Mohammed Abdulwadud Soubra / Profile

- Information

|

8+ years

experience

|

1

products

|

7606

demo versions

|

|

134

jobs

|

0

signals

|

0

subscribers

|

Friends

8599

Requests

Outgoing

Mohammed Abdulwadud Soubra

Latest News

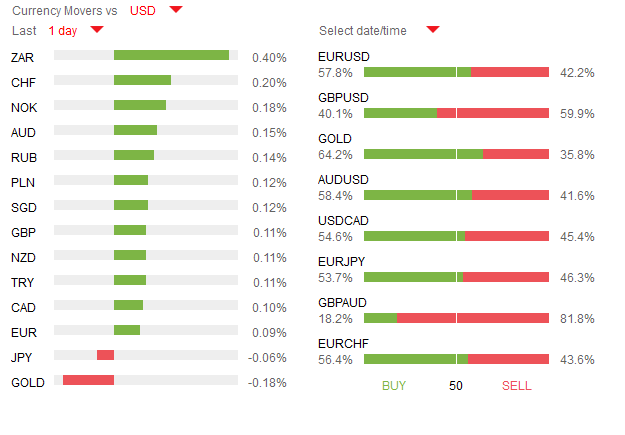

The first quarter GDP estimate out of the UK was confirmed at 0.4% following the release of the second estimate, marking the country’s weakest quarter since Q1 of 2015 – as a result, GBPUSD dropped a meagre 0.3% on the day. Meanwhile, the US’ core durable goods orders came in as expected, at 0.4%, while the headline figure smashed estimates mostly due to aircraft and automobile orders. Additionally, unemployment claims dropped 10K on the week, at 268K vs expectations of 275K. Despite the mostly positive US macro data, the USD-Index fell 0.3% yesterday.

Janet Yellen’s speech will be the main event for today’s markets, though that is scheduled for later in the afternoon - it’s highly unlikely that she will detach from her general “FED is data dependent” pitch. Sticking with the US, preliminary GDP figures (their second estimate) for Q1 are expected to get rise to 0.8% from the initial 0.5%. Also of note, the Atlanta’s FED GDP forecasting model for Q2 rose to 2.9% from 2.5% yesterday, following the stellar durable goods report. Lastly, consumer sentiment out of the US is forecasted to remain relatively unchanged when the UoM publishes its report this afternoon

The first quarter GDP estimate out of the UK was confirmed at 0.4% following the release of the second estimate, marking the country’s weakest quarter since Q1 of 2015 – as a result, GBPUSD dropped a meagre 0.3% on the day. Meanwhile, the US’ core durable goods orders came in as expected, at 0.4%, while the headline figure smashed estimates mostly due to aircraft and automobile orders. Additionally, unemployment claims dropped 10K on the week, at 268K vs expectations of 275K. Despite the mostly positive US macro data, the USD-Index fell 0.3% yesterday.

Janet Yellen’s speech will be the main event for today’s markets, though that is scheduled for later in the afternoon - it’s highly unlikely that she will detach from her general “FED is data dependent” pitch. Sticking with the US, preliminary GDP figures (their second estimate) for Q1 are expected to get rise to 0.8% from the initial 0.5%. Also of note, the Atlanta’s FED GDP forecasting model for Q2 rose to 2.9% from 2.5% yesterday, following the stellar durable goods report. Lastly, consumer sentiment out of the US is forecasted to remain relatively unchanged when the UoM publishes its report this afternoon

Mohammed Abdulwadud Soubra

Added topic MT4 ROAMING DATA FOLDER

Hello Could any one help me regarding the data folder in MT4 I want to replace it from Drive to another Drive in my PC it is coming by default in C: drive like the path below (even if the MT4 has installed in different drive such as the

Share on social networks · 1

8

Mohammed Abdulwadud Soubra

Greece’s creditors reached a deal to avoid a summer car crash in a way that only they know how, involving extension of maturities, adjustment of interest rate payments with a good dose of things still to be decided, some of them after the German federal elections next year. The often used headline in recent years was “kicking the can down the road” and for the most part, this amounts to another example of that. The IMF remains involved, but retains its demand for meaningful debt restructuring. Still, for the single currency, this has removed one of the potential risks for the summer, with the deal unusually being reached comfortably ahead of the loan disbursement next month.

Yesterday saw a sharp move lower on EURGBP, pushing 3.5 month lows as the single currency was favoured vs. the dollar by yen bulls. On the other side, sterling is gaining more confidence that the EU referendum will see a win for the ‘remain’ side next month. The Bank of England Governor had a charged appearance in front of the Treasury Select Committee yesterday largely focusing on the issue. Sterling is again, so far, the strongest performing major currency this week. For today, there may be a stronger focus than usual on the German IFO data at 08:00 GMT, with yesterday’s GDP data showing a better than expected balance of growth for Germany. The market expects a modest rise in the headline index. The yen remains cautiously optimistic going into the G7 meeting this coming weekend, USDJPY struggling for a sustained push above the 110 level.

Yesterday saw a sharp move lower on EURGBP, pushing 3.5 month lows as the single currency was favoured vs. the dollar by yen bulls. On the other side, sterling is gaining more confidence that the EU referendum will see a win for the ‘remain’ side next month. The Bank of England Governor had a charged appearance in front of the Treasury Select Committee yesterday largely focusing on the issue. Sterling is again, so far, the strongest performing major currency this week. For today, there may be a stronger focus than usual on the German IFO data at 08:00 GMT, with yesterday’s GDP data showing a better than expected balance of growth for Germany. The market expects a modest rise in the headline index. The yen remains cautiously optimistic going into the G7 meeting this coming weekend, USDJPY struggling for a sustained push above the 110 level.

Mohammed Abdulwadud Soubra

Latest News

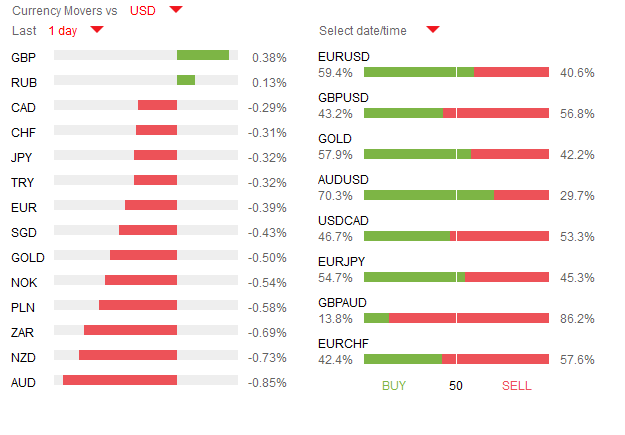

Figures out of Germany showed that economic sentiment in the country fell in May, mostly due to uncertainties regarding the economic outlook and the upcoming “Brexit” referendum. Meanwhile, yesterday's new home sales in the US smashed estimates, coming in at 619K vs forecasts of 521K, causing EURUSD to fall 0.8% on the day. GBPUSD in the meantime gained 0.9% yesterday, as the stay camp continues to gain momentum ahead of the June 23 referendum vote. Eurogroup ministers agreed on a formal deal with Greece to release 10.3B Euros after Greek officials agreed on further austerity measures. Lastly, the FED’s James Bullard stated that “there’s no reason to prejudge June”, however that labour data suggested it was time to hike interest rates in the summer.

Today’s economic calendar begins with German IFO business climate, expected to have risen to 106.9 from 106.6. This report comes after yesterday’s disappointing economic sentiment figures from the region which showed that the population was uncertain regarding Germany’s economic outlook. The spotlight for today will turn to Canada’s central bank and their announcement regarding the country’s latest monetary policy stance. The majority of analysts believe that the BOC will leave interest rates unchanged, yet highlight the damaging effects on the economy from the fall in the price of oil.

Figures out of Germany showed that economic sentiment in the country fell in May, mostly due to uncertainties regarding the economic outlook and the upcoming “Brexit” referendum. Meanwhile, yesterday's new home sales in the US smashed estimates, coming in at 619K vs forecasts of 521K, causing EURUSD to fall 0.8% on the day. GBPUSD in the meantime gained 0.9% yesterday, as the stay camp continues to gain momentum ahead of the June 23 referendum vote. Eurogroup ministers agreed on a formal deal with Greece to release 10.3B Euros after Greek officials agreed on further austerity measures. Lastly, the FED’s James Bullard stated that “there’s no reason to prejudge June”, however that labour data suggested it was time to hike interest rates in the summer.

