Fundamental Weekly Forecasts for US Dollar, AUDUSD, GBPUSD. USDJPY and GOLD

US Dollar - "This week docket isn’t shabby for market movers – retail sales, UofM sentiment survey, upstream inflation reports, small business optimism and a July labor conditions aggregate – but none of the offerings carry the mark of a decisive view changer. With the market still not fully pricing a Fed hike until January while the Fed sees two this year, there is premium to tap. Yet, it will be difficult to tap this week."

GBPUSD - "Upcoming UK Jobless Claims figures will be of special interest as Bank of England Governor Mark Carney made clear that interest rate policy will depend on economic data. Current consensus estimates predict that the Claimant Count Rate—the percentage of eligible workforce participants claiming unemployment benefits—remained near multi-decade lows through July. Just as importantly, economists expect that Average Weekly Earnings growth remained near its highest in five years through June. Downside surprises in either could force fairly important losses in the British Pound."

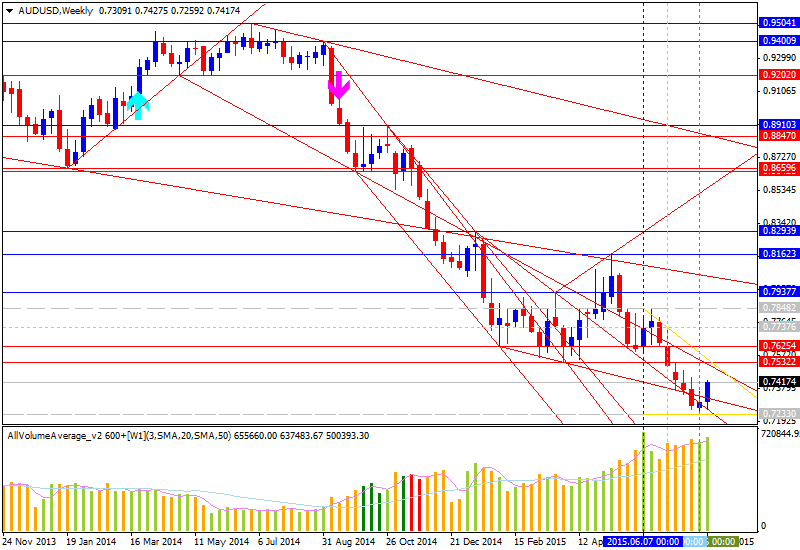

AUDUSD - "A handful of Chinese releases is also noteworthy. July’s Retail Sales and Industrial Production numbers are due to cross the wires. As with the US, data flow out of the behemoth East Asian economy has improved in recent months. At minimum, this hints that the probability for particularly dour results that raise concerns about negative spillover to Australia is comparatively low relative to the alternative."

USDJPY - "With USD/JPY snapping back from a fresh weekly of 125.06, the lack of following-through behind the NFP reaction raises the risk for a larger pullback, and the exchange rate may face a further consolidation in the days ahead should we see another mixed batch of data prints coming out of the U.S. economy. On the other hand, key developments pointing to a stronger recovery may put the dollar-yen on a more bullish course and may spur a test of 2015 highs (125.84) as the Fed keeps the door open for a September liftoff."

GOLD - "From a technical standpoint gold has continued to hold above critical support into 1067/70 where the median-line off the 2014 high converges on basic trendline support dating back to June 2006 and the 100% extension of the decline off the yearly high. Weekly momentum has also continued to hold above the 30-threshold and as noted last week, gold remains vulnerable for a near-term recovery while above this region. Note that although prices are lower for a seventh consecutive week, gold has been unable to test the 5-year low made back on July 24th. Key resistance remains at 1145/50 with only a break above the upper median-line parallel off the yearly high invalidating the broader downside bias (bearish invalidation~ 1175). A break of the lows targets the 2010 low at 1044 backed by a key longer-term Fibonacci confluence lower down at 975/80."