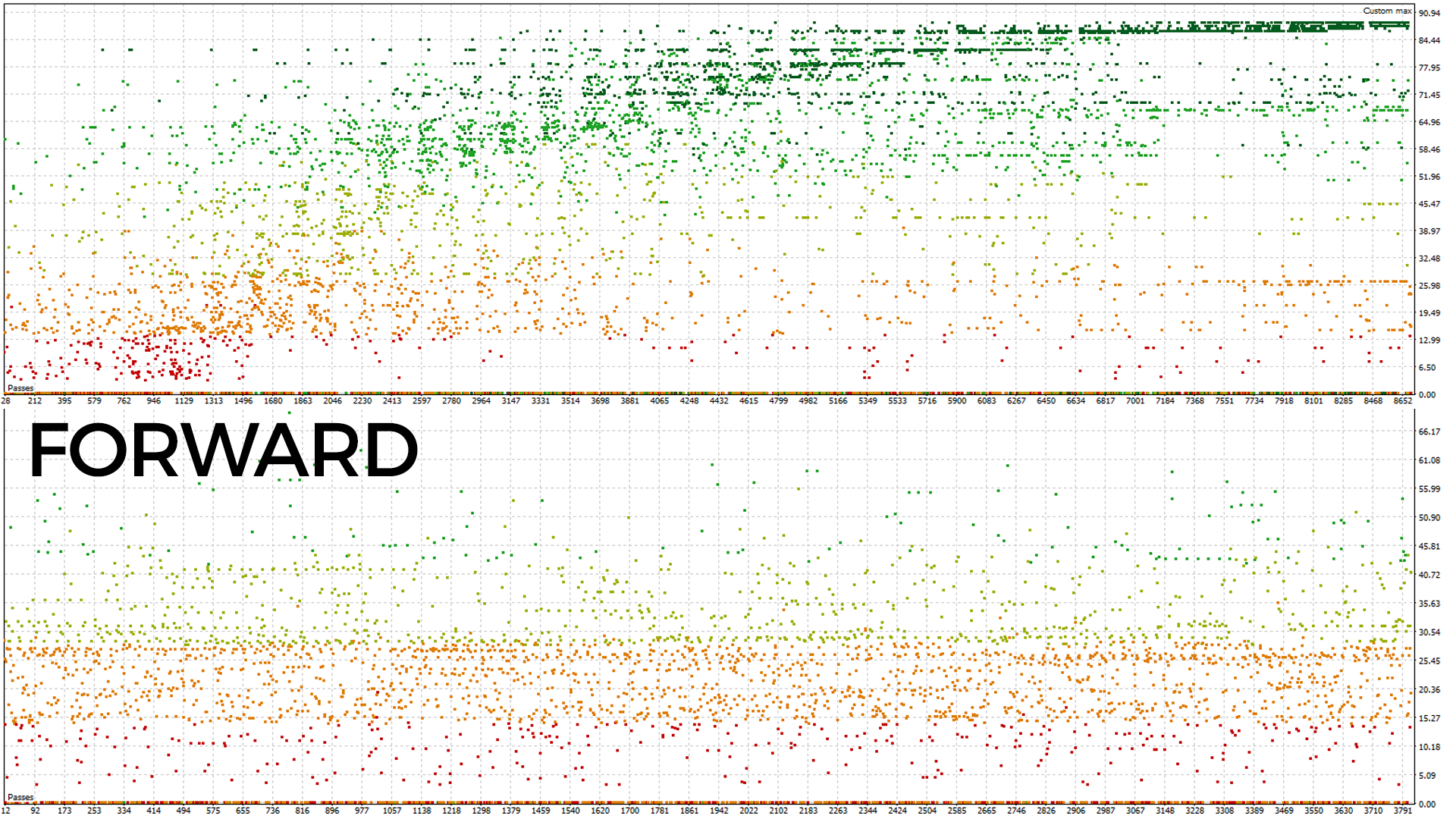

This is what most marketers usually do, and this is why their results look so attractive: they optimize over an extended period, generating many little green dots (as shown in the first image), looking for the perfection in excess and focusing on generating many sales.

On the other hand, our approach is different: we also optimize over an extended period, but then validate out of sample to verify the real effectiveness of the strategy, which results in more robust sets (although not as visually striking, second image ), generating fewer sales but offering results that are more in line with reality.

Our goal is to attract traders who understand that the important thing is not superficial beauty, but obtaining results that reflect with a higher degree of probability the future conditions of the market.

On the other hand, our approach is different: we also optimize over an extended period, but then validate out of sample to verify the real effectiveness of the strategy, which results in more robust sets (although not as visually striking, second image ), generating fewer sales but offering results that are more in line with reality.

Our goal is to attract traders who understand that the important thing is not superficial beauty, but obtaining results that reflect with a higher degree of probability the future conditions of the market.

: