Unveiling Market Sentiment:

A Look at Volume Spread Analysis (VSA) for Forex Traders

For Forex traders, understanding market sentiment is crucial for making informed decisions. Traditional technical analysis focuses on price movements, but what if you could peer deeper and gauge the buying and selling pressures behind those movements? Enter Volume Spread Analysis (VSA).

What is VSA?

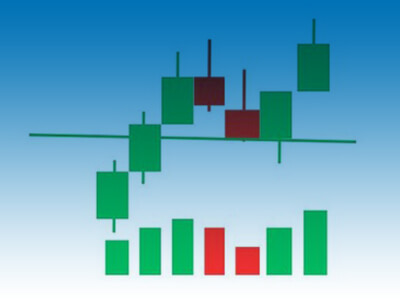

VSA is a technical analysis method that examines the relationship between price action and volume to gauge the underlying supply and demand in the market. By analyzing candlestick charts alongside volume bars, VSA attempts to identify the intentions of big players, like institutions and market makers.

Key elements of VSA:

- Volume: High volume on strong price movements (large candles) suggests institutional involvement, potentially signaling a trend’s continuation. Conversely, low volume on strong price moves might indicate a lack of conviction and possible trend reversal.

- Price Range (Spread): The difference between the high and low of a candle represents the price range. VSA focuses on the closing price relative to this range. A close near the high with high volume suggests buying pressure, while a close near the low with high volume indicates selling dominance.

- Closing Price Location: The location of the closing price within the candle’s body offers clues. A close near the middle suggests indecision, while a close near the extremes (top or bottom) signifies buying or selling pressure, respectively.

Interpreting the Story:

VSA focuses on specific candlestick patterns combined with volume levels to make inferences about supply and demand. Here are some basic interpretations:

- High volume on a wide-range bar: This could signal strong buying (closing near the high) or selling pressure (closing near the low).

- Low volume on a wide-range bar: This might indicate indecision or exhaustion after a strong move.

- High volume on a narrow-range bar: This could suggest accumulation by big players (closing near the high) or distribution (closing near the low).

Remember: VSA is not a magic formula. It’s a tool that, when used in conjunction with other technical indicators and strong risk management, can enhance your trading decisions.

VSA for Forex Trading:

While VSA can be applied to any market, keep in mind that Forex has its own quirks. Unlike stocks, volume in Forex represents the number of ticks (price changes) rather than actual traded units. However, skilled VSA users can still interpret the relative changes in tick volume.

Benefits of VSA:

- Improved trade timing: VSA can help identify potential entry and exit points by gauging the strength behind price movements.

- Confirmation of trends: VSA can act as a filter, confirming the validity of trends identified by other technical indicators.

- Understanding market psychology: By deciphering the volume behind price movements, VSA offers insights into the sentiment of larger market participants.

Limitations of VSA:

- Subjectivity: VSA interpretation can be subjective, requiring practice and experience to refine your analysis.

- Not a standalone strategy: VSA should be used in conjunction with other technical indicators and risk management strategies.

Learning Resources:

- Books: “Volume Spread Analysis” by Richard Wyckoff

- Online Courses: Numerous online courses and resources delve deeper into VSA

The Takeaway:

VSA offers a valuable tool for Forex traders seeking to understand market sentiment beyond just price action. By incorporating VSA into your analysis, you can gain valuable insights into the buying and selling pressures driving price movements, potentially leading to more informed trading decisions. However, remember that VSA should be used in conjunction with other trading strategies and risk management practices.

Ready to delve deeper? Explore VSA educational resources online, including forums and video tutorials, to gain a practical understanding of the various price and volume patterns. Remember, practice and experience are key to mastering VSA and using it effectively in your Forex trading journey.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Happy trading

may the pips be ever in your favor!