Weekly technical and fundamental analysis of gold:

Today is Sunday, December 24th, 2023. If you take a look at the daily chart of the world gold ounce right now, you will notice that the global gold has increased to a very important level of $1970 on its last working day. Gold has had a growth rate of 12.58% in the year 2023 and has also managed to reach its historical peak of $2148 .

Now, the world gold ounce is facing two major challenges as it enters the new year of 2024. The first challenge is the change in the Federal Reserve's monetary policies, and the second challenge is the geopolitical issues and their impact on the global economy.

In reviewing gold in 2023, it faced sticky banking crises and inflation:

The financial markets were pleased and optimistic when the Federal Reserve finally lifted its foot off the pedal of contractionary policies or increasing interest rates at the end of 2022.

As soon as the yield on ten-year Treasury notes fell on the eve of the New Year 2023, gold reacted positively and rose more than 6% in January 2023. However, as inflation began to rise again, gold entered a stagnant phase because investors started to reconsider the central bank's policies.

Then, as the banking crises and turmoil in the United States began in March, gold also made up its mind and rose to above the important level of $2000. This region was the highest price of gold in the first quarter of 2023.

It was such that within five days, three small to medium-sized banks in the United States named Silicon Valley, Silvergate Bank, and Signature Bank went bankrupt, which was a fundamental factor that caused capital flight towards a safe asset.

Since the Federal Reserve and major market regulators quickly responded by creating a banking liquidity provision program (BTFP) to reduce tensions in financial markets, part of the monthly upward trend of gold was halted, and this precious metal showed a slight growth in April.

Meanwhile, the market realized that inflation in the United States in the second quarter of 2023 was stickier than expected, and the market is also highly competitive for job seekers.

In response to this issue, the Federal Reserve raised its interest rates again.

In fact, the US central bank decided to increase its interest rates by 25 basis points in each of the first three meetings of 2023. This means that the

Federal Reserve increased its rates from the range of 4.5% to 4.25% to 5.25% to 5%.

Meanwhile, due to the decrease in fears and concerns about the banking crisis and its spread to other banks and other parts of the financial markets, as well as the rise in the yield of ten-year Treasury notes, global gold ended the months of May and June in a red zone with a downward trend.

Then, after the Federal Reserve stopped its contractionary policies in June, it increased its interest rates by another 25 basis points in July and raised them to 5.25% to 5.5%.

The Federal Reserve did not close the door on further interest rate hikes because the US economy and

non-farm payroll (NFP) reports were better and higher than market expectations.

Finally, gold also came under downward pressure in the summer and fell about 6% in a two-month period from August to September.

Geopolitical issues and the dovish tone of the Federal Reserve:

In the third quarter of 2023, when signs of a tight labor market (meaning low job but high labor force) and a decrease in inflationary pressures were observed in the United States, this led the Federal Reserve to loosen its contractionary policies.

It is true that central bank policymakers did not mention any shift or change in their monetary policies, but global gold revived again.

At the same time, after announcing readiness for war and starting anti-invasion operations in the Gaza Strip in response to Hamas' surprise attack on southern Israel on October 7, which led to the killing of civilians and hostage-taking, secure asset flows dominated financial markets, and traders rushed to buy safe assets.

Global gold, which is considered a safe asset, also increased by more than 7% in the same month of October.

This was such that gold again managed not only to cross the important technical and psychological level of $2000 but also to consolidate itself above this important level.

Meanwhile, news of the Houthi rebels' attack on three commercial ships in the Red Sea on Sunday and the US Navy's response, which led to the downing of three unmanned aircraft on December 10, led to another increase in gold at the beginning of the week.

This important factor sparked concerns about the escalation of the Israel-Hamas conflict into a widespread crisis in the Middle East, and gold reached its historical high of $2149 on December 11 in the

Asian trading session.

It is true that after this short-lived war, gold again fell to the important level of $2000, but the adoption of a new dovish tone (meaning expansionary policies and interest rate cuts) by the Federal Reserve caused the US dollar to fall and global gold to strengthen again.

The outlook for global gold in 2024:

After the last policy meeting of 2023, the US Federal Reserve kept its interest rates unchanged in the range of 5.25% to 5.5% and referred to the continuous improvement in the inflation outlook.

Current Federal Reserve

Chairman

Jerome Powell said at a press conference after this meeting that it is still too early to declare victory over inflation, but acknowledged that the question of when the process of interest rate cuts will begin is under review.

Powell also announced that we are strongly focused on ensuring that a major mistake does not occur and that rates do not remain high for a long time.

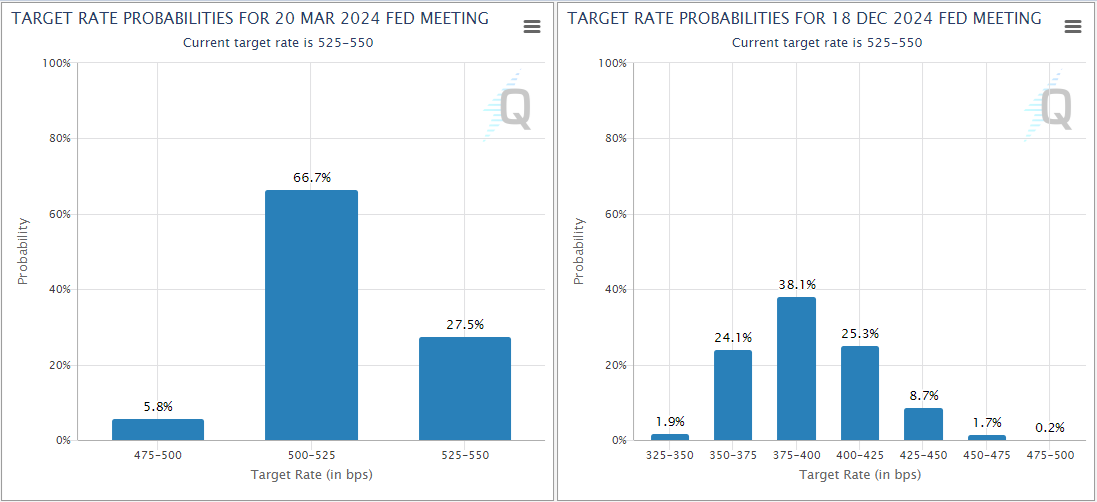

Until December 2024, almost 60% of the market gives the possibility that Federal Reserve interest rates will reach 3.75% to 4% or even lower.

The current market situation shows that there is currently a relatively significant decline in interest rates priced into the market for next year, and if macroeconomic data goes against this expectation, there is room for a dollar increase.

It is noteworthy that the Federal Reserve is confident about the absence of a recession in the United States. If you remember, the US Gross Domestic Product (GDP) had a significant growth (annualized 5.2%) in the third quarter.

Of course, do not forget that since inventory accumulation was the main driver of GDP growth during that period, seeing a sharp decline in US growth rates in the first half of 2024 will not be surprising at all.

Three Possible Scenarios for Gold Prices in the First Half of 2024:

1. As the job market moves out of balance and relatively healthy economic activity remains, inflation will continue to decline steadily. Additionally, the GDP for the first and second quarters will be between 1.5% and 2%.

In this scenario, gold can still continue its upward trend, but before completing its long-term trend, the continuation of this upward movement will be limited.

A strong job market with a strong economy allows the Federal Reserve to adopt a cautious approach to changing its monetary policies, limiting the decline of the dollar and bond yields.

2. While

unemployment rates increase significantly, inflation continues to decline steadily and economic growth declines worryingly in the first and second quarters to less than 1%.

In this scenario, gold is also on an upward trend and even has the potential for greater profits for this expensive metal. However, if the US economy weakens, it will have a negative impact on other economies such as China, which can limit demand for gold.

3. In our third scenario, gold will have a negative reflection. The priority of the Federal Reserve is to return inflation to its 2% target, and policymakers are likely to refrain from early interest rate cuts even if the job market or economy is good.

In this case, with an increase in US dollar bond yields, the US dollar becomes stronger, causing gold to start falling.

Geopolitical Unrest and Uncertainty

The Russia-Ukraine war in 2022 and the Israel-Hamas conflict in 2023 showed that gold is still a safe and acceptable asset for investors during times of uncertainty.

Further escalation and expansion of conflicts in the Middle East can push gold prices higher. In addition, renewed escalation of the Russia-Ukraine war can have a similar impact on XAU/USD.

US Presidential Election

It is difficult to say how the results of the presidential election and all related developments can affect financial markets.

However, according to a Real Clear Politics poll conducted on December 15, there is almost a 50% chance that Donald Trump, the former US president, could be re-elected.

If elected, Trump is seeking to impose a 10% tariff on most foreign goods and gradually eliminate imports of essential goods from China during a four-year plan.

While worsening relations with China can have a negative impact on the outlook for gold demand, higher tariffs can also make the Federal Reserve's job of reducing inflation to its 2% target more difficult.

As you may know, China is the largest consumer of gold in the world. Thanks to post-COVID reopening, China's economy renewed its upward trend in 2023.

Gross domestic product (GDP) grew by 4.9% in the third quarter after annual growth of 6.3% in the previous quarter.

However, recent readings of PMI and consumer activity data suggest signs of sluggishness in

China's economy in a negative scenario.

