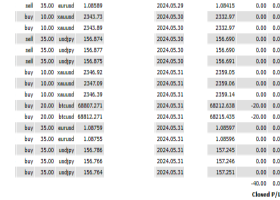

Trading Summary for May 13 - May 17: Total Profit +5,907 USD. USD Plummets on US CPI! How Will the Market React to This

Trading Summary for May 13 - May 17: Total Profit +5,907 USD

The much-anticipated US CPI was calmer than expected, leading to a significant USD selling trend.

Although the trade directions were correct, the USD experienced significant volatility immediately after the data release. This resulted in substantial losses as gold and AUD buy positions hit stop losses. Despite recovering through a Bitcoin buy position, the overall profit was almost breakeven. It was a turbulent week with significant movements, but it was challenging to navigate successfully.

Upcoming Focus:

1. US Core CPI Slows for the First Time in Six Months - A Step Toward Rate Cuts This Year

The April US Consumer Price Index (CPI), excluding volatile food and energy, showed the first slowdown in six months on a monthly basis. This was a small step for US financial authorities considering a rate cut within the year. According to the Bureau of Labor Statistics, housing and gasoline accounted for more than 70% of the overall CPI growth.

While financial authorities might hope this data indicates a downward trend in inflation, further data will be needed to gain the confidence required to start considering rate cuts. Fed Chair Jerome Powell stated on the 14th, "We need to be patient and wait for the restrictive policy to take effect."

(Source: Bloomberg)

Although more data showing a decline in inflation will be necessary for US financial authorities to act, the expectation for rate cuts has increased. The USD selling perspective continues.

2. Focus on UK CPI

The pound is expected to focus on UK inflation and economic indicators to be released from mid to late week. On the 22nd, the April Consumer Price Index (CPI) will be released, followed by the May Manufacturing/Services PMI on the 23rd, and April Retail Sales on the 24th.

The previous March CPI rose 3.2% year-on-year, slowing from February but exceeding market expectations by 0.1%. The market took this as a continuation of the battle against inflation, causing early rate cut expectations to retreat. However, BOE Governor Andrew Bailey has forecasted a sharp drop in May CPI, so this release will confirm whether the inflation slowdown is on track. The 1-3 month average weekly earnings (excluding bonuses) released this week met expectations, indicating easing wage pressures.

(Source: Traders web)

As countries grapple with inflation, the UK, Canada, and Japan will also release CPI data. Significant movements are expected post-announcement, and the plan is to follow the subsequent trends.

3. Bitcoin Traders Aim for $74,000 Next Week - Spot ETFs See Net Inflows for Four Consecutive Days

Bitcoin could surpass its all-time high of $74,000 as early as next week due to institutional demand and increased risk appetite.

The US spot ETFs linked to Bitcoin have seen inflows for four consecutive days, with BlackRock's IBIT receiving $94 million on May 16, indicating a shift in investor sentiment. Some traders believe that Bitcoin (BTCUSD) could surpass its all-time high of $74,000 as early as next week due to institutional demand and increased interest in risk assets.

"Bitcoin retreated towards $65,000 on May 16 but is already attempting to regain its footing above $66,000 by the morning of the 17th. If supported by global risk appetite, this cryptocurrency could exceed $70,000 over the weekend," said Alex Kuptsikevich, a senior market analyst at FxPro, in a note to CoinDesk, referring to increased inflows into spot ETFs.

(Source: CoinDesk)

With the US CPI calming, cryptocurrencies are becoming attractive for buying again. The plan is to continue with a buying perspective.

P.S.

The latest AI model, ChatGPT, launched the new "GPT-4o" on the 13th, making headlines.

With this upgrade, it has become more "human-like," enabling smoother conversations with emotions.

It feels like the birth of more realistic androids is just around the corner. YouTube Link

The level and speed of data analysis have significantly improved, in addition to emotions and conversations.

For example, when I uploaded a photo taken at the sea and asked, "Where is this?" GPT-4 could not pinpoint the location, but GPT-4o identified it as the coast of Normandy, France, almost precisely.

It was impressive to experience such accuracy instantly with just one image. GPT-4o also recognizes and responds to a wider range of contexts more effectively.

Make the most of this advanced technology to benefit both your work and personal life.

Have a great weekend! 😊