Today’s economic calendar begins with German IFO business climate, expected to have risen to 106.9 from 106.6. This report comes after yesterday’s disappointing economic sentiment figures from the region which showed that the population was uncertain regarding Germany’s economic outlook. The spotlight for today will turn to Canada’s central bank and their announcement regarding the country’s latest monetary policy stance. The majority of analysts believe that the BOC will leave interest rates unchanged, yet highlight the damaging effects on the economy from the fall in the price of oil.

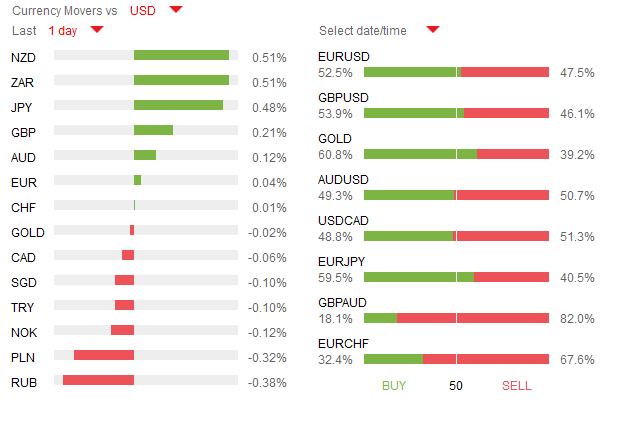

Mohammed Abdulwadud Soubra

It’s the Aussie and euro feeling the pressure at the start of the European session and for very different reasons. The Aussie has reacted to comments from RBA Governor Stevens, where he talked in more detail about the continued low inflation outlook, with indications that he expects this to persistent for foreseeable future. This has given some life to expectations of further rate cuts, hence the push towards the 0.7060 level as we enter the European session. Meanwhile, the euro appears to be finding the going tougher as the dollar becomes more confident regarding the prospects of a tightening of rates as early as June. Furthermore, ahead of the main G7 meeting later this week, investors are becoming more cautious of going long the yen vs. the USD, even though the indications from this weekend’s meeting of finance ministers and central bank governors suggested there was a wide gap between the US and Japan on the appropriate response.

With less than a month go to until the EU referendum in the UK, BoE Governor Mark Carney appears before the UK Parliamentary Treasury Committee today. He’s been in some hot water in recent weeks for appearing to favour remaining in the EU, which does not fit with the Bank’s remit of independence and impartiality. Expect him to have a tough time of it. Meanwhile, the currency appears to be gaining more confidence that the result will be a win for the ‘remain’ camp, but the result is far from a done deal at this point in time. As such, we’re likely to see sterling continuing to take greater notice of polls in the coming days.

With less than a month go to until the EU referendum in the UK, BoE Governor Mark Carney appears before the UK Parliamentary Treasury Committee today. He’s been in some hot water in recent weeks for appearing to favour remaining in the EU, which does not fit with the Bank’s remit of independence and impartiality. Expect him to have a tough time of it. Meanwhile, the currency appears to be gaining more confidence that the result will be a win for the ‘remain’ camp, but the result is far from a done deal at this point in time. As such, we’re likely to see sterling continuing to take greater notice of polls in the coming days.

Mohammed Abdulwadud Soubra

Today's important market news Time: GMT

Med 08:30 UK Public Sector Net Borrowing

Med 09:00 Ger ZEW Survey - Current Situation

Med 09:00 Ger ZEW Survey - Economic Sentiment

High 09:00 UK Inflation Report Hearings

Med 09:00 EU ZEW Survey - Economic Sentiment

Med 12:00 EU Eurogroup meeting

Med 12:00 EU EU Financial Stability Review

Med 14:00 US New Home Sales (MoM)

Med 14:00 US New Home Sales Change (MoM)

Med 22:45 AUS Trade Balance (MoM)

Med 22:45 AUS Exports

Med 22:45 AUS Trade Balance (YoY)