Chinese government advisers have said in an exclusive interview with Reuters that their growth targets for 2024 were between 4.5% and 5.5%.

Meanwhile, Moody's rating agency warned of a downgrade in China's credit rating due to increasing risks related to medium-term structural decline and economic growth, and continued decline in the real estate sector.

Weekly Technical Analysis of Gold:

The weekly chart of global gold confirms the continuation of the upward trend of gold on the verge of entering 2024.

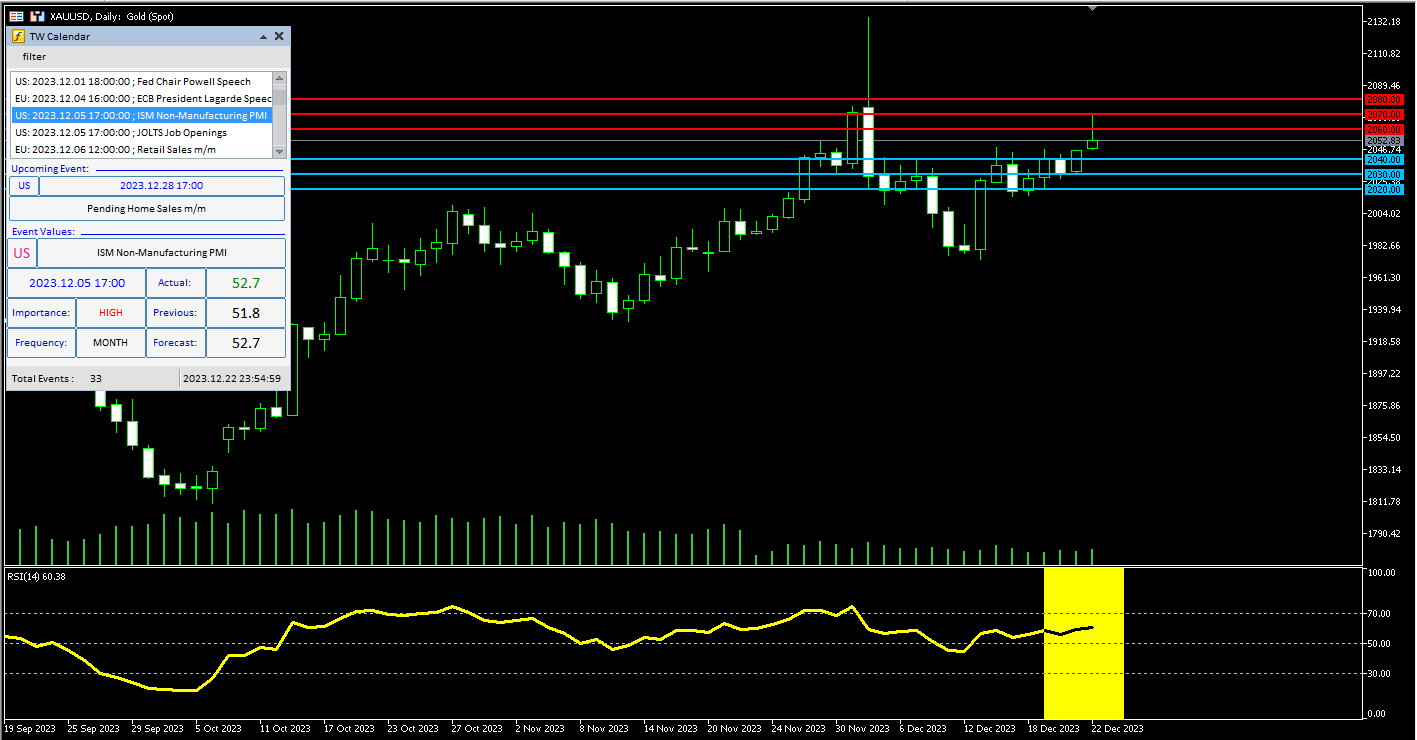

If you look at the daily gold chart, you will see that last week's price floor was $2016 and its ceiling was $2070.

The global gold ounce rose about 1.67% positively last week, making market bulls happy.

If you look at the gold chart, you will notice that the price of gold closed at $2053.

The RSI indicator on the daily time frame is rising and showing a number of 60. This indicates that gold has maintained its upward momentum and further increases are not unexpected.

Important Support Levels for Gold:

If gold starts to decline, the first important support level will be $2040. If market bears go below this area, the next important level will be $2030. Finally, if gold falls below this area, the next important level will be a very important area of $2020.

Important Resistance Levels for Gold:

If gold increases, the first important resistance level will be $2060. If market bulls go higher than this area, the next important level will be $2070. Finally, if gold crosses this area as well, the next important level will be $2080.

I hope this review and analysis will be useful and effective along with your own strategy and expertise.