Fundamental Weekly Forecasts for US Dollar, AUDUSD, USDJPY and GOLD: Risk Aversion Likely if FOMC Hints Rate Hike Due Sooner than Expected

US Dollar - "The US Dollar continues to benefit from expectations that the US central bank will be the most aggressive of any major central bank in raising rates, but such a benefit could easily become a detriment if there’s a material downgrade in expectations. Indeed, recent market indecision underlines the US Dollar’s vulnerability to any disappointments."

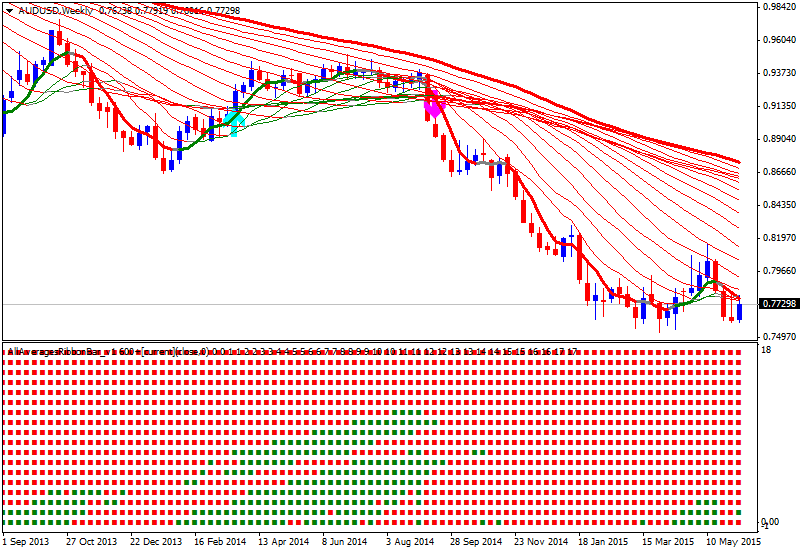

AUDUSD - "The Fed policy outlook has deteriorated since the beginning of the year as a slump in economic growth in the first quarter fueled bets that officials will delay stimulus withdrawal. This narrative is remarkably similar to what was seen in 2014. Then too, investors expected the FOMC to delay or at least slow the pace of “tapering” QE asset purchases following a disappointing start to the year. For its part, the central bank maintained that the slowdown owed to transitory factors. It opted to stay the course and delivered the end of QE3 on schedule. Policymakers’ rhetoric in response to this year’s hiccup has been virtually identical, underscoring similarities between current events and those of 12 months ago."

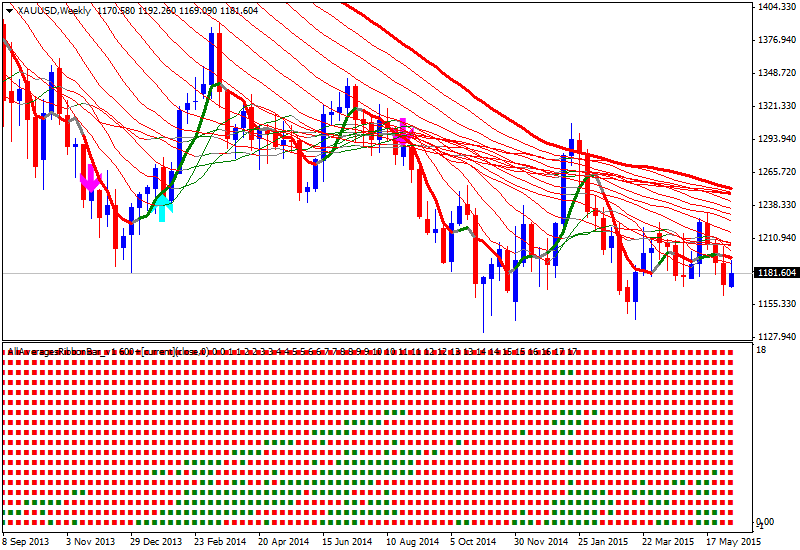

GOLD - "From a technical standpoint gold broke out of a descending pitchfork formation off the May high with the rally extending as high as 1192 before pulling back into the close of the week. Bullion remains at risk while below 1197 with a breach above 1204 needed to put the long-side back into focus. Key near-term support rests at 1163/64 where the 61.8% extension of the decline off the May highs converges on the 76.4% retracement off the advance off the March low. A break below this level targets the November 2014 TL support / 1150/51. Note that daily momentum has continued to hold above the 40-threshold on this pullback off the May highs, supporting the argument that gold may be attempting to base here. We’ll look for a break of the monthly opening range alongside the 40-50 RSI range for guidance heading into next week."

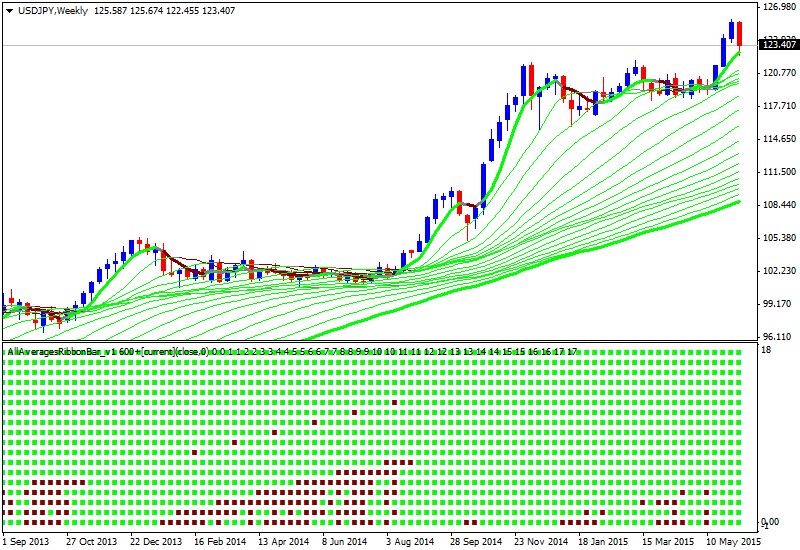

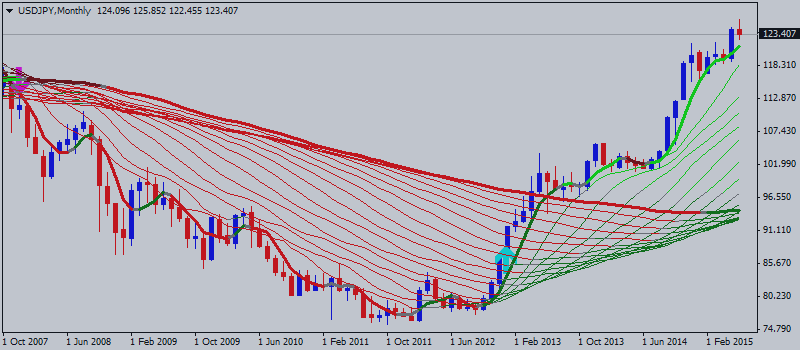

USDJPY - "The risk for a slower pace of Fed rate hikes paired with a more upbeat tone from the BoJ may produce some chop ahead of the key event risks, and the dollar-yen may face a larger pullback should the fresh batch of central bank drag on U.S. interest rate expectations. Nevertheless, the long-term outlook for USD/JPY remains bullish as Governor Kuroda and Co. looks poised to retain its easing cycle well beyond 2015."