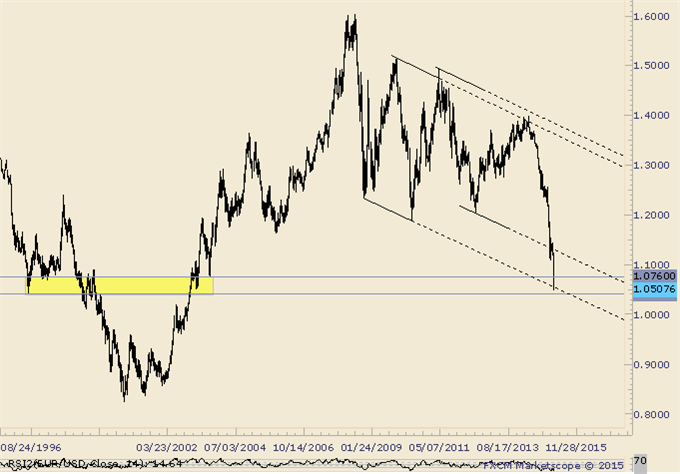

Technical Price Pattern Analysis for EURUSD, GBPUSD, AUDUSD, NZDUSD, USDJPY, USDCAD and USDCHF - monthly RSI has broken out of a triangle pattern

Weekly

-“BIG picture, monthly RSI has broken out of a triangle pattern.

Sometimes, a pattern breakout in momentum (or OBV) precedes the breakout

in price. The development’s implications are obviously significant.”

-“There is a long term level to be aware of. The line that extends off

of the 2008 and 2010 lows is at about 1.0545 this week. The March 2003

low is at 1.0499.” EURUSD ends the week at 1.05.

GBPUSD

Weekly

-“A breakout from a 1 month inverse head and shoulders pattern is valid

above today’s low (breakout day) but GBPUSD does face channel resistance

at this level. The reversal pattern’s objective is 1.5494, which is in

line with the December low at 1.5485.”

-“GBPUSD met the target and traded into the mid-1.5500s this week. There

is good resistance here from former lows and slopes on multiple time

frames. A breakdown towards 1.4250-1.4350 may be underway.” Look towards

the mentioned levels as long as price is below 1.5030.

AUDUSD

Daily

-“Today’s (2/26) reversal comes just shy of channel resistance. As long

as price is contained by channel resistance, downside resolution remains

possible.” Focus remains on the lower end of the channel in the low

.70s but channel resistance must hold. A push above would indicate an

important behavior change.

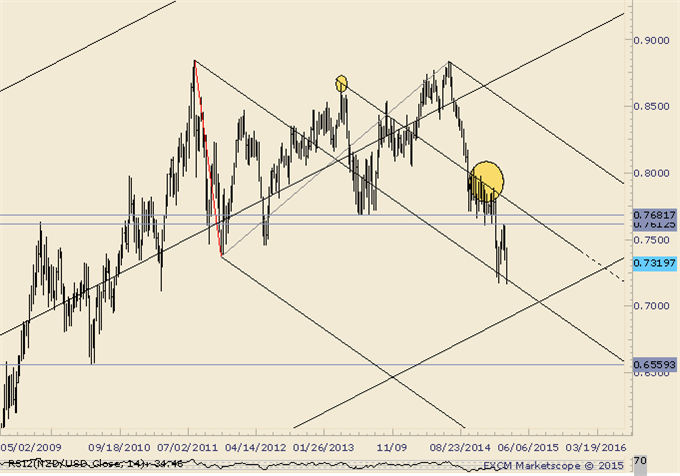

NZDUSD

Weekly

-“NZDUSD traded to the 61.8% retracement of its 3 year range today

(.7929) and the next level of interest probably isn’t until the 2013

Labor Day gap at .7722. One can’t help but notice that an epic double

top is possible with a target of .5898. That would trigger on a drop

below .7370.”

-If the major double top is going to prove successful, then the February high needs to remain in place.

USDJPY

Weekly

-“Continue to favor a broad range as 119.80-120.70 as resistance and

116.40-117.10 as support. A move through either one of these zones would

define target zones of 124-128 and 110-114.”

-USDJPY is flirting with a breakout from the cited resistance zone

(120.70). The next area of interest on the upside would be

123.16-124.13. A daily close below 119.50 would indicate a reversal.

USDCAD

Weekly

-“The contracting range indicates potential for a triangle from the

high. Typically, a triangle will lead to a thrust in the direction of

the preceding trend.” Triangle targets are 1.3074 and 1.3245. If the

path is still higher, then former triangle resistance should provide

support if reached (about 1.2550).

USDCHF

Monthly

-“USDCHF has retraced nearly the entire SNB fiasco and returned to the

year open price. This level is also the 2012 high. A confluence of such

important prices (year and open and a former yearly high) is often

decent support/resistance so a break through this would major. The

median line remains estimated support near .9300.” An upper parallel is

all that remains as possible resistance before the high.