maybe it will fall))

With the growing distrust of the dollar around the world, the price of gold is set to rise in the long term.

By the new year, I think it may rise to $1,200/troy ounce or more.

Our banks are ready to buy up all the gold they produce.The demand is growing.

Colossal material and human resources are spent on production of gold.

The content of gold in ores is constantly decreasing, reserves are depleting, costs are increasing due to the same increase in energy resources, etc.

Gold is the hard work of millions of people, not the American printing press with empty papers.

Trust in gold has always been and always will be.

should adjust a little.

Well, well... :)

As soon as the IMF gets an inside track on when it's going to dump the next 40t of ginger, it'll come up in this thread right away.

Our banks are ready to buy up all the gold produced.Demand is growing.

You are confusing theory and practice.

Theoretically, "Our banks are ready to buy up all the gold they produce. Demand is growing."

and PRACTICAL - this year, for the first time, gold loans were not even available to all artisans by the end of January. for 2009.

I don't know about now, but as of January-February this year, gold was being squeezed VERY hard, including the lack of lending for its production and the buying and closing (=not opening) of deposits.

And everything else you say - yes, I totally agree.

I agree about long term trading.

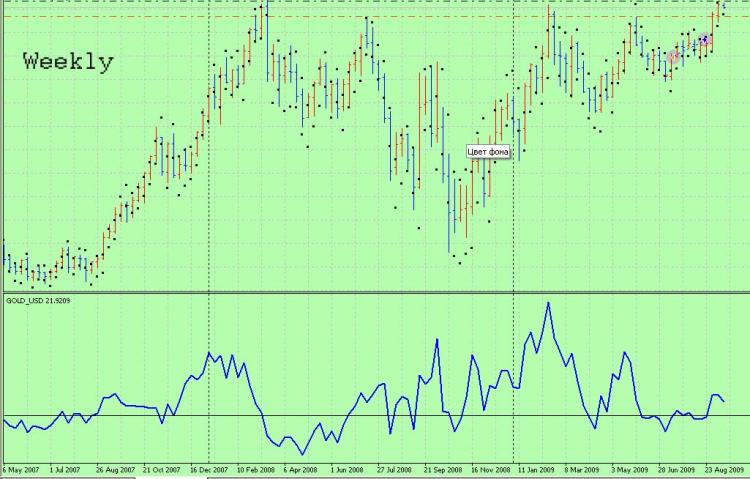

Judging by the seasonal indicator(gold investments) there is a demand for gold from September to February.

The weekly chart shows an increasing trend. The indicator, which shows a correlation with the dollar index, confirms the growth of gold.

The situation is similar on the daily chart.

From the above, I have set a pending buy order at 1011.

As of today, the large hedge (red line) is more on the sell side than the buy side. However, the shift to the sell side is not evident. There is no build-up of positions.

Small speculators (gray line) in general show non-tral mood. Strong movements in their group have not been observed for several months.

The general dynamics of Open Interest (green line) has also slowed down. In general, there is a redistribution of supply/demand elasticity between market participants. It means that the current price level (high enough) might well become a new price point in the history of gold trading.

Overall conclusions. Gold at the moment is not interesting for both bulls and bears. More promising at the moment are other related precious metals, especially platinum, which shows a good range of trades and, besides, has a record level of open interest. It is this market that is heating up right now, and we will see this metal fall soon.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use