How to build a diversified and profitable forex trading portfolio for traders of all experience levels

Introduction:

The foreign exchange market, or forex, is a global market that offers a wide range of trading opportunities for traders of all experience levels. However, its volatile nature highlights the importance of managing risk effectively. A key strategy for this management is building a well-diversified trading portfolio.

In this blog, we will explore a comprehensive approach to building forex trading portfolios, emphasizing the relevance of correlation analysis and decorrelation strategy.

Diversification between different types of trading systems

A well-diversified trading portfolio should include a combination of different types of trading systems. This helps mitigate risk by exposing yourself to different market strategies and approaches.

Some examples of forex trading systems include:

- Trend systems , which are based on the idea that prices tend to move in one direction over long periods of time.

- Reversal systems , which are based on the idea that prices tend to return to their mean after moving too far.

- Scalping systems , which focus on making small short-term profits.

- Arbitrage systems , which are based on the purchase and sale of assets in different markets to obtain a profit.

By incorporating different types of trading systems into a portfolio, traders can reduce their exposure to losses and increase their chances of making profits.

Diversification between different currency pairs

Another way to diversify a forex trading portfolio is to include a variety of currency pairs. This helps reduce the risk of correlation, which occurs when two assets move in the same direction.

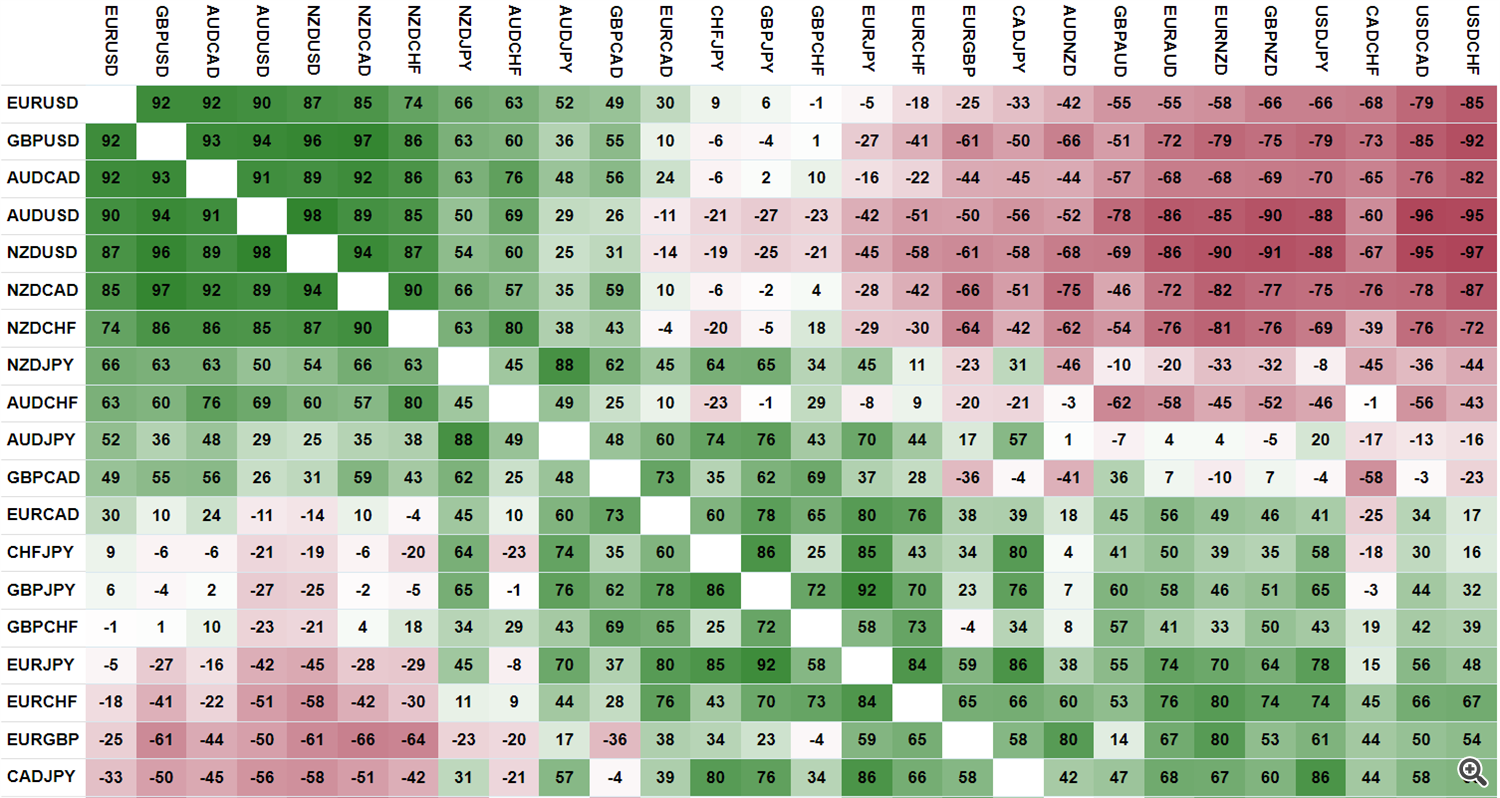

The correlation between currency pairs can be measured using a scale from -100 to 100, where 0 represents no correlation, -100 represents a perfect negative correlation, and 100 represents a perfect positive correlation.

Traders should look for currency pairs with low correlation with each other. This will help reduce the risk of a loss in one currency pair being passed on to other pairs in the portfolio.

Application of correlation and decorrelation

To apply correlation and decorrelation to building a trading portfolio, traders should follow the following steps:

- Identify the trading systems you wish to use.

- Evaluate the correlation between the currency pairs you wish to trade.

- Select currency pairs with a low correlation in losses.

Conclusions

Building a diversified and profitable forex trading portfolio is an important strategy for traders of all experience levels. By incorporating different types of trading systems and currency pairs, traders can reduce risk and increase their chances of making profits.