Med 22:45 AUS Imports

Med 08:30 UK Public Sector Net Borrowing

Med 09:00 Ger ZEW Survey - Current Situation

Med 09:00 Ger ZEW Survey - Economic Sentiment

High 09:00 UK Inflation Report Hearings

Med 09:00 EU ZEW Survey - Economic Sentiment

Med 12:00 EU Eurogroup meeting

Med 12:00 EU EU Financial Stability Review

Med 14:00 US New Home Sales (MoM)

Med 14:00 US New Home Sales Change (MoM)

Med 22:45 AUS Trade Balance (MoM)

Med 22:45 AUS Exports

Med 22:45 AUS Trade Balance (YoY)

Med 22:45 AUS Imports

Mohammed Abdulwadud Soubra

NEWS

Monday, May 23, 2016 5:41 pm +03:00

Webinar: USD Crosses in Focus as Index Eyes Resistance

Setups we’re tracking as the USDOLLAR attempts a fourth consecutive week of gains. Here are the updated targets & invalidation le...Continue Reading

Monday, May 23, 2016 3:00 pm +03:00

USDOLLAR Index Turns to Fed Speakers for Breakout Catalysts

Monday, May 23, 2016 11:37 am +03:00

EUR/USD Slightly Lower After Soft Markit Euro-Zone PMI Figures

Monday, May 23, 2016 6:06 am +03:00

Euro to Look Past PMI Data, US Dollar May Rise on Fed Comments

Monday, May 23, 2016 5:41 pm +03:00

Webinar: USD Crosses in Focus as Index Eyes Resistance

Setups we’re tracking as the USDOLLAR attempts a fourth consecutive week of gains. Here are the updated targets & invalidation le...Continue Reading

Monday, May 23, 2016 3:00 pm +03:00

USDOLLAR Index Turns to Fed Speakers for Breakout Catalysts

Monday, May 23, 2016 11:37 am +03:00

EUR/USD Slightly Lower After Soft Markit Euro-Zone PMI Figures

Monday, May 23, 2016 6:06 am +03:00

Euro to Look Past PMI Data, US Dollar May Rise on Fed Comments

Mohammed Abdulwadud Soubra

Added topic #include <stdlib.mqh>

Hi all :) I am confused why the here under library call is coming as an executed file: #include <stdlib.mqh> Can any one help me please, I would be appreciated for the help. I want to i nclude

Mohammed Abdulwadud Soubra

Latest News

The USDJPY pair dipped below 110 this morning following the release of disappointing Japanese trade balance and manufacturing data which showed that exports fell 10.1% year-on-year in April. Boston’s FED president, Eric Rosengreen, stated that the US is on the edge of meeting most of the economic conditions set forth in order for FOMC members to be able to raise interest rates at the June meeting. Despite the latest chatter by hawkish FED members, the options markets has begun pricing in less of a chance for the US to raise interest rates in June – currently at 26% versus last week’s +30% probability.

Europe will publish services and manufacturing PMI figures this morning, both expected to have risen marginally in April. The FED’s James Bullard (Voter, Hawk) is scheduled to speak in Beijing this morning about US economic and monetary policy. The North American session will see volumes slightly lower as Canadian banks are off due to a public holiday. Meanwhile, the US is anticipated to show that the manufacturing sector slightly rebounded in April as it releases its latest flash manufacturing PMI figures.

The USDJPY pair dipped below 110 this morning following the release of disappointing Japanese trade balance and manufacturing data which showed that exports fell 10.1% year-on-year in April. Boston’s FED president, Eric Rosengreen, stated that the US is on the edge of meeting most of the economic conditions set forth in order for FOMC members to be able to raise interest rates at the June meeting. Despite the latest chatter by hawkish FED members, the options markets has begun pricing in less of a chance for the US to raise interest rates in June – currently at 26% versus last week’s +30% probability.

Europe will publish services and manufacturing PMI figures this morning, both expected to have risen marginally in April. The FED’s James Bullard (Voter, Hawk) is scheduled to speak in Beijing this morning about US economic and monetary policy. The North American session will see volumes slightly lower as Canadian banks are off due to a public holiday. Meanwhile, the US is anticipated to show that the manufacturing sector slightly rebounded in April as it releases its latest flash manufacturing PMI figures.

: