This article was written for this product: https://www.mql5.com/en/market/product/41480

| Strategy overview: Deep learning neural networks & intelligent hedging |

|---|

"Big Data Algorithm Hedging" is a self-learning, genetic algorithm that determines high probability points of entry in price direction. Its built-in artificial intelligence utilizes deep learning neural networks to exploit raw edges found within the market. Because of its ability to adapt to market conditions, this system has maintained its edge for over 15 years. To further reduce risk and maximize profits, an advanced money management methodology is put into place and is adjustable based on your personal preferences.

4-in-1 trading logic and advanced money management:

- Artificial intelligence through deep learning neural networks to predict price direction

- Intelligent hedging that adjusts to market conditions automatically

- Autonomous lot sizing based on risk profiles (fixed or variable)

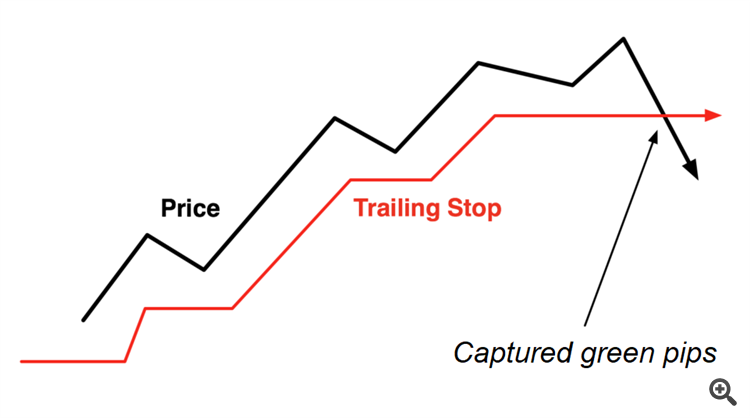

- Basic & advanced money management (trailing stop, breakeven, hedging) to minimize risk

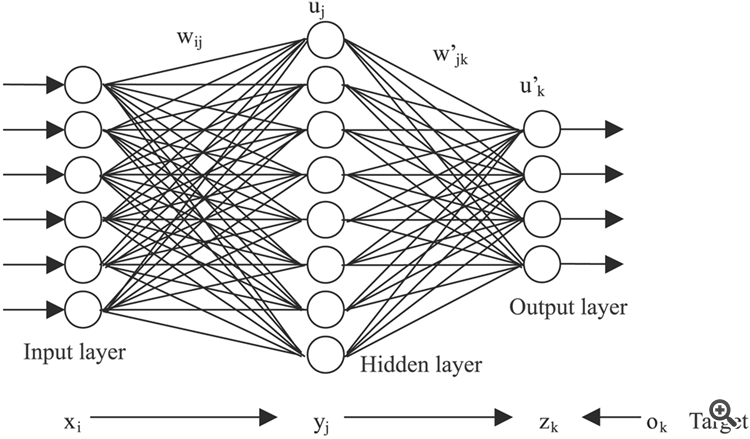

Artificial intelligence through deep learning neural networks

An multivariate input layer consists of >= 6 nodes (Xi) of associated variables at any point in time, governed by an autonomous process of deep learning and genetic algorithmic churn that shuffles the relevant variables in order to adjust to current market conditions. Associated weights (Wij) of the input layer are determined by micro-structural changes in the state of the market and price movements. The hidden layer of the neural network receives >= 8 nodes (Yj) and assigns weights (Wjk) according to the in-sample (IS) and out-of-sample (OOS) tests to ascertain valid signals. In the output layer, the filtered signals (Uk) are streamlined into >=1 buy or sell orders.

Intelligent hedging that adjusts to market conditions automatically

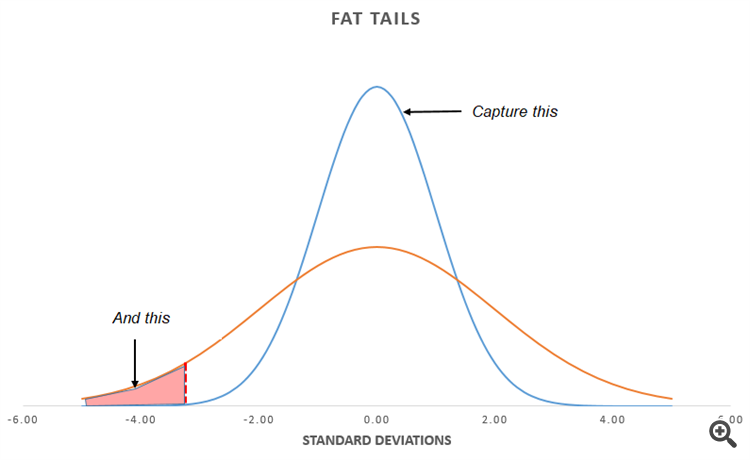

The forex market is a fat-tailed distribution disguised as a normal distribution. As a retail trader, you want to be on the right side of a fat tail market movement when it arrives. Our intelligent hedging methodology maximizes the fractal behaviour of price movement to hunt for opportunities on both ends of the pareto spectrum.

