Discussion of article "Deep Neural Networks (Part IV). Creating, training and testing a model of neural network"

Respect to the author, for high productivity in writing articles and feel in them scientific strength, but IMHO wanted to be also practical sense.

In the operative part of the author indicates that the purpose of the approaches described by him, is to simplify the work with data (use of unlabelled) reduce the number of iterations (epochs), etc.

Therefore, the expected result is obviously acceleration of the learning process of multilayer perseptron (MLP) without affecting the results of its work (with practically equal results).

Then I have a question - have you already solved everything with the work of the perseptron, in the form of identifying patterns, forecasting financial markets, and have you got confirming examples?

The question is rhetorical, because in the current cycle of 4 articles I have not found a single example of an Expert Advisor or indicator, which is probably why there are almost no interested discussions from the MQL community in the branches of these articles.

However, the answer is in the author's earlier works - it turns out that he tried to solve this problem, but as you can see, unsuccessful, and at the moment it is no longer workable...

https://www.mql5.com/ru/forum/79058/page6#comment_5791509

- 2017.09.20

- www.mql5.com

I need some simple examples. There aren't many academics here.

Good afternoon.

I am far from being an academic or even a programmer. Just a practicing trader.

What examples would help you understand the topic?

Good luck

If the proposed application of neural networks in trading, does not make it meaningless, then certainly mastering and applying such a powerful tool would be extremely interesting.

If the proposed application of neural networks in trading does not make it meaningless, then of course, mastering and applying such a powerful tool would be extremely interesting.

I don't understand the highlighted part at all. Trading is rendered meaningless by the use of NN ? Can you decipher it? I'm just curious.

Good luck

I don't understand the highlighted part at all. Trading becomes meaningless when using NN ? Can you decipher it? Just curious.

Good luck

Alas, the proposed application of MO in trading is reduced to teaching neural networks to predict price movement, not on the basis of semantic analysis of its dynamics, revealing the nature of the current market events (which networks are not yet capable of), but statistical - that is, in fact - probabilistic approach, which is purely mathematical in nature.

The system that calculates the probability of an event and takes "fateful" decisions for a trader should not use primitive conditionally-reflexive connections as its basis, but should be based on a deep understanding of market processes, which is obvious to any professional trader.

However, please accept my admiration for your work.

I don't understand the highlighted part at all. Trading becomes meaningless when using NN ? Can you decipher it? Just curious.

Good luck

Don't look for meaning where there is none :)))) People just want to be a little closer to the market, for example, ready-made trading strategies, so that it would be clearer... and where they can stop in these endless intricacies of neural networks + after all, R is not used by many people here, so it's a bit heavy, heavy.... :) But the articles are very cool, no doubt you always have

I would do you know what I would do... stop on one package, let's say mxnet, do all the research in R, show and tell something, and then connect dll to mt5 of this package and show how to use the basic models that are offered there... then more people could try it from here, because not everyone will even want to install R... but this is imho.

Good afternoon.

I am far from being an academic or even a programmer. Just a practicing trader.

What examples would help you understand the topic?

Good luck

I am far from science and programming, but you teach to program neural networks, as in that anecdote, "if you can't do it yourself - teach others":))))

And as a practicing trader, can you voice any successes of NN's work or is their profit limited to royalties for articles?

The article Deep Neural Networks (Part IV) is published . Creation, training and testing of a neural network model:

Author: Vladimir Perervenko

Deep Neural Networks perform the best to model data with clear structures (patterns) such as the data representing the objects in images, where DNN successfully applied to object detection in computer vision and image segmentation. Market price fluctuation is an unstructured data (with no apparent patterns), where it doesn't matter how deep is the NN layers to adding up the features, layer by layer, and expecting to create higher order features representing correct trade signals...

Anyway, I like your articles and your hard attempt to use DNN for trading.

Best,

Rasoul

Deep Neural Networks perform the best to model data with clear structures (patterns) such as the data representing the objects in images, where DNN successfully applied to object detection in computer vision and image segmentation. Market price fluctuation is an unstructured data (with no apparent patterns), where it doesn't matter how deep is the NN layers to adding up the features, layer by layer, and expecting to create higher order features representing correct trade signals...

Anyway, I like your articles and your hard attempt to use DNN for trading.

Best,

Rasoul

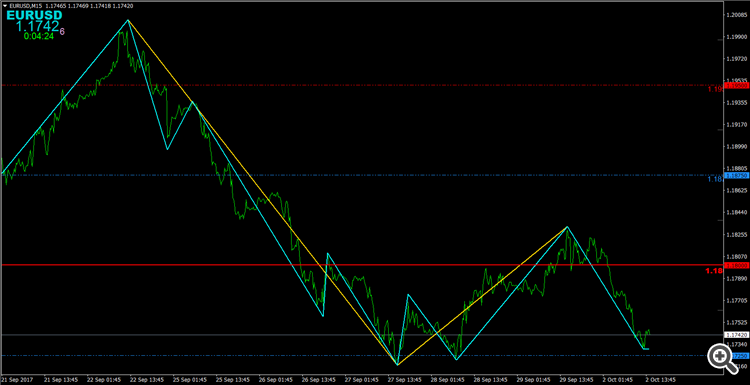

This is the right idea, but I do not understand how it relates to the article. See the picture.

You do not see clear structures (patterns)? Can we differently understand this definition?

In the figure, two Zigzags with minimum knee lengths of 38/75 n.

You do not read the articles carefully.

Good luck

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Deep Neural Networks (Part IV). Creating, training and testing a model of neural network has been published:

This article considers new capabilities of the darch package (v.0.12.0). It contains a description of training of a deep neural networks with different data types, different structure and training sequence. Training results are included.

The trained neural network can be trained further on new data as many times as required. This is possible only with a limited number of models. Structural diagram of a deep neural network initialized by complex restricted Boltzmann machines (DNRBM) is shown on Fig.2.

Fig.2. Structural diagram of DNSRBM

Author: Vladimir Perervenko