For a full-fledged technical analysis, it is necessary to see the situation in the oldest timeframes, but it is easier to look for the optimal entry point in a younger timeframe. It is easy to click a button, but it is not easy to keep several different images in your mind. Often traders use a second monitor, and some have even more. Anyone can do this, but the desire to see everything in a single window remains. For a programmer, the task is quite solvable, and in this article I would like to share the results of my work.

Regardless of which of the charts is current, program instructions allow you to get any information from any timeframe. The only problem is to maintain the correct time scale for the display.

For example, if the M5 chart is selected, the M15 indicator should occupy three bars, and the M30 indicator should occupy six bars. As a result, charts from the higher timeframes are presented in a stepwise manner, in the form of a "ladder", but this is the "correct" ladder showing the real situation. This creates a completely new picture, which cannot be seen by simply switching graphs. Long horizontal lines formed by higher timeframes can serve as pivot levels and an additional reference point. As a result, the graph becomes more informative and visual.

Take a look how the well-known "moving average" indicator looks like in the multiframe version.

Pay attention: here is the current H1 timeframe, and therefore each value of the H4 chart occupies four bars, and one value for D1 occupies twenty-four bars. Thus, we see several timeframes at the same time, but each is represented at the correct scale.

When the lines D1, H4, H1 are present on the chart at the same time, it becomes clear how exactly the notorious "price bubble" is blowing up. A clear understanding appears at what moment it all began, and what stage in the development of the process occurs at the present moment. You can see how far the typical deviation occurs, and also note the asymmetric nature of the positive and negative phases.

When the price gets stuck in the "sideways" - all moving averages are collected in one common unit. When a breakout occurs and the price moves with acceleration, different lines break away from each other, and the distance between them changes in proportion to the strength of the trend. While the price is moving along a sloping corridor, the moving averages run alongside.

When various indicator charts are present in the window at the same time, they begin to interact not only with the price, but also with each other, as a result of which the trader has an additional research tool. Very important facts that could go unnoticed become quite obvious.

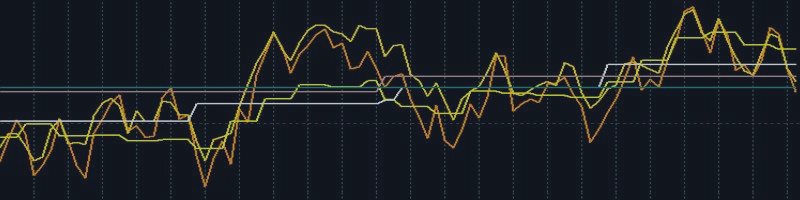

This is clearly seen in the example of another multiframe indicator, created on the basis of the standard "Average Directional Movement". The indicator is useful, but in its original form it is not convenient to use. For simplicity and clarity, it is presented as an oscillator showing the difference between +DI and -DI. If +DI is greater than -DI, the oscillator is positive, and vice versa.This screenshot shows how it looks if you combine the lines of the MN1, W1, D1, H4, H1 and M30 timeframes in the correct scale. It immediately becomes clear how at the moment of the trend strengthening, the lines of the lower timeframes begin to overtake the older ones. The extrema of the M30 clearly show the tipping points.

If the lines MN1 and W1 are above zero, this indicates a global upward trend, therefore in such a period, buy orders are safer. When MN1 and W1 fall below zero, sell orders are preferable.

Thus, the technique of drawing different timeframes in a single window while maintaining the correct time scale is productive and promising. New opportunities for generating trading signals are opening up and their reliability is increasing.In addition to MA and ADM, any other indicator can be presented in a similar form, for example, ATR Channel, Williams Percent Range, Demarker, CCI, RSI or any other.

Comparison of information obtained from different timeseries can be successfully applied in trading robots, but this is a topic for another article.

All of the author's software products have been tested on a real account with Just2trade.