Colleagues, I am interested in opinions on oil prices.

Prices are at not bad levels for long term buying (my personal opinion), but I would like to collect traders' opinions, as a lot of information is thrown in for manipulation rather than for adequate substantiated analysis.

Thank you all in advance for your constructive and informed opinions!

- www.mql5.com

Сергей Криушин:

Как только сделают аккумулятор, способный поднимать самолет или хотя бы одного человека, а это уже рядом - все, конец нефтяной эпохи...да и слава Богу - перегрели Землю дальше некуда... там еще вкупе сверх проводники на подходе... вот это кризис так кризис будет... так что сейчас еще цветочки

Yes, there are already planes that fly on batteries.

...Prices are at good levels for long term buying (my personal opinion)...

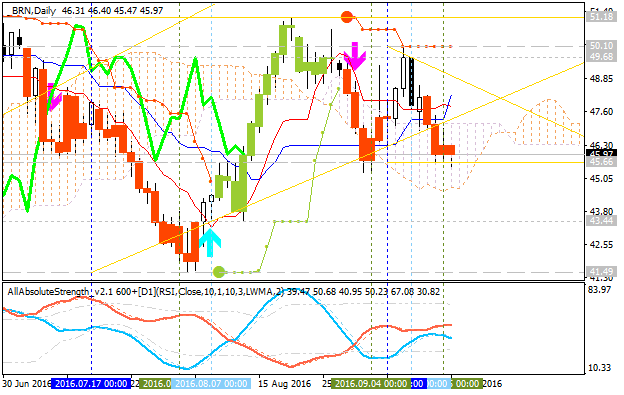

Looking at the daily timeframe (a month ahead analysis, so to speak), the price is inside the Ichimoku cloud and is testing the support level of 45.66.

- That is, if the price breaks down this level on the daily closed bar, it will already be possible to say (and the media will broadcast about it) that the price has moved into a downtrend (and the nearest daily targets in this case are 43.44 and 41.49).

- If price breaks through the resistance level of 50.10 up on the closed daily bar, the primary uptrend will be resumed (with the nearest daily target in that case as 51.18).

- If none of that happens, then it will be like now - just multidirectional movement waiting for a trend in one direction or the other (i.e. - waiting for fundamental news, which will be able to move the price to break one or the other levels up or down). And by the way, I think that is the most likely scenario of price movement for September.

Looking at the daily timeframe (a month ahead analysis, so to speak), the price is inside the Ichimoku cloud and is testing the support level of 45.66.

- That is, if the price breaks down this level on the daily closed bar, it will already be possible to say (and the media will broadcast about it) that the price has moved into a downtrend (and the nearest daily targets in this case are 43.44 and 41.49).

- If price breaks through the resistance level of 50.10 up on the closed daily bar, the primary uptrend will resume (with the nearest daily target in that case as 51.18).

- If none of that happens, then it will be like now - just multidirectional movement waiting for a trend in one direction or the other (i.e. - waiting for fundamental news, which will be able to move the price to break one or the other levels up or down). And, by the way, I think that is the most likely scenario of price movement for September.

And by the way, a downward price movement is very likely, because -

The Chinkou Span line of the Ichimoku indicator (green on the left) crosses the historical price down, but so far on the open daily bar. This indicator signal is lagged (delayed), but it is the strongest. That is, if this cross will be on the closed daily bar, there is a possibility of a downside break-down of the level of 45.66 and further down very easily to 43.44 and below. In addition, the pattern of the Symmetrical Triangle has already been broken by the price and there is only one more pattern left to break down (the descending triangle).

Therefore, a downward price movement next month as the rest of September and part of October is very likely. But it will only be possible to tell in a few days.

Of course, in this case it is better to read the fundamental news (as well as speeches, that is - who's to say what) that affect price movement for example (which is what will determine price movement now).

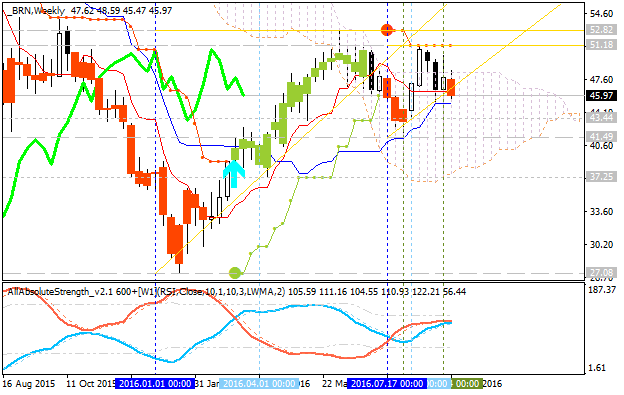

If we talk about the price movement until the end of the year, there is still a divergent uptrend (W1 timeframe). In other words, the correction has not even started yet. Very serious fundamental moments are needed here (God forbid a war somewhere, for example) for the price to move quickly to 41 and further down.

In other words, for the next two or three years, the price will move in different directions within those very levels (see above) and everything will be as boring as it is now.

If we look at the monthly timeframe several years ahead (and the Ichimoku indicator is known to be drawn in the future as well), we will see the same situation - differently directed price movements in anticipation of the trend direction. The only difference is that the levels, inside of which prices move in different directions, are more remote from each other. For example, in the long-term perspective, if the monthly bar closes below 41.49, which is also possible only against the background of the strong fundamental news, we can say about the renewal of the downtrend.

In other words, for the next two or three years the price will move in different directions inside these very levels (see above) and everything will be as boring as it is now.

Do you use Ishimoku indicator with standard parameters?

Thank you for the clear, well-grounded analysis )

Do you use the standard Ishimoku indicator?

However, it depends on where this analysis will go. If to North America, for example, they use more moving averages (SMA with a period of 200, SMA with a period of 100, and if the analysis will be performed on intraday timeframes, then by Fibo, etc. - with a period of 21, 34, etc.). The levels are all the same, but some interpolation is slightly different. For example, the chart is simply divided into the primary ascending and primary descending trends by the SMA indicator with the period of 200. And what is between 100 SMA and 200 SMA - it is divergent trend (if it is above 200 SMA, it is multidirectional ascending, and vice versa).

In other words, it's simpler there. They don't even use the shift there ...

I remember, there was even an article (I do not remember which English magazine), that analyzed signals from Ichimoku indicator (like "Russian technical analysis"), and signals from moving crosses (like "American technical analysis") in terms of technical analysis and market conditions. I was surprised by the fact that they have almost 60% of the same signals, although Ichimoku has 6 different signals and everything should be considered as a whole, while Muwings are very simple.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Prices are at not bad levels for long term buying (my personal opinion), but I would like to collect traders' opinions, as a lot of information is thrown in for manipulation rather than for adequate substantiated analysis.

Thanks in advance for the constructive and substantiated opinions!