Autonomous lot sizing & advanced money management

Having precise entries is akin to having good attacking skills from a football team. Sound money management is having that strong defence that you need to ensure consistent victory. The BDA algorithm comes with built-in advanced money management capabilities, including trailing stop, breakeven and hedging.

| We bring institutional-grade algorithms to the you, at a fraction of the cost |

|---|

Our algorithms go through a rigorous 3-step process to identify anomalies in the markets to generate alpha:

- Big data mining: We procure massive quantities of high-quality tick data from hundreds of regulated brokerage firms, including STPs, ECNs, NDDs and market-making brokers.

- Machine learning & artificial intelligence: Using at least 15 years of raw data, our proprietary machine learning algorithms run millions of in-sample and out-of-sample tests to identify nuances in each market. Armed with potentially exploitable edges, we then employ artificial intelligence to accelerate the strategy development process, and filter the quality strategies from the mundane ones.

- Monte Carlo simulations: We make use of multivariate Monte Carlo simulations to stress-test our algorithms to its breaking point. Each simulation produces a minimum of 10,000 possible equity curve permutations, validated by market variations to enhance its chance of success in live trading conditions. Of every 100 strategies developed in steps (1) and (2), only 1% of them make the final cut.

| Recommended setup |

|---|

Currency pair: EURUSD

Timeframe: H1

Capital: $1,000 or more

Leverage: 1:500 (or less)

Broker: ICMarkets, Tickmill, Darwinex

Recommended settings: Default settings work great. Basic money management and advanced money management settings are up to your own discretion depending on risk appetite.

| Inputs of EA explained in detail |

|---|

======== Risk Settings ========

Close all trades if floating loss ($): When floating loss reaches this amount, all trades would be closed automatically

Close all trades now: When set to TRUE, all open trades in trading account would close

Close current CHART trades now: When set to TRUE, all open trades on current chart would close

======== Trade Setup ========

Enable trading: When set to FALSE, no new trades would open

Lot mode (Fixed / percent):

- When set to FIXED, only fixed lots (defined in "Fixed lot" field) would be used

- When set to PERCENT, a percentage of the available margin (defined in "Percent lot" field) would be used

Fixed lot: Used when "Lot mode" field is set to "FIXED"

Percent lot (of avail. margin): Used when "Lot mode" field is set to "PERCENT"

======== Trade Mgt. ========

Max. buy orders: Maximum no. of buy orders to be open at any time

Max. sell orders: Maximum no. of sell orders to be open at any time

Lot mgt. type:

- "Fixed lot" = Same fixed lot would be used for every new trade opened (E.g. 0.01 / 0.01 / 0.01 / 0.01)

- "Sum lot" = Fixed lot would be added on top of each other for every new trade opened (E.g. 0.01 / 0.02 / 0.03 / 0.04)

- "Martingale lot" = Lot size would be multiplied by "lot factor" (E.g. If "lot factor" = 2, then 0.01 / 0.02 / 0.04 / 0.08)

- "Step lot" = Lot size follows a progressive step-up (E.g. 0.01 / 0.01 / 0.01 / 0.02 / 0.02 / 0.02)

Lot factor: Used only if "Lot mgt. type" selected is "Martingale lot"

Max. lot size: Maximum lot size

Min. distance between trades (pips): Minimum pip distance before a new trade opens

======== Basic Money Mgt. ========

Enable basket profit: When set to TRUE, all open trades would close when floating profit is hit

Close all basket profit when profit = this: When "Enable basket profit" is set to TRUE, all open trades would close when this floating profit is hit

Enable trailing stop: When set to TRUE, trailing stop capability would be activated

Trailing start (pips): Pip distance to hit before trailing stop activates

Trailing stop (pips): Number of pips to trail for open trades

Enable breakeven: When set to TRUE, breakeven capability would be activated

Breakeven start (pips): Pip distance to hit before breakeven activates

Breakeven stop (step): Number of pips for breakeven

======== Advanced Money Mgt. (AMM)========

Enable AMM: When set to TRUE, AMM will be activated

Min. drawdown to activate AMM ($): Minimum floating loss before AMM kicks in

Min. open trades to activate AMM: Minimum number of open trades before AMM kicks in

AMM min. TP (pips): Minimum pip distance between trades for AMM

AMM trailing TP (pips): Number of trailing pips for AMM

| Default settings - For the everyday trader |

|---|

15 years of robust testing with variable spread (99.9%):

1k capital, fixed lot 0.01, 1:500 leverage, AMM enabled, 2004 to Jul 2019:

| Conservative settings - For the safe trader |

|---|

11 years of robust testing with variable spread (99.9%).

1k capital, fixed lot 0.01, 1:100 leverage, AMM disabled, 2010 to Jul 2019:

| Compounded settings - For the wealth creator |

|---|

11 years of robust testing with variable spread (99.9%).

10k capital, 0.5 percent lot, 1:500 leverage, AMM enabled, 2010 to Jul 